Markets

Visualizing How the 50 Largest U.S. Companies are Connected

Visualizing How the 50 Largest U.S. Companies are Connected

For any corporation, the Board of Directors plays a crucial role in corporate governance.

Elected by the company’s shareholders, the board is meant to represent shareholder interests – it ultimately hires the CEO, sets strategic objectives, approves annual budgets, and provides accountability to the shareholders regarding the performance of the organization.

These duties are no cakewalk, and finding capable and experienced board members to help run a multi-billion dollar corporation just isn’t easy.

Corporate Overlap

To locate a qualified candidate, one option is to hire someone that already has experience working on a big corporate board – and because it’s a part-time gig, people can actually be on multiple boards at once.

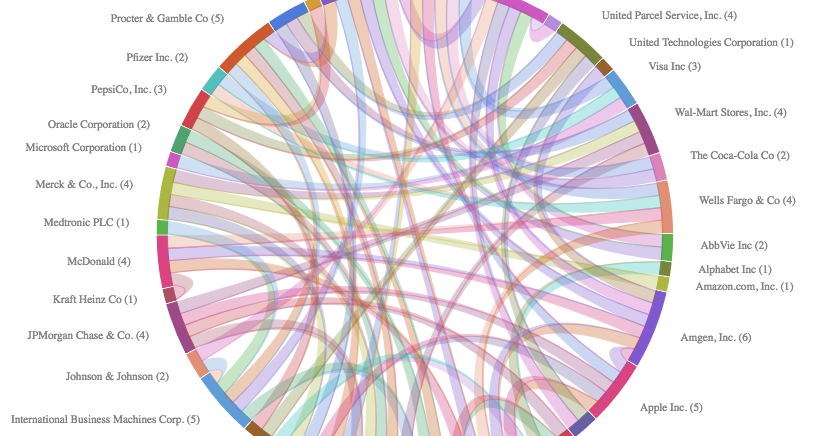

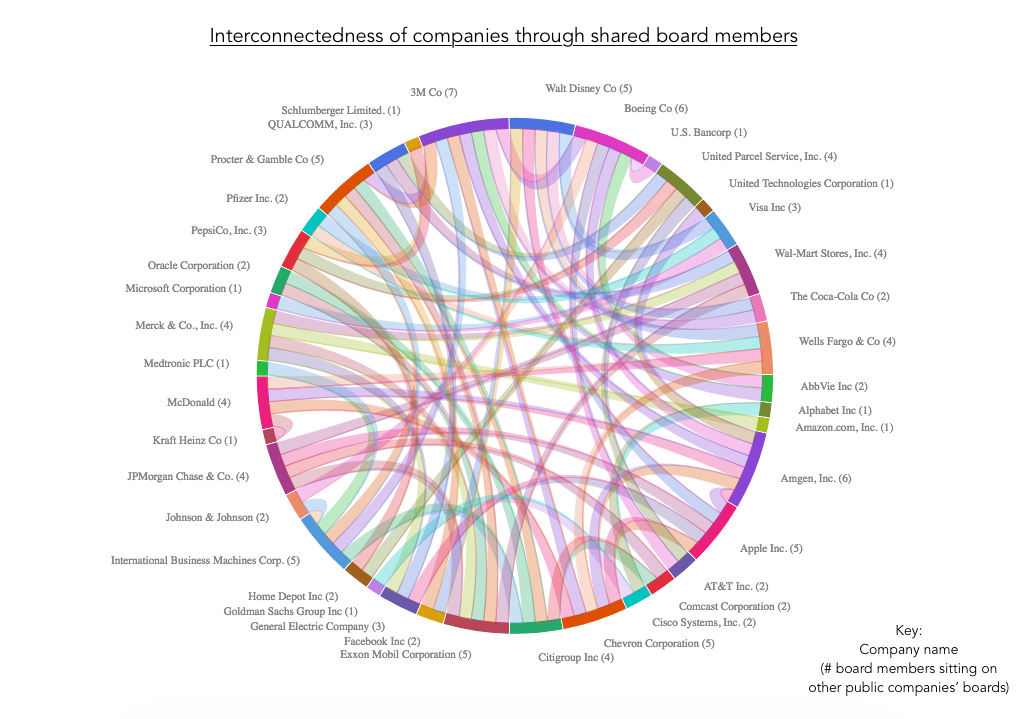

Today’s data visualization is from Reddit user /r/qwerty2020 and it shows the overlap between boards of the top 50 largest companies in the United States. It reveals that 78% of the multi-billion dollar companies here have at least one board connection with another company on the list.

The Most Connected Companies

Here are the three most connected companies:

3M (7 connections)

The 3M board has 12 members on it, including people like the retired CEOs of Kroger and UPS, and the current CFO of Microsoft.

As for board members in common, there are seven people on 3M’s board that have a connection to one of the other 50 large companies, including: Boeing, Coca-Cola, AbbVie, Proctor & Gamble, Amgen, Chevron, and IBM.

Boeing (6 connections)

Boeing’s board has 13 members, including the CEO and Chairman of Amgen, and Ronald Reagan’s former White House Chief of Staff (Kenneth Duberstein). The former CEO of Allstate and the former CEO of Continental Airlines also serve on the board.

It has six connections to other big U.S. companies through its board, including: 3M, AbbVie, Amgen, Johnson & Johnson, U.S. Bancorp, and AT&T.

Amgen (6 connections)

The large biopharmaceutical company has 13 people on its Board of Directors, including the CEO and Chairman of Phillips 66, the former CEO of Mattel, and a former CFO of Walmart.

In total, it has six people that also serve on other boards: 3M, United Technologies, Apple, Boeing, Chevron, and McDonald’s.

Runners up: (5 connections)

Other highly-connected companies include Walt Disney, Apple, Chevron, Exxon Mobil, IBM, and Procter & Gamble – each has five board members that also serve for other top 50 corporations.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries