An Introduction to MSCI ESG Indexes

The following content is sponsored by MSCI

An Introduction to MSCI ESG Indexes

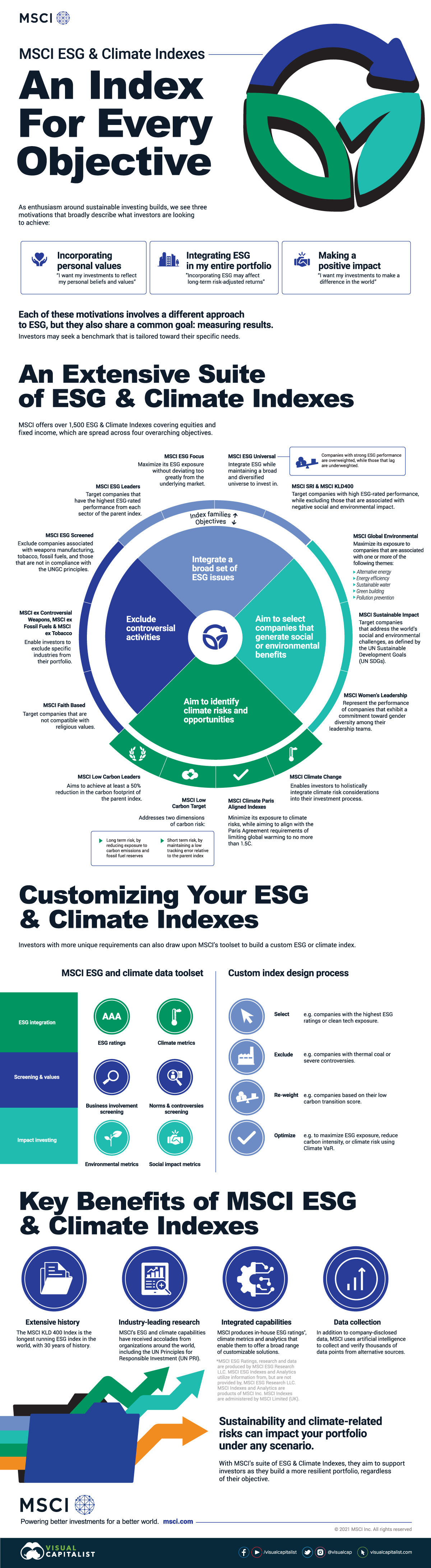

There are various portfolio objectives within the realm of sustainable investing.

For example, some investors may want to build a portfolio that reflects their personal values. Others may see environmental, social, and governance (ESG) criteria as a tool for improving long-term returns, or as a way to create positive impact. A combination of all three of these motivations is also possible.

To support investors as they embark on their sustainable journey, our sponsor, MSCI, offers over 1,500 purpose-built ESG indexes. In this infographic, we’ll take a holistic view at what these indexes are designed to achieve.

An Extensive Suite of ESG & Climate Indexes

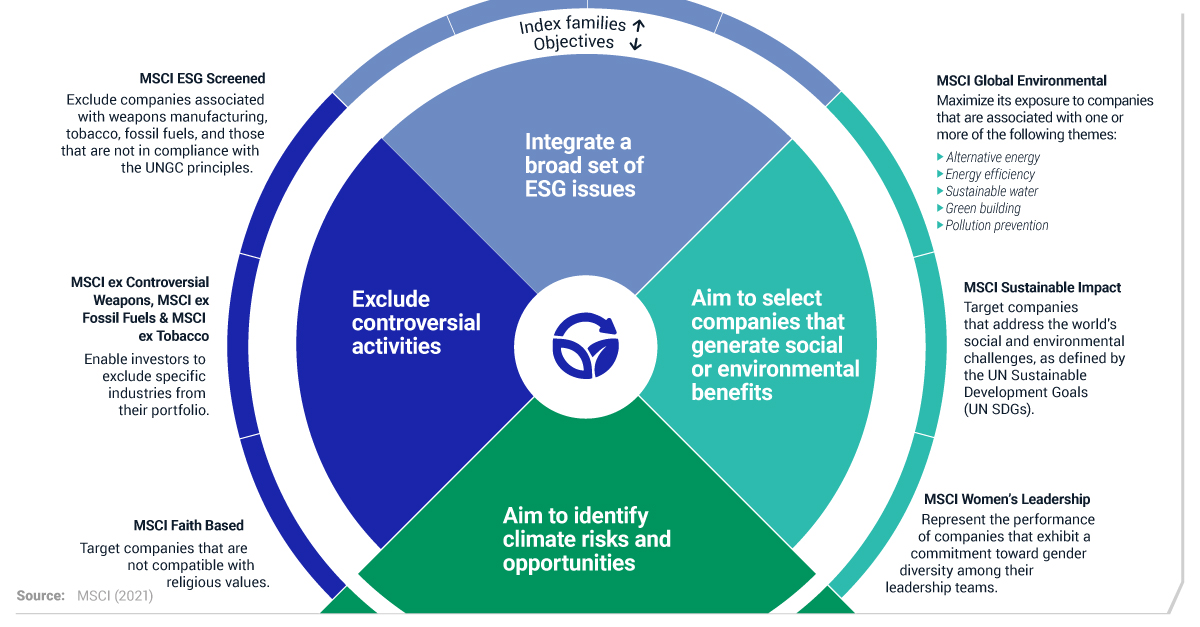

Below, we’ll summarize the four overarching objectives that MSCI’s ESG & climate indexes are designed to support.

Objective 1: Integrate a broad set of ESG issues

Investors with this objective believe that incorporating ESG criteria can improve their long-term risk-adjusted returns.

The MSCI ESG Leaders indexes are designed to support these investors by targeting companies that have the highest ESG-rated performance from each sector of the parent index.

For those who do not wish to deviate from the parent index, the MSCI ESG Universal indexes may be better suited. This family of indexes will adjust weights according to ESG performance to maintain the broadest possible universe.

Objective 2: Generate social or environmental benefits

A common challenge that impact investors face is measuring their non-financial results.

Consider an asset owner who wishes to support gender diversity through their portfolios. In order to gauge their success, they would need to regularly filter the entire investment universe for updates regarding corporate diversity and related initiatives.

In this scenario, linking their portfolios to an MSCI Women’s Leadership Index would negate much of this groundwork. Relative to a parent index, these indexes aim to include companies which lead their respective countries in terms of female representation.

Objective 3: Exclude controversial activities

Many institutional investors have mandates that require them to avoid certain sectors or industries. For example, approximately $14.6 trillion in institutional capital is in the process of divesting from fossil fuels.

To support these efforts, MSCI offers indexes that either:

- Exclude individual sectors such as fossil fuels, tobacco, or weapons;

- Exclude companies from a combination of these sectors; or

- Exclude companies that are not compatible with certain religious values.

Objective 4: Identify climate risks and opportunities

Climate change poses a number of wide-reaching risks and opportunities for investors, making it difficult to tailor a portfolio accordingly.

With MSCI’s climate indexes, asset owners gain the tools they need to build a more resilient portfolio. The MSCI Climate Change indexes, for example, reduce exposure to stranded assets, increase exposure to solution providers, and target a minimum 30% reduction in emissions.

An Index for Every Objective

Regardless of your motivation for pursuing sustainable investment, the need for an appropriate benchmark is something that everyone shares.

With an extensive suite of ESG indexes designed specifically for sustainability and climate change, MSCI aims to support asset owners as they build a more unique and personalized portfolio.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.