Markets

5 Big Picture Trends Being Accelerated by the Pandemic

As every email introduction has reminded us in 2020, we’re living in “unprecedented times”.

No doubt, even after a viable vaccine is released to the general public and things begin to return to some semblance of normalcy, there will be long lasting effects on society and the economy. It’s been said that COVID-19 has hit fast forward on a number of trends, from e-commerce to workplace culture.

Today, we’ll highlight five of these accelerating trends.

#1: Screen Life Takes Hold

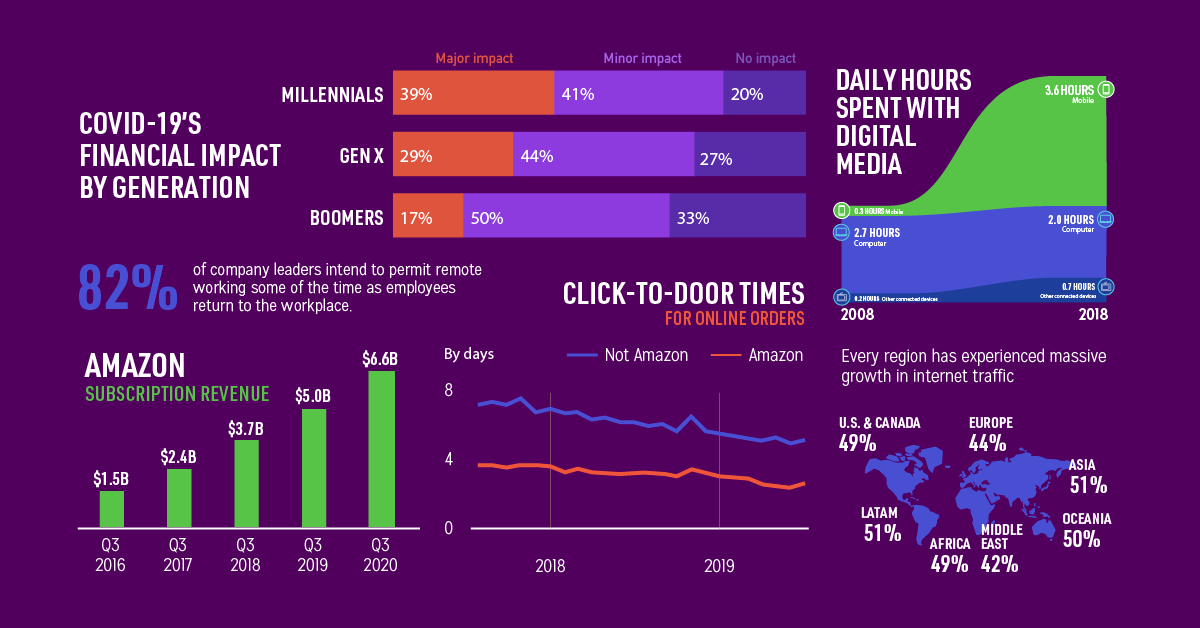

Smartphones have drastically altered many parts our lives – including how we spend time. In the decade from 2008 to 2018, screen time on mobile devices increased 12x.

Fast forward to today, and screen time is up across the board, with some of the most dramatic increases seen among kids and teenagers. 44% of people under the age of 18 now report four hours or more of screen time per day – up from 21% prior to the pandemic.

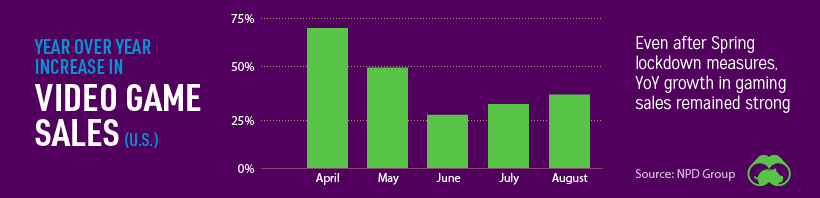

Gaming is another digital segment that has benefited from the pandemic. Video game revenue spiked in the springtime, and sales have remained strong going further into 2020. Companies are hoping that casual gamers won over during lockdown will continue playing once the pandemic has come to an end.

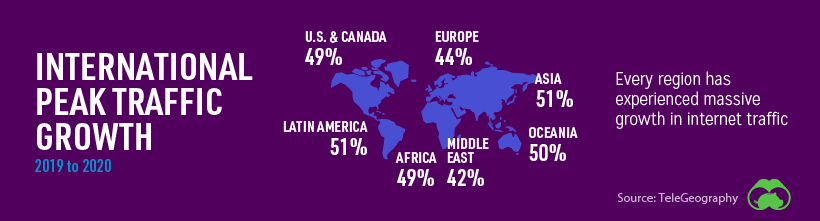

Acceleration signal: International bandwidth and internet traffic was already increasing steadily, but COVID-19 stay-at-home activity has blown away previous numbers.

Even as more workplaces and schools begin to operate normally again, it’s doubtful that screen time will drop back down to pre-COVID levels.

#2: The Big Consumer Shake-Up

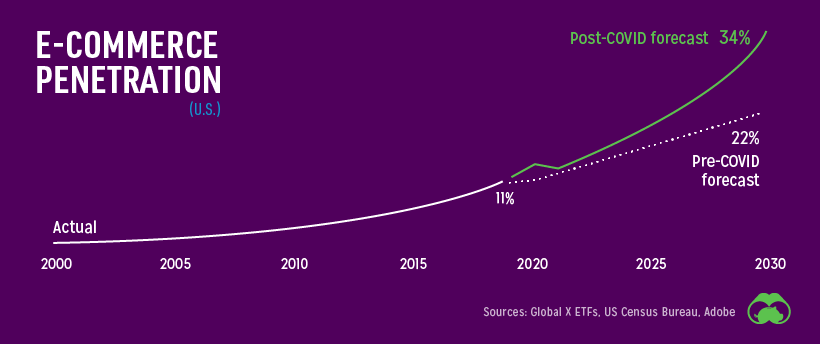

The consumer economy has been innovating on two fronts: making physical buying as “frictionless” as possible, and making e-commerce as nimble as possible. COVID-19 broke old habits and sped up that evolution.

Innovations in real world shopping appear to be moving in the direction of cashierless checkouts, but in order for that model to work, people first need to embrace contactless payment methods such as mobile wallets and cards with tap payment.

So far, the pandemic has been an accelerant in moving people away from cash and pin-and-swipe credit cards in lagging markets. Once people get used to the convenience of contactless payments, it’s likely they’ll continue using those methods.

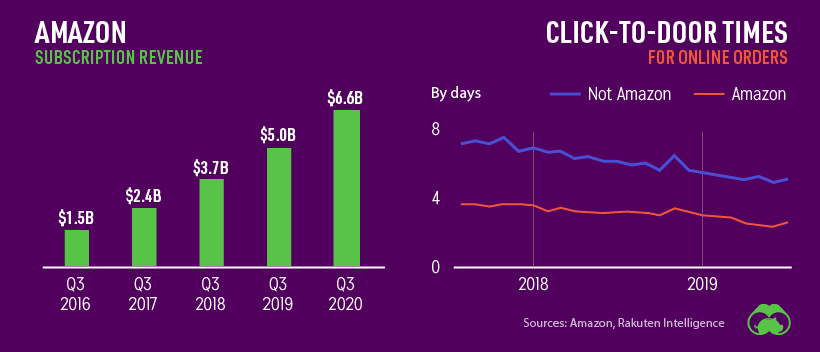

Of course, no conversation about e-commerce is complete without talking about Amazon. The company has seen consistent growth in subscription revenue in recent years, and the company’s actions have a wide-reaching effect on the rest of the industry.

Much like the gaming industry, e-commerce companies like Amazon are hoping that people who dabbled with online ordering during the pandemic months, will convert into lifelong customers.

Acceleration signal: E-commerce penetration projections have shifted upward.

In hindsight, 2020 could be an inflection point where e-commerce gained a much bigger slice of the overall retail pie.

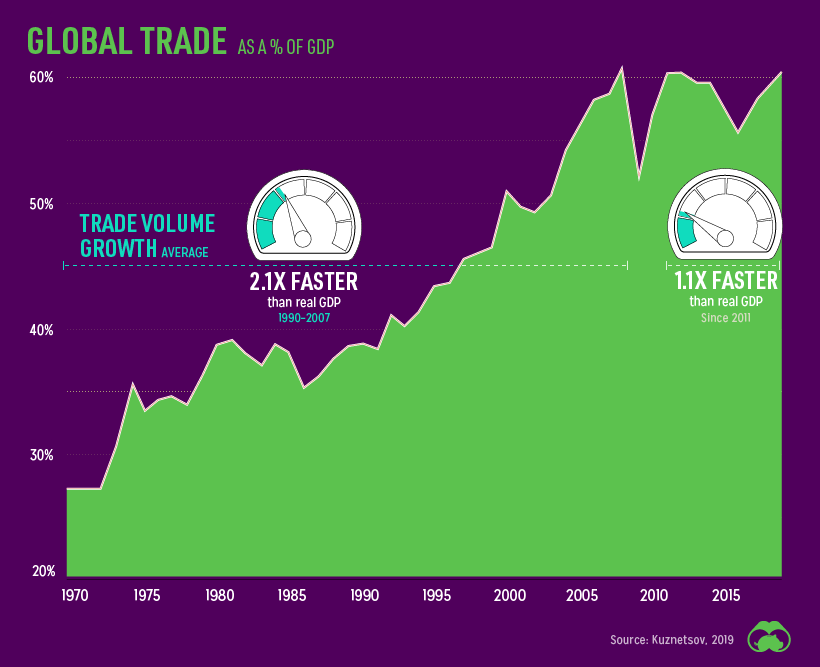

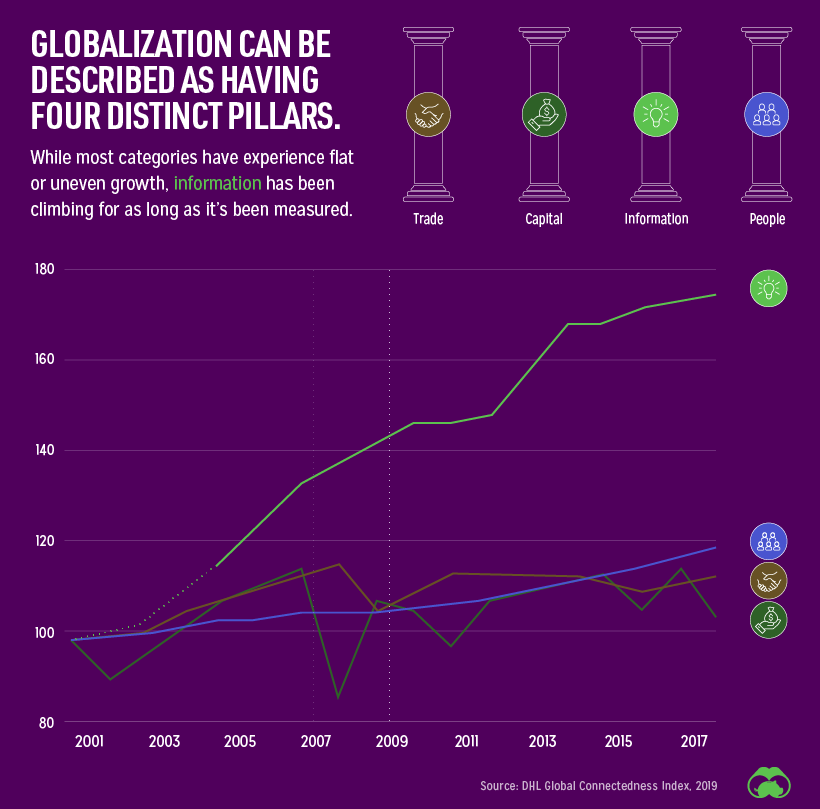

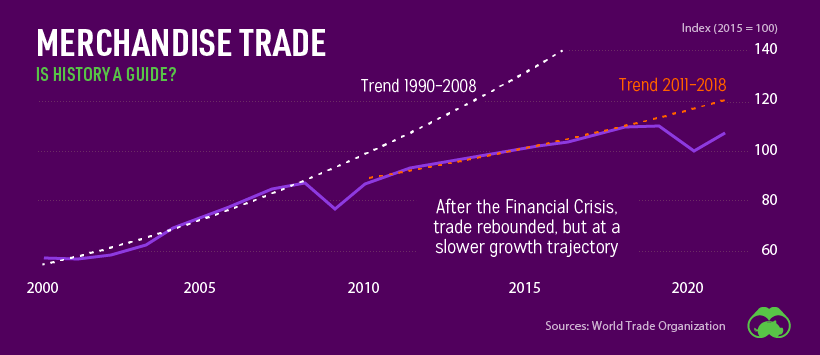

#3: Peak Globalization

Globalization went on a tear starting from the mid-1980s until it hit a plateau during the financial crisis. Since that point, global trade as a percentage of GDP has flat-lined in the face of trade wars, and now COVID-19.

Trade was obviously impacted by the pandemic, and it’s too early to say what the long-term effects will be. One thing that is clear is that the information component of globalization is becoming an even more important piece of the world’s economic puzzle.

Even before COVID-19 took hold, the global services trade was growing 60% faster than the goods trade, and was valued at approximately $13.4 trillion in 2019.

Acceleration signal: The dip in merchandise trade looks eerily similar to the one that took place in 2008.

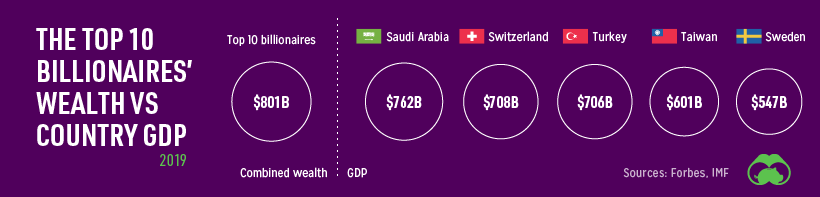

#4: The Wealth Chasm

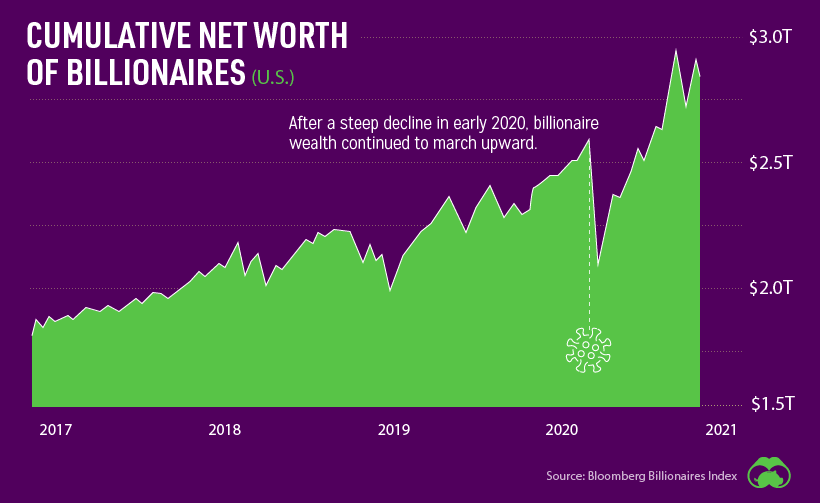

On the high end of the wealth spectrum, billionaires are worth more than ever.

Meanwhile, in the broader economy, inequality has grown over the last few decades. Those in the top 50% wealth bracket have seen increasing gains, while the bottom 50% have seen stagnation.

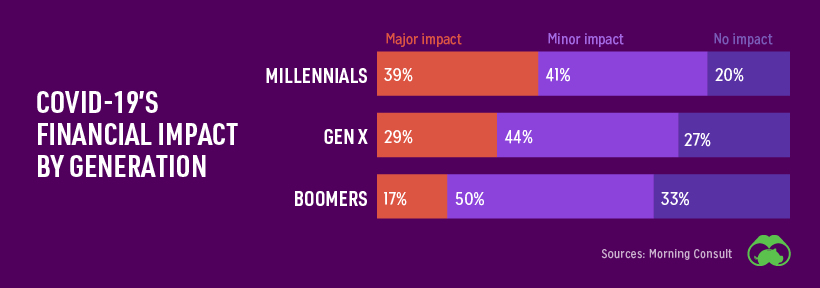

This issue is sure to be compounded by economic turmoil brought on by COVID-19. Younger generations face the dual challenges of being more likely to be negatively impacted by the pandemic, while also being the least likely to have savings to cover an interruption in income.

In fact, nearly half of people in the 18–24 year old age group have nothing saved at all.

The longer the economy is affected by COVID-19 measures, the more of a wedge will be driven between people who have continued working and those who are employed in impacted industries (e.g. tourism, events).

Acceleration signal: Growth in the net worth of billionaires has been largely unaffected by COVID-19.

#5: The Flexible Workplace

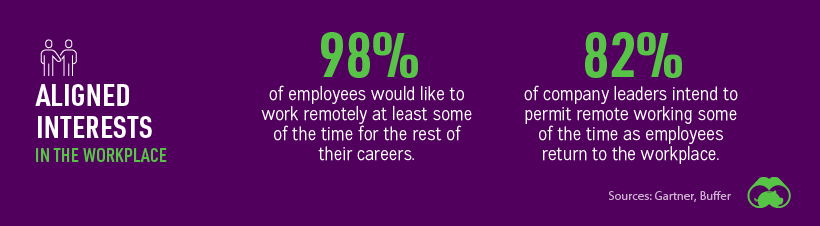

As of 2019, over half of companies that didn’t have a flexible or remote workplace policy cited “longstanding company policy” as the reason. In other words, that is just the way things have always worked.

Of course, the pandemic has forced many companies to rethink these policies.

This grand experiment in remote work and distributed teams will have an impact on office life as we know it, potentially reshaping the entire “office economy”. The impact is already being felt, with global commercial property investment volume falling by 48% in Q3 2020.

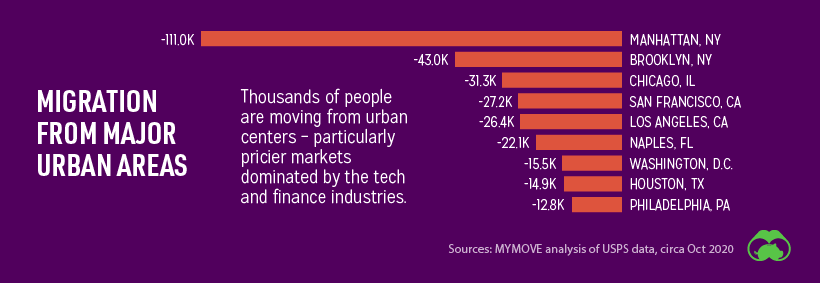

Acceleration signal: Thousands of people are moving out of pricey urban areas, presumably because they are able to work remotely from a cheaper location.

If you like this post, find hundreds of charts

like this in our new book “Signals”:

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Markets1 week ago

Markets1 week agoRanked: The Largest U.S. Corporations by Number of Employees

-

Green3 weeks ago

Green3 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?