Politics

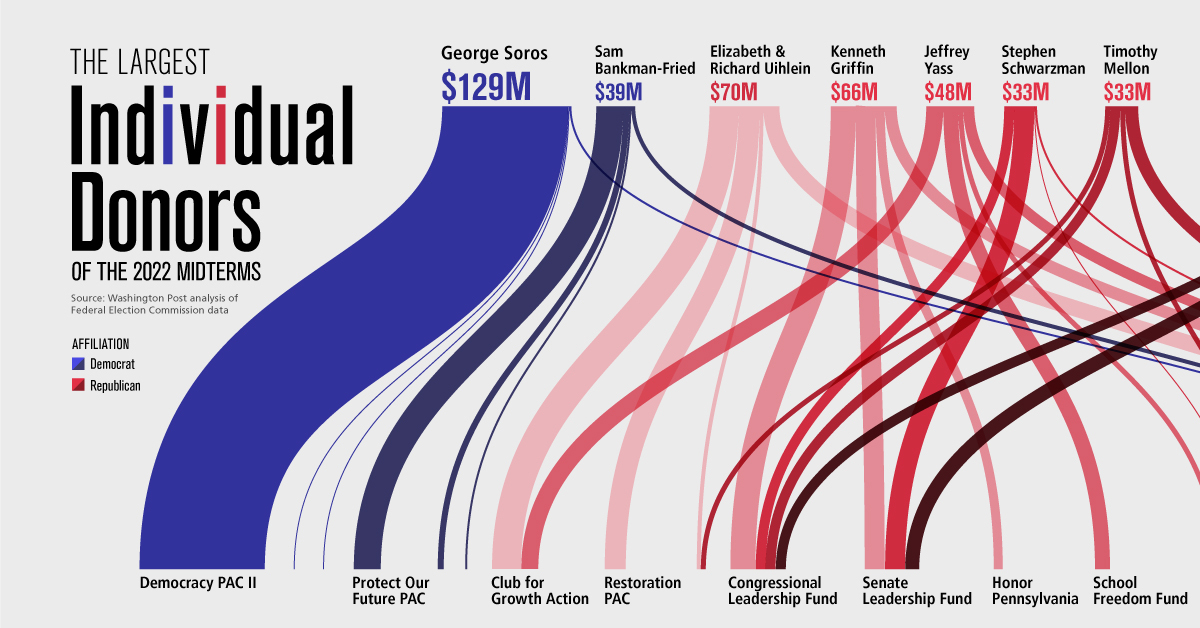

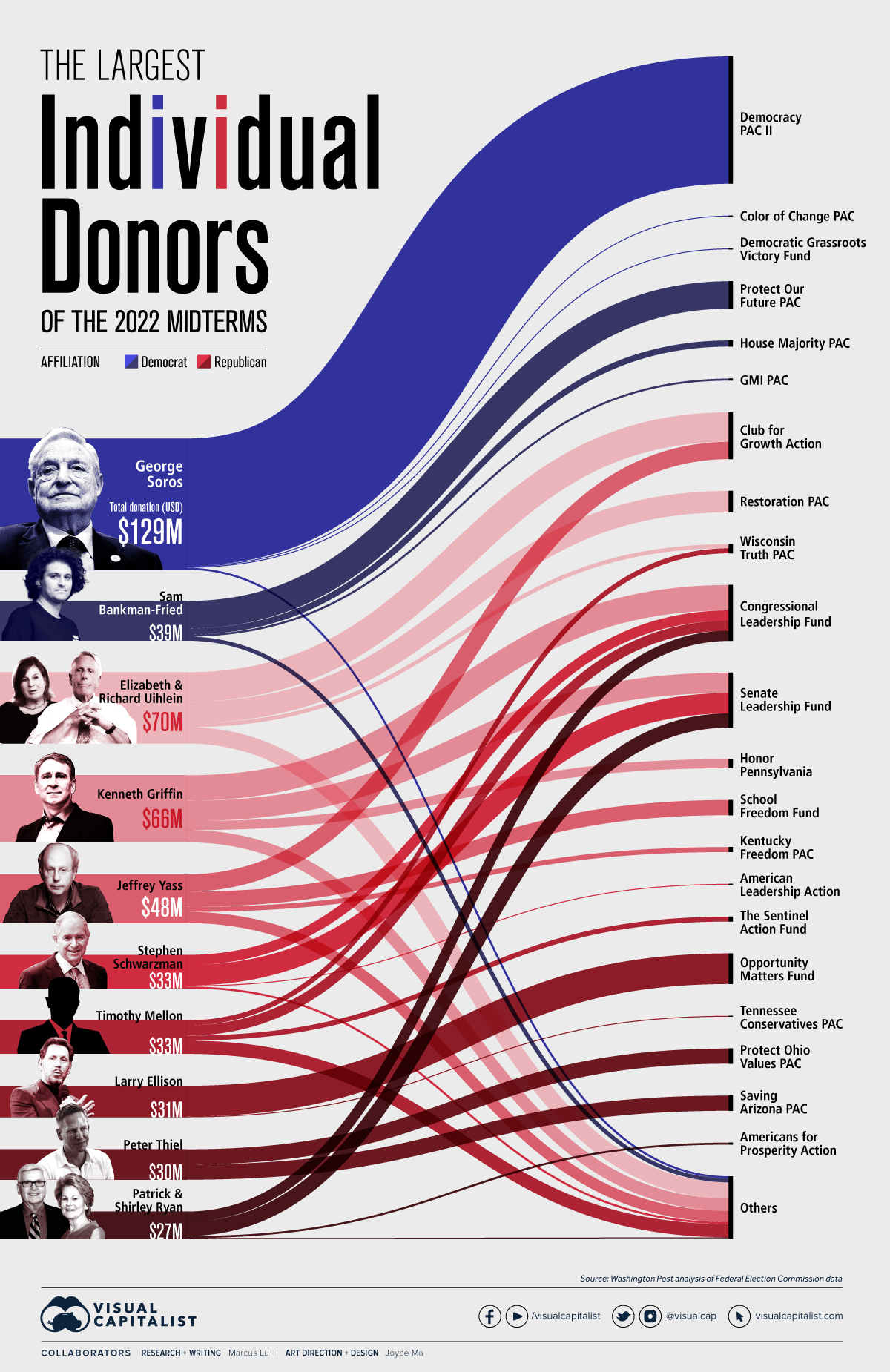

Visualized: The Biggest Donors of the 2022 U.S. Midterm Elections

Visualized: The Biggest Donors of the 2022 U.S. Midterm Elections

This year’s midterm election is expected to set a new spending record, with over $9 billion being raised. This is significantly higher than the previous record of $7 billion, which was set in 2018.

According to a recent analysis by the Washington Post, $1 billion of these funds can be attributed to the top 50 donors. In typical Visual Capitalist style, we’ve illustrated this data to provide you with better insight.

Overview of the Data

The following table lists the top 10 individual donors of the 2022 midterm elections.

| Rank | Name | Affiliation | Total Donation (USD millions) |

|---|---|---|---|

| #1 | George Soros | Democrat | $129 |

| #2 | Elizabeth & Richard Uihlein | Republican | $70 |

| #3 | Kenneth Griffin | Republican | $66 |

| #4 | Jeffrey Yass | Republican | $48 |

| #5 | Sam Bankman-Fried | Democrat | $39 |

| #6 | Stephen Schwarzman | Republican | $33 |

| #7 | Timothy Mellon | Republican | $33 |

| #8 | Larry Ellison | Republican | $31 |

| #9 | Peter Thiel | Republican | $30 |

| #10 | Patrick & Shirley Ryan | Republican | $27 |

Sorting this top 10 donor list by party, we can see that $168 million was raised for the Democrats, and $338 million for the Republicans.

Continue reading below for some interesting background info on all 10 of these individuals. Net worth values were gathered from Forbes on November 1, 2022.

George Soros (Net worth: $7B)

George Soros is a Hungarian-born American billionaire, widely known for his philanthropical efforts and for “breaking” the Bank of England. He has had an illustrious career as a hedge fund manager, founding Soros Fund Management in 1970. Visit this page to see the top 100 holdings of Soros Fund Management’s portfolio.

Soros has donated over $30 billion of his fortune to various causes and charities. He is the founder and chairman of two Super PACs (political action committees) named Democracy PAC and Democracy PAC II.

Unlike regular PACs, Super PACs face no limits in terms of fundraising or political spending.

Elizabeth & Richard Uihlein (Combined net worth: $7B)

Elizabeth & Richard Uihlein are the founders of Uline, one of North America’s largest distributors of logistics supplies (boxes, tape, gloves, etc.). The company makes several billion in sales per year.

The couple have gained media attention for making substantial donations to the Republican party. According to Forbes, the Uihleins have donated a total of $194 million since the 1990s.

Kenneth Griffin (Net worth: $31B)

Kenneth Griffin is the founder and CEO of Citadel, a hedge fund based in the U.S. He also owns Citadel Securities, which is the largest market maker on the New York Stock Exchange (NYSE).

Market makers act as a middleman in financial markets by facilitating buy and sell orders for investors. Using equities (stocks) as an example, when a market maker receives an order from a buyer, it sells shares from its own inventory. This enables the stock market to run smoothly.

Griffin found himself in the spotlight during the GameStop short squeeze when his firm provided emergency funding to Melvin Capital Management.

Jeffrey Yass (Net worth: $30B)

Once a pro gambler, Jeffrey Yass is a cofounder of Susquehanna International Group (SIG), a successful trading firm based in Philadelphia. SIG specializes in quantitative research and trading, which involves the use of computer algorithms to identify opportunities.

Yass is frequently cited as the richest person in the state of Pennsylvania and has gained media attention for his large political contributions.

Sam Bankman-Fried (Net worth: $17B)

Sam Bankman-Fried is the founder and CEO of FTX, which is currently the world’s third largest cryptocurrency exchange behind Binance and Coinbase. The company is based in the Bahamas and offers trading in more than 300 cryptocurrencies.

In May 2022, Bankman-Fried declared that he was willing to donate “north of $100 million” in the upcoming 2024 presidential election. He has since backtracked this comment.

At some point, when you’ve given your message to voters, there’s just not a whole lot more you can do.

– Sam Bankman-Fried

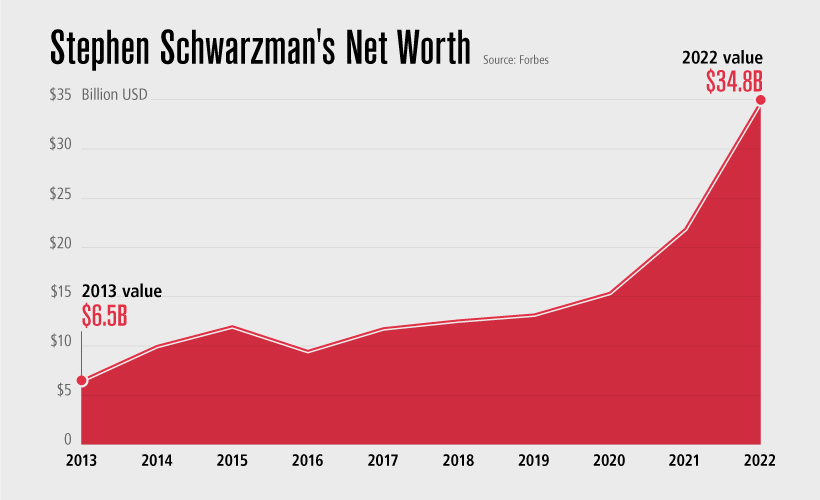

Stephen Schwarzman (Net worth: $35B)

Stephen Schwarzman is the chairman and CEO of The Blackstone Group, a globally recognized private equity firm. Blackstone’s portfolio of companies includes Ancestry.com, a well-known family history service, and Bumble, a popular online dating platform.

Shown below, Schwarzman’s wealth has increased substantially since 2020.

The bulk of Schwarzman’s political contributions have gone towards the Senate Leadership Fund, an independent Super PAC which aims to build a Republican Senate majority.

Timothy Mellon (Family net worth: $11B)

Timothy Mellon was the chairman and majority owner of Pan Am Systems, a privately held company with operations in transportation, manufacturing, and energy. In November 2020, CSX Corporation announced it had signed an agreement to purchase Pan Am. The sale was approved in April 2022.

Mellon made headlines in 2021 when it was revealed that he made a whopping $53 million donation to the Texas border wall fund. At the time of reporting, this represented 98% of total funding.

Larry Ellison (Net worth: $102B)

Larry Ellison is the chairman and cofounder of Oracle, one of the world’s largest software companies. Oracle is listed on the NYSE and has a market cap of over $200 billion. Ellison was also a Tesla board member from December 2018 to August 2022.

The vast majority of his political contributions have gone towards the Opportunity Matters Fund, which supports candidates who promote the Opportunity Agenda. It calls for enhanced financial literacy, apprenticeships, and education options.

Peter Thiel (Net worth: $4B)

Peter Thiel is a successful entrepreneur and venture capitalist, perhaps best known for cofounding PayPal. He also cofounded Palantir Technologies, a data analytics company, and is a general partner of Founders Fund, a venture capital firm with investments in major names such as SpaceX.

Thiel is one of the Republican Party’s largest donors, a position that sets him apart from many other Silicon Valley figures. In February 2022, it was reported that he would be stepping down as a Meta board member.

Patrick and Shirley Ryan (Patrick’s net worth: $9B)

Patrick Ryan is the founder and retired CEO of AON Corporation, one of the world’s largest insurance companies. In 2010, he founded another company known as Ryan Specialty Group, which provides services to insurance brokers.

