Business

11 Things Leaders Should Never Say to Teams

Being a leader comes with great responsibility.

Not only are you accountable for the success of your division or organization, but your team is also constantly reliant on you for feedback, coaching, and guiding personal development.

While juggling these priorities, it’s not always easy for a manager to know the exact right thing to say to employees on the team. To further complicate matters, we all have bad management habits that have compounded over time, and they can be difficult to shed.

Building a New Lexicon

Today’s infographic comes to us from Headway Capital, and it highlights 11 things that leaders should never say to their teams.

More importantly, it breaks down the negative implications of each instance, while also providing suggestions on how we can evolve our managerial skills to ensure that we are approaching each situation far more proactively.

Life as a leader is busy, and it has many competing priorities.

However, to grow the type of company culture that pays long-term dividends, it’s worth it to try and better develop the way you give feedback to team members.

Typical Mistakes

Using the list of items in the infographic, we can generally categorize these mistakes in a few distinct categories.

1. Gut Reactions

The quick dismissal of someone’s effort (“That’s not important”) or the temptation to play the busy card (“I don’t have time to talk right now”) can send the message that an employee’s time or thoughts are not valued.

Instead, small adjustments can be made to encourage better outcomes. For example, you could make it clear that while you may be busy in the moment, that a time can be scheduled at a later date to discuss the issue in detail.

2. Business Truisms

Likewise, spouting overused, quasi-motivational business phrases (“Failure is not an option”) or using dictative language (“We’ve already tried that before”) can stifle innovation at a company.

It’s better to instead ask questions, such as “What is our backup plan if this idea doesn’t work?” or “What other options do you see?”, to expand the range of opportunities that can be pursued.

3. Generic Feedback

Finally, although phrases like “Keep doing what you’re doing” or “Nice job today” seem to be positive and engaging, they actually are ineffective from a development perspective.

Employees need specific feedback to grow, so all that has to happen here is to mention a specific task or project along with the feedback. Team members can then internalize precisely what made a project or task a success, and apply it to other areas in the workplace.

Markets

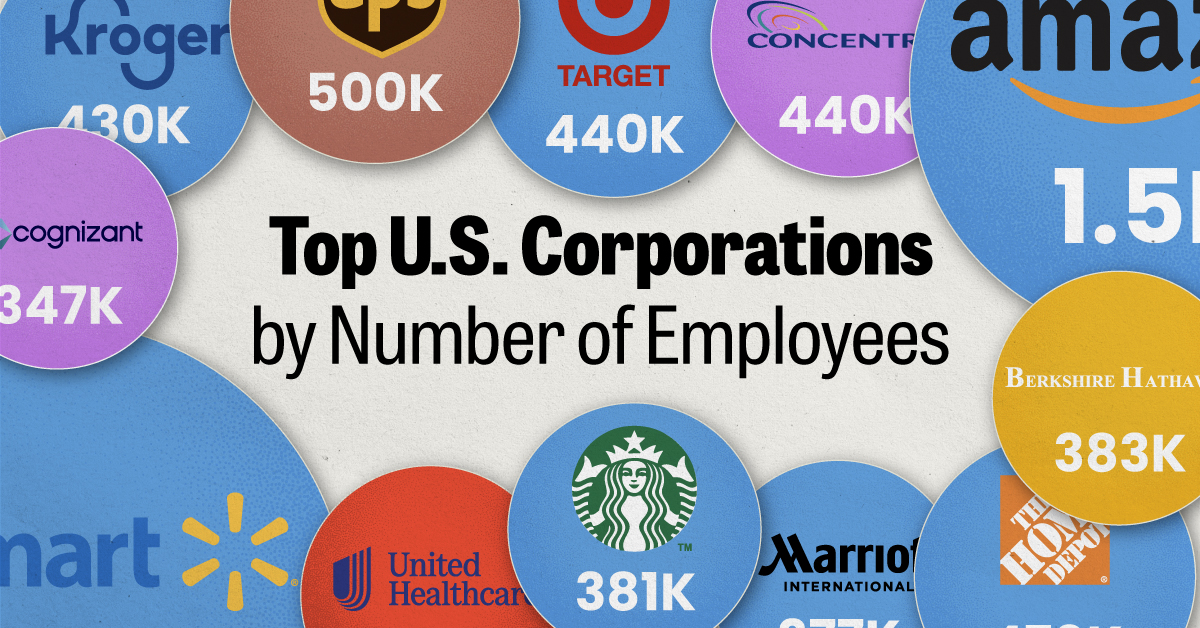

Ranked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

The Largest U.S. Corporations by Number of Employees

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Revenue and profit are common measures for measuring the size of a business, but what about employee headcount?

To see how big companies have become from a human perspective, we’ve visualized the top U.S. companies by employees. These figures come from companiesmarketcap.com, and were accessed in March 2024. Note that this ranking includes publicly-traded companies only.

Data and Highlights

The data we used to create this list of largest U.S. corporations by number of employees can be found in the table below.

| Company | Sector | Number of Employees |

|---|---|---|

| Walmart | Consumer Staples | 2,100,000 |

| Amazon | Consumer Discretionary | 1,500,000 |

| UPS | Industrials | 500,000 |

| Home Depot | Consumer Discretionary | 470,000 |

| Concentrix | Information Technology | 440,000 |

| Target | Consumer Staples | 440,000 |

| Kroger | Consumer Staples | 430,000 |

| UnitedHealth | Health Care | 400,000 |

| Berkshire Hathaway | Financials | 383,000 |

| Starbucks | Consumer Discretionary | 381,000 |

| Marriott International | Consumer Discretionary | 377,000 |

| Cognizant | Information Technology | 346,600 |

Retail and Logistics Top the List

Companies like Walmart, Target, and Kroger have a massive headcount due to having many locations spread across the country, which require everything from cashiers to IT professionals.

Moving goods around the world is also highly labor intensive, explaining why UPS has half a million employees globally.

Below the Radar?

Two companies that rank among the largest U.S. corporations by employees which may be less familiar to the public include Concentrix and Cognizant. Both of these companies are B2B brands, meaning they primarily work with other companies rather than consumers. This contrasts with brands like Amazon or Home Depot, which are much more visible among average consumers.

A Note on Berkshire Hathaway

Warren Buffett’s company doesn’t directly employ 383,000 people. This headcount actually includes the employees of the firm’s many subsidiaries, such as GEICO (insurance), Dairy Queen (retail), and Duracell (batteries).

If you’re curious to see how Buffett’s empire has grown over the years, check out this animated graphic that visualizes the growth of Berkshire Hathaway’s portfolio from 1994 to 2022.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001