Money

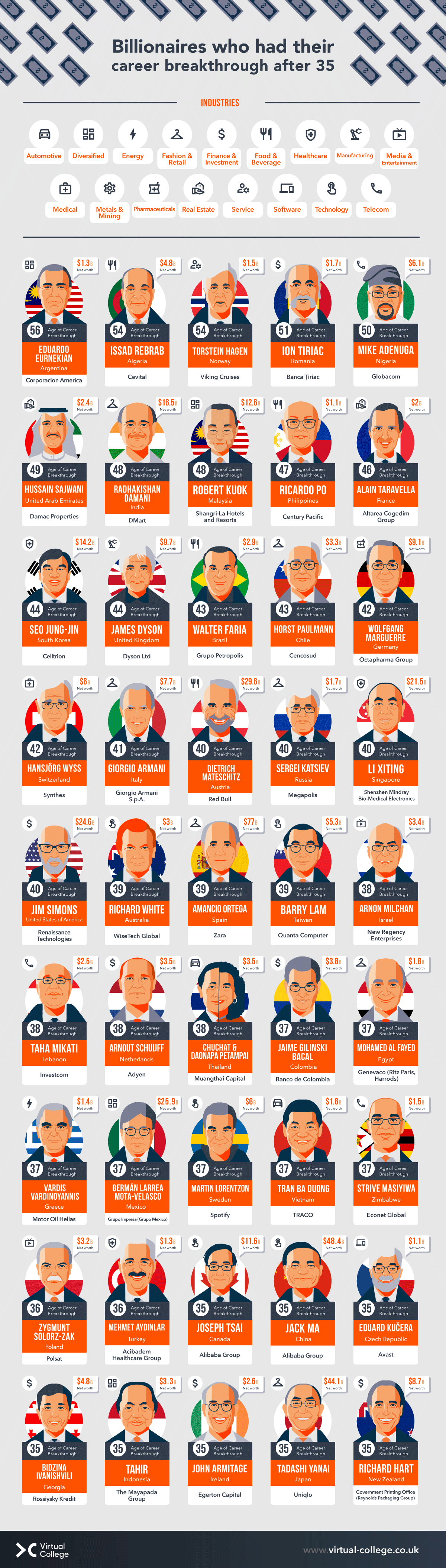

Billionaire Late Bloomers, by Age of Their Breakthrough

Billionaire Late Bloomers, by Age of Breakthrough

More often than not, individuals and media alike focus on the success stories of early bloomers.

These early-age accomplishments of some of the richest people in the world are highlighted as marvels. The early achievements of hoodie-wearing CEOs like Mark Zuckerberg or Evan Spiegel—who became billionaires at ages 23 and 25, respectively—come to mind.

But there’s also the case to be made for the late bloomer. According to the Census Bureau, a 35-year-old is three times more likely to found a successful start-up than someone aged 22.

The infographic above, from Virtual College, highlights 45 billionaires who had their breakthrough later in life, by the age of their respective breakthrough.

Billionaires With Career Breakthroughs at or After Age 35

Though these late successes span many different industries and countries, there are many consistent through lines.

The 45 billionaires highlighted had an average age of 41 and an average net worth of $10 billion.

| Billionaire | Company | Age of Breakthrough | Net Worth ($B) | Nationality |

|---|---|---|---|---|

| Eduardo Eurnekian | Corporacion America | 56 | $1.3 | 🇦🇷 Argentina |

| Issad Rebrab | Cevital | 54 | $4.8 | 🇩🇿 Algeria |

| Torstein Hagen | Viking Cruises | 54 | $1.5 | 🇳🇴 Norway |

| Ion Tiriac | Banca Tiriac | 51 | $1.7 | 🇷🇴 Romania |

| Mike Adenuga | Globacom | 50 | $6.1 | 🇳🇬 Nigeria |

| Hussain Sajwani | Damac Properties | 49 | $2.4 | 🇦🇪 UAE |

| Radhakishan Damani | Dmart | 48 | $16.5 | 🇮🇳 India |

| Robert Kuok | Shangra-La Hotels and Resorts | 48 | $12.6 | 🇲🇾 Malaysia |

| Ricardo Po | Century Pacific | 47 | $1.1 | 🇵🇭 Philippines |

| Alain Tarvella | Altarea Cogedim Group | 46 | $2.0 | 🇫🇷 France |

| Seo Jung-Jin | Celltrion | 44 | $14.2 | 🇰🇷 South Korea |

| James Dyson | Dyson Ltd | 44 | $9.7 | 🇬🇧 UK |

| Walter Faria | Grupo Petropolis | 43 | $2.9 | 🇧🇷 Brazil |

| Horst Paulmann | Cencosud | 43 | $3.3 | 🇨🇱 Chile |

| Wolfgang Marguerre | Octapharma Group | 42 | $9.1 | 🇩🇪 Germany |

| Hansjorg Wyss | Synthes | 42 | $6.0 | 🇨🇭Switzerland |

| Giorgio Armani | Giorgio Armani S.p.A. | 41 | $7.7 | 🇮🇹 Italy |

| Dietrich Mateschitz | Red Bull | 40 | $29.6 | 🇦🇹 Austria |

| Sergei Katsiev | Megapolis | 40 | $1.7 | 🇷🇺 Russia |

| Li Xiting | Shenzhen Mindray Bio-Medical Electronics | 40 | $21.5 | 🇸🇬 Singapore |

| Jim Simmons | Renaissance Technologies | 40 | $24.6 | 🇺🇸 U.S. |

| Richard White | WiseTech Global | 39 | $3.5 | 🇦🇺 Australia |

| Amancio Ortega | Zara | 39 | $77 | 🇪🇸 Spain |

| Barry Lam | Quanta Computer | 39 | $5.3 | 🇹🇼 Taiwan |

| Arnon Milchan | New Regency Enterprises | 38 | $3.4 | 🇮🇱 Israel |

| Taha Mikati | Investcom | 38 | $2.5 | 🇱🇧 Lebanon |

| Arnout Schuijff | Adyen | 38 | $3.5 | 🇳🇱 Netherlands |

| Chuchat & Daonapa Petampai | Muangthai Capital | 38 | $3.5 | 🇹🇭 Thailand |

| Jaime Gilinski Bacal | Banco De Colombia | 37 | $3.8 | 🇨🇴 Colombia |

| Mohamed Al Fayed | Genevaco (Ritz Paris, Harrods) | 37 | $1.8 | 🇪🇬 Egypt |

| Vardis Vardinyannis | Motor Oil Hellas | 37 | $1.4 | 🇬🇷 Greece |

| German Larrea Mota-Velasco | Grupo Mexico | 37 | $25.9 | 🇲🇽 Mexico |

| Martin Lorentzon | Spotify | 37 | $6.0 | 🇸🇪 Sweden |

| Tran Ba Duong | Traco | 37 | $1.6 | 🇻🇳 Vietnam |

| Strive Masiyiwa | Econet Global | 37 | $1.5 | 🇿🇼 Zimbabwe |

| Zygmunt Solorz-Zak | Polsat | 36 | $3.2 | 🇵🇱 Poland |

| Mehmet Aydinlar | Acibadem Healthcare Group | 36 | $1.3 | 🇹🇷 Turkey |

| Joseph Tsai | Alibaba Group | 35 | $11.6 | 🇨🇦 Canada |

| Jack Ma | Alibaba Group | 35 | $48.4 | 🇨🇳 China |

| Eduard Kucera | Avast | 35 | $1.1 | 🇨🇿 Czech Republic |

| Bidzina Ivanishvili | Rossiysky Kredit | 35 | $4.8 | 🇬🇪 Georgia |

| Tahir | The Mayapada Group | 35 | $3.3 | 🇮🇩 Indonesia |

| John Armitage | Egerton Capital | 35 | $2.6 | 🇮🇪 Ireland |

| Tadashi Yanai | Uniqlo | 35 | $44.1 | 🇯🇵 Japan |

| Richard Hart | Raynolds Packaging Group | 35 | $8.7 | 🇳🇿 New Zealand |

Here are just a few highlights of late career breakthroughs:

Jack Ma

Ma is best known for co-founding Alibaba and becoming one of China’s wealthiest people, but his start came rather unexpectedly. After failing to secure jobs as a fresh graduate and starting his own translation company, Ma went on a business trip to the U.S. and discovered the internet (and a lack of Chinese websites). Over time, he connected Chinese companies with American coders to create websites, and soon saw room in the market for a business-to-business marketplace, which became Alibaba. The company secured millions in investment and would go on to become one of China’s leading forces in tech, all without Ma writing a single line of code.

Amancio Ortega

As the former CEO of fashion chain Zara and its parent company Inditex, Ortega is Europe’s third wealthiest person. That success came after opening the first Zara store in 1975 with his then-wife Rosalía Mera, with their store focusing on cheaper versions of high-end fashion. Ortega fine-tuned the design and manufacturing process to produce new trends more quickly, helping to pioneer the concept of “fast fashion,” and soon becoming a fashion powerhouse.

Jim Simons

Simons was once lauded as the world’s greatest investor, largely due to his outlandish returns of over 60% before fees. But he actually started in the academic field, acquiring a PhD in mathematics—he worked in many faculties, and even as a codebreaker for the NSA. Eventually, Simons utilized his mathematical knowledge on Wall Street, where he had his breakthrough in 1982 by starting his model-based hedge fund—Renaissance Technologies, and built a net worth of $24.6 billion.

Dietrich Mateschitz

One of the 60 richest people in the world, Austrian businessman Mateschitz got his start in marketing for Unilever and then cosmetics company Blendax. His breakthrough came on a business trip to Thailand, where the 40-year-old discovered that the local energy drink Krating Daeng helped his jet lag. Mateschitz and the drink’s creator, Chaleo Yoovidhya, each put up $500,000 to turn the drink into an exported energy brand, and Red Bull was born.

James Dyson

Before Dyson was a household name of vacuums, fans, and dryers, The UK’s James Dyson was an industrial engineer with many ideas for inventions. After getting frustrated with the bags of Hoover vacuum cleaners, Dyson had the idea for a bagless cyclone vacuum, and developed one after more than 5,000 prototypes over five years (and supported by his wife’s salary). At first he couldn’t find a manufacturer or success in the UK, so Dyson instead sold his vacuums in Japan and ended up winning the 1991 International Design Fair Prize there. Thirty years later, Dyson’s success led to a royal knighting and becoming the fourth richest person in the UK.

Late Bloomers: The Rule Not The Exception

It’s helpful to remember that these stories might be incredible and successful on a grand scale, but they are not entirely unique.

According to the U.S. Census Bureau, the majority of successful businesses have been founded by middle-aged people and the average age of a company’s founder at the time of founding is 41.9 years. Experience definitely pays dividends, and the saying that “life is a marathon, not a sprint” seems especially true for this list of late breakthrough billionaires.

Money

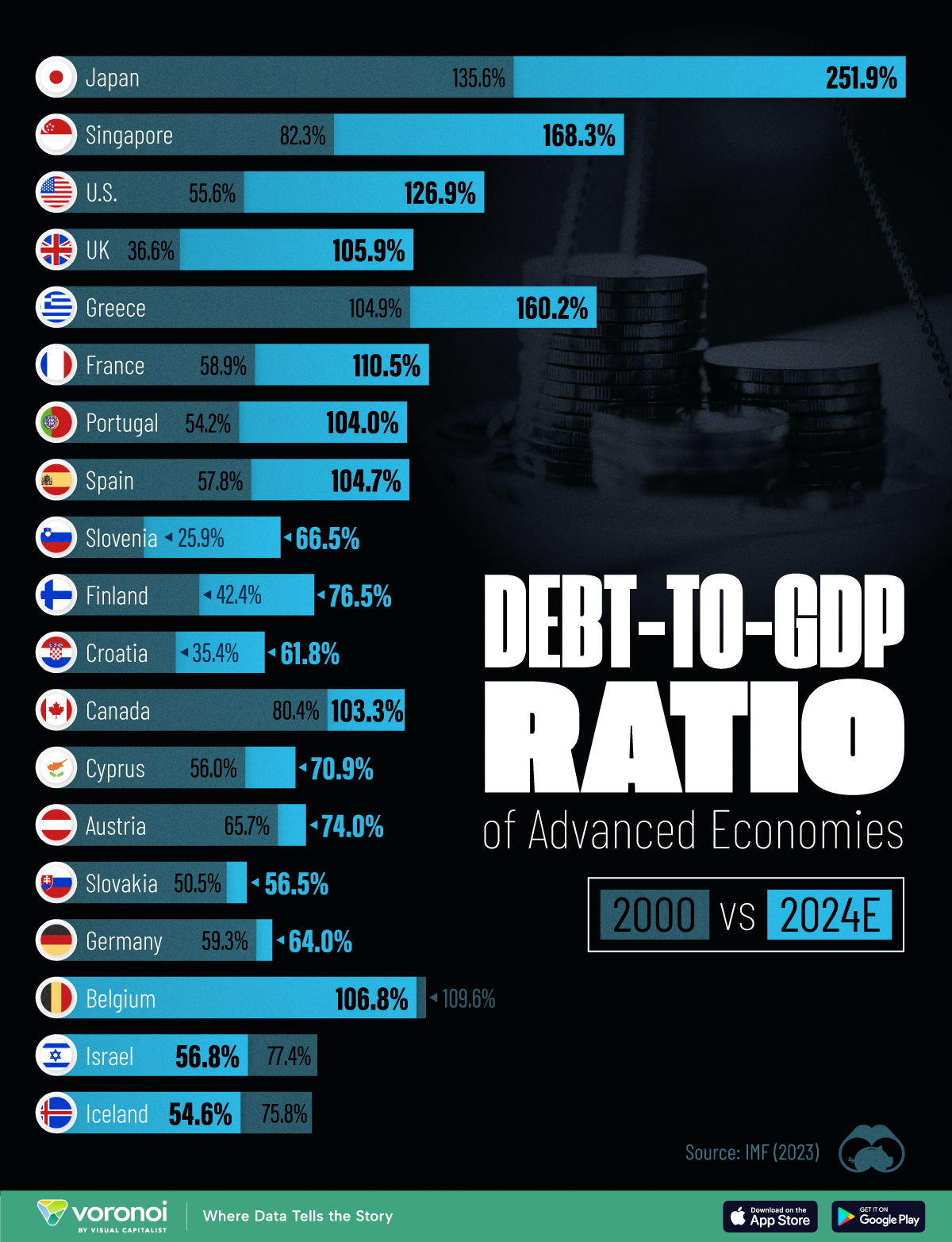

How Debt-to-GDP Ratios Have Changed Since 2000

See how much the debt-to-GDP ratios of advanced economies have grown (or shrank) since the year 2000.

How Debt-to-GDP Ratios Have Changed Since 2000

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Government debt levels have grown in most parts of the world since the 2008 financial crisis, and even more so after the COVID-19 pandemic.

To gain perspective on this long-term trend, we’ve visualized the debt-to-GDP ratios of advanced economies, as of 2000 and 2024 (estimated). All figures were sourced from the IMF’s World Economic Outlook.

Data and Highlights

The data we used to create this graphic is listed in the table below. “Government gross debt” consists of all liabilities that require payment(s) of interest and/or principal in the future.

| Country | 2000 (%) | 2024 (%) | Change (pp) |

|---|---|---|---|

| 🇯🇵 Japan | 135.6 | 251.9 | +116.3 |

| 🇸🇬 Singapore | 82.3 | 168.3 | +86.0 |

| 🇺🇸 United States | 55.6 | 126.9 | +71.3 |

| 🇬🇧 United Kingdom | 36.6 | 105.9 | +69.3 |

| 🇬🇷 Greece | 104.9 | 160.2 | +55.3 |

| 🇫🇷 France | 58.9 | 110.5 | +51.6 |

| 🇵🇹 Portugal | 54.2 | 104.0 | +49.8 |

| 🇪🇸 Spain | 57.8 | 104.7 | +46.9 |

| 🇸🇮 Slovenia | 25.9 | 66.5 | +40.6 |

| 🇫🇮 Finland | 42.4 | 76.5 | +34.1 |

| 🇭🇷 Croatia | 35.4 | 61.8 | +26.4 |

| 🇨🇦 Canada | 80.4 | 103.3 | +22.9 |

| 🇨🇾 Cyprus | 56.0 | 70.9 | +14.9 |

| 🇦🇹 Austria | 65.7 | 74.0 | +8.3 |

| 🇸🇰 Slovak Republic | 50.5 | 56.5 | +6.0 |

| 🇩🇪 Germany | 59.3 | 64.0 | +4.7 |

| 🇧🇪 Belgium | 109.6 | 106.8 | -2.8 |

| 🇮🇱 Israel | 77.4 | 56.8 | -20.6 |

| 🇮🇸 Iceland | 75.8 | 54.6 | -21.2 |

The debt-to-GDP ratio indicates how much a country owes compared to the size of its economy, reflecting its ability to manage and repay debts. Percentage point (pp) changes shown above indicate the increase or decrease of these ratios.

Countries with the Biggest Increases

Japan (+116 pp), Singapore (+86 pp), and the U.S. (+71 pp) have grown their debt as a percentage of GDP the most since the year 2000.

All three of these countries have stable, well-developed economies, so it’s unlikely that any of them will default on their growing debts. With that said, higher government debt leads to increased interest payments, which in turn can diminish available funds for future government budgets.

This is a rising issue in the U.S., where annual interest payments on the national debt have surpassed $1 trillion for the first time ever.

Only 3 Countries Saw Declines

Among this list of advanced economies, Belgium (-2.8 pp), Iceland (-21.2 pp), and Israel (-20.6 pp) were the only countries that decreased their debt-to-GDP ratio since the year 2000.

According to Fitch Ratings, Iceland’s debt ratio has decreased due to strong GDP growth and the use of its cash deposits to pay down upcoming maturities.

See More Debt Graphics from Visual Capitalist

Curious to see which countries have the most government debt in dollars? Check out this graphic that breaks down $97 trillion in debt as of 2023.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?