Politics

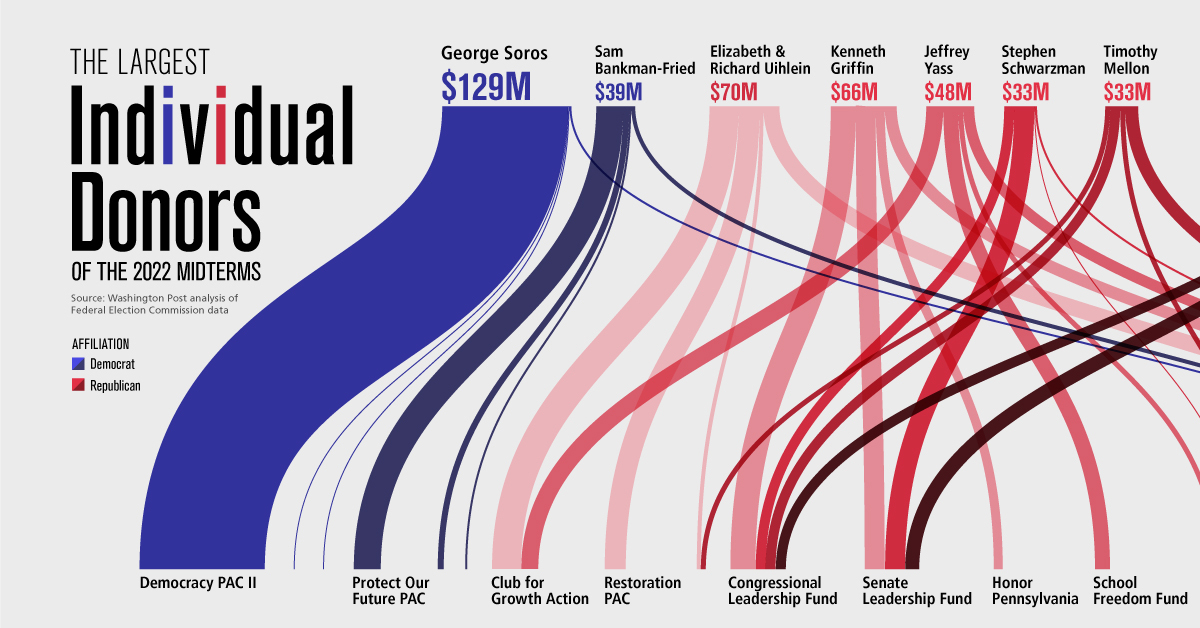

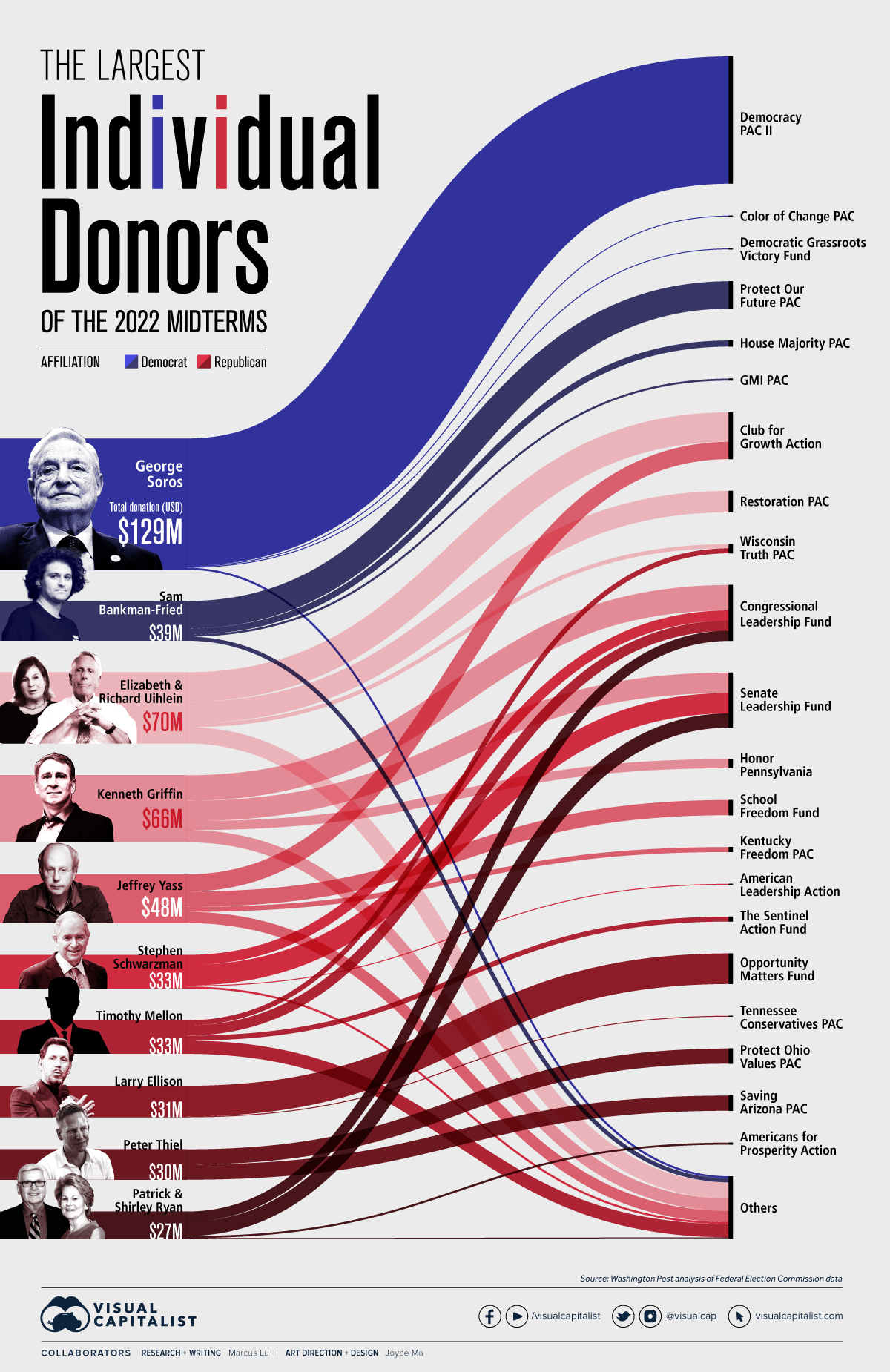

Visualized: The Biggest Donors of the 2022 U.S. Midterm Elections

Visualized: The Biggest Donors of the 2022 U.S. Midterm Elections

This year’s midterm election is expected to set a new spending record, with over $9 billion being raised. This is significantly higher than the previous record of $7 billion, which was set in 2018.

According to a recent analysis by the Washington Post, $1 billion of these funds can be attributed to the top 50 donors. In typical Visual Capitalist style, we’ve illustrated this data to provide you with better insight.

Overview of the Data

The following table lists the top 10 individual donors of the 2022 midterm elections.

| Rank | Name | Affiliation | Total Donation (USD millions) |

|---|---|---|---|

| #1 | George Soros | Democrat | $129 |

| #2 | Elizabeth & Richard Uihlein | Republican | $70 |

| #3 | Kenneth Griffin | Republican | $66 |

| #4 | Jeffrey Yass | Republican | $48 |

| #5 | Sam Bankman-Fried | Democrat | $39 |

| #6 | Stephen Schwarzman | Republican | $33 |

| #7 | Timothy Mellon | Republican | $33 |

| #8 | Larry Ellison | Republican | $31 |

| #9 | Peter Thiel | Republican | $30 |

| #10 | Patrick & Shirley Ryan | Republican | $27 |

Sorting this top 10 donor list by party, we can see that $168 million was raised for the Democrats, and $338 million for the Republicans.

Continue reading below for some interesting background info on all 10 of these individuals. Net worth values were gathered from Forbes on November 1, 2022.

George Soros (Net worth: $7B)

George Soros is a Hungarian-born American billionaire, widely known for his philanthropical efforts and for “breaking” the Bank of England. He has had an illustrious career as a hedge fund manager, founding Soros Fund Management in 1970. Visit this page to see the top 100 holdings of Soros Fund Management’s portfolio.

Soros has donated over $30 billion of his fortune to various causes and charities. He is the founder and chairman of two Super PACs (political action committees) named Democracy PAC and Democracy PAC II.

Unlike regular PACs, Super PACs face no limits in terms of fundraising or political spending.

Elizabeth & Richard Uihlein (Combined net worth: $7B)

Elizabeth & Richard Uihlein are the founders of Uline, one of North America’s largest distributors of logistics supplies (boxes, tape, gloves, etc.). The company makes several billion in sales per year.

The couple have gained media attention for making substantial donations to the Republican party. According to Forbes, the Uihleins have donated a total of $194 million since the 1990s.

