Energy

The Top 10 Reasons Investors Should Look at Cobalt

Every once in a while, a previously underappreciated metal rises to prominence.

Several factors can cause this to happen: new technology, changing consumer preferences, supply constraints, or skyrocketing demand can all bring an unknown metal to the forefront of discussion.

Cobalt could be the latest metal that fits this description. It’s a crucial metal to the boom in lithium-ion battery demand, but it also has an increasingly precarious supply chain that could be very volatile moving forward.

Why Investors Should Look at Cobalt

Today’s infographic comes from eCobalt Solutions, a company focused on providing ethically produced and environmentally sound battery grade cobalt salts.

It presents the investment case for the relatively unknown metal.

With the green movement in full swing, there is compelling evidence that cobalt could be the next relatively unknown metal to rise to prominence.

Here are the top 10 reasons that investors should look at cobalt:

1. Cobalt is one of the few metals used for superalloys.

Nearly 20% of all cobalt is used for superalloys – a class of high-tech metals that originally emerged to suit the high operating temperatures of jet engines.

There are three main superalloy types:

- Nickel-based: the bulk of alloys produced

- Cobalt-based: higher melting point gives ability to absorb stress, and corrosion resistance

- Iron-based: the original superalloy, invented prior to the 1940s

Their use has extended into many other fields – and today, superalloys are used in all types of turbines, space vehicles, rocket engines, nuclear reactors, power plants, and chemical equipment.

2. The green economy runs on cobalt.

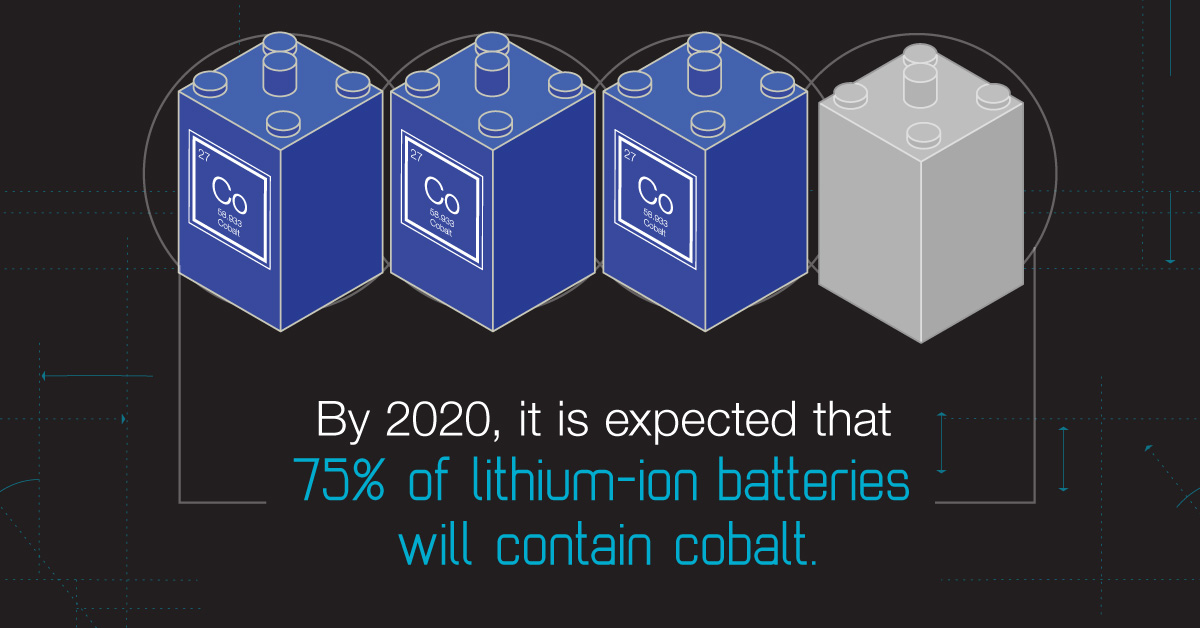

There are many types of lithium-ion batteries, but the vast majority of li-ions sold today use cobalt in some capacity.

In fact, by 2020 it is expected that 75% of lithium-ion batteries will contain cobalt. Why? It’s because cobalt is the most important metal for increasing the energy density of lithium-ion cathodes.

3. …And green uses such as EVs are driving the upwards trajectory of cobalt demand.

By 2020, almost 1/5 of cobalt demand will stem from electric vehicles.

Total refined cobalt demand:

| Year | Demand | % xEV batteries | % Electronics batteries |

|---|---|---|---|

| 2010 | 64,000 | <1% | 30% |

| 2015 | 95,000 | 6% | 36% |

| 2020e | 124,000 | 17% | 31% |

Source: CRU

“Cobalt’s demand growth profile remains one of the best among industrial metals peers. Its exposure to rechargeable batteries continues to play a crucial role.” – Macquarie

4. Getting cobalt is the hard part.

98% of cobalt is produced as a by-product of copper and nickel mines. The problem? If copper and nickel production isn’t growing, then more cobalt isn’t mined to meet demand.

5. Why not find more cobalt?

It’s easier said than done. The vast majority of the world’s cobalt lies in risky regions like the DRC.

| Country | % Cobalt Supply in 2014 |

|---|---|

| DRC | 58% |

| Russia | 6% |

| Cuba | 5% |

| Australia | 5% |

| Philippines | 4% |

| Madagascar | 4% |

| Other | 19% |

Source: CRU

6. And so supply can tighten…

Chemical cobalt – the kind used in batteries, is expected to fall into a growing deficit over the next few years. By 2020, CRU expects that deficit to be at least 12,000 tonnes.

7. Meanwhile, the U.S. government definitely doesn’t have any strategic stockpiles.

According to the U.S Defense Logistics Agency, the government sold off cobalt all the way up until 2008. Now there is only 301 tonnes left in strategic stockpiles.

8. Cobalt was one of the best-performing metals in 2016.

| Metal | 2016 performance |

|---|---|

| Zinc | 66% |

| Cobalt | 47% |

| Nickel | 17% |

| Aluminum | 17% |

| Copper | 17% |

| Silver | 16% |

| Gold | 9% |

| Platinum | 1% |

| Uranium | -42% |

9. Cobalt prices have been rising, but they are nowhere near all-time highs yet.

All-time highs for cobalt prices happened in 2008, after the DRC government placed restrictions on export of ores and concentrates. For a brief stint, cobalt prices even exceeded $50/lb.

The current price? Roughly $16/lb.

10. Many experts predict the cobalt market to be interesting to watch in 2017:

“Just how much cobalt is in stockpiles in China is the Million Dollar Question. Clarity here can materially affect the cobalt price.” Chris Berry, House Mountain Partners, LLC

“The refined cobalt market will fall into a 3,000 tonne deficit this year following seven years of overcapacity and oversupply. CRU anticipates prices to increase onward into 2017…” – Edward Spencer, CRU Group

“With this growth will come further disruption to the traditional market structures that have developed in cobalt over the last 30 years. In short, a new, more secure supply chain for the modern era will need to be created, a task that includes new mines, new refineries, and a more transparent supply chain.” – Andrew Miller, Benchmark Minerals

Energy

Charted: 4 Reasons Why Lithium Could Be the Next Gold Rush

Visual Capitalist has partnered with EnergyX to show why drops in prices and growing demand may make now the right time to invest in lithium.

4 Reasons Why You Should Invest in Lithium

Lithium’s importance in powering EVs makes it a linchpin of the clean energy transition and one of the world’s most precious minerals.

In this graphic, Visual Capitalist partnered with EnergyX to explore why now may be the time to invest in lithium.

1. Lithium Prices Have Dropped

One of the most critical aspects of evaluating an investment is ensuring that the asset’s value is higher than its price would indicate. Lithium is integral to powering EVs, and, prices have fallen fast over the last year:

| Date | LiOH·H₂O* | Li₂CO₃** |

|---|---|---|

| Feb 2023 | $76 | $71 |

| March 2023 | $71 | $61 |

| Apr 2023 | $43 | $33 |

| May 2023 | $43 | $33 |

| June 2023 | $47 | $45 |

| July 2023 | $44 | $40 |

| Aug 2023 | $35 | $35 |

| Sept 2023 | $28 | $27 |

| Oct 2023 | $24 | $23 |

| Nov 2023 | $21 | $21 |

| Dec 2023 | $17 | $16 |

| Jan 2024 | $14 | $15 |

| Feb 2024 | $13 | $14 |

Note: Monthly spot prices were taken as close to the 14th of each month as possible.

*Lithium hydroxide monohydrate MB-LI-0033

**Lithium carbonate MB-LI-0029

2. Lithium-Ion Battery Prices Are Also Falling

The drop in lithium prices is just one reason to invest in the metal. Increasing economies of scale, coupled with low commodity prices, have caused the cost of lithium-ion batteries to drop significantly as well.

In fact, BNEF reports that between 2013 and 2023, the price of a Li-ion battery dropped by 82%.

| Year | Price per KWh |

|---|---|

| 2023 | $139 |

| 2022 | $161 |

| 2021 | $150 |

| 2020 | $160 |

| 2019 | $183 |

| 2018 | $211 |

| 2017 | $258 |

| 2016 | $345 |

| 2015 | $448 |

| 2014 | $692 |

| 2013 | $780 |

3. EV Adoption is Sustainable

One of the best reasons to invest in lithium is that EVs, one of the main drivers behind the demand for lithium, have reached a price point similar to that of traditional vehicle.

According to the Kelly Blue Book, Tesla’s average transaction price dropped by 25% between 2022 and 2023, bringing it in line with many other major manufacturers and showing that EVs are a realistic transport option from a consumer price perspective.

| Manufacturer | September 2022 | September 2023 |

|---|---|---|

| BMW | $69,000 | $72,000 |

| Ford | $54,000 | $56,000 |

| Volkswagon | $54,000 | $56,000 |

| General Motors | $52,000 | $53,000 |

| Tesla | $68,000 | $51,000 |

4. Electricity Demand in Transport is Growing

As EVs become an accessible transport option, there’s an investment opportunity in lithium. But possibly the best reason to invest in lithium is that the IEA reports global demand for the electricity in transport could grow dramatically by 2030:

| Transport Type | 2022 | 2025 | 2030 |

|---|---|---|---|

| Buses 🚌 | 23,000 GWh | 50,000 GWh | 130,000 GWh |

| Cars 🚙 | 65,000 GWh | 200,000 GWh | 570,000 GWh |

| Trucks 🛻 | 4,000 GWh | 15,000 GWh | 94,000 GWh |

| Vans 🚐 | 6,000 GWh | 16,000 GWh | 72,000 GWh |

The Lithium Investment Opportunity

Lithium presents a potentially classic investment opportunity. Lithium and battery prices have dropped significantly, and recently, EVs have reached a price point similar to other vehicles. By 2030, the demand for clean energy, especially in transport, will grow dramatically.

With prices dropping and demand skyrocketing, now is the time to invest in lithium.

EnergyX is poised to exploit lithium demand with cutting-edge lithium extraction technology capable of extracting 300% more lithium than current processes.

-

Lithium2 days ago

Lithium2 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Energy7 days ago

Energy7 days agoThe World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

-

Energy4 weeks ago

Energy4 weeks agoThe World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

-

Energy1 month ago

Energy1 month agoHow Much Does the U.S. Depend on Russian Uranium?

Currently, Russia is the largest foreign supplier of nuclear power fuel to the U.S.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy2 months ago

Energy2 months agoVisualizing the Rise of the U.S. as Top Crude Oil Producer

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue