Precious Metals

Animation: How Billionaire Investors Are Protecting Their Wealth

It can take a lifetime to build a fortune of Buffett or Dalio sized proportions.

But, as all billionaires know, there is always risk present in the market – and even though a catastrophic geopolitical or financial event is very unlikely, it is important to be prepared for anything.

How Billionaires Protect Their Wealth

Today’s animation comes to us from Sprott Physical Bullion Trusts, and it shows the worries that are keeping billionaires up at night, and how they are positioning themselves to preserve wealth in any market environment.

Let’s take a closer look at the actions that these billionaires are taking, and why they are so concerned in the first place.

The Cash Misconception

Most billionaires are surprisingly cash poor on a relative basis. The average billionaire only holds 1% of their net worth in liquid assets like cash because the vast majority of their fortunes are usually tied up in business interests, stocks, bonds, mutual funds, and other financial assets.

Wealth is not stagnant, and the portfolios of these billionaires will move along with the health of the economy and markets. This can either make their wealth flourish – or any market crash could damage their entire fortune.

For this reason, billionaires are very concerned about market fluctuations, and they actively seek ways to protect their wealth even in the wake of a catastrophic geopolitical, economic, or monetary event.

How Billionaires are Positioned

In two earlier infographics, we outlined the current geopolitical risks that have elite investors worried, as well as the types of market risks that could materialize.

Keeping the above points in mind, billionaire investors are positioning their portfolios accordingly.

Warren Buffett

By accumulating massive amounts of cash in Berkshire Hathaway, value investor Warren Buffett has preserved his optionality. If a downturn hits the market, he can deploy the cash and get assets at bottom barrel prices. (Sidenote: see the size and scope of the vast Warren Buffett Empire)

David Einhorn

The billionaire founder of Greenlight Capital believes that financial repression and monetary debasement employed by central bankers can be neutralized with gold.

Paul Tudor Jones

The reclusive hedge fund manager, who called the 1987 crash, is being very careful in choosing the assets he holds. He has observed bonds are the most expensive they’ve ever been by virtually any metric – and has joked that he’d rather hold a burning chunk of coal than a U.S. Treasury bond.

Ray Dalio

The founder of the world’s largest hedge fund is adamant that 5-10% of a portfolio should currently be held in gold. Not surprisingly, in November 2017, Bridgewater loaded up on its gold holdings by 525%.

No matter the size of your investment portfolio, it’s worth studying how the world’s most elite investors are protecting their fortunes. By hedging against big events and diversifying their investment portfolios to include safe havens, they maximize their chances for success in any investment environment.

Mining

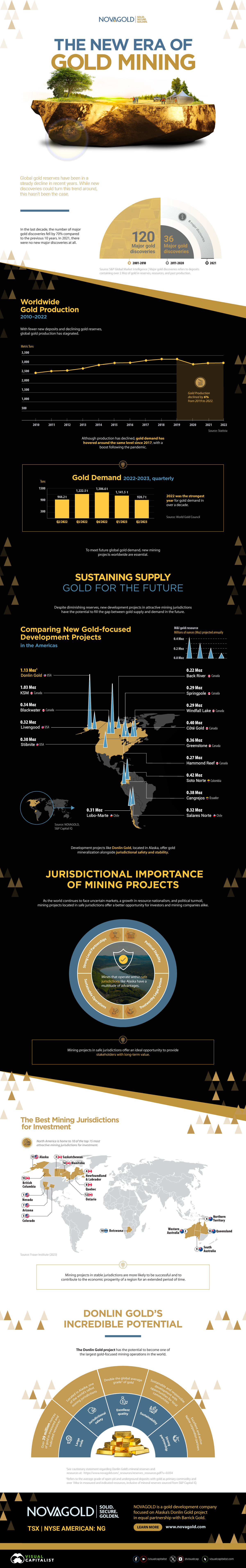

Visualizing the New Era of Gold Mining

This infographic highlights the need for new gold mining projects and shows the next generation of America’s gold deposits.

Visualizing the New Era of Gold Mining

Between 2011 and 2020, the number of major gold discoveries fell by 70% relative to 2001-2010.

The lack of discoveries, alongside stagnating gold production, has cast a shadow of doubt on the future of gold supply.

This infographic sponsored by NOVAGOLD highlights the need for new gold mining projects with a focus on the company’s Donlin Gold project in Alaska.

The Current State of Gold Production

Between 2010 and 2019, gold production increased steadily, though this growth has stagnated over the past few years.

| Year | Gold Production, tonnes | YoY % Change |

|---|---|---|

| 2010 | 2,560 | - |

| 2011 | 2,660 | 3.9% |

| 2012 | 2,690 | 1.1% |

| 2013 | 2,800 | 4.1% |

| 2014 | 2,990 | 6.8% |

| 2015 | 3,100 | 3.7% |

| 2016 | 3,110 | 0.3% |

| 2017 | 3,230 | 3.9% |

| 2018 | 3,300 | 2.2% |

| 2019 | 3,300 | 0.0% |

| 2020 | 3,030 | -8.2% |

| 2021 | 3,090 | 2.0% |

| 2022 | 3,100 | 0.3% |

Along with a small decrease in gold production in 2020, there were no new major gold discoveries in 2021.

The fall in production and long-term lack of gold discoveries point towards a possible imbalance in gold supply and demand. This calls for the introduction of new gold development projects that can fill the supply-demand gap in the future.

Sustaining Supply: Gold for the Future

Jurisdictions play an important role when looking for projects that could sustain gold production well into the future.

From political stability to trustworthy legal systems, the characteristics of a jurisdiction can make or break mining projects. Amid ongoing market uncertainty, political turmoil, and resource nationalism, projects in safe jurisdictions offer a better investment opportunity for investors and mining companies.

Today, 10 of the top 15 mining jurisdictions for investment are located in North America, according to the Fraser Institute report published in 2023.

A Golden Opportunity

Located in Alaska, one of the world’s safest mining jurisdictions, NOVAGOLD’s 50% owned Donlin Gold project has the highest average grade of gold among major development projects in the Americas. For every tonne of ore, Donlin Gold offers 2.24 grams of gold, which is more than twice the global average grade of 1.04g/t.

Additionally, Donlin Gold is the second-largest gold-focused development project in the Americas, with over 39 million ounces of gold in M&I resources inclusive of reserves.

NOVAGOLD is focused on the Donlin Gold project in equal partnership with Barrick Gold.

Learn more about Donlin Gold .

-

Lithium2 days ago

Lithium2 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

-

Mining3 weeks ago

Mining3 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

While the price of gold has reached new record highs in 2024, gold mining stocks are still far from their 2011 peaks.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy4 months ago

Energy4 months agoThe Periodic Table of Commodity Returns (2014-2023)

Commodity returns in 2023 took a hit. This graphic shows the performance of commodities like gold, oil, nickel, and corn over the last decade.

-

Mining4 months ago

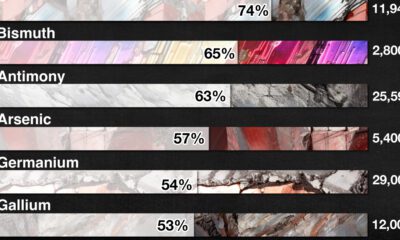

Mining4 months agoChina Dominates the Supply of U.S. Critical Minerals List

The U.S. Geological Survey estimates that in 2022, China was the world’s leading producer of 30 out of 50 entries on the U.S. critical minerals list.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries