Demographics

The Problem of an Aging Global Population, Shown by Country

The Implications of an Aging Population

The world is experiencing a seismic demographic shift—and no country is immune to the consequences.

While increasing life expectancy and declining birth rates are considered major achievements in modern science and healthcare, they will have a significant impact on future generations.

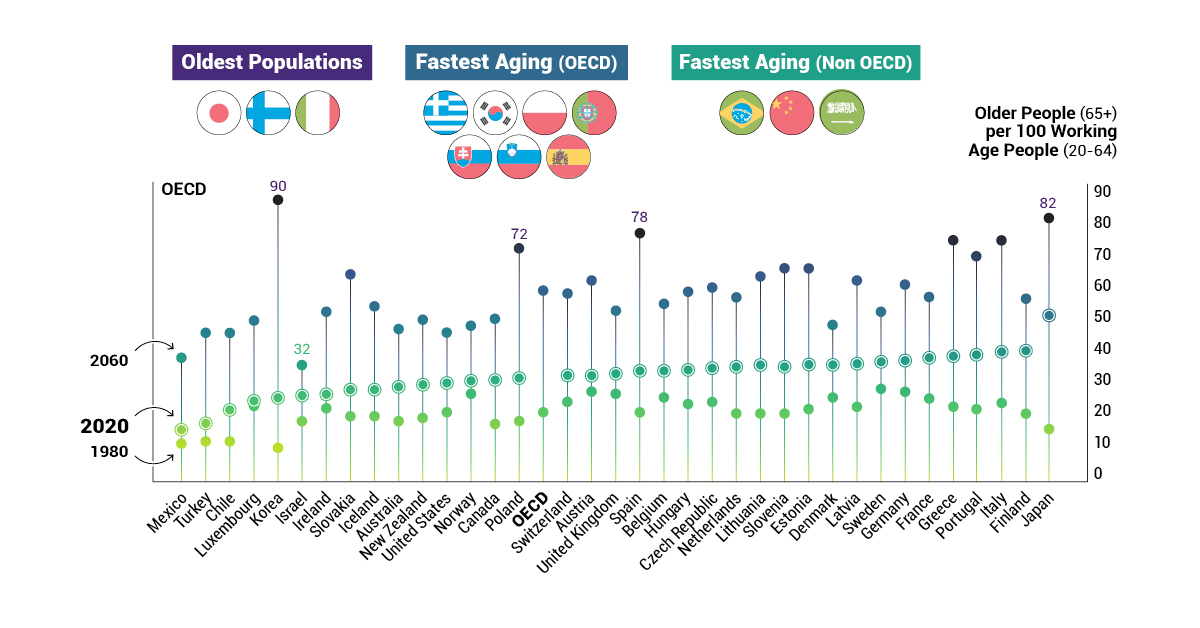

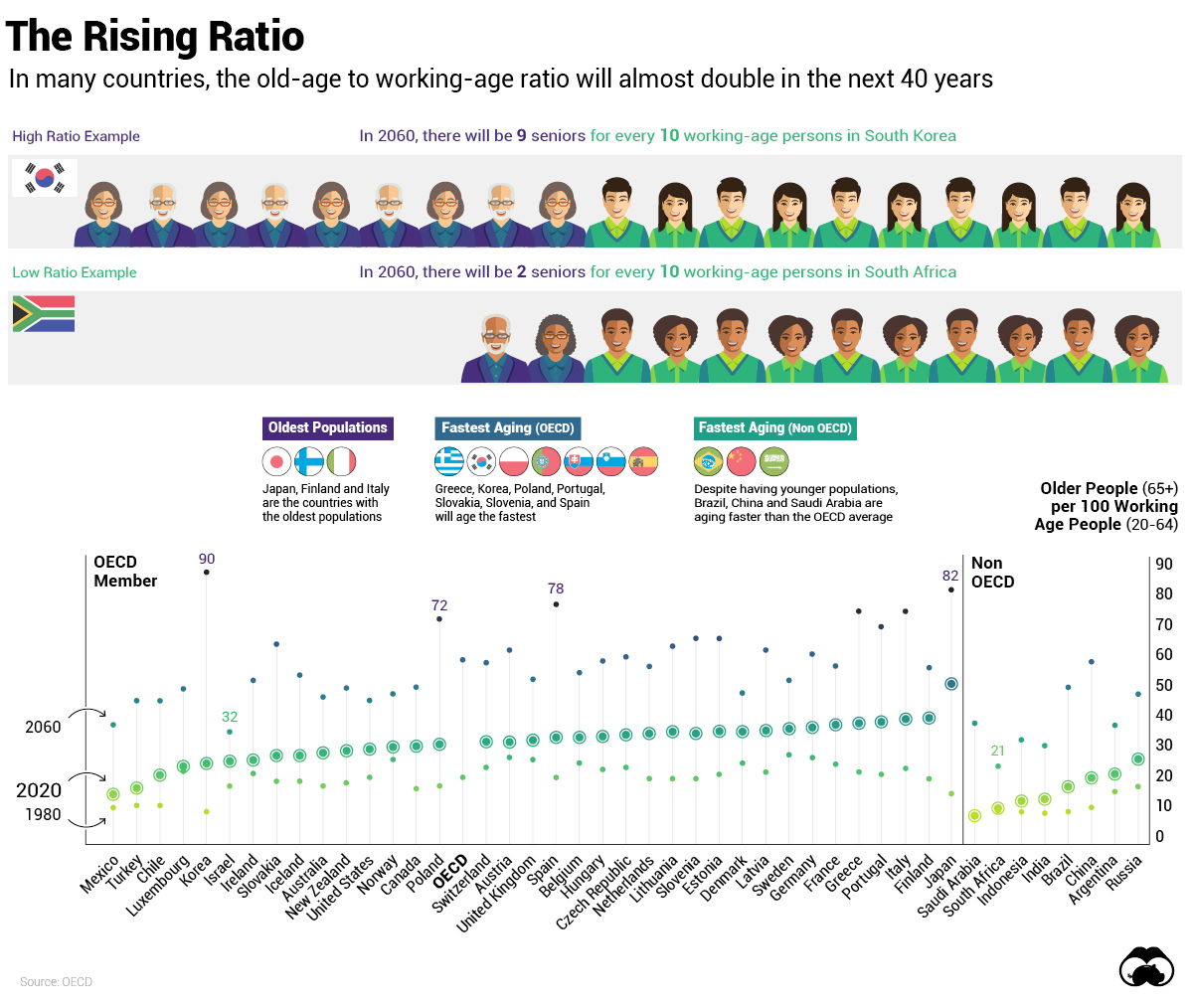

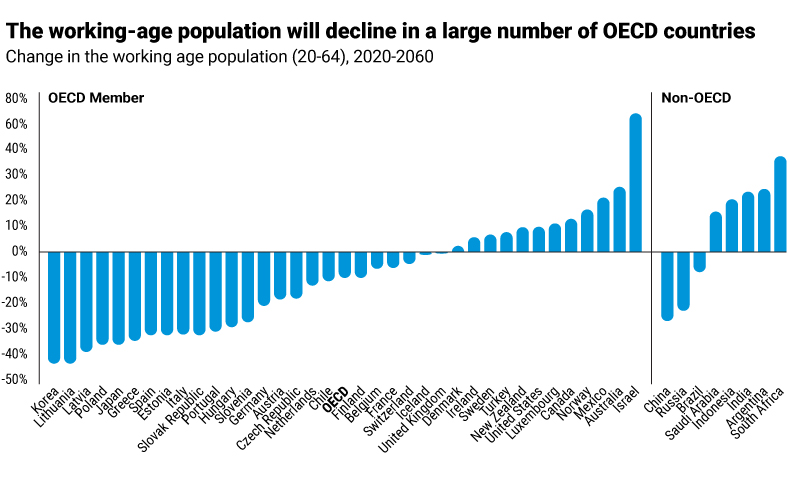

Today’s graphic relies on OECD data to demonstrate how the old-age to working-age ratio will change by 2060, highlighting some of the world’s fastest aging countries.

