A Visual Guide to Investing in Psychedelics

The following content is sponsored by Tryp Therapeutics.

A Visual Guide to Investing in Psychedelics

The psychedelics industry has exploded in recent years, presenting new opportunities for investors as it continues to grow and evolve.

Due to its potential to revolutionize medicine as we know it, an eye-watering increase in capital flows have been pumped into the market, spurring its development even further. But given the complexities of the industry, it is by no means easy to understand.

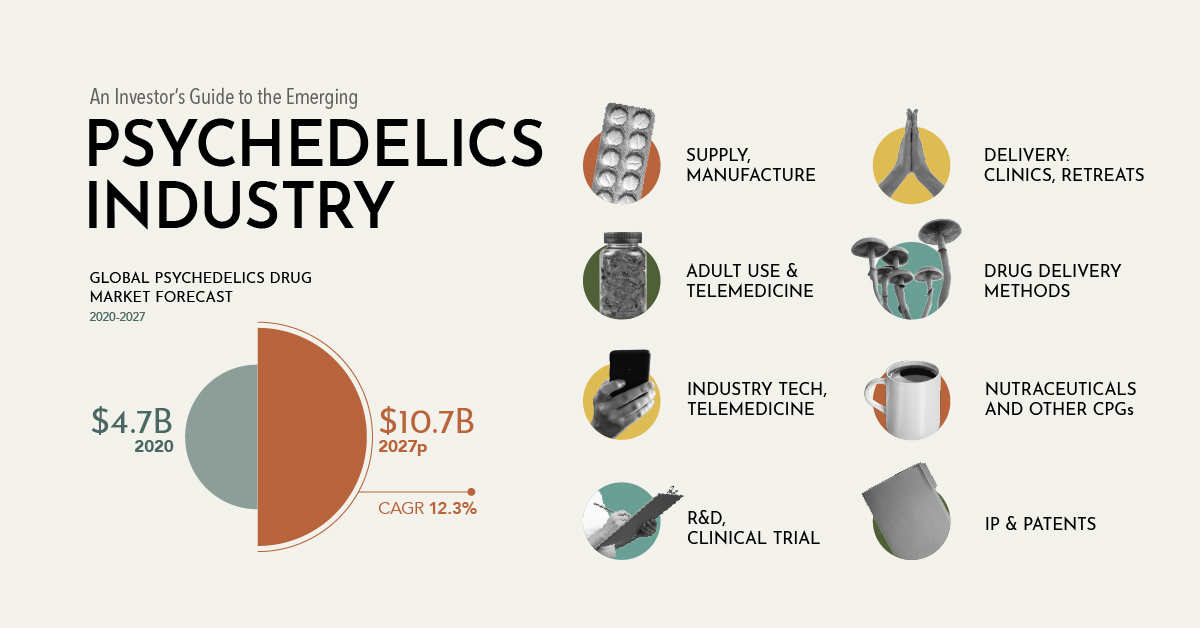

The graphic above from our sponsor Tryp Therapeutics provides a visual overview of the major sectors that make up the multi-billion dollar psychedelics industry, as well as some of the most active companies that operate within each of them.

The Psychedelics Industry, Sector by Sector

According to Psilocybin Alpha, there are eight major market segments (based on different stages in the supply chain) that make up the psychedelics industry today.

The companies mentioned in the graphic exhibit substantial activity within each segment but it is not an exhaustive list. Some of them are also exploring different focus areas, and therefore may appear across numerous segments. Let’s dive in.

Supply and Manufacture

[Cultivation, synthesis, and other production of psychedelics.]

This segment includes companies in the industry that currently manufacture psychedelic drugs synthetically or operate cultivation facilities. Others that fall in this category possess (or plan to apply for) licenses to cultivate or produce psychedelics.

When it comes to synthetic manufacturers, the companies operating in this space believe that this approach could generate more consistent pharmaceutical-grade yields at a lower cost compared to existing methods of extraction.

Clinics and Retreats

[The delivery of psychedelic therapies via clinics, retreats, etc.]

Regulated psychedelic therapies are gaining popularity across the globe through ketamine clinics and psilocybin retreats to name a few.

While access to legal therapies is not yet widespread, there are many companies in this space leading the way for regulated experiences. Amsterdam-based Synthesis, for example, partners with Imperial College London to collect and analyze guest data to improve the efficacy of these programs.

Adult Use and Microdosing

[Recreational use of legal psychedelics.]

While psilocybin, or magic mushrooms as they are more commonly referred to, are illegal in the Netherlands, magic truffles are not.

Even though truffles and mushrooms are essentially just two different parts of fungi (truffles grow underground while mushrooms grow above ground), they each have different regulations in the Netherlands that companies like retail startup PharmaDrug are using to their advantage.

Drug Delivery Methods

[Drug delivery methods for psychedelic therapies.]

Many of the companies in this segment have filed provisional patent applications for innovative drug delivery methods. These include hard-shell capsules, oral strips, and nasal sprays among others.

Industry Tech and Telemedicine

[Telehealth and software development.]

Some of the largest psychedelics companies are increasing their focus on digital therapeutics and are therefore carving out a new path for the industry.

As just one example, telehealth company Mindleap has created a platform that connects mental health professionals with patients seeking psychedelic-based therapy.

Nutraceuticals and Other CPGs

[Consumer packaged goods, such as functional mushrooms.]

Considering the growing awareness of psychedelics to treat both mental and physical ailments, the consumer packaged goods segment of psychedelics has massive potential. However, this is still in its early stages.

It is therefore unsurprising to find many psychedelics companies dabbling in the functional mushroom market as an additional source of revenue.

IP and Patents

[Companies building psychedelic patent portfolios.]

Patent applications are ripe in the emerging psychedelics industry, especially in the biotech arena.

Although the concept of patenting psychedelics is widely debated, companies operating in the psychedelics industry are using them as a distinct competitive advantage, while advancing innovation in the space at the same time.

R&D and Clinical Trials

[Research and development and/or clinical trials involving psychedelics.]

While there are too many companies shepherding drug candidates through the clinical trials process to mention, there are over a dozen companies currently in Phase 2.

Tryp Therapeutics for example expects to initiate at least two Phase 2a clinical trials in 2021, with others planning for 2022. The company can then apply for drug approval once Phase 3 trials have been completed.

Tryp Therapeutics: Pioneers in Psychedelic Medicine

Tryp Therapeutics is a pharmaceutical company focused on developing clinical stage compounds for diseases with high unmet medical needs.

By harnessing the power of psilocybin, Tryp Therapeutics is going beyond mental health to treat a wide range of chronic pain indications, such as fibromyalgia, phantom limb pain, complex regional pain syndrome, and eating disorders.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.