Kenneth Griffin (Net worth: $31B)

Kenneth Griffin is the founder and CEO of Citadel, a hedge fund based in the U.S. He also owns Citadel Securities, which is the largest market maker on the New York Stock Exchange (NYSE).

Market makers act as a middleman in financial markets by facilitating buy and sell orders for investors. Using equities (stocks) as an example, when a market maker receives an order from a buyer, it sells shares from its own inventory. This enables the stock market to run smoothly.

Griffin found himself in the spotlight during the GameStop short squeeze when his firm provided emergency funding to Melvin Capital Management.

Jeffrey Yass (Net worth: $30B)

Once a pro gambler, Jeffrey Yass is a cofounder of Susquehanna International Group (SIG), a successful trading firm based in Philadelphia. SIG specializes in quantitative research and trading, which involves the use of computer algorithms to identify opportunities.

Yass is frequently cited as the richest person in the state of Pennsylvania and has gained media attention for his large political contributions.

Sam Bankman-Fried (Net worth: $17B)

Sam Bankman-Fried is the founder and CEO of FTX, which is currently the world’s third largest cryptocurrency exchange behind Binance and Coinbase. The company is based in the Bahamas and offers trading in more than 300 cryptocurrencies.

In May 2022, Bankman-Fried declared that he was willing to donate “north of $100 million” in the upcoming 2024 presidential election. He has since backtracked this comment.

At some point, when you’ve given your message to voters, there’s just not a whole lot more you can do.

– Sam Bankman-Fried

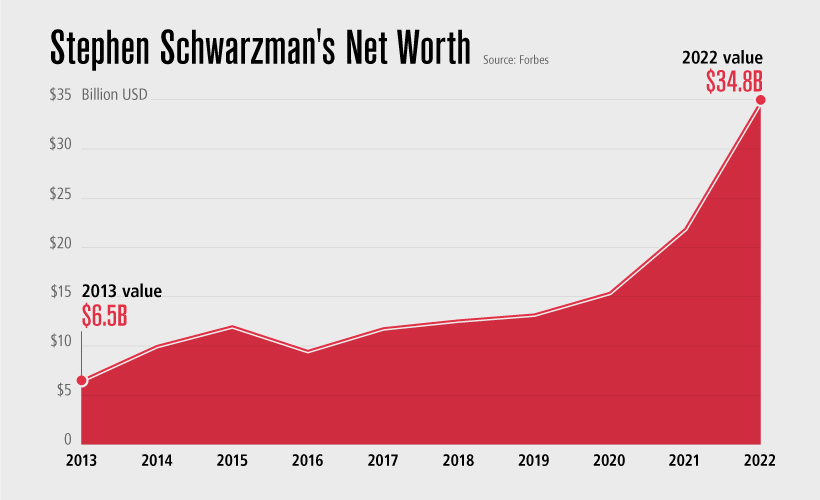

Stephen Schwarzman (Net worth: $35B)

Stephen Schwarzman is the chairman and CEO of The Blackstone Group, a globally recognized private equity firm. Blackstone’s portfolio of companies includes Ancestry.com, a well-known family history service, and Bumble, a popular online dating platform.

Shown below, Schwarzman’s wealth has increased substantially since 2020.

The bulk of Schwarzman’s political contributions have gone towards the Senate Leadership Fund, an independent Super PAC which aims to build a Republican Senate majority.

Timothy Mellon (Family net worth: $11B)

Timothy Mellon was the chairman and majority owner of Pan Am Systems, a privately held company with operations in transportation, manufacturing, and energy. In November 2020, CSX Corporation announced it had signed an agreement to purchase Pan Am. The sale was approved in April 2022.

Mellon made headlines in 2021 when it was revealed that he made a whopping $53 million donation to the Texas border wall fund. At the time of reporting, this represented 98% of total funding.

Larry Ellison (Net worth: $102B)

Larry Ellison is the chairman and cofounder of Oracle, one of the world’s largest software companies. Oracle is listed on the NYSE and has a market cap of over $200 billion. Ellison was also a Tesla board member from December 2018 to August 2022.

The vast majority of his political contributions have gone towards the Opportunity Matters Fund, which supports candidates who promote the Opportunity Agenda. It calls for enhanced financial literacy, apprenticeships, and education options.

Peter Thiel (Net worth: $4B)

Peter Thiel is a successful entrepreneur and venture capitalist, perhaps best known for cofounding PayPal. He also cofounded Palantir Technologies, a data analytics company, and is a general partner of Founders Fund, a venture capital firm with investments in major names such as SpaceX.

Thiel is one of the Republican Party’s largest donors, a position that sets him apart from many other Silicon Valley figures. In February 2022, it was reported that he would be stepping down as a Meta board member.

Patrick and Shirley Ryan (Patrick’s net worth: $9B)

Patrick Ryan is the founder and retired CEO of AON Corporation, one of the world’s largest insurance companies. In 2010, he founded another company known as Ryan Specialty Group, which provides services to insurance brokers.

Together with his wife Shirley, the Ryans have made large donations towards the Senate Leadership Fund and other Republican groups.

War

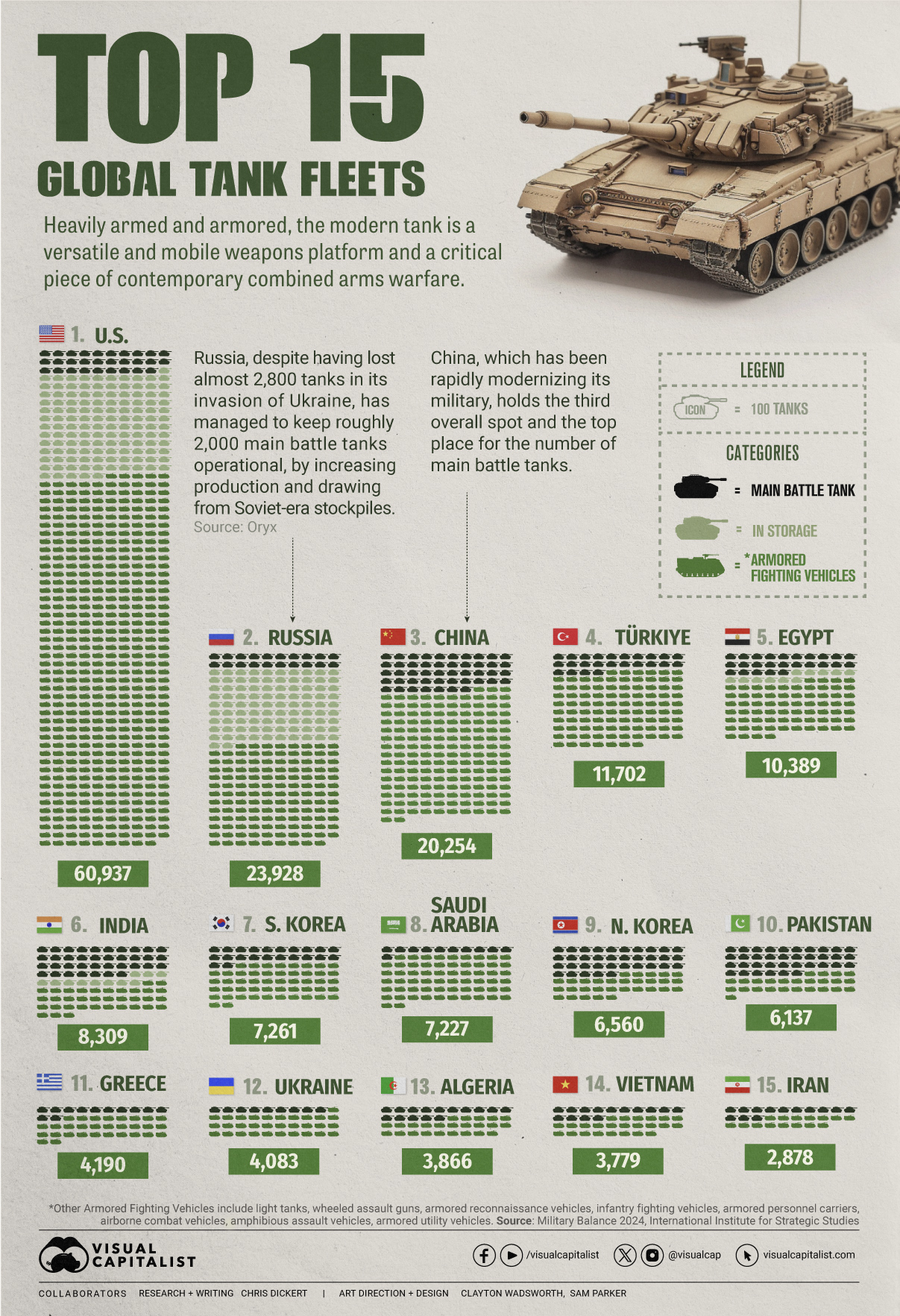

Visualized: Top 15 Global Tank Fleets

Heavily armed and armored, the modern tank is a versatile and mobile weapons platform, and a critical piece of contemporary warfare.

The Top 15 Global Tank Fleets

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Heavily armed and armored, the modern tank is a versatile and mobile weapons platform, and a critical piece of contemporary warfare.

This visualization shows the top 15 global tank fleets, using data from the 2024 Military Balance report from the International Institute for Strategic Studies (IISS).

Let’s take an in-depth look at the top three fleets:

1. United States

As the world’s pre-eminent military power, it’s perhaps no surprise that the United States also has the largest tank fleet, by a wide margin.

In total, they have just over 45,000 armored fighting vehicles in operation, along with 2,640 main battle tanks (MBTs), and 12,800 vehicles in storage, of which 2,000 are main battle tanks.

| Category | Vehicles | Global rank |

|---|---|---|

| Main battle tanks | 2,640 | 4 |

| Armored reconnaissance | 1,745 | 1 |

| Infantry fighting vehicles | 3,262 | 3 |

| Armored personnel carriers | 10,644 | 1 |

| Amphibious assault vehicles | 1,401 | 1 |

| Armored utility vehicles | 28,445 | 1 |

| Storage | 12,800 | 1 |

| Total | 60,937 | 1 |

The U.S. is internalizing the lessons from the ongoing invasion of Ukraine, where Western-supplied anti-tank weapons and massed Ukrainian artillery have been cutting Russian tanks to pieces. As a result, the U.S. recently canceled an upgrade of the M1 Abrams in favor of a more ambitious upgrade.

Meanwhile, the U.S. is nervously eyeing a more confident China and a potential clash over Taiwan, where air and naval forces will be critical. However, a recent war game showed that Taiwanese mechanized ground forces, kitted out with American-made tanks and armored fighting vehicles, were critical in keeping the island autonomous.

2. Russia

According to Oryx, a Dutch open-source intelligence defense website, at time of writing, Russia has lost almost 2,800 main battle tanks since invading Ukraine. Considering that in the 2022 edition of the Military Balance, Russia was estimated to have 2,927 MBTs in operation, those are some hefty losses.

Russia has been able to maintain about 2,000 MBTs in the field, in part, by increasing domestic production. Many defense plants have been taken over by state-owned Rostec and now operate around the clock. Russia is also now spending a full third of their budget on defense, equivalent to about 7.5% of GDP.

At the same time, they’ve also been drawing down their Soviet-era stockpiles, which are modernized before being sent to the front. Just how long they can keep this up is an open question; their stockpiles are large, but not limitless. Here is what their storage levels look like:

| Category | 2023 | 2024 | YOY change |

|---|---|---|---|

| Main battle tanks | 5,000 | 4,000 | -20.0% |

| Armored reconnaissance | 1,000 | 100 | -90.0% |

| Infantry fighting vehicles | 4,000 | 2,800 | -30.0% |

| Armored personnel carriers | 6,000 | 2,300 | -61.7% |

| Total | 16,000 | 9,200 | -42.5% |

3. China

China holds the third overall spot and top place globally for the number of main battle tanks in operation. Untypically, the People’s Liberation Army has no armored vehicles in storage, which perhaps isn’t surprising when you consider that China has been rapidly modernizing its military and that stockpiles usually contain older models.

China also has one of the world’s largest fleets of armored fighting vehicles, second only to the United States. Breaking down that headline number, we can also see that they have the largest number of light tanks, wheeled guns, and infantry fighting vehicles.

| Category | Vehicles | Global rank |

|---|---|---|

| Main battle tanks | 4,700 | 1 |

| Light tanks | 1,330 | 1 |

| Wheeled guns | 1,250 | 1 |

| Infantry fighting vehicles | 8,200 | 1 |

| Armored personnel carriers | 3,604 | 5 |

| Airborne combat vehicles | 180 | 2 |

| Amphibious assault vehicles | 990 | 2 |

| Total | 20,254 | 3 |

This is equipment that would be integral if China were to make an attempt to reunify Taiwan with the mainland by force, where lightly armored mechanized units need to move with speed to occupy the island before Western allies can enter the fray. It’s worth noting that China also has one of the world’s largest fleets of amphibious assault vehicles.

End of the Tank?

Many commentators at the outset of Russia’s invasion of Ukraine, were quick to predict the end of the tank, however, to paraphrase Mark Twain, reports of the tank’s demise are greatly exaggerated.

With the U.S. and China both developing remote and autonomous armored vehicles, tanks could be quite different in the future, but there is nothing else that matches them for firepower, mobility, and survivability on the modern battlefield today.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?