The Demographic Debacle

By 2050, there will be 10 billion people on earth, compared to 7.7 billion today—and many of them will be living longer. As a result, the number of elderly people per 100 working-age people will nearly triple—from 20 in 1980, to 58 in 2060.

Populations are getting older in all OECD countries, yet there are clear differences in the pace of aging. For instance, Japan holds the title for having the oldest population, with ⅓ of its citizens already over the age of 65. By 2030, the country’s workforce is expected to fall by 8 million—leading to a major potential labor shortage.

In another example, while South Korea currently boasts a younger than average population, it will age rapidly and end up with the highest old-to-young ratio among developed countries.

A Declining Workforce

Globally, the working-age population will see a 10% decrease by 2060. It will fall the most drastically by 35% or more in Greece, Japan, Korea, Latvia, Lithuania, and Poland. On the other end of the scale, it will increase by more than 20% in Australia, Mexico, and Israel.

Israel’s notably higher increase of 67% is due to the country’s high fertility rate, which is comparable to “baby boom” numbers seen in the U.S. following the second World War.

As countries prepare for the coming decades, workforce shortages are just one of the impacts of aging populations already being felt.

Managing the Risks

There are many other social and economic risks that we can come to expect as the global population continues to age:

- The Squeezed Middle: With more people claiming pension benefits but less people paying income taxes, the shrinking workforce may be forced to pay higher taxes.

- Rising Healthcare Costs: Longer lives do not necessarily mean healthier lives, with those over 65 more likely to have at least one chronic disease and require expensive, long-term care.

- Economic Slowdown: Changing workforces may lead capital to flow away from rapidly aging countries to younger countries, shifting the global distribution of economic power.

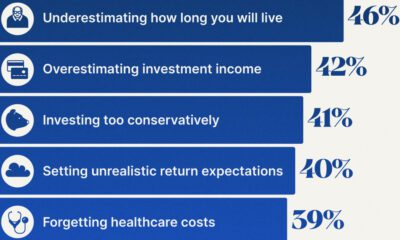

The strain on pension systems is perhaps the most evident sign of a drastically aging population. Although the average retirement age is gradually increasing in many countries, people are saving insufficiently for their increased life span—resulting in an estimated $400 trillion deficit by 2050.

Pensions Under Pressure

A pension is promised, but not necessarily guaranteed. Any changes made to existing government programs can alter the lives of future retirees entirely—but effective pension reforms that lessen the growing deficit are required urgently.

Towards a Better System

Certain countries are making great strides towards more sustainable pension systems, and the Global Pension Index suggests initiatives that governments can take into consideration, such as:

- Continuing to increase the age of retirement

- Increasing the level of savings—both inside and outside pension funds

- Increasing the coverage of private pensions across the labor force, including self-employed and contract employees, to provide improved integration between various pillars

- Preserving retirement funds by limiting the access to benefits before the retirement age

- Increasing the trust and confidence of all stakeholders by improving transparency of pension plans

Although 59% of employees are expecting to continue earning well into their retirement years, providing people with better incentives and options to make working at an older age easier could be crucial for ensuring continued economic growth.

Live Long and Prosper

As 2020 marks the beginning of the Decade of Healthy Ageing, the world is undoubtedly entering a pivotal period.

Countries all over the world face tremendous pressure to effectively manage their aging populations, but preparing for this demographic shift early will contribute to the economic advancement of countries, and allow populations—both young and old—to live long and prosper.

Demographics

The Smallest Gender Wage Gaps in OECD Countries

Which OECD countries have the smallest gender wage gaps? We look at the 10 countries with gaps lower than the average.

The Smallest Gender Pay Gaps in OECD Countries

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

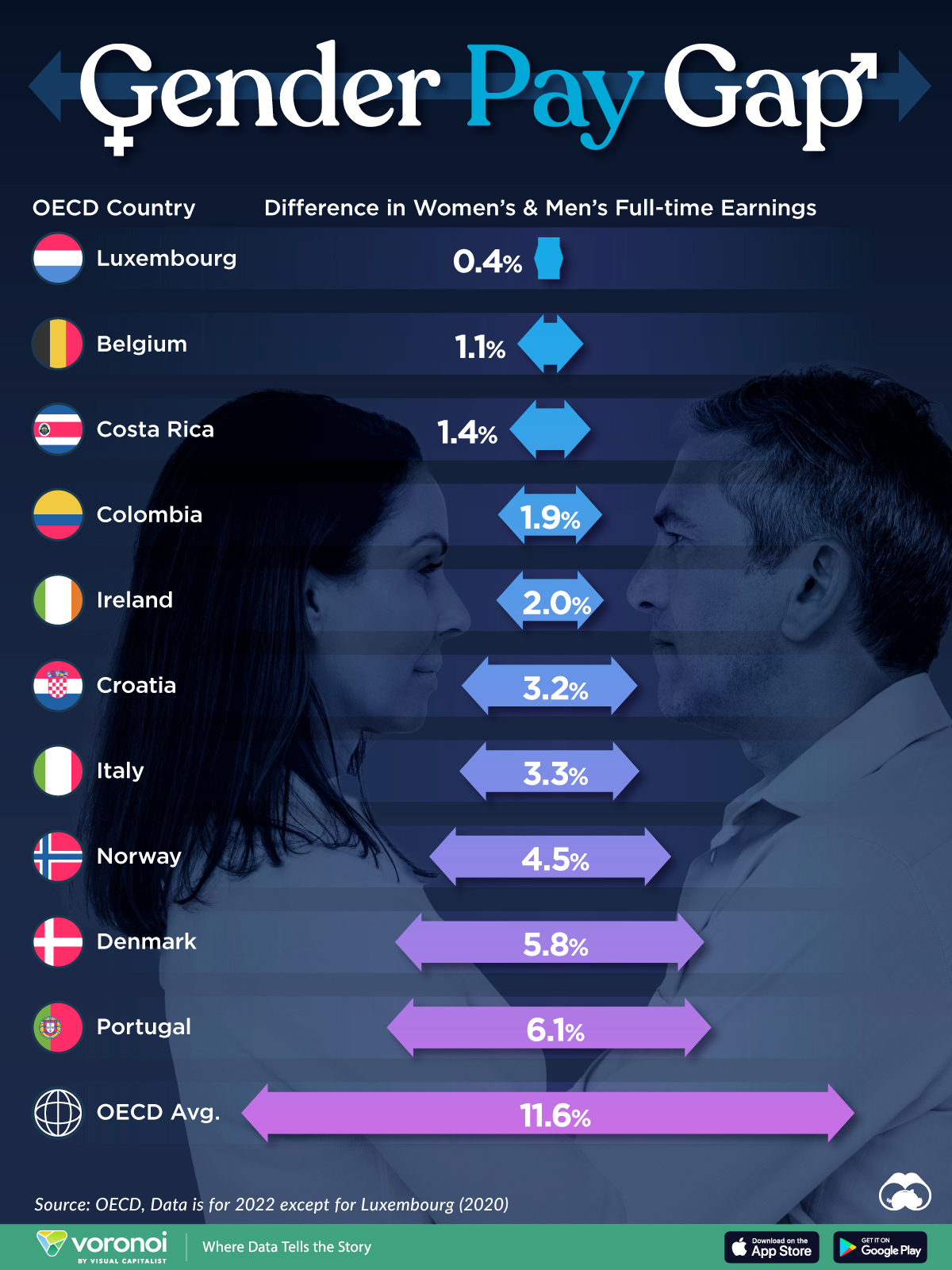

Among the 38 member countries in the Organization for Economic Cooperation and Development (OECD), several have made significant strides in addressing income inequality between men and women.

