Technology

Visualizing the Best Funded Startup in Each State

Visualizing the Best Funded Startup in Each State

Over the last 20 years, people have flocked from all over the world to Silicon Valley.

It’s the epicenter of the tech boom, and a magnet that attracts talent, ideas, and capital to come together to create new things. Software mania has shifted the most important corporate addresses in the country from the streets of Manhattan to obscure towns like Mountain View, Cupertino, or Menlo Park.

While a booming ecosystem has lured many to the Valley, it’s simultaneously unlocked new technologies that have made it possible to work, collaborate, and build new startups from anywhere.

The result has been the birth of influential startups and ecosystems in every locale imaginable – and today, it’s true that nearly every state has an impressive tech startup to call its own.

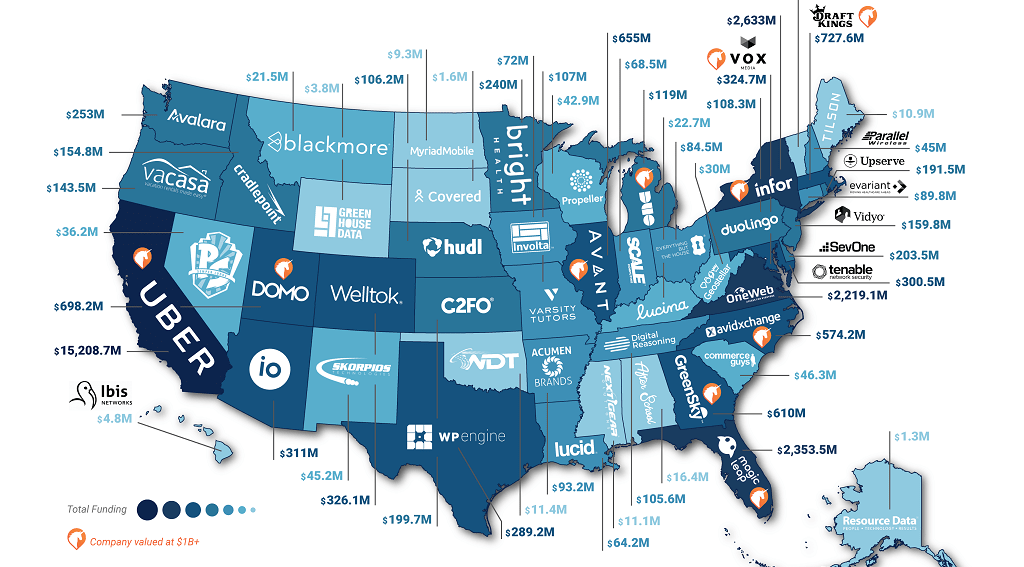

Best Funded Startups by State

Today’s infographic comes to us from CB Insights and it showcases the best funded VC-backed startups in every state with more than $1 million in disclosed equity financing since 2015.

Here’s the best funded startup in each state (and D.C.) as of May 23, 2018:

| Rank | State | Company | Disclosed Equity Funding ($M) |

|---|---|---|---|

| #1 | California | Uber | $15,208 |

| #2 | New York | Infor | $2,633 |

| #3 | Florida | Magic Leap | $2,354 |

| #4 | Virginia | OneWeb | $2,219 |

| #5 | Massachusetts | DraftKings | $728 |

| #6 | Utah | Domo | $698 |

| #7 | Illinois | Avant | $655 |

| #8 | Georgia | GreenSky | $610 |

| #9 | North Carolina | AvidXChange | $574 |

| #10 | Colorado | Welltok | $326 |

| #11 | DC | Vox Media | $325 |

| #12 | Arizona | IO Data Centers | $311 |

| #13 | Maryland | Tenable Network Security | $301 |

| #14 | Texas | WP Engine | $289 |

| #15 | Washington | Avalara | $253 |

| #16 | Minnesota | Bright Health | $240 |

| #17 | Delaware | SevOne | $204 |

| #18 | Kansas | C2FO | $200 |

| #19 | Rhode Island | Upserve | $192 |

| #20 | New Jersey | Vidyo | $160 |

| #21 | Idaho | CradlePoint | $155 |

| #22 | Oregon | Vacasa | $144 |

| #23 | Michigan | Duo Security | $119 |

| #24 | Pennsylvania | Duolingo | $108 |

| #25 | Missouri | Varsity Tutors | $107 |

| #26 | Nebraska | Hudl | $106 |

| #27 | Tennessee | Digital Reasoning Systems | $106 |

| #28 | Arkansas | Acumen Brands | $93 |

| #29 | Connecticut | eVariant | $90 |

| #30 | Ohio | Everything But The House | $85 |

| #31 | Iowa | Involta | $72 |

| #32 | Indiana | Scale Computing | $69 |

| #33 | Louisiana | Lucid | $64 |

| #34 | South Carolina | Commerce Guys | $46 |

| #35 | New Mexico | Skorpios Technologies | $45 |

| #36 | New Hampshire | Parallel Wireless | $45 |

| #37 | Wisconsin | Propeller Health | $43 |

| #38 | Nevada | PlayStudios | $36 |

| #39 | West Virginia | Geostellar | $30 |

| #40 | Kentucky | Lucina Health | $23 |

| #41 | Montana | Blackmore Sensors & Analytics | $22 |

| #42 | Alabama | AfterSchool | $16 |

| #43 | Oklahoma | Weather Decision Technologies | $11 |

| #44 | Mississippi | Next Gear Solutions* | $11 |

| #45 | Maine | Tilson Technology Management | $11 |

| #46 | North Dakota | Myriad Mobile | $9 |

| #47 | Vermont | Faraday | $6 |

| #48 | Hawaii | Ibis Networks | $5 |

| #49 | Wyoming | Green House Data* | $4 |

| #50 | South Dakota | Covered Insurance Solutions | $2 |

| #51 | Alaska | Resource Data* | $1 |

It’s important to note that three states did not meet CB Insight’s exact requirements for this list: Alaska, Mississippi, and Wyoming. As a result, those states are represented by private startups that have raised money since 2015, but they have not disclosed any VC-backing.

Uber Versus All

Although prominent startups are being backed by venture capital in practically every state, the Golden State still shows why it’s still the startup mecca. Uber has raised $15.21 billion in funding, which is actually more than the best-funded startup in every state combined together:

Uber (California):

$15.21 billion

The Best Funded Startup In Every Other State (50 companies):

$15.0 billion

The other startups are no slouches either – they are represented by household names like Vox Media (D.C.), Magic Leap (Florida), Draft Kings (Massachusetts), and Domo (Utah), as well as many other successful companies.

Uber is a funding outlier even among California-based companies, with Lyft ($4.8 billion) and Airbnb ($4.4 billion) being the next best funded startups in the state.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

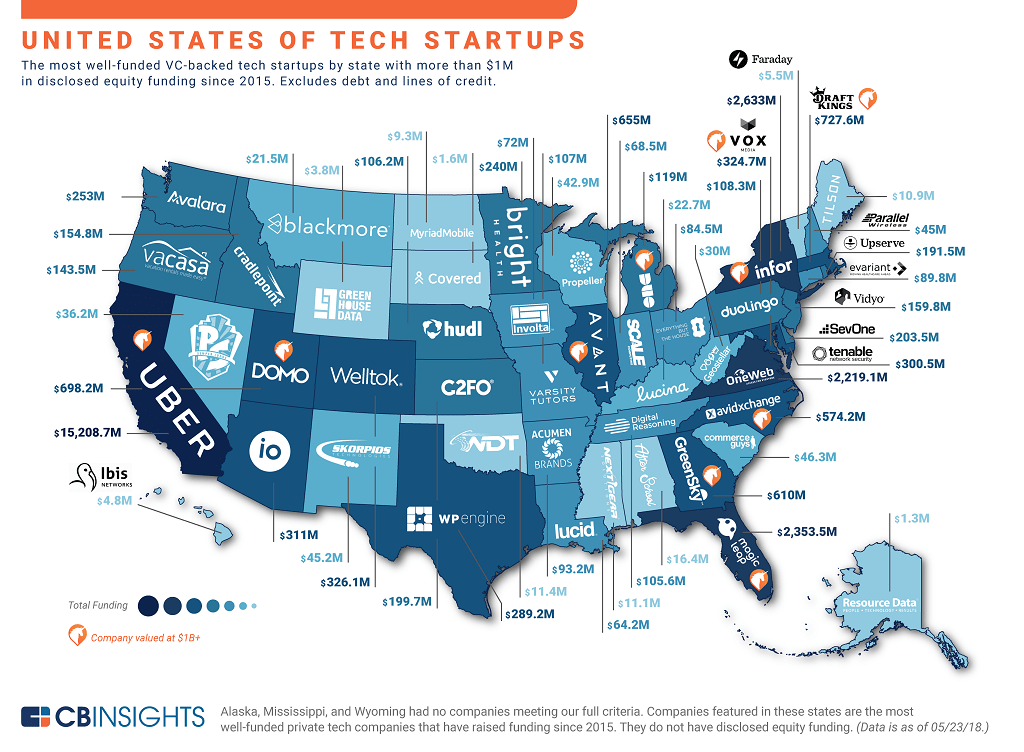

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes