Markets

The Best and Worst Performing Sectors in 2017

The Best and Worst Performing Sectors in 2017

Regardless of what you think of it, the second-longest U.S. bull market in modern history continues to rage on.

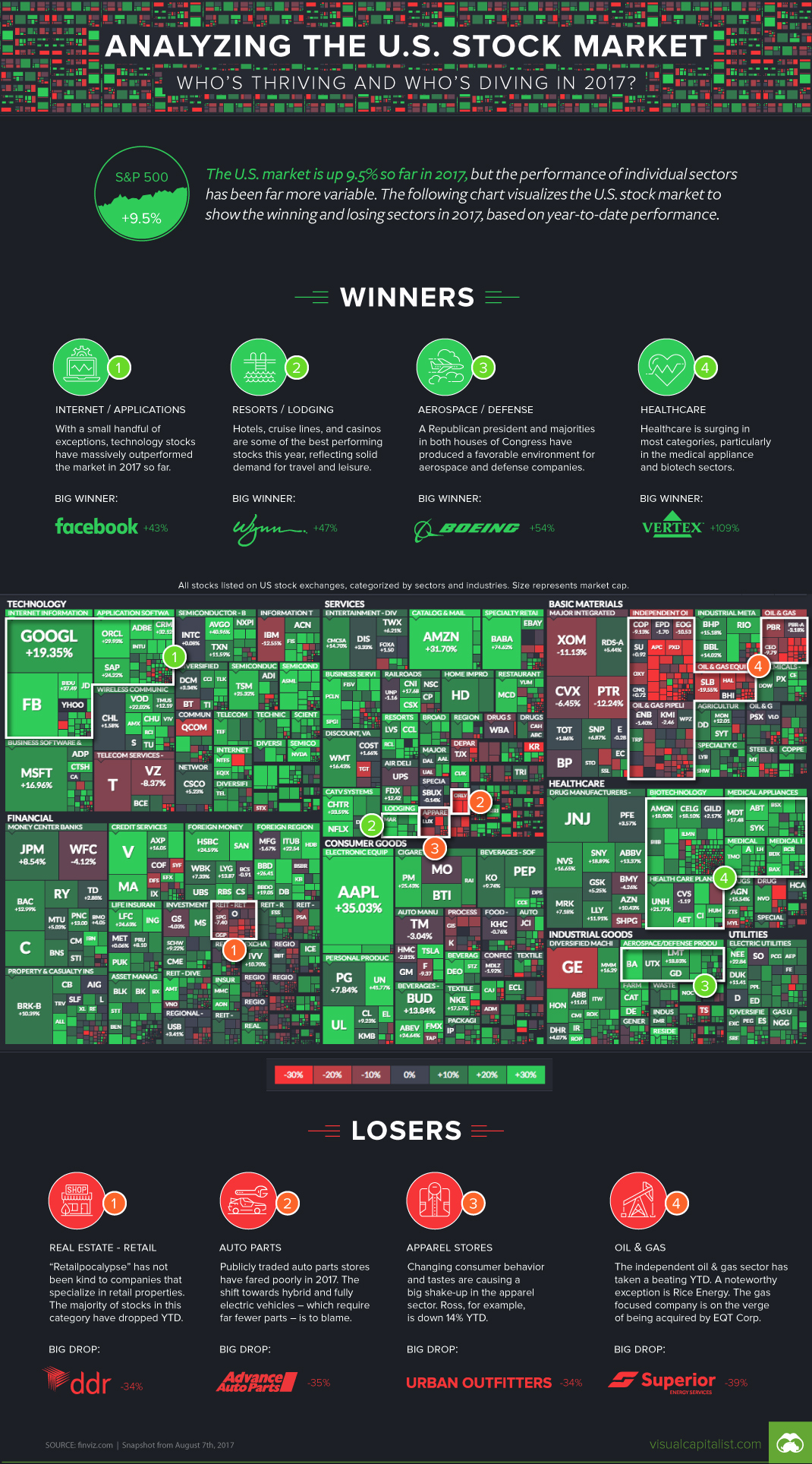

Even this year, which is the eighth anniversary of the lows of the Financial Crisis, has the S&P 500 charging forward with a 9.5% performance year-to-date. That said, it’s important to keep in mind that individual sectors that make up the market are not created equally – and while some have been crushing it, others have been taking a beating.

Today’s visualization, including a screenshot pulled from FinViz.com, shows a map of stocks in the U.S. market. Divided into different subsectors and colored by performance YTD, it helps give an idea of what has outperformed the market, and which stocks have been left in the dust.

The Winners So Far

1. Internet and Software

Companies like Facebook and Alphabet continue to dominate online advertising, while Microsoft, Baidu, and JD.com also are outperforming. SaaS-focused companies like Salesforce, Oracle, Workday, and Adobe also are beating the market as a whole in 2017 so far.

2. Resorts and Lodging

Hotels, cruise lines, and casinos are performing impressively in 2017 so far, even with companies like Airbnb competing on the accommodation front. Wynn Resorts, for example, is up over 40% on the year so far.

3. Aerospace and Defense

With Trump in the White House and both houses of Congress being controlled by Republicans, it’s no surprise to see big aerospace companies like Boeing up over 50% YTD.

4. Healthcare

As the population continues to age, medical appliance and biotech subsectors have taken off in 2017.

The Losers So Far

1. Real Estate (Retail)

The “Retailpocalypse” has not been kind to REITs focused on commercial spaces.

2. Auto Parts

With EVs and autonomous vehicles approaching on the horizon, less auto parts will be needed per capita.

3. Apparel Stores

Changing consumer tastes and the transition to online/mobile shopping is making life tough for some companies, like Urban Outfitters, which is down more than -30% on the year.

4. Independent Oil & Gas

The recovery in oil prices that happened in 2016 has not continued into 2017, and this has hurt independent oil and gas producers that have higher average costs.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Travel1 week ago

Travel1 week agoRanked: The World’s Top Flight Routes, by Revenue

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024