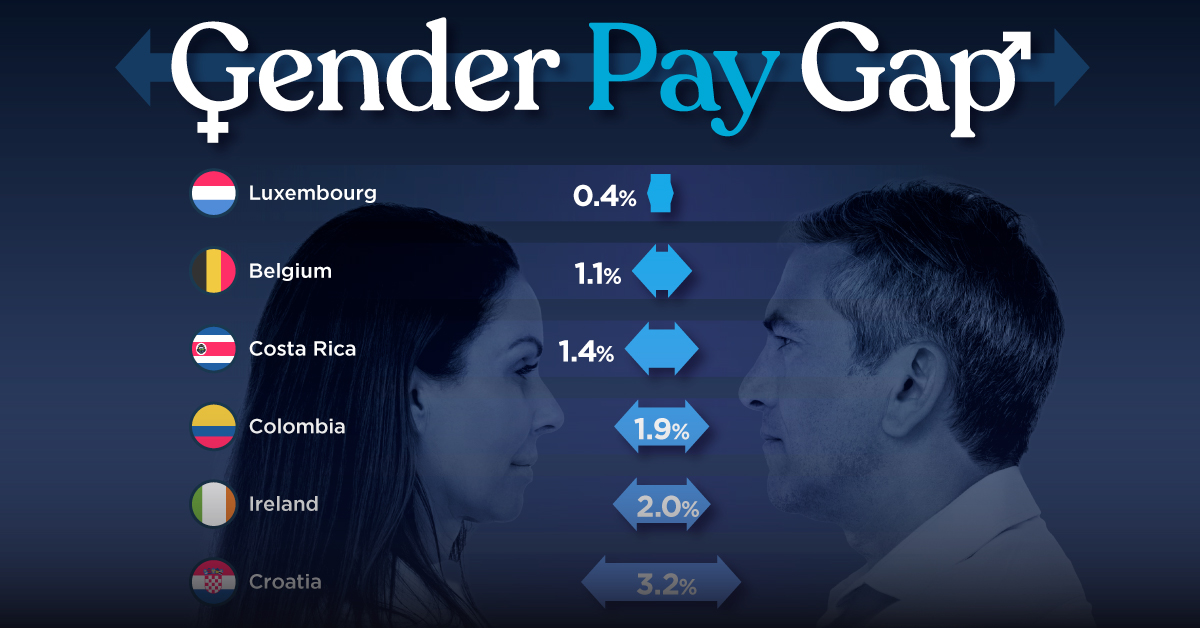

In this graphic we’ve ranked the OECD countries with the 10 smallest gender pay gaps, using the latest data from the OECD for 2022.

The gender pay gap is calculated as the difference between median full-time earnings for men and women divided by the median full-time earnings of men.

Which Countries Have the Smallest Gender Pay Gaps?

Luxembourg’s gender pay gap is the lowest among OECD members at only 0.4%—well below the OECD average of 11.6%.

| Rank | Country | Percentage Difference in Men's & Women's Full-time Earnings |

|---|---|---|

| 1 | 🇱🇺 Luxembourg | 0.4% |

| 2 | 🇧🇪 Belgium | 1.1% |

| 3 | 🇨🇷 Costa Rica | 1.4% |

| 4 | 🇨🇴 Colombia | 1.9% |

| 5 | 🇮🇪 Ireland | 2.0% |

| 6 | 🇭🇷 Croatia | 3.2% |

| 7 | 🇮🇹 Italy | 3.3% |

| 8 | 🇳🇴 Norway | 4.5% |

| 9 | 🇩🇰 Denmark | 5.8% |

| 10 | 🇵🇹 Portugal | 6.1% |

| OECD Average | 11.6% |

Notably, eight of the top 10 countries with the smallest gender pay gaps are located in Europe, as labor equality laws designed to target gender differences have begun to pay off.

The two other countries that made the list were Costa Rica (1.4%) and Colombia (1.9%), which came in third and fourth place, respectively.

How Did Luxembourg (Nearly) Eliminate its Gender Wage Gap?

Luxembourg’s virtually-non-existent gender wage gap in 2020 can be traced back to its diligent efforts to prioritize equal pay. Since 2016, firms that have not complied with the Labor Code’s equal pay laws have been subjected to penalizing fines ranging from €251 to €25,000.

Higher female education rates also contribute to the diminishing pay gap, with Luxembourg tied for first in the educational attainment rankings of the World Economic Forum’s Global Gender Gap Index Report for 2023.

See More Graphics about Demographics and Money

While these 10 countries are well below the OECD’s average gender pay gap of 11.6%, many OECD member countries including the U.S. are significantly above the average. To see the full list of the top 10 OECD countries with the largest gender pay gaps, check out this visualization.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive1 week ago

Automotive1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001