Gaming

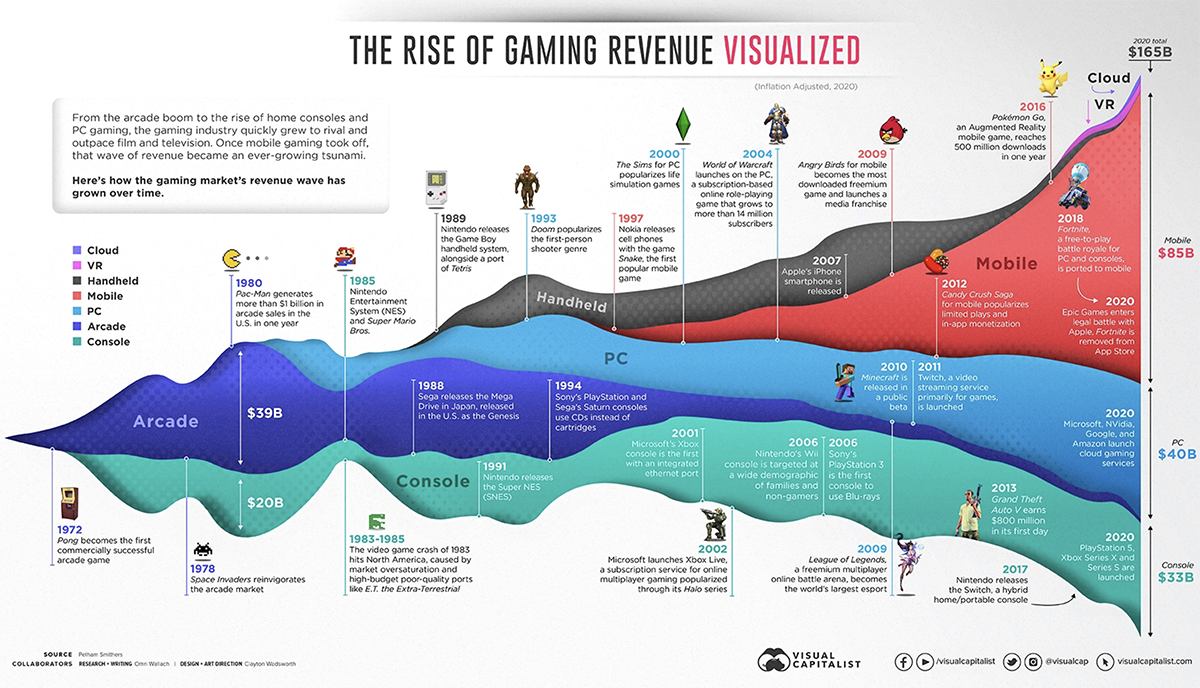

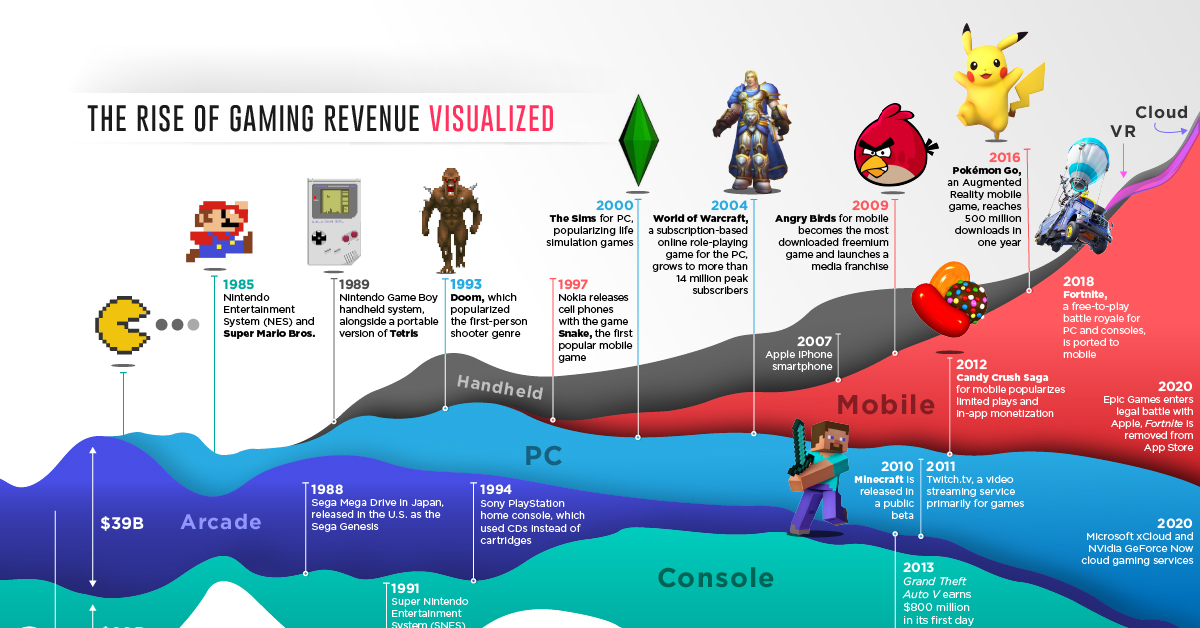

50 Years of Gaming History, by Revenue Stream (1970-2020)

Click here to view the full version of this graphic

50 Years of Gaming History, by Revenue Stream (1970-2020)

View a more detailed version of the above by clicking here

Every year it feels like the gaming industry sees the same stories—record sales, unfathomable market reach, and questions of how much higher the market can go.

We’re already far past the point of gaming being the biggest earning media sector, with an estimated $165 billion revenue generated in 2020.

But as our graphic above helps illustrate, it’s important to break down shifting growth within the market. Research from Pelham Smithers shows that while the tidal wave of gaming has only continued to swell, the driving factors have shifted over the course of gaming history.

1970–1983: The Pre-Crash Era

At first, there was Atari.

Early prototypes of video games were developed in labs in the 1960s, but it was Atari’s release of Pong in 1972 that helped to kickstart the industry.

The arcade table-tennis game was a sensation, drawing in consumers eager to play and companies that started to produce their own knock-off versions. Likewise, it was Atari that sold a home console version of Pong in 1975, and eventually its own Atari 2600 home console in 1977, which would become the first console to sell more than a million units.

In short order, the arcade market began to plateau. After dwindling due to a glut of Pong clones, the release of Space Invaders in 1978 reinvigorated the market.

Arcade machines started to be installed everywhere, and new franchises like Pac-Man and Donkey Kong drove further growth. By 1982, arcades were already generating more money than both the pop music industry and the box office.

1985–2000: The Tech Advancement Race

Unfortunately, the gaming industry grew too quickly to maintain.

Eager to capitalize on a growing home console market, Atari licensed extremely high budget ports of Pac-Man and a game adaptation of E.T. the Extra Terrestrial. They were rushed to market, released in poor quality, and cost the company millions in returns and more in brand damage.

As other companies also looked to capitalize on the market, many other poor attempts at games and consoles caused a downturn across the industry. At the same time, personal computers were becoming the new flavor of gaming, especially with the release of the Commodore 64 in 1982.

It was a sign of what was to define this era of gaming history: a technological race. In the coming years, Nintendo would release the Nintendo Entertainment System (NES) home console in 1985 (released in Japan as the Famicom), prioritizing high quality games and consistent marketing to recapture the wary market.

On the backs of games like Duck Hunt, Excitebike, and the introduction of Mario in Super Mario Bros, the massive success of the NES revived the console market.

Estimated Total Console Sales by Manufacturer (1970-2020)

| Manufacturer | Home Console sales | Handheld Console Sales | Total Sales |

|---|---|---|---|

| Nintendo | 318 M | 430 M | 754 M |

| Sony | 445 M | 90 M | 535 M |

| Microsoft | 149 M | - | 149 M |

| Sega | 64-67 M | 14 M | 81 M |

| Atari | 31 M | 1 M | 32 M |

| Hudson Soft/NEC | 10 M | - | 10 M |

| Bandai | - | 3.5 M | 3.5 M |

Source: Wikipedia

Nintendo looked to continue its dominance in the field, with the release of the Game Boy handheld and the Super Nintendo Entertainment System. At the same time, other competitors stepped in to beat them at their own game.

In 1988, arcade company Sega entered the fray with the Sega Mega Drive console (released as the Genesis in North America) and then later the Game Gear handheld, putting its marketing emphasis on processing power.

Electronics maker Sony released the PlayStation in 1994, which used CD-ROMs instead of cartridges to enhance storage capacity for individual games. It became the first console in history to sell more than 100 million units, and the focus on software formats would carry on with the PlayStation 2 (DVDs) and PlayStation 3 (Blu-rays).

Even Microsoft recognized the importance of gaming on PCs and developed the DirectX API to assist in game programming. That “X” branding would make its way to the company’s entry into the console market, the Xbox.

2001–Present: The Online Boom

It was the rise of the internet and mobile, however, that grew the gaming industry from tens of billions to hundreds of billions in revenue.

A primer was the viability of subscription and freemium services. In 2001, Microsoft launched the Xbox Live online gaming platform for a monthly subscription fee, giving players access to multiplayer matchmaking and voice chat services, quickly becoming a must-have for consumers.

Meanwhile on PCs, Blizzard was tapping into the Massive Multiplayer Online (MMO) subscription market with the 2004 release of World of Warcraft, which saw a peak of more than 14 million monthly paying subscribers.

All the while, companies saw a future in mobile gaming that they were struggling to tap into. Nintendo continued to hold onto the handheld market with updated Game Boy consoles, and Nokia and BlackBerry tried their hands at integrating game apps into their phones.

But it was Apple’s iPhone that solidified the transition of gaming to a mobile platform. The company’s release of the App Store for its smartphones (followed closely by Google’s own store for Android devices) paved the way for app developers to create free, paid, and pay-per-feature games catered to a mass market.

Now, everyone has their eyes on that growing $85 billion mobile slice of the gaming market, and game companies are starting to heavily consolidate.

Major Gaming Acquisitions Since 2014

| Date | Acquirer | Target and Sector | Deal Value (US$) |

|---|---|---|---|

| Apr. 2014 | Oculus - VR | $3.0 Billion | |

| Aug. 2014 | Amazon | Twitch - Streaming | $1.0 Billion |

| Nov. 2014 | Microsoft | Mojang - Games | $2.5 Billion |

| Feb. 2016 | Activision Blizzard | King - Games | $5.9 Billion |

| Jun. 2016 | Tencent | Supercell - Games | $8.6 Billion |

| Feb. 2020 | Embracer Group | Saber Interactive - Games | $0.5 Billion |

| Sep. 2020 | Microsoft | ZeniMax Media - Games | $7.5 Billion |

| Nov. 2020 | Take-Two Interactive | Codemasters - Games | $1.0 Billion |

Console makers like Microsoft and Sony are launching cloud-based subscription services even while they continue to develop new consoles. Meanwhile, Amazon and Google are launching their own services that work on multiple devices, mobile included.

After seeing the success that games like Pokémon Go had on smartphones—reaching more than $1 billion in yearly revenue—and Grand Theft Auto V’s record breaking haul of $1 billion in just three days, companies are targeting as much of the market as they can.

And with the proliferation of smartphones, social media games, and streaming services, they’re on the right track. There are more than 2.7 billion gamers worldwide in 2020, and how they choose to spend their money will continue to shape gaming history as we know it.

Technology

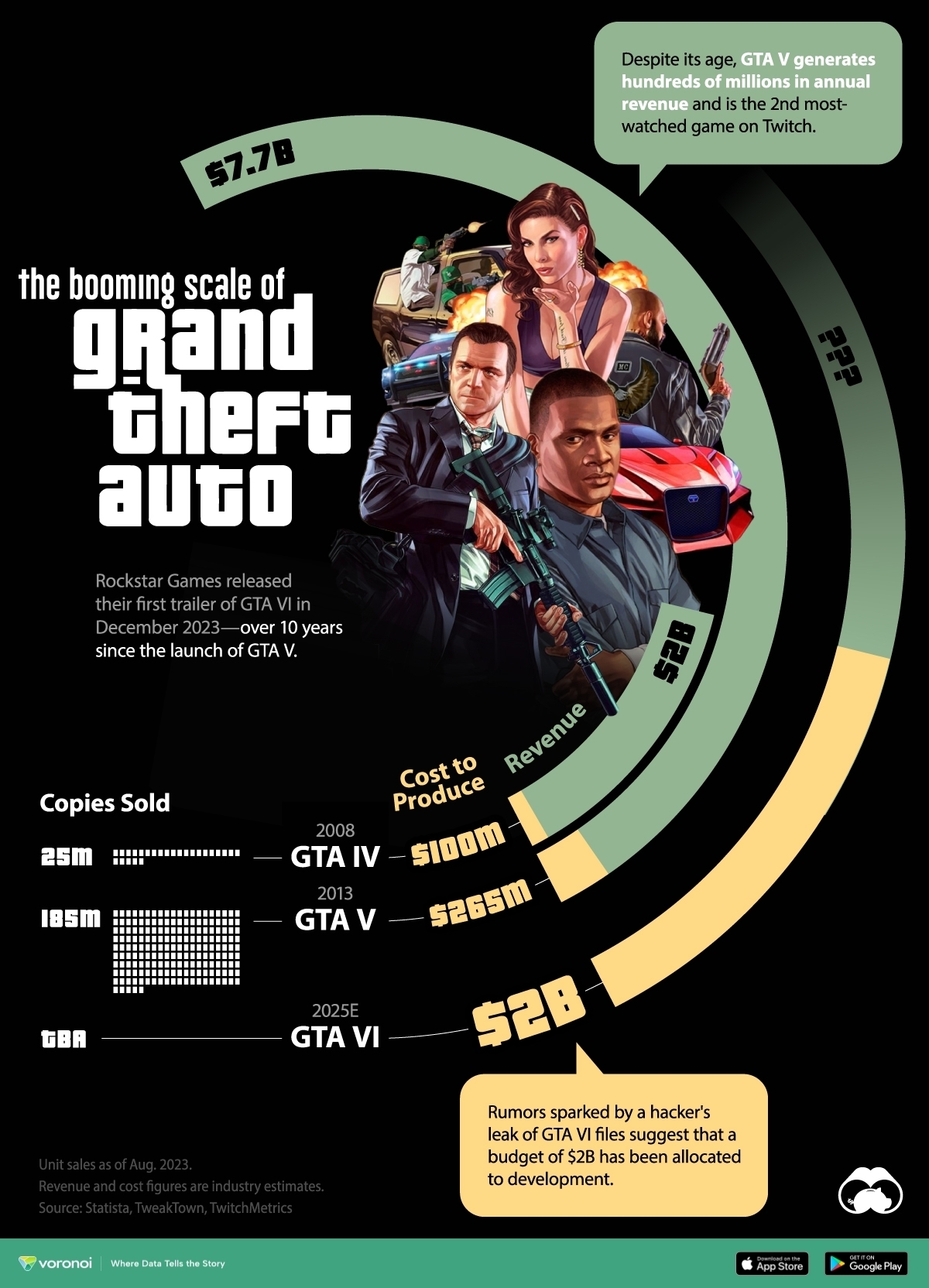

Charting Grand Theft Auto: GTA’s Budget and Revenues

Dive into the GTA budget through the years, with GTA VI set to be the most expensive video game of all time.

Charting Grand Theft Auto: GTA’s Budget and Revenues

Over 10 years since the launch of Grand Theft Auto V (GTA V), the second most-sold video game in history, Rockstar Games has announced its sequel GTA VI will be “coming 2025.”

As the anticipation only grows for this next big entry in the franchise, we take a look at the GTA budget through the years. How much have the last two games cost to make, how much have they earned, and how do they compare with the latest entry?

Data for this visualization comes from Statista, TweakTown, and Twitch Metrics.

How Much Has GTA VI Cost to Make?

The GTA franchise has grown enormously in scale from humble beginnings as a top-down, 2D video game in 1997. Fifteen installments later, the upcoming release, GTA VI, is estimated to be the most expensive video game to be made yet.

Here’s a look at how much GTA VI and the last two major releases cost, and how much revenue they’ve earned as of August 2023.

| Year | Title | Production Costs ($) | Revenue ($) | Copies Sold |

|---|---|---|---|---|

| 2025 (est.) | GTA VI | $2B (rumored) | N/A | N/A |

| 2013 | GTA V | $265M | $7.7B | 185M |

| 2008 | GTA IV | $100M | $2B | 25M |

In 2008, GTA IV cost around $100 million—already a budget that rivalled big Hollywood releases. However with 25 million copies sold, the game earned nearly $2 billion—a five-fold return on its production cost.

Five years later, GTA V (2013) cost more than $200 million to make—twice GTA IV’s budget. A decade after its release, GTA V has generated close to $8 billion, with hundreds of millions in annual revenue from subscriptions and in-game purchases—a model that its successor is sure to follow.

In fact, subscription fees and in-game purchases represented 78% of Take-Two Interactive’s (parent of GTA developer Rockstar Games) revenues in 2023.

Analysts estimate the to-be-released GTA VI’s costs at $2 billion, including marketing and other expenses. A massive open-world (set in the Miami-inspired “Vice City”), cutting edge graphics, and a reportedly brand-new game engine are all reasons for the game’s outsized budget.

For comparison, the current most expensive games to have been made include Red Dead Redemption 2 (also by Rockstar) and Star Citizen, both reportedly with a $500 million budget.

Meanwhile, Take-Two Interactive shares are up more than 50% for the year.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023