Technology

An Army of Swipers: Dating in the Modern Age

Widespread cultural shifts from generation to generation are nothing new.

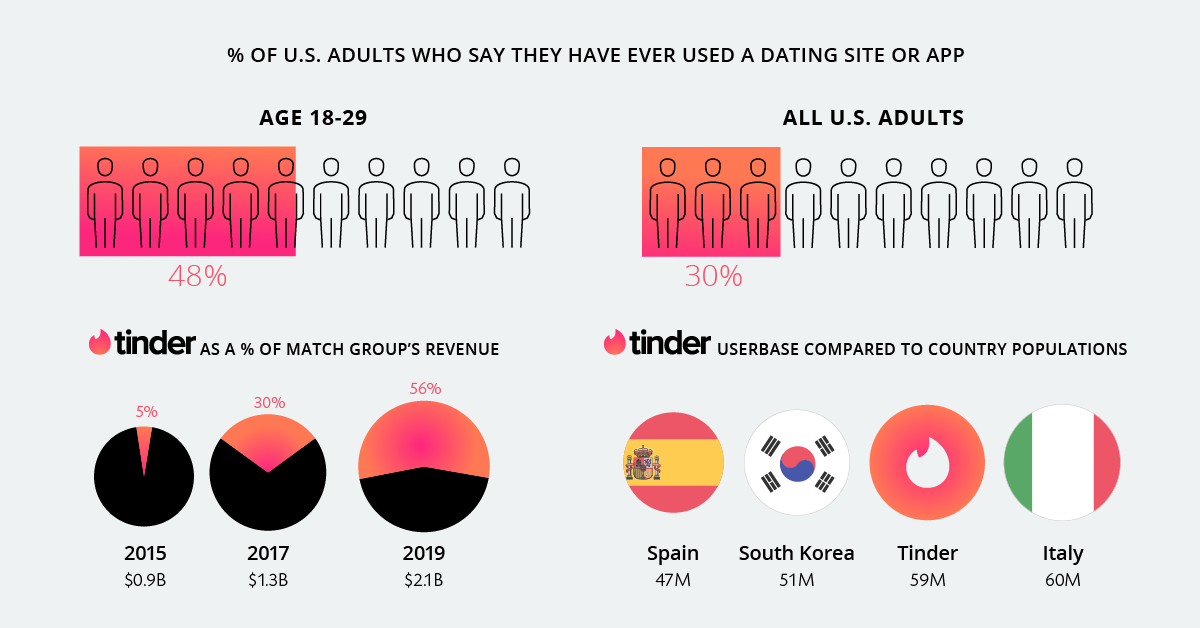

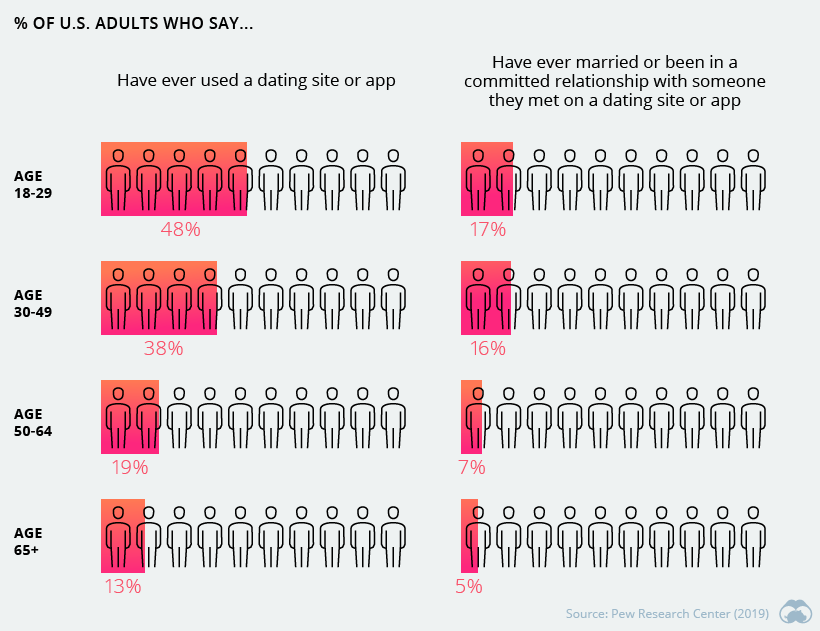

The digital era has helped fuel a surge in mobile and online dating among younger, tech-savvy generations. In fact, almost half of Americans today between the ages of 18 and 29 years old report having used a dating site or app to find a partner.

For the millions of people around the world diving into the world of digital dating, there are dozens of online dating platforms to choose from. Increasingly though, many of these brands are controlled by a single company.

A Match Made In Heaven

Forget traditional face-to-face interactions—online dating has emerged as the most popular way couples are meeting today. Though the volume of users is increasingly large, the number of companies in the space continues to narrow.

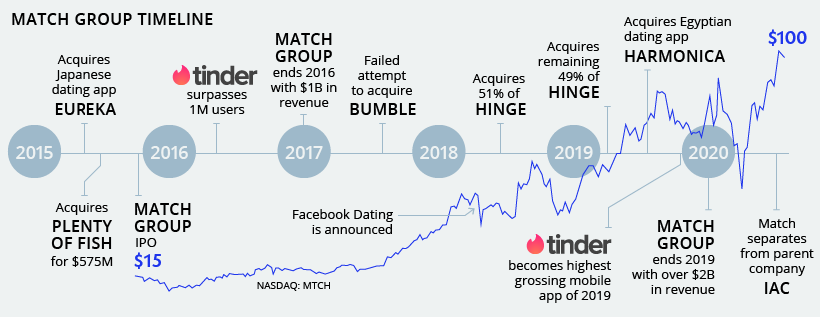

The largest in this space, Match Group, has gone all-in on online dating, acquiring some 20 companies throughout its brief history. As a result, Match Group now has an impressive 45 dating services in its growing roster.

Taking a familiar page out of the Big Tech playbook, Match Group’s big bet has so far paid off.

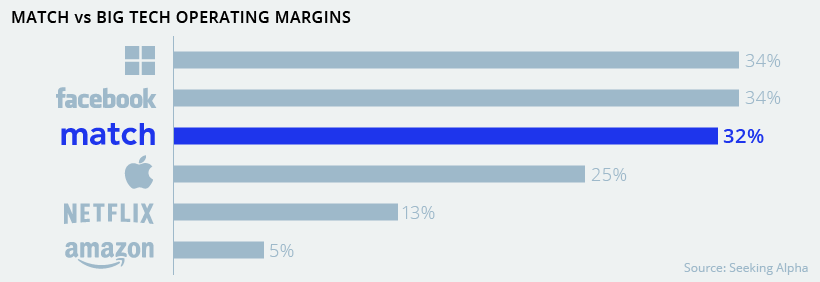

They’ve managed to execute on an asset-light, software-based subscription model that results in plenty of recurring revenue. This strategy has also led to operating margins that rival those of Big Tech companies like Facebook or Microsoft.

The result? Since their 2015 IPO, Match Group’s stock is up 600%, reaching a market capitalization of $25 billion, eclipsing many other well-known household names.

Wall Street Swipes Right

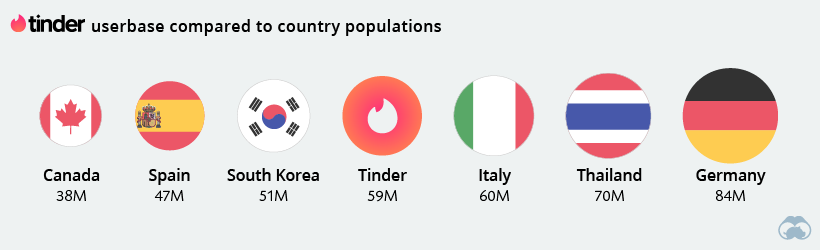

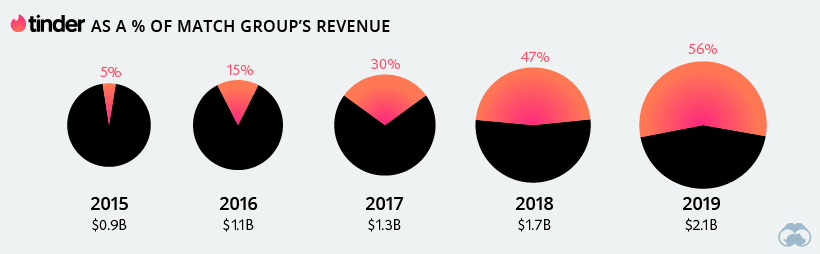

While Match Group does frequently boast about its diverse set of dating platforms, much of the success boils down to a few moving parts. One big part in particular, is Tinder and its impressive userbase of 59 million people.

Tinder’s “army of swipers” continues to grow. If the app’s userbase were a country, it would rank 25th in the world. Alternatively, imagine if every citizen of Canada, Jamaica, Ireland, Sweden, and Albania combined decided to pop open their app store and download Tinder at the same time.

Tinder now has upwards of 6 million paid subscribers, charging a subscription fee around $20 per month. These revenues continue to form a large piece of the overall equation.

How important is Tinder for Match? In their investor presentations, they provide separate data on Tinder while labeling all other apps under the “All Other Brands” category.

In recent times, Match Group has commented that they see “traditional dating” as their biggest competitor. Socio-cultural, demographic, and tech trends seem to suggest mobile online dating is not just a fad, but a concrete and dominant means through which people connect.

User growth figures have not shown weakness either. Both Millennials and Gen Z make up the bulk of Match Group’s userbase—and both generations are comfortable with digitalization as well as delaying life milestones such as marriage. This may suggest their layover in the so-called “dating period” will be lengthy—good news for giants like Match Group.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?