Markets

12 Types of Technical Indicators Used by Stock Traders

If you’re planning to hold a portfolio of blue chip stocks well into retirement, then short-term movements in the market are not likely your biggest worry.

However, if you dabble in the stock market on a day-to-day basis, or if you simply want to know what drives the thinking of other market participants, it can be very beneficial to understand the basics of technical indicators.

Many traders swear by them to help with the timing of their trades or to alert them of trends. But, even for an investor more focused on the underlying fundamentals of companies, learning how these indicators work can provide added conviction on new or existing trades.

Types of Technical Indicators

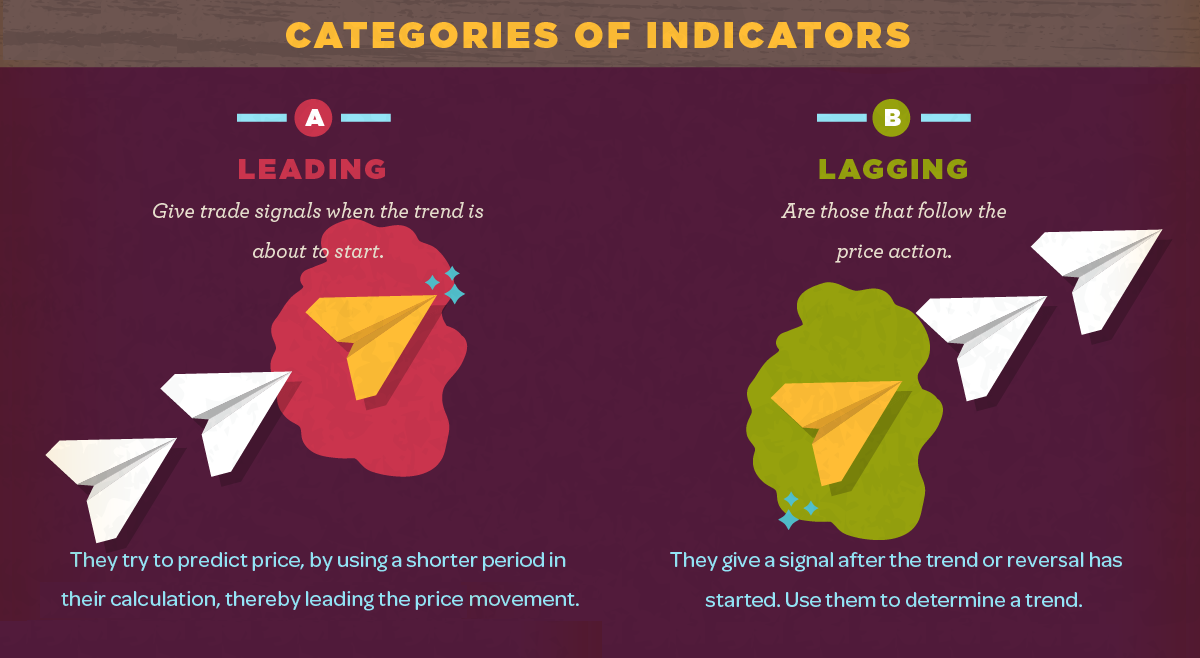

Today’s infographic comes to us from StocksToTrade.com, and it explores the fundamentals behind 12 of the most commonly-used technical indicators. It differentiates between lagging and leading indicators, and also explains some basic tactics for incorporating these markers into an overall investment strategy.

The infographic differentiates between four different types, including trend, momentum, volatility, and volume indicators.

Trend indicators

These technical indicators measure the direction and strength of a trend by comparing prices to an established baseline.

Moving Averages: Used to identify trends and reversals, as well as to set up support and resistance levels.

Parabolic Stop and Reverse (Parabolic SAR): Used to find potential reversals in the market price direction.

Moving Average Convergence Divergence (MACD): Used to reveal changes in the strength, direction, momentum, and duration of a trend in a stock’s price.

Momentum indicators

These technical indicators may identify the speed of price movement by comparing the current closing price to previous closes.

Stochastic Oscillator: Used to predict price turning points by comparing the closing price to its price range.

Commodity Channel Index (CCI): An oscillator that helps identify price reversals, price extremes, and trend strength.

Relative Strength Index (RSI): Measures recent trading strength, velocity of change in the trend, and magnitude of the move.

Volatility Indicators

These technical indicators measure the rate of price movement, regardless of direction.

Bollinger bands: Measures the “highness” or “lowness” of price, relative to previous trades.

Average True Range: Shows the degree of price volatility.

Standard Deviation: Used to measure expected risk and to determine the significance of certain price movements.

Volume Indicators

These technical indicators measure the strength of a trend based on volume of shares traded.

Chaikin Oscillator: Monitors the flow of money in and out of the market, which can help determine tops and bottoms.

On-Balance Volume (OBV): Attempts to measure level of accumulation or distribution, by comparing volume to price.

Volume Rate of Change: Highlights increases in volume. These normally happen mostly at market tops, bottoms, or breakouts.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?