Energy

What Uses the Most Energy in Your Home?

Warren Buffett describes his first rules of investing as: “Rule #1: Never lose money. Rule #2: Don’t forget rule #1”.

But losing money doesn’t just happen in a stock portfolio – it’s also a common occurrence in other facets of life. That’s why Warren Buffett leads such a frugal lifestyle. He knows that every extra dollar spent on something he doesn’t need is wasted capital.

In practically every house in America, capital is being wasted on energy consumption. That’s because the average electricity spend per year is $1,368.36 per year, and 35% of the power used is actually wasted.

This is neither good for your bank account or the environment.

What Uses the Most Energy in Your Home?

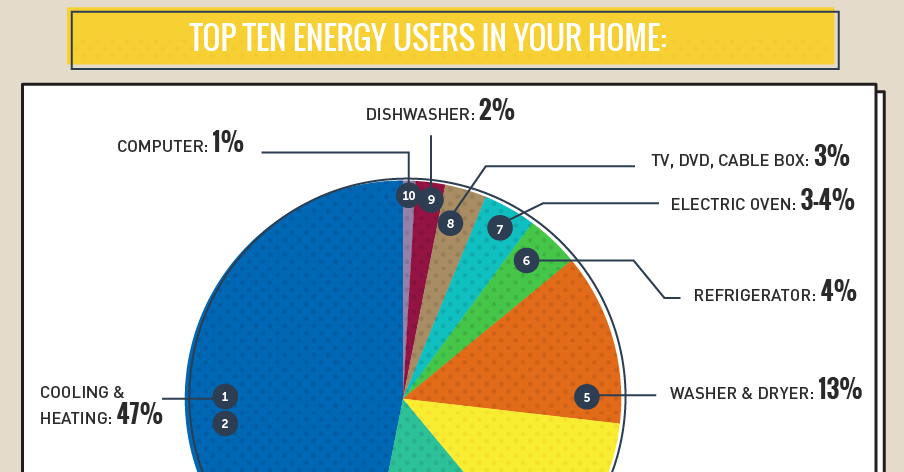

Today’s infographic from Connect4Climate shows the breakdown in the energy use of a typical home.

It highlights the average cost per year of different appliances, while also showing what uses the most energy over the course of the year.

Modern comfort comes at a price, and keeping all those air conditioners, refrigerators, chargers, and water heaters going makes household energy the third-largest use of energy in the United States.

Here’s what uses the most energy in your home:

- Cooling and heating: 47% of energy use

- Water heater: 14% of energy use

- Washer and dryer: 13% of energy use

- Lighting: 12% of energy use

- Refrigerator: 4% of energy use

- Electric oven: 3-4% of energy use

- TV, DVD, cable box: 3% of energy use

- Dishwasher: 2% of energy use

- Computer: 1% of energy use

One of the easiest ways to reduce wasted energy and money? Shut off “vampire electronics”, or devices that suck power even when they are turned off. These include digital cable or satellite DVRs, laptop computers, printers, DVD players, central heating furnaces, routers and modems, phones, gaming consoles, televisions, and microwaves.

Warren Buffett would probably agree that a penny saved is a penny earned – and being more efficient with your energy use is good for your pocketbook and the environment.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Travel1 week ago

Travel1 week agoAirline Incidents: How Do Boeing and Airbus Compare?

-

Markets2 weeks ago

Markets2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America