Technology

There’s Big Money to Be Made in Asteroid Mining

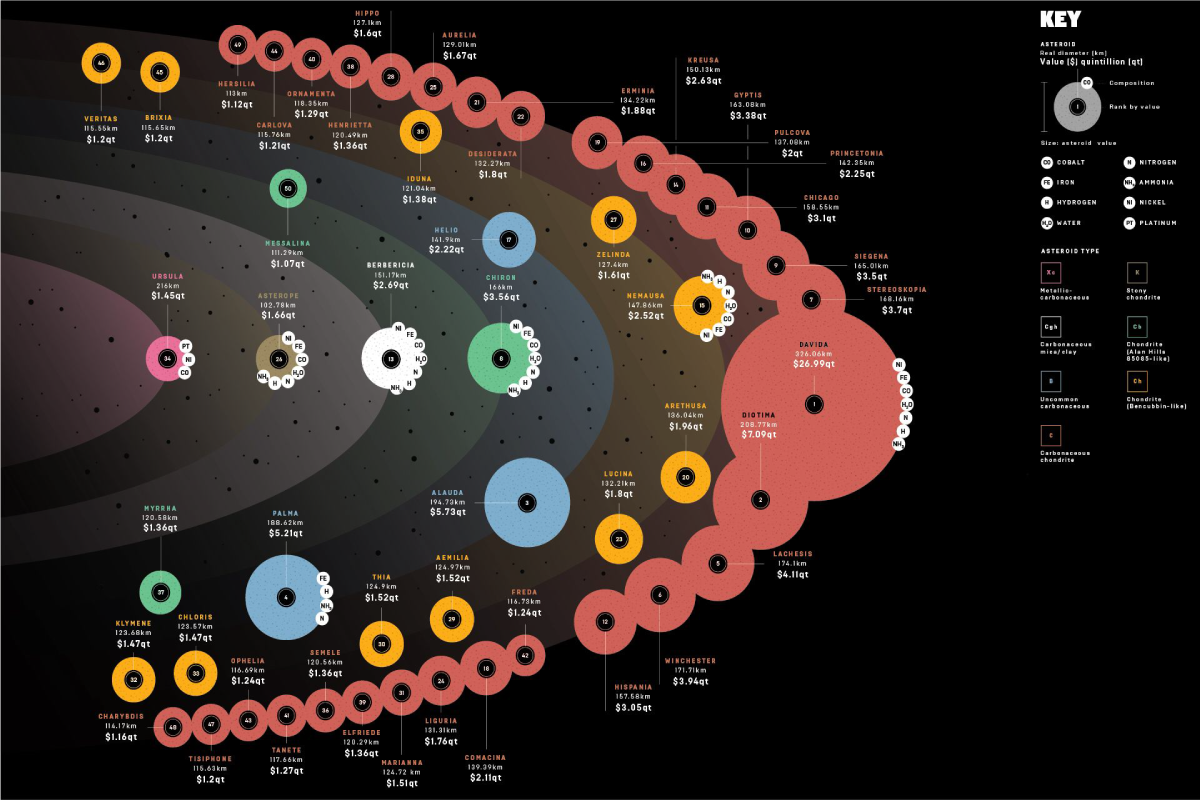

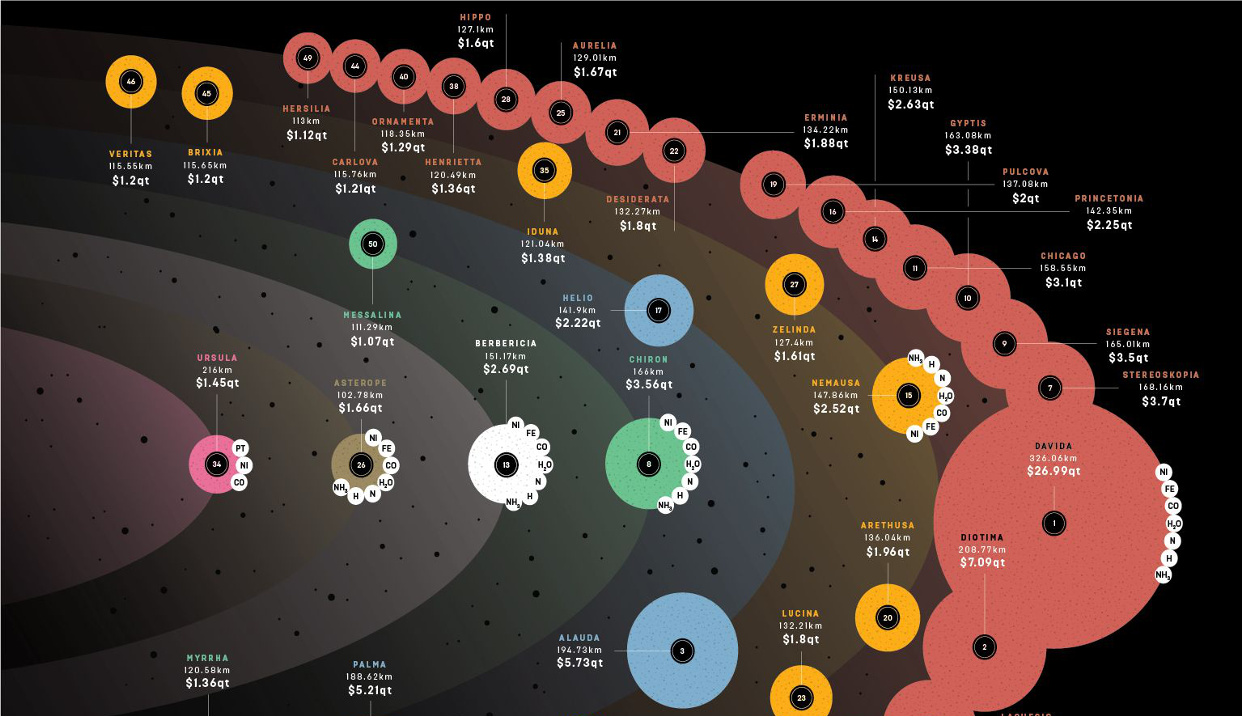

Click below to expand to the full version of the infographic

Image courtesy of: Wired

There’s Big Money to Be Made in Asteroid Mining

See the full version of the infographic.

If humans were ever able to get their hands on just one asteroid, it would be a game-changer.

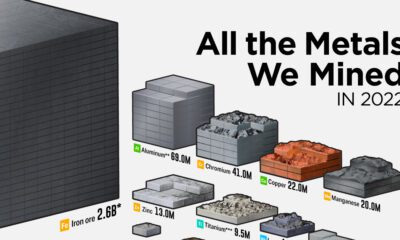

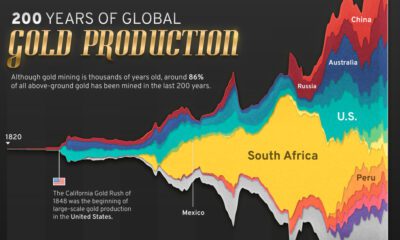

That’s because the value of many asteroids are measured in the quintillions of dollars, which makes the market for Earth’s annual production of raw metals – about $660 billion per year – look paltry in comparison.

The reality is that the Earth’s crust is saddled with uneconomic materials, while certain types of asteroids are almost pure metal. X-type asteroids, for example, are thought to be the remnants of large asteroids that were pulverized in collisions in which their dense, metallic cores got separated from the mantle.

There is one such X-type asteroid near earth that is believed to hold more platinum than ever mined in human history.

Near-Earth Mining Targets

Asteroid mining companies such as Planetary Resources and Deep Space Industries are the first-movers in the sector, and they’ve already started to identify prospective targets to boldly mine where no man has mined before.

Both companies are looking specifically at near-Earth asteroids in the near-term, which are the easiest ones to get to. So far, roughly 15,000 such objects have been discovered, and their orbits all come in close proximity to Earth.

Planetary Resources has identified eight of these as potential targets and has listed them publicly, while Deep Space Industries has claimed to have “half a dozen very, very attractive targets”.