Together with his wife Shirley, the Ryans have made large donations towards the Senate Leadership Fund and other Republican groups.

Economy

The Bloc Effect: International Trade with Geopolitical Allies on the Rise

Rising geopolitical tensions are shaping the future of international trade, but what is the effect on trading among G7 and BRICS countries?

The Bloc Effect: International Trade with Allies on the Rise

International trade has become increasingly fragmented over the last five years as countries have shifted to trading more with their geopolitical allies.

This graphic from The Hinrich Foundation, the first in a three-part series covering the future of trade, provides visual context to the growing divide in trade in G7 and pre-expansion BRICS countries, which are used as proxies for geopolitical blocs.

Trade Shifts in G7 and BRICS Countries

This analysis uses IMF data to examine differences in shares of exports within and between trading blocs from 2018 to 2023. For example, we looked at the percentage of China’s exports with other BRICS members as well as with G7 members to see how these proportions shifted in percentage points (pp) over time.

Countries traded nearly $270 billion more with allies in 2023 compared to 2018. This shift came at the expense of trade with rival blocs, which saw a decline of $314 billion.

Country Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

🇮🇳 India 0.0 3.9

🇷🇺 Russia 0.7 -3.8

🇮🇹 Italy 0.8 -0.7

🇨🇦 Canada 0.9 -0.7

🇫🇷 France 1.0 -1.1

🇪🇺 EU 1.1 -1.5

🇩🇪 Germany 1.4 -2.1

🇿🇦 South Africa 1.5 1.5

🇺🇸 U.S. 1.6 -0.4

🇯🇵 Japan 2.0 -1.7

🇨🇳 China 2.1 -5.2

🇧🇷 Brazil 3.7 -3.3

🇬🇧 UK 10.2 0.5

All shifts reported are in percentage points. For example, the EU saw its share of exports to G7 countries rise from 74.3% in 2018 to 75.4% in 2023, which equates to a 1.1 percentage point increase.

The UK saw the largest uptick in trading with other countries within the G7 (+10.2 percentage points), namely the EU, as the post-Brexit trade slump to the region recovered.

Meanwhile, the U.S.-China trade dispute caused China’s share of exports to the G7 to fall by 5.2 percentage points from 2018 to 2023, the largest decline in our sample set. In fact, partly as a result of the conflict, the U.S. has by far the highest number of harmful tariffs in place.

The Russia-Ukraine War and ensuing sanctions by the West contributed to Russia’s share of exports to the G7 falling by 3.8 percentage points over the same timeframe.

India, South Africa, and the UK bucked the trend and continued to witness advances in exports with the opposing bloc.

Average Trade Shifts of G7 and BRICS Blocs

Though results varied significantly on a country-by-country basis, the broader trend towards favoring geopolitical allies in international trade is clear.

Bloc Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

Average 2.1 -1.1

BRICS 1.6 -1.4

G7 incl. EU 2.4 -1.0

Overall, BRICS countries saw a larger shift away from exports with the other bloc, while for G7 countries the shift within their own bloc was more pronounced. This implies that though BRICS countries are trading less with the G7, they are relying more on trade partners outside their bloc to make up for the lost G7 share.

A Global Shift in International Trade and Geopolitical Proximity

The movement towards strengthening trade relations based on geopolitical proximity is a global trend.

The United Nations categorizes countries along a scale of geopolitical proximity based on UN voting records.

According to the organization’s analysis, international trade between geopolitically close countries rose from the first quarter of 2022 (when Russia first invaded Ukraine) to the third quarter of 2023 by over 6%. Conversely, trade with geopolitically distant countries declined.

The second piece in this series will explore China’s gradual move away from using the U.S. dollar in trade settlements.

Visit the Hinrich Foundation to learn more about the future of geopolitical trade

-

Economy19 hours ago

Economy19 hours agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

United States1 week ago

United States1 week agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

We visualized product categories that saw the highest % increase in price due to U.S. inflation as of March 2024.

-

Economy4 weeks ago

Economy4 weeks agoG20 Inflation Rates: Feb 2024 vs COVID Peak

We visualize inflation rates across G20 countries as of Feb 2024, in the context of their COVID-19 pandemic peak.

-

Economy1 month ago

Economy1 month agoMapped: Unemployment Claims by State

This visual heatmap of unemployment claims by state highlights New York, California, and Alaska leading the country by a wide margin.

-

Economy2 months ago

Economy2 months agoConfidence in the Global Economy, by Country

Will the global economy be stronger in 2024 than in 2023?

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries