Mining

The Story of Voisey’s Bay: The Discovery (1 of 3)

The Story of Voisey’s Bay: The Discovery (Part 1 of 3)

Presented by: Equitas Resources, “Nickel exploration in Labrador”

Preface

The legendary story of one of Canada’s most significant base metal discoveries happened just before the dawn of the internet era. While some investors recall the sequence of events and the value that was created by Diamond Fields, there are many investors today, both new and old, who are not familiar with the story of Voisey’s Bay.

For this infographic, we have turned to Jacquie McNish’s fabulous book The Big Score, which documents the history of the discovery, biographical elements of Robert Friedland’s life, and the ensuing bidding war between Inco and Falconbridge that led to one of the most spectacular takeovers in mining history. If you like these infographics, then look into buying Jacquie’s book. It was gripping and full of information.

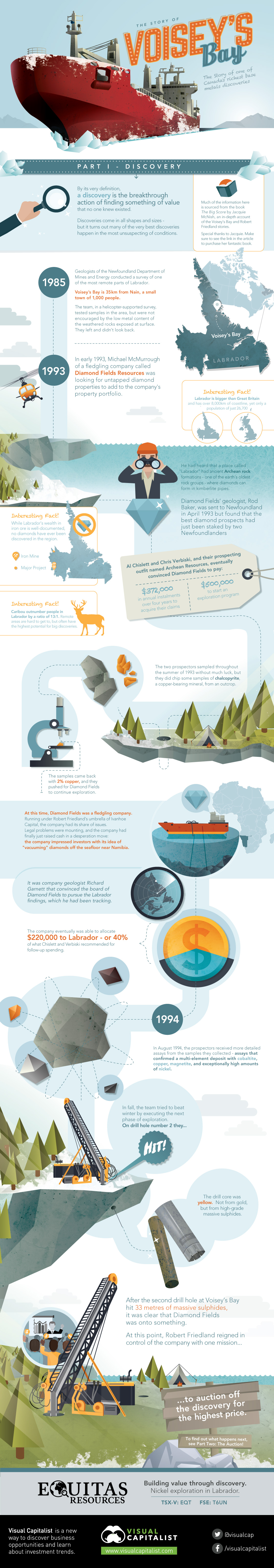

The Origins

By its very definition, a discovery is the breakthrough action of finding something of value that no one knew existed. Discoveries come in all shapes and sizes – but it turns out many of the very best discoveries happen in the most unsuspecting of conditions.

Labrador is located on the Northeast tip of Quebec in Canada, and it’s in this remote area that the Voisey’s Bay discovery takes place. Labrador is bigger than Great Britain and has over 8,000km of coastline, yet only a population of just 26,700. For context, caribou outnumber people in Labrador by a ratio of 13:1.

In 1985, geologists of the Newfoundland Department of Mines and