Mining

The World’s Most Popular Mints: Key Facts and Comparisons

In the precious metals industry, trust is paramount. That’s why if you own any gold or silver bullion, there is a good chance that it comes from one of the few internationally recognized and reputable mints around the world.

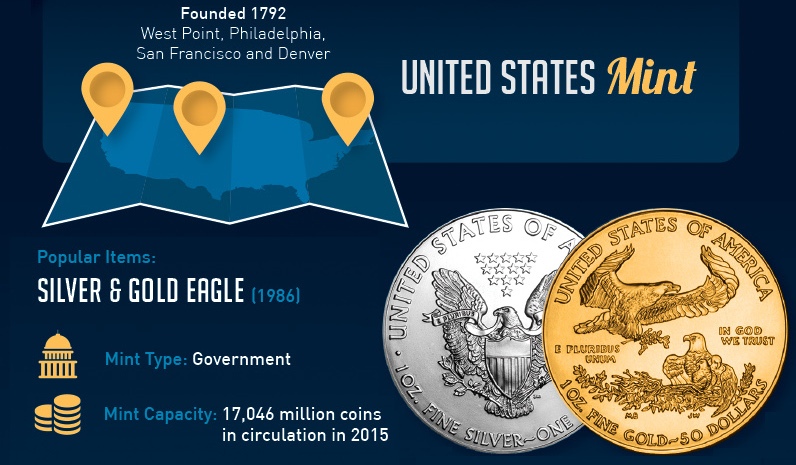

In this infographic with JMBullion, we highlight key facts and comparisons on some of the world’s most popular mints, including the United States Mint, the Royal Canadian Mint, Perth Mint, PAMP Suisse, and Sunshine Minting.

Some quick facts on each of the world’s most popular mints:

The United States Mint was founded in 1792, and now has minting operations in Philadelphia, Denver, West Point, and San Francisco. The mint produced more than 17 billion coins for circulation in 2015 for the fastest annual pace since 19.4 billion coins were struck in 2001. Legend holds that George Washington donated some of his personal silver to the Mint for manufacturing early coinage.

The Royal Canadian Mint was founded in 1908 in Ottawa, Canada. It produces over one billion coins per year, with the Silver Maple Leaf as its signature bullion offering. In 2007, the Royal Canadian Mint created the largest coin in the world – a 100 kg, 99.999% pure, $1 million gold bullion coin.

The Perth Mint was founded in 1899 in Perth, Australia. It was originally built to refine metal from the gold rushes occurring in Western Australia, while also distributing sovereigns and half-sovereigns for the British Empire. In 1970, the Mint’s jurisdiction was moved to the State Government of Western Australia. The Australian Kookaburra (1990-), Koala (2007-), and Kangaroo (1990-1993, 2016-) are some of the mint’s most popular products among bullion buyers.

PAMP Suisse, a private mint, was founded in Switzerland in 1977. The mint refines an impressive 450 tonnes of gold annually, and much of the gold used for worldwide jewelry production comes from PAMP. The Mint also produces the popular Fortuna bar, which is available in gold, silver, and platinum, with sizes ranging from 1 gram to 100 oz.

Sunshine Minting is another private mint. Founded in Idaho in 1979, Sunshine mints 70 million ounces of bullion each year, including its version of the popular Silver Buffalo Round. Sunshine Minting is also the primary supplier of one-ounce silver planchets (round metal disks, ready to be struck as coins) to the United States Mint.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023