Markets

United Airlines: Visualizing the Numbers Behind the Crisis

The people in Pepsi’s marketing and PR departments must be relieved, because the internet’s viral outrage is finally being channeled in a different direction.

This time the fury is targeted towards United Airlines – a brand that is in full-blown crisis mode after a bloodied passenger was forcibly dragged off a plane, and millions of people witnessed videos of the incident being spread over social media.

Two days into the crisis, here are some charts that will help give context around what happened, as well as the potential effect on the United brand itself.

Damage Done?

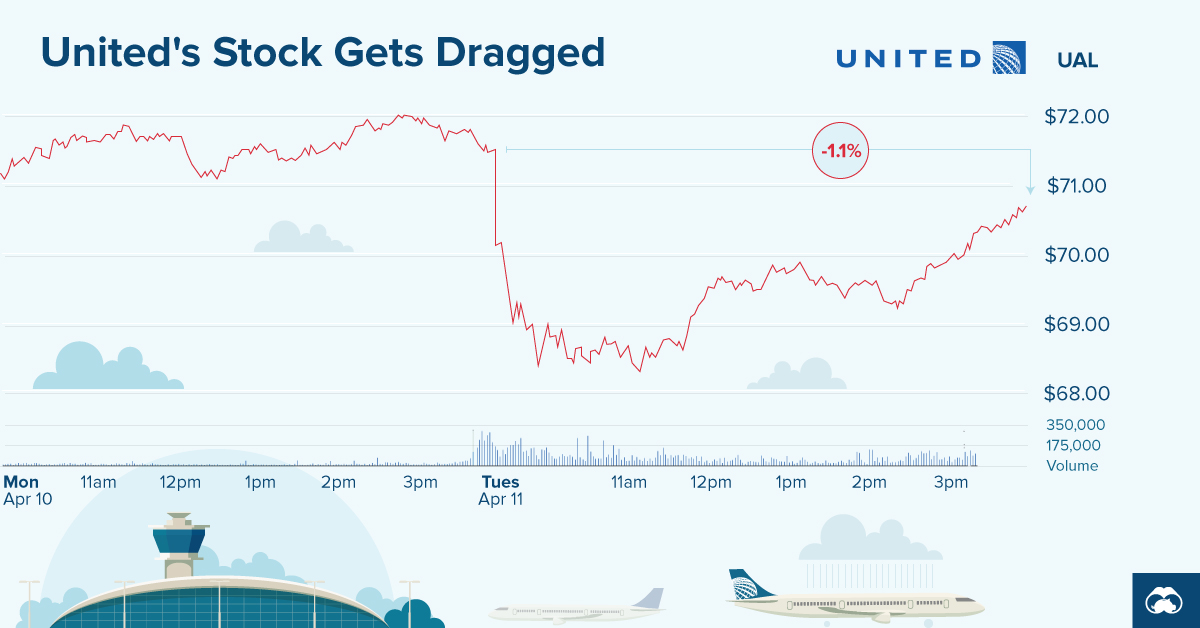

First, let’s take a look at what’s happened to United’s stock price since the incident:

While some public relations crises have minimal effects on the long-term financial performance of companies, this market reaction is an interesting gauge to consider.

The stock’s lowest point today was -4.3% below the open, which is equal to a nearly $1 billion loss in market capitalization. At that point, it was speculated that Warren Buffett’s Berkshire Hathaway, which owns 9% of all outstanding shares of United Continental Holdings Inc., could lose up to $87 million.

The market clearly saw the crisis as creating risk around United’s fundamental business, but the stock has mostly recovered since those intraday lows. That said, if there are reports of top line revenue being affected because of boycotts or other issues, then the incident’s impact on the stock price could easily re-surface.

Social Media Blowback

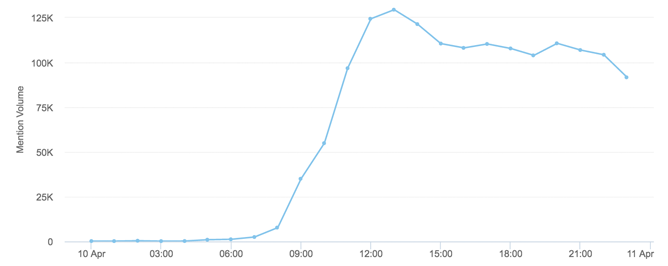

With today’s interconnected world, a public relations crisis can start with one tweet. Here’s the snowball effect in brand mentions of United that occurred on April 10th:

Courtesy of: Brandwatch

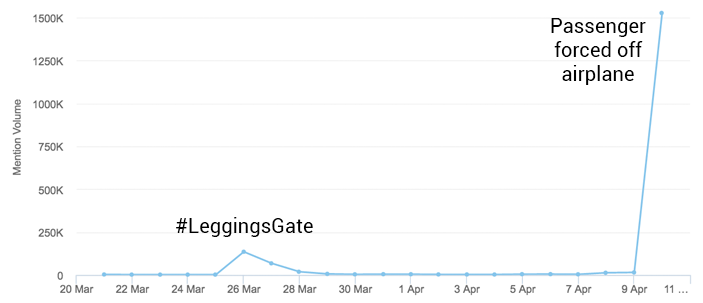

Here’s another look. This time, it’s a comparison of mentions over the last 21 days.

Courtesy of: Brandwatch

Yes, it’s only been about two weeks since United’s last PR crisis, called #LeggingsGate. As you can see, however, the most recent disaster is many times worse in terms of mentions.

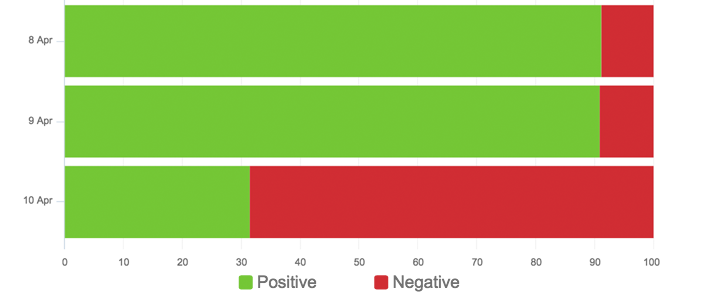

With millions of references to the United Airlines brand occurring on social media, here is the split between positive and negative sentiment as of April 10th::

Courtesy of: Brandwatch

Denied Boarding Rates

But how big of a problem is making passengers deboard a plane, in the first place?

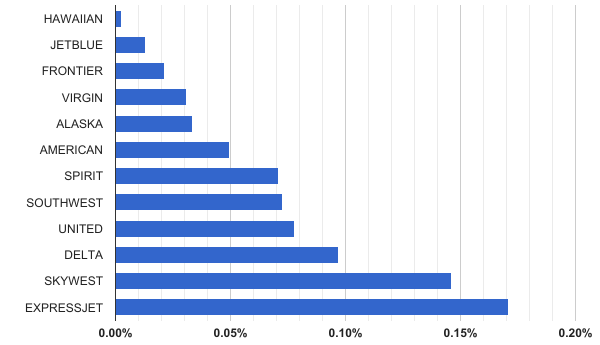

The next chart shows denied boarding rates, inclusive of voluntary and involuntary activity, from January to September 2016:

Data: U.S. Dept of Transportation

United and Delta are the two worst offenders here, with denied boarding rates that are worse than American, Virgin, Alaska, JetBlue, or Southwest.

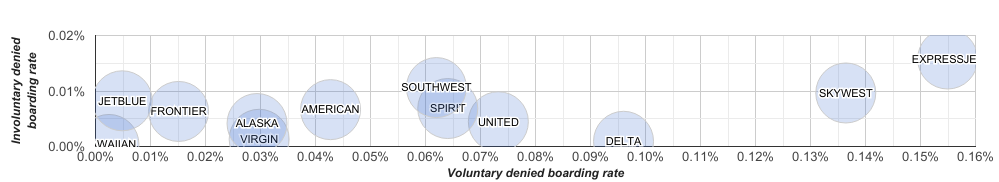

Lastly, here’s the same figures, except contrasting voluntary vs. involuntary denied boarding rates from January to September 2016:

Data: U.S. Dept of Transportation

Southwest and ExpressJet lead the way with the most involuntary denied boardings, and United Airlines is in the middle of the pack. However, in terms of voluntary denied boardings, United and Delta have much higher rates than other major airlines such as American or Virgin.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023