Finance

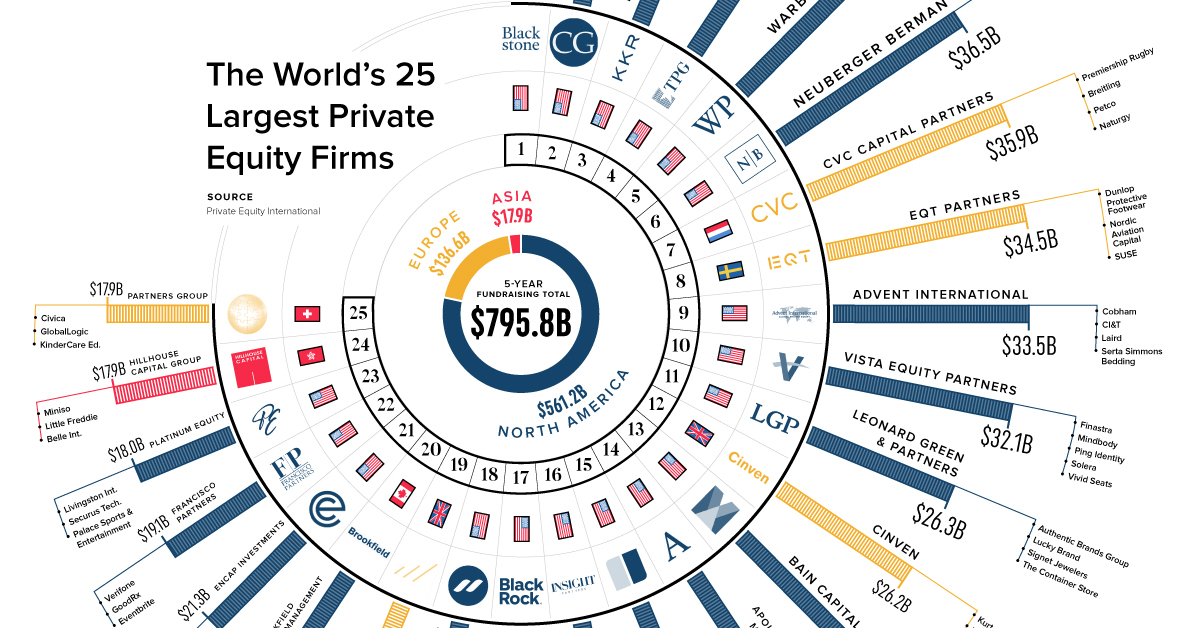

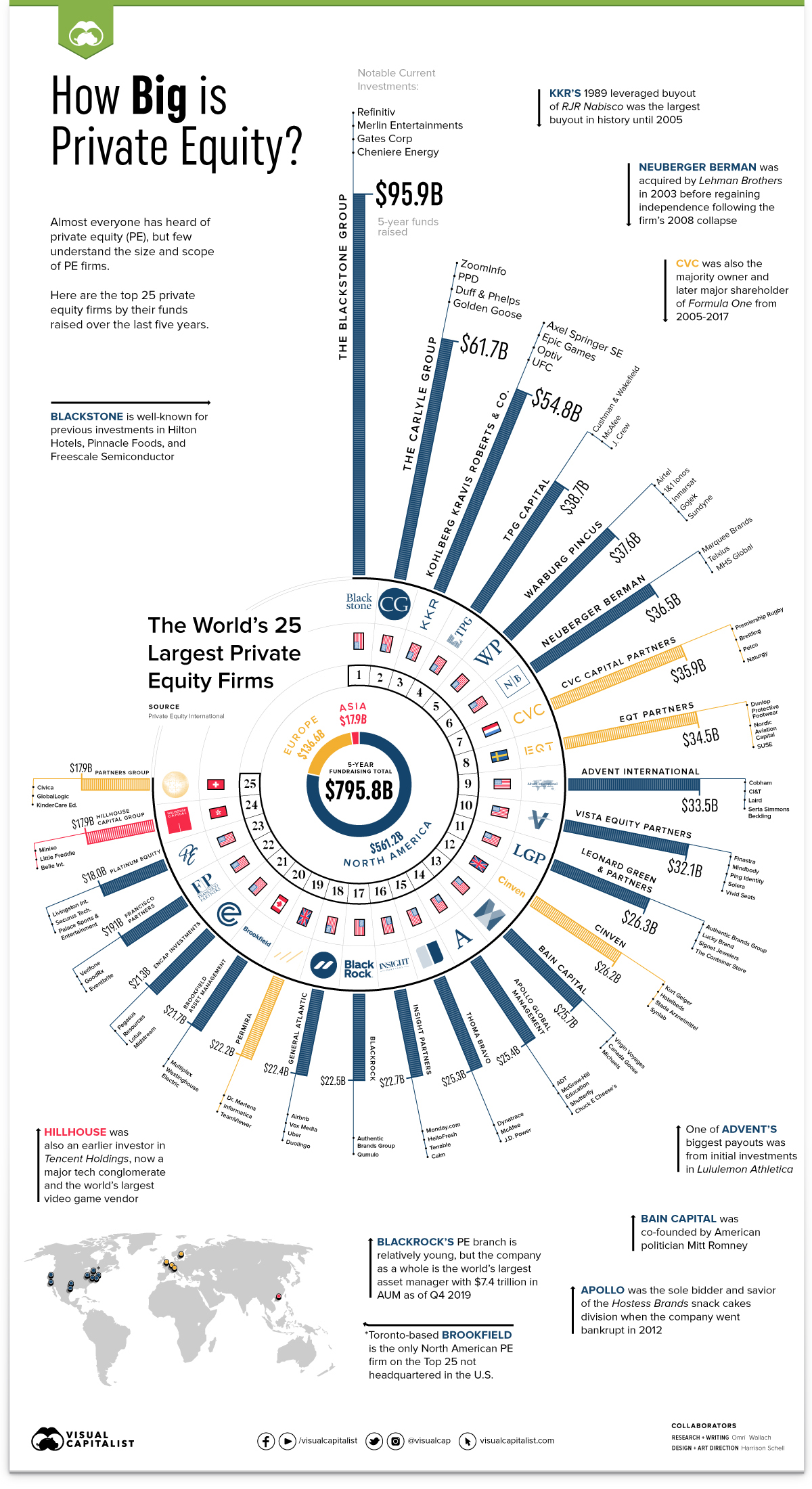

The 25 Largest Private Equity Firms in One Chart

The 25 Largest Private Equity Firms Since 2015

Frequent the business section of your favorite newspaper long enough, and you’ll see mentions of private equity (PE).

Maybe it’s because a struggling company got bought out and taken private, just as Toys “R” Us did in 2005 for $6.6 billion.

Otherwise, it’s likely a mention of a major investment (or payout) that a PE firm scored through venture or growth capital. For example, after Airbnb had to postpone its original plans for a 2020 initial public offering (IPO) in light of the pandemic, the company raised more than $1 billion in PE funding to plan for a new listing later this year.

Yet many people don’t fully understand the size and scope of private equity. To demonstrate the impact of PE, we break down the funds raised by the top 25 firms over the last five years.

How Private Equity Firms Operate

First, we need to differentiate between private equity and other forms of investment.

A PE firm makes investments and provides financial backing to startups and non-public companies (or public companies that are being taken private).

Each firm raises a PE fund by pooling capital from investors, which it then uses to carry out transactions such as leveraged buyouts, venture and growth capital, distressed investments, and mezzanine capital.

Unlike other investment firms such as hedge funds, private equity firms take a direct role in managing their assets. In order to maximize value, that can mean asset stripping, lay-offs, and other significant restructuring.

Traditionally, PE investments are held on a longer-term basis, with the goal of maximizing the target company’s value through an IPO, merger, recapitalization, or sale.

The List: The Most PE Funds Raised in Five Years

So which names should you know in private equity?

Here are the largest 25 private equity firms by their five-year PE fundraising total over the last five years, with data on funds and investments from respective firms and Private Equity International.

They include well-known private equity houses like The Blackstone Group and KKR (Kohlberg Kravis Roberts), as well as investment managers with private equity divisions like BlackRock.

| Rank | Private Equity Firm | 5-Year Funds Raised ($B) | Notable Current Investments |

|---|---|---|---|

| 1 | The Blackstone Group | 95.95 | Refinitiv, Merlin Entertainments |

| 2 | The Carlyle Group | 61.72 | ZoomInfo, PPD |

| 3 | Kohlberg Kravis Roberts & Co. | 54.76 | Axel Springer SE, Epic Games |

| 4 | TPG Capital | 38.68 | Cirque du Soleil, Cushman & Wakefield |

| 5 | Warburg Pincus | 37.59 | Airtel, Sundyne |

| 6 | Neuberger Berman | 36.51 | Marquee Brands, Telxius |

| 7 | CVC Capital Partners | 35.88 | Petco, Premiership Rugby |

| 8 | EQT Partners | 34.46 | Dunlop Protective Footwear, SUSE |

| 9 | Advent International | 33.49 | Cobham, Serta Simmons Bedding, |

| 10 | Vista Equity Partners | 32.1 | Finastra, Mindbody |

| 11 | Leonard Green & Partners | 26.31 | Lucky Brand, Signet Jewelers |

| 12 | Cinven | 26.15 | Kurt Geiger, Hotelbeds |

| 13 | Bain Capital | 25.74 | Virgin Voyages, Canada Goose |

| 14 | Apollo Global Management | 25.42 | ADT, Chuck E Cheese's |

| 15 | Thoma Bravo | 25.29 | Dynatrace, McAfee |

| 16 | Insight Partners | 22.74 | Monday.com, HelloFresh |

| 17 | BlackRock | 22.46 | Authentic Brands Group, Qumulo |

| 18 | General Atlantic | 22.42 | Airbnb, Vox Media |

| 19 | Permira | 22.21 | Dr. Martens, Informatica |

| 20 | Brookfield Asset Management | 21.69 | Multiplex, Westinghouse Electric |

| 21 | EnCap Investments | 21.33 | Pegasus Resources, Lotus Midstream |

| 22 | Francisco Partners | 19.13 | Verifone, GoodRx |

| 23 | Platinum Equity | 18.00 | Livingston International, Palace Sports & Entertainment |

| 24 | Hillhouse Capital Group | 17.89 | Miniso, Belle International |

| 25 | Partners Group | 17.87 | Civica, KinderCare Education |

Most of the world’s top PE firms, including TPG Capital (which invested in Ducati Motorcycles, J. Crew, and Del Monte Foods) and Advent International (an early investor in Lululemon Athletica) are headquartered in the U.S.

In fact, of the largest 25 private equity firms in the last five years, just four are headquartered in Europe (CVC, EQT, Cinven, and Permira) and one in Asia (Hillhouse).

Another name that might be recognizable is Bain Capital, which was co-founded by Utah Senator and former Republican Presidential nominee Mitt Romney and found success with investments in AMC Theatres, Domino’s Pizza, and iHeartMedia.

Famous Private Equity Investments

One of the most surprising things investors discover about private equity is how many large organizations have been funded through the PE world.

More well-known investments include KKR’s $31.1 billion takeover of food and tobacco conglomerate RJR Nabisco in 1989, and Blackstone’s $26 billion buyout of Hilton Hotels Corporation in 2007.

But other well-known companies have been funded, saved, or restructured through private equity. That list includes grocery chain Safeway, fast food chain Burger King, international racing operator Formula One Group, and hotel and casino company Caesars Entertainment (then called Harrah’s Entertainment).

Many other notable investments could soon pay off for private equity. With IPOs back in season, tech companies like Airbnb and Epic Games are ripe for payouts. At the same time, restructuring companies like J. Crew and Chuck E Cheese’s always offers a chance to recapitalize.

With the COVID-19 economic downturn resulting in newly distressed companies and potential takeover targets, expect the private equity world to be very active in the foreseeable future.

Green

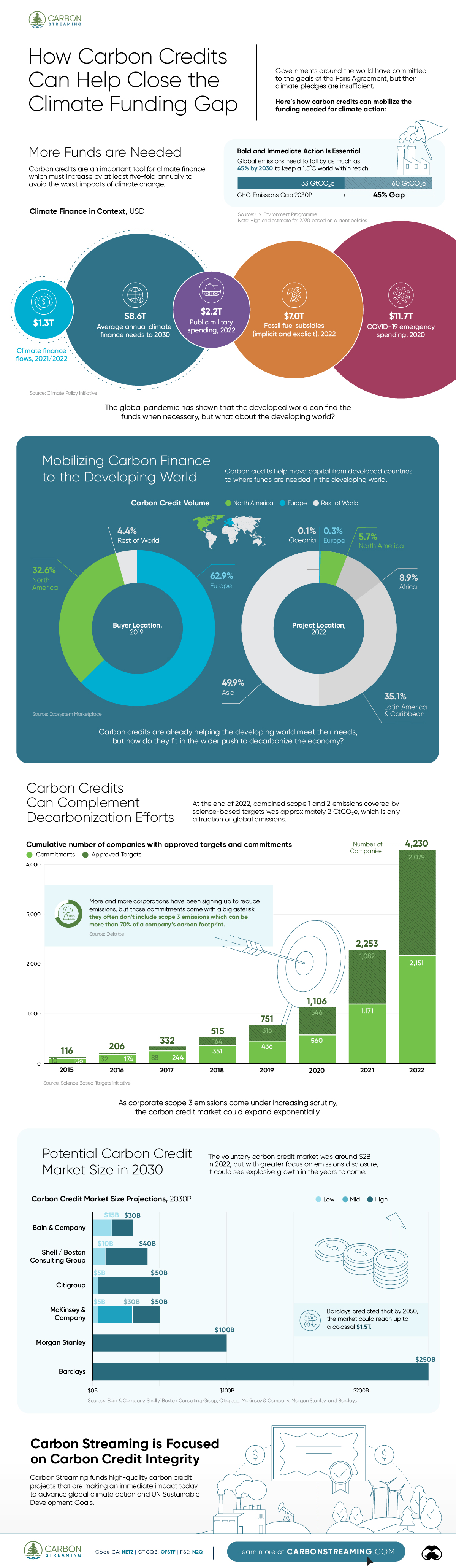

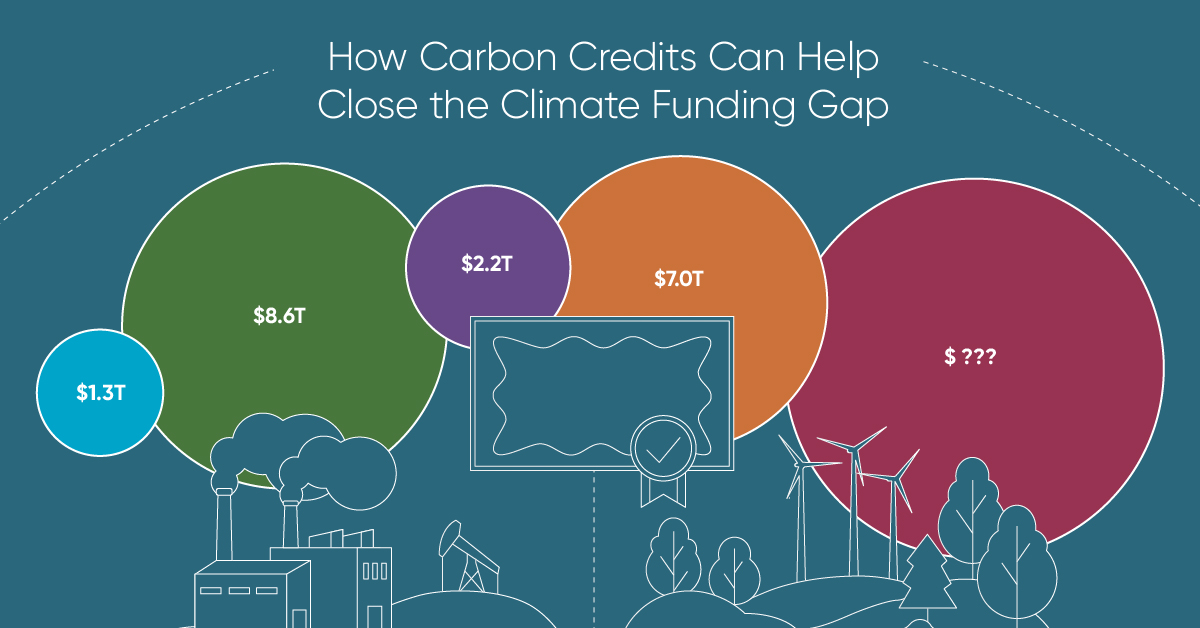

How Carbon Credits Can Help Close the Climate Funding Gap

To keep a 1.5℃ world within reach, global emissions need to fall by as much as 45% by 2030, and carbon credits could help close the gap.

How Carbon Credits Can Help Close the Climate Funding Gap

Governments around the world have committed to the goals of the Paris Agreement, but their climate pledges are insufficient. To keep a 1.5℃ world within reach, global emissions need to fall by as much as 45% by 2030.

Bold and immediate action is essential, but so are resources that will make it happen.

In this graphic, we have partnered with Carbon Streaming to look at the role that the voluntary carbon market and carbon credits can play in closing that gap.

More Funds are Needed for Climate Finance

According to data from the Climate Policy Initiative, climate finance, which includes funds for both adaptation and mitigation, needs to increase at least five-fold, from $1.3T in 2021/2022, to an average $8.6T annually until 2030, and then to just over $10T in the two decades leading up to 2050.

That adds up to a very large number, but consider that in 2022, $7.0T went to fossil fuel subsidies, which almost covers the annual estimated outlay. And the world has shown that when pressed, governments can come up with the money, if the global pandemic is any indication.

Mobilizing Carbon Finance to the Developing World

But the same cannot be said of the developing world, where debt, inequality, and poverty reduce the ability of governments to act. And this is where carbon credits can play an important role. According to analyses from Ecosystem Marketplace, carbon credits help move capital from developed countries, to where funds are needed in the developing world.

For example, in 2019, 69.2% of the carbon credits by volume in the voluntary carbon market were purchased by buyers in Europe, and nearly a third from North America. Compare that to over 90% of the volume of carbon credits sold in the voluntary carbon market in 2022 came from projects that were located outside of those two regions.

Carbon Credits Can Complement Decarbonization Efforts

Carbon credits can also complement decarbonization efforts in the corporate world, where more and more companies have been signing up to reduce emissions. According to the 2022 monitoring report from the Science Based Targets initiative, 4,230 companies around the world had approved targets and commitments, which represented an 88% increase from the prior year. However, as of year end 2022, combined scope 1 and 2 emissions covered by science-based targets totaled approximately 2 GtCO2e, which represents just a fraction of global emissions.

The fine print is that this is just scope 1 and 2 emissions, and doesn’t include scope 3 emissions, which can account for more than 70% of a company’s total emissions. And as these emissions come under greater and greater scrutiny the closer we get to 2030 and beyond, the voluntary carbon credit market could expand exponentially to help meet the need to compensate for these emissions.

Potential Carbon Credit Market Size in 2030

OK, but how big? In 2022, the voluntary carbon credit market was around $2B, but some analysts predict that it could grow to between $5–250 billion by 2030.

| Firm | Low Estimate | High Estimate |

|---|---|---|

| Bain & Company | $15B | $30B |

| Barclays | N/A | $250B |

| Citigroup | $5B | $50B |

| McKinsey & Company | $5B | $50B |

| Morgan Stanley | N/A | $100B |

| Shell / Boston Consulting Group | $10B | $40B |

Morgan Stanley and Barclays were the most bullish on the size of the voluntary carbon credit market in 2030, but the latter firm was even more optimistic about 2050, and predicted that the voluntary carbon credit market could grow to a colossal $1.5 trillion.

Carbon Streaming is Focused on Carbon Credit Integrity

Ultimately, carbon credits could have an important role to play in marshaling the resources needed to keep the world on track to net zero by 2050, and avoiding the worst consequences of a warming world.

Carbon Streaming uses streaming transactions, a proven and flexible funding model, to scale high-integrity carbon credit projects to advance global climate action and UN Sustainable Development Goals.

Learn more at www.carbonstreaming.com.

-

Green1 week ago

Green1 week agoRanking the Top 15 Countries by Carbon Tax Revenue

This graphic highlights France and Canada as the global leaders when it comes to generating carbon tax revenue.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

South Asian nations are the global hotspot for pollution. In this graphic, we rank the world’s most polluted countries according to IQAir.

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001

One country is taking reforestation very seriously, registering more than 400,000 square km of forest growth in two decades.

-

Green3 weeks ago

Green3 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

The country with the most forest loss since 2001 lost as much forest cover as the next four countries combined.

-

Markets2 months ago

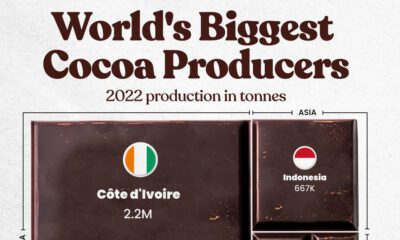

Markets2 months agoThe World’s Top Cocoa Producing Countries

Here are the largest cocoa producing countries globally—from Côte d’Ivoire to Brazil—as cocoa prices hit record highs.

-

Environment2 months ago

Environment2 months agoCharted: Share of World Forests by Country

We visualize which countries have the biggest share of world forests by area—and while country size plays a factor, so too, does the environment.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023