Mining

21 Incredible Uses for Silver

From our perspective, silver is the most fascinating metal in existence.

Silver is best known for having extraordinary properties that have made it an effective monetary metal for thousands of years. Currency buffs all know the metal as being rare, durable, fungible, malleable, ductile, and divisible, which match the properties of money agreed on by most economists. Silver, of course, has been used by civilizations ranging from Ancient Rome to the United States for monetary purposes.

However, these monetary uses are just the tip of the iceberg in terms of silver’s overall utility. More than 50% of all silver uses are for industrial applications, and it’s not just a single application that dominates that mix.

Silver has an array of properties that make it interesting for many practical purposes. Firstly, silver is the most conductive and the most reflective metal, which make it useful in batteries, solar panels, and electronics. It’s also an effective industrial catalyst for producing very important materials such as plastics or polyester. Lastly, silver is extremely anti-bacterial and non-toxic, making it handy for a wide variety of medical and technological applications.

21 Incredible Uses for Silver

The following infographic shows 21 incredible uses for silver. Many of them may be surprising or seemingly “oddball”, but it really speaks to the impressive versatility of the metal.

Image courtesy of: BullionVault

The above infographic from BullionVault puts the many uses of silver in perspective.

The metal’s properties make it a great choice for technological applications such as batteries, solar panels, media storage, or 3d printing. However, it also has many “oddball” uses as well: anti-microbial labcoats, water purification, laundry detergent, photography, stained glass, wood preservation, treating warts, cloud seeding, and food garnishing.

The possibilities seem endless for silver, and there’s no telling what it could be used for in the future.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Travel1 week ago

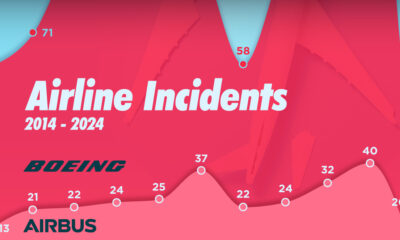

Travel1 week agoAirline Incidents: How Do Boeing and Airbus Compare?

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America