While these will be important for verifying the feasibility of asteroid mining, the reality is that near-Earth asteroids are just tiny minnows in an ocean of big fish. Their main advantage is that they are relatively easy to access, but most targets identified so far are less than 1,000 ft (300 m) in diameter – meaning the potential economic payoff of a mission is still unclear.

Where the Money is Made

The exciting part of asteroid mining is the asteroid belt itself, which lies between Mars and Jupiter. It is there that over 1 million asteroids exist, including about 200 that are over 60 miles (100 km) in diameter.

NASA estimates this belt to hold $700 quintillion of bounty. That’s about $100 billion for each person on Earth.

There are obviously many technical challenges that must be overcome to make mining these possible. As it stands, NASA aims to bring back a grab sample from the surface of asteroid Bennu that is 2 and 70 ounces (about 60 to 2,000 grams) in size. The cost of the mission? Approximately $1 billion.

To do anything like that on a large scale will require robots, spacecraft, and other technologies that simply do not exist yet. Further, missions like this could cost trillions of dollars – a huge risk and burden in the case that a mission is unsuccessful.

Until then, the near-Earth asteroids are the fertile testing ground for aspirational asteroid miners – and we look forward to seeing what is possible in the future.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Markets1 week ago

Markets1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Automotive1 week ago

Automotive1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001