Space

Exploring the Expanse: 30 Years of Hubble Discoveries

View the full-size version of the infographic

Exploring the Expanse: 30 Years of Hubble Discoveries

View the full-size version of the infographic by clicking here.

We’ve been fascinated by space for centuries, but telescopes truly opened our eyes to what lies beyond our frontiers.

For 30 years, the Hubble Space Telescope has been our companion in helping us understand outer space, paving the way for many important scientific discoveries in the process.

A Window to the Universe

Hubble launched on Apr 24, 1990 and has been in our orbit ever since. However, it had something of a shaky start. Due to an error in its primary mirror, it returned many wobbly and blurry images—until a servicing mission in December 1993 fixed the issue.

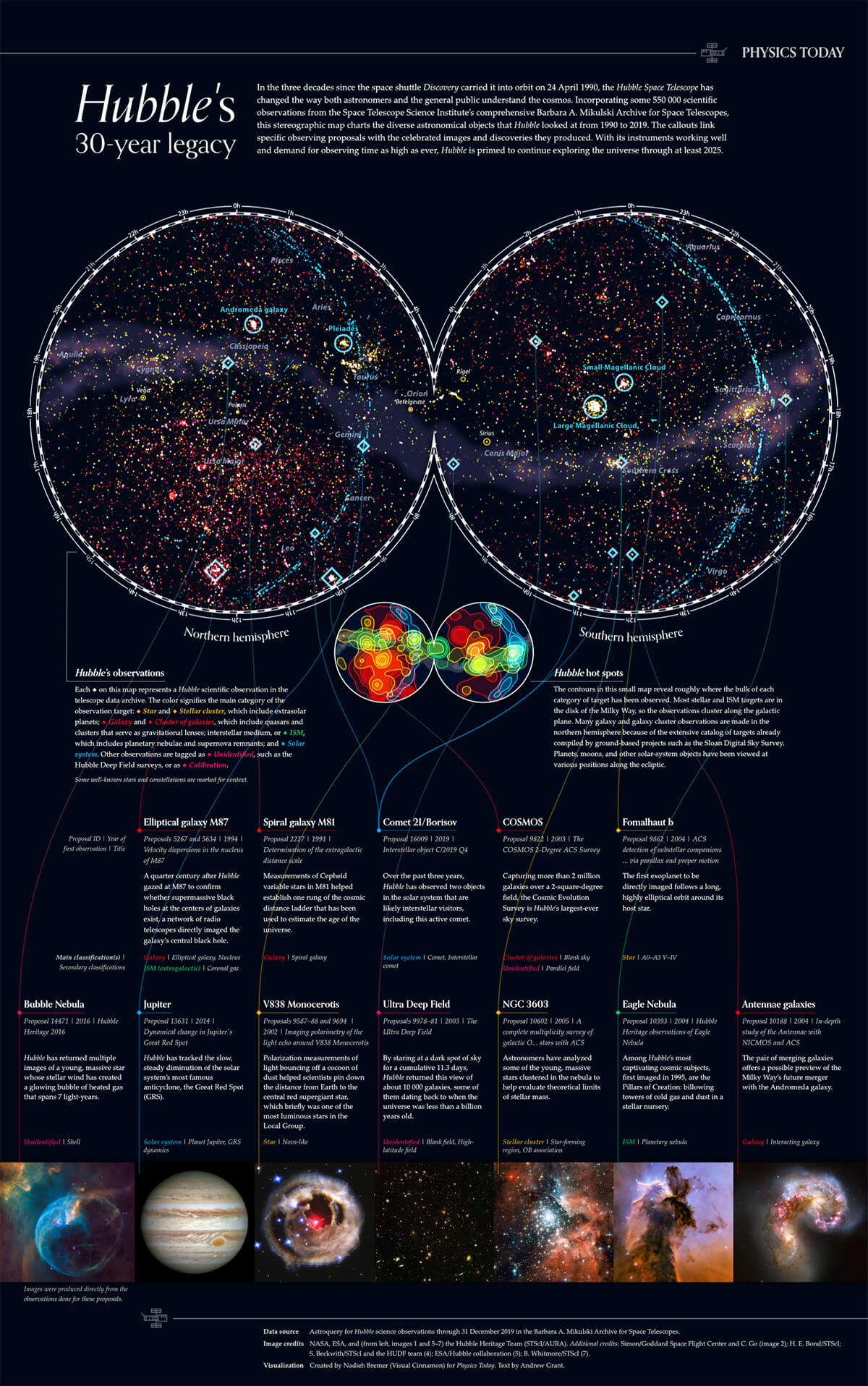

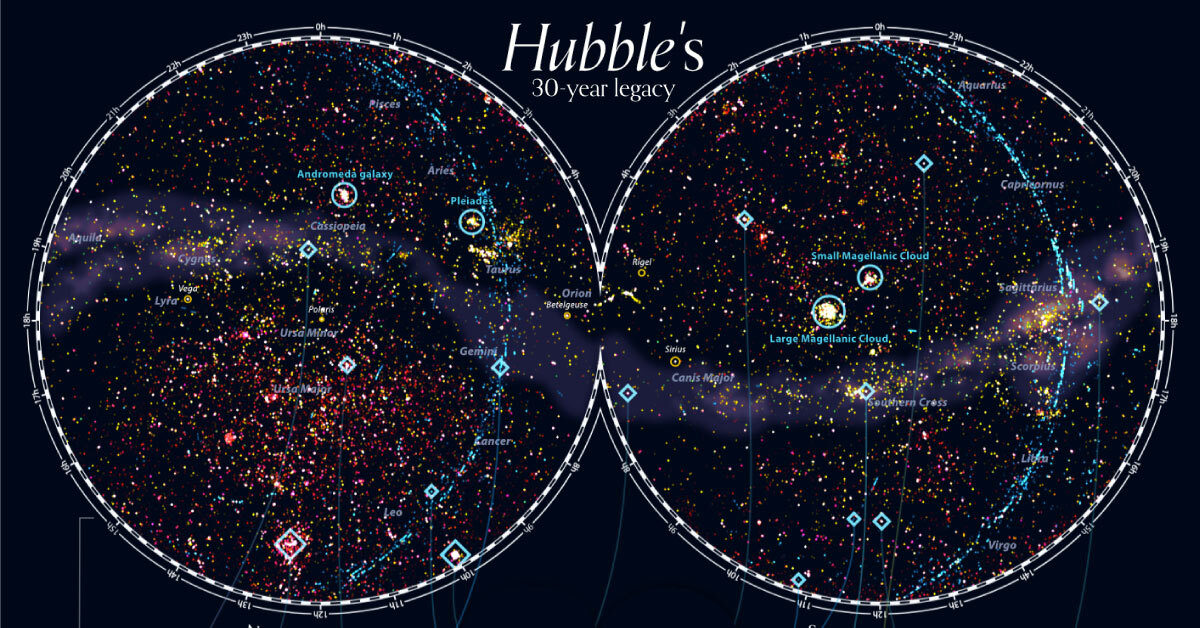

Today’s incredible map was created by Nadieh Bremer of Visual Cinnamon, for the scientific journal Physics Today. It incorporates over 550,000 scientific observations, to show the diverse objects captured by Hubble between 1990-2019.

Certain constellations have been included to help place these findings, many of which are also visible to the naked eye. Here are the main color-coded categories found on the map:

- Yellow: Star/ Stellar cluster

Example: V838 Monocerotis, which includes a red star and a light echo. - Red: Galaxy/ Clusters of galaxies

Example: Spiral galaxy M81, half the size of the Milky Way. - Green: Interstellar medium (ISM)

Example: Eagle Nebula, a majestic spire of cosmic dust and gas, resembling pillars and spanning 4-5 light years. - Blue: Solar System

Example: Jupiter’s Great Red Spot, a high-pressure storm in the planet’s atmosphere. - Pink: Calibration/Unidentified (e.g. Hubble Deep Field surveys)

Example: Ultra Deep Field, which captured a view of 10,000 galaxies over 11 days—some which date back to the early billion years of the universe.

NASA considers the Hubble telescope the “most significant advance in astronomy since Galileo’s telescope” and not without good reason—its total observations top 1.3 million.

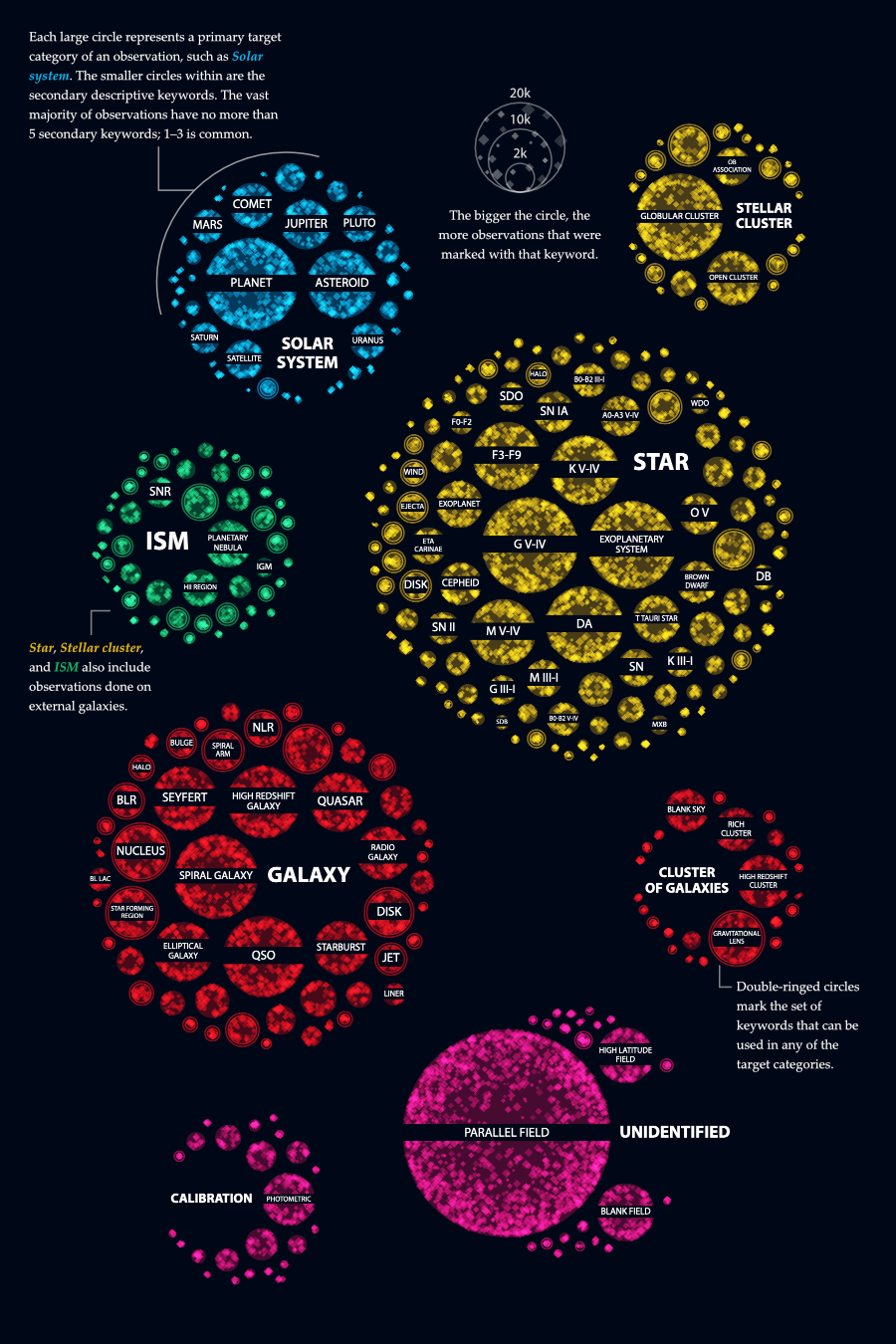

Hubble Observations, by Category

The journey doesn’t end there, either. Bremer also looked at the frequency of Hubble observations that occurred within each of these categories, ranging from 1,000-20,000.

Source: Physics Today

Each category encompasses multiple distinctive descriptions. For example, galaxies can be broken down further into whether they are spiral, nuclear, elliptical-shaped and much more.

Hubble’s Growing Legacy

The images sent back by Hubble over these three decades are not just for aesthetic purposes. The telescope is also responsible for immense contributions to the astronomy field: close to 13,000 scientific papers have used Hubble as a source to date.

The biggest scientific breakthrough thus far? The realization that our universe is expanding at an accelerating rate—thanks to a force called dark energy.

Hubble really did open up the whole universe to us in a way that nothing else did.

—Colleen Hartman, Former Deputy Center Director, NASA Goddard Space Flight Center

It’s clear that Hubble already has an impressive legacy, and it’s not expected to be retired until at least the year 2025. Soon, it will be joining forces with the new James Webb Space Telescope, to be launched in March 2021. For the next generation of space enthusiasts, their eyes to the skies may well be the Webb instead.

For the true data viz nerds among us, here is an in-depth blog post detailing the sky map’s creation from scratch.

Space

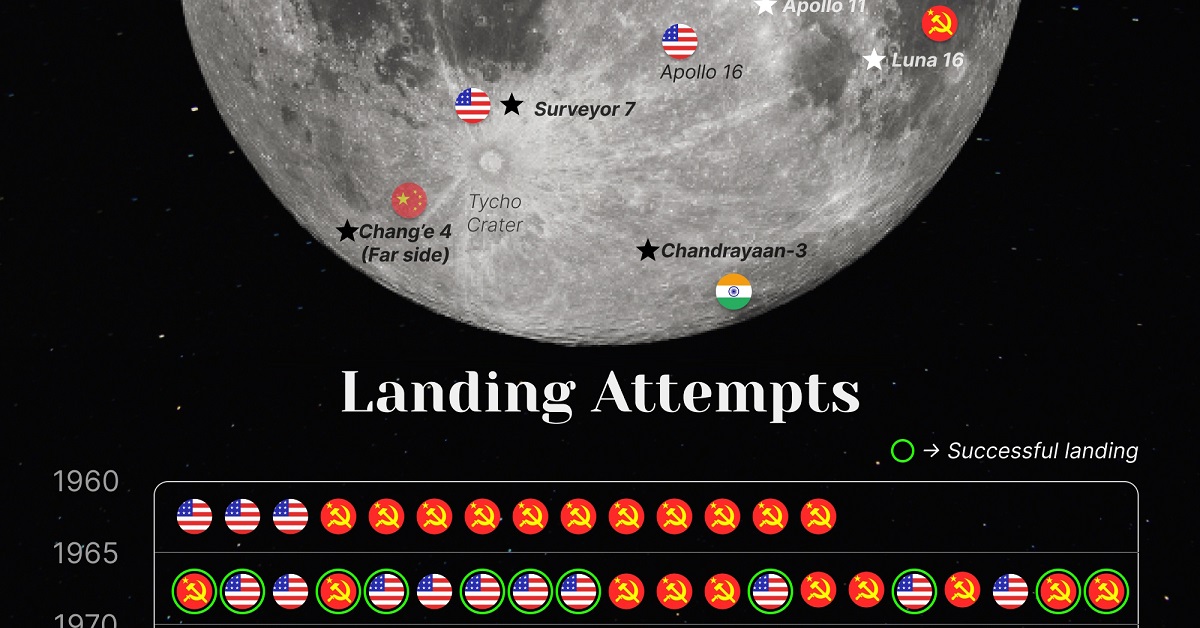

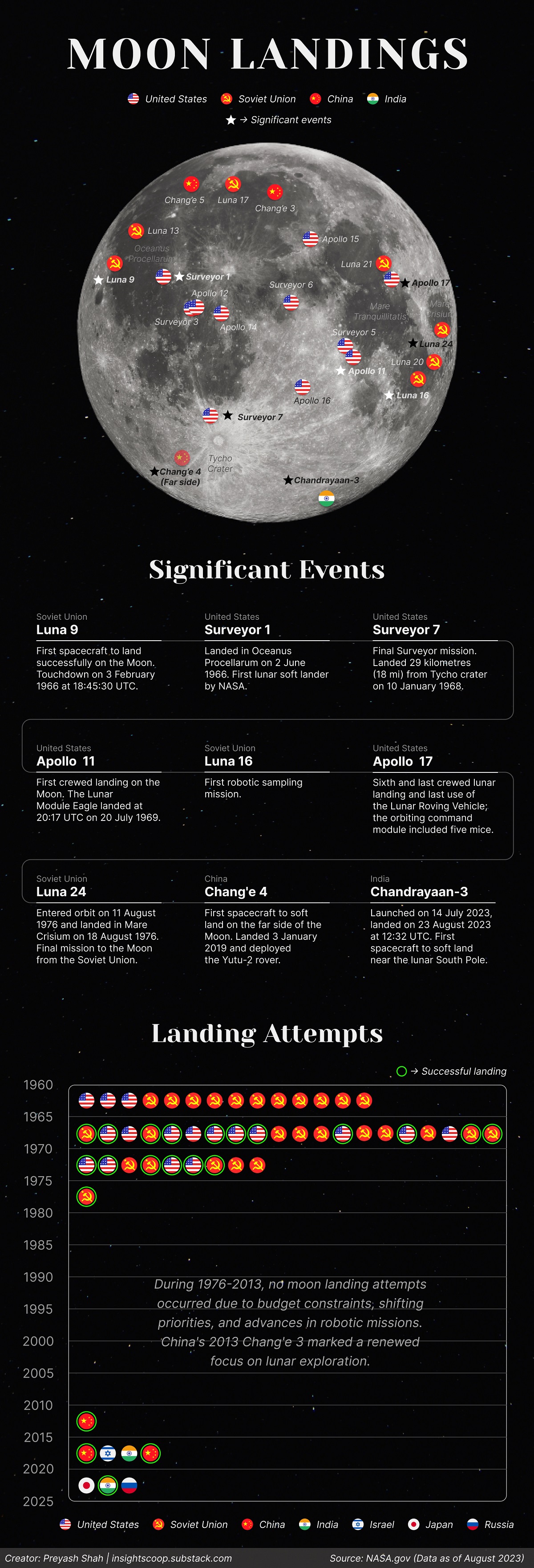

Visualizing All Attempted and Successful Moon Landings

Since the beginning of the space race, only four countries have successfully accomplished missions to the moon.

Visualizing All Attempted and Successful Moon Landings

Since before Ancient Greece and the first Chinese Dynasties, people have sought to understand and learn more about the moon.

Curiosity and centuries of study culminated in the first moon landing in the 1960s. But there have been many other attempted moon landings, both before and after.

This chart by Preyash Shah illustrates all the moon landings using NASA data since 1966 when Soviet lander Luna 9 touched down.

Race to the Moon

The 1960s and 1970s marked an era of intense competition between the U.S. and the Soviet Union as they raced to conquer the moon.

During the Cold War, space became a priority as each side sought to prove the superiority of its technology, its military firepower, and its political-economic system.

In 1961, President John F. Kennedy set a national goal to have a crewed lunar landing and return to Earth.

After several failed attempts from both sides, on July 20, 1969, the Apollo 11 mission was successful and astronauts Neil Armstrong and Buzz Aldrin became the first humans to set foot on the moon.

| Mission | Launch Date | Operator | Country | Mission Type | Outcome |

|---|---|---|---|---|---|

| Ranger 3 | 26-Jan-62 | NASA | 🇺🇸 U.S. | Lander | Spacecraft failure |

| Ranger 4 | 23-Apr-62 | NASA | 🇺🇸 U.S. | Lander | Spacecraft failure |

| Ranger 5 | 18-Oct-62 | NASA | 🇺🇸 U.S. | Lander | Spacecraft failure |

| Luna E-6 No.2 | 4-Jan-63 | OKB-1 | ☭ USSR | Lander | Launch failure |

| Luna E-6 No.3 | 3-Feb-63 | OKB-1 | ☭ USSR | Lander | Launch failure |

| Luna 4 | 2-Apr-63 | OKB-1 | ☭ USSR | Lander | Spacecraft failure |

| Luna E-6 No.6 | 21-Mar-64 | OKB-1 | ☭ USSR | Lander | Launch failure |

| Luna E-6 No.5 | 20-Apr-64 | OKB-1 | ☭ USSR | Lander | Launch failure |

| Kosmos 60 | 12-Mar-65 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Luna E-6 No.8 | 10-Apr-65 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Luna 5 | 9-May-65 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Luna 6 | 8-Jun-65 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Luna 7 | 4-Oct-65 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Luna 8 | 3-Dec-65 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Luna 9 | 31-Jan-66 | Lavochkin | ☭ USSR | Lander | Successful |

| Surveyor 1 | 30-May-66 | NASA | 🇺🇸 U.S. | Lander | Successful |

| Surveyor 2 | 20-Sep-66 | NASA | 🇺🇸 U.S. | Lander | Spacecraft failure |

| Luna 13 | 21-Dec-66 | Lavochkin | ☭ USSR | Lander | Successful |

| Surveyor 3 | 17-Apr-67 | NASA | 🇺🇸 U.S. | Lander | Successful |

| Surveyor 4 | 14-Jul-67 | NASA | 🇺🇸 U.S. | Lander | Spacecraft failure |

| Surveyor 5 | 8-Sep-67 | NASA | 🇺🇸 U.S. | Lander | Successful |

| Surveyor 6 | 7-Nov-67 | NASA | 🇺🇸 U.S. | Lander | Successful |

| Surveyor 7 | 7-Jan-68 | NASA | 🇺🇸 U.S. | Lander | Successful |

| Luna E-8 No.201 | 19-Feb-69 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Luna E-8-5 No.402 | 14-Jun-69 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Luna 15 | 13-Jul-69 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Apollo 11 | 16-Jul-69 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Successful |

| Kosmos 300 | 23-Sep-69 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Kosmos 305 | 22-Oct-69 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Apollo 12 | 14-Nov-69 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Successful |

| Luna E-8-5 No.405 | 6-Feb-70 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Apollo 13 | 11-Apr-70 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Partial failure |

| Luna 16 | 12-Sep-70 | Lavochkin | ☭ USSR | Lander | Successful |

| Luna 17 | 10-Nov-70 | Lavochkin | ☭ USSR | Lander | Successful |

| Apollo 14 | 31-Jan-71 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Successful |

| Apollo 15 | 26-Jul-71 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Successful |

| Luna 18 | 2-Sep-71 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Luna 20 | 14-Feb-72 | Lavochkin | ☭ USSR | Lander | Successful |

| Apollo 16 | 16-Apr-72 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Successful |

| Apollo 17 | 7-Dec-72 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Successful |

| Luna 21 | 8-Jan-73 | Lavochkin | ☭ USSR | Lander | Successful |

| Luna 23 | 16-Oct-75 | Lavochkin | ☭ USSR | Lander | Partial failure |

| Luna E-8-5M No.412 | 16-Oct-75 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Luna 24 | 9-Aug-76 | Lavochkin | ☭ USSR | Lander | Successful |

| Chang'e 3 | 1-Dec-13 | CNSA | 🇨🇳 China | Lander | Operational |

| Chang'e 4 | 7-Dec-18 | CNSA | 🇨🇳 China | Lander | Operational |

| Beresheet | 22-Feb-19 | SpaceIL | 🇮🇱 Israel | Lander | Spacecraft failure |

| Chandrayaan-2 | 22-Jul-19 | ISRO | 🇮🇳 India | Lander | Spacecraft Failure |

| Chang'e 5 | 23-Nov-20 | CNSA | 🇨🇳 China | Lander | Successful |

| Hakuto-R Mission 1 | 11-Dec-22 | ispace | 🇯🇵 Japan | Lander | Spacecraft failure |

| Chandrayaan-3 | 14-Jul-23 | ISRO | 🇮🇳 India | Lander | Successful |

| Luna 25 | 10-Aug-23 | Roscosmos | 🇷🇺 Russia | Lander | Spacecraft failure |

After the Apollo missions, the fervor of lunar exploration waned. From 1976 to 2013, no moon landing attempts occurred due to budget constraints, shifting priorities, and advances in robotic missions.

However, a new chapter in space exploration has unfolded in recent years, with emerging players entering the cosmic arena. With its Chang’e missions, China has made significant strides, landing rovers on the moon and exploring the far side of the moon.

India, too, has asserted its presence with the Chandrayaan missions. In 2023, the country became the 4th nation to reach the moon as an unmanned spacecraft landed near the lunar south pole, advancing the country’s space ambitions to learn more about the lunar ice, potentially one of the moon’s most valuable resources.

Exploring Lunar Water

Since the 1960s, even before the historic Apollo landing, scientists had theorized the potential existence of water on the moon.

In 2008, Brown University researchers employed advanced technology to reexamine lunar samples, discovering hydrogen within beads of volcanic glass. And in 2009, a NASA instrument aboard the India’s Chandrayaan-1 probe confirmed the presence of water on the moon’s surface.

Water is deemed crucial for future space exploration. Beyond serving as a potential source of drinking water for future moon explorations, ice deposits could play a pivotal role in cooling equipment. Lunar ice could also be broken down to produce hydrogen for fuel and oxygen for breathing, essential for supporting extended space missions.

With a reinvigorated interest in exploring the moon, manned moon landings are on the horizon once again. In April 2023, NASA conducted tests for the launch of Artemis I, the first American spacecraft to aim for the moon since 1972. The agency aims to send astronauts to the moon around 2025 and build a base camp on the lunar surface.

-

Misc2 weeks ago

Misc2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money1 week ago

Money1 week agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

Creator Program

Creator Program