Gold

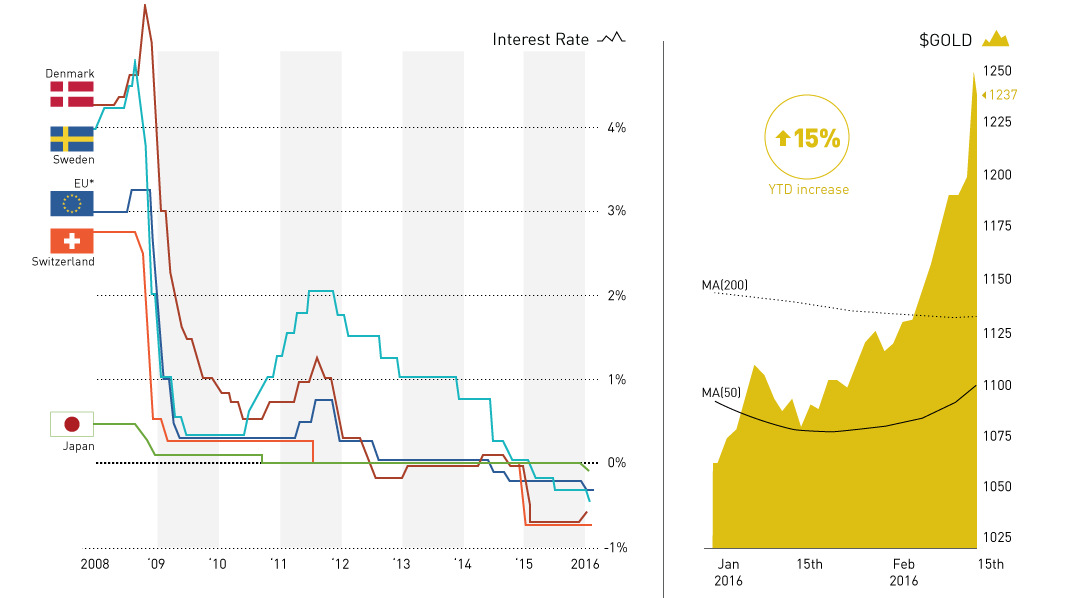

The World is Turning Japanese [Chart]

![The World is Turning Japanese [Chart]](https://www.visualcapitalist.com/wp-content/uploads/2016/02/turning-japanese-chart.png)

The World is Turning Japanese [Chart]

Negative rates, Kuroda’s “Peter Pan” analogy, and gold’s surge

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Nearly a year ago, Bank of Japan governor Haruhiko Kuroda described the unlikely inspiration behind Japan’s unprecedented monetary stimulus: Peter Pan.

I trust that many of you are familiar with the story of Peter Pan, in which it says, ‘the moment you doubt whether you can fly, you cease forever to be able to do it’. Yes, what we need is a positive attitude and conviction. Indeed, each time central banks have been confronted with a wide range of problems, they have overcome the problems by conceiving new solutions.

Kuroda’s optimism is desperately needed in a country that has now been officially “leapfrogged” by the four Asian Tigers in terms of Real GDP per capita (PPP). With over a decade of experimentation in extreme monetary policy under their belts, Japan has very little to show for it.

It would be fine if this story of economic malaise could be confined as a global outlier. However, recent circumstances have prodded the world’s central bankers to finally buy into the tale of Peter Pan.

The world is turning Japanese.

So Much Negativity

Negative interest rates were an economic pipe dream many decades ago, but the idea of “charging” interest to hold money is now becoming mainstream. Conventional wisdom was that depositors would just hoard cash rather than depositing at a cost, but now the people running central banks are beginning to believe that this fear is misplaced. Especially as society becomes more cashless, the inconvenience of withdrawing money to save a few bucks isn’t worth it.

Central banks in Switzerland, Sweden, Denmark, and Japan now all have negative interest rates. The ECB has also held their Deposit Facility Rate for overnight deposits in the negative since June 2014.

In recent weeks, the interest in this economic experiment has risen significantly. Sweden cut their rates deeper into negative territory, signalling to the rest of the world that there is nothing to fear. Meanwhile, both the Federal Reserve and the Bank of Canada have openly pondered the possibility of NIRP in their respective jurisdictions.

Misplaced Conviction?

Not everyone agrees with the central bankers in seeing the Peter Pan analogy to be a fitting representation.

We’d liken it more to a squad of musketeers running out of gunpowder, and turning desperately to their bayonets to win a decision. It doesn’t matter how much conviction and optimism the crew has in their bayonet skills – at the end of the day, it’s only going to add a few extra minutes of life into the inevitable battle against a much more powerful deflationary force.

In other words, “hope” isn’t a strategy that central bankers can use to any efficacy, and wishful thinking can only go so far. The market seems to agree, and it’s part of the reason that stocks have sold off this year. Even the “safe haven” gold trade is back, after being absent for much of the previous year.

Many critique assets such as gold, which is up 15% year-to-date, because it does not pay a dividend or interest.

This may be true, but at least gold does not “charge” interest, as bankers across the world are beginning to ponder.

Mining

Gold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

Gold vs. S&P 500: Which Has Grown More Over Five Years?

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Gold is considered a unique asset due to its enduring value, historical significance, and application in various technologies like computers, spacecraft, and communications equipment.

Commonly regarded as a “safe haven asset”, gold is something investors typically buy to protect themselves during periods of global uncertainty and economic decline.

It is for this reason that gold has performed rather strongly in recent years, and especially in 2024. Persistent inflation combined with multiple wars has driven up demand for gold, helping it set a new all-time high of over $2,400 per ounce.

To put this into perspective, we visualized the performance of gold alongside the S&P 500. See the table below for performance figures as of April 12, 2024.

| Asset/Index | 1 Yr (%) | 5 Yr (%) |

|---|---|---|

| 🏆 Gold | +16.35 | +81.65 |

| 💼 S&P 500 | +25.21 | +76.22 |

Over the five-year period, gold has climbed an impressive 81.65%, outpacing even the S&P 500.

Get Your Gold at Costco

Perhaps a sign of how high the demand for gold is becoming, wholesale giant Costco is reportedly selling up to $200 million worth of gold bars every month in the United States. The year prior, sales only amounted to $100 million per quarter.

Consumers aren’t the only ones buying gold, either. Central banks around the world have been accumulating gold in very large quantities, likely as a hedge against inflation.

According to the World Gold Council, these institutions bought 1,136 metric tons in 2022, marking the highest level since 1950. Figures for 2023 came in at 1,037 metric tons.

See More Graphics on Gold

If you’re fascinated by gold, be sure to check out more Visual Capitalist content including 200 Years of Global Gold Production, by Country or Ranked: The Largest Gold Reserves by Country.

-

Travel1 week ago

Travel1 week agoAirline Incidents: How Do Boeing and Airbus Compare?

-

Markets3 weeks ago

Markets3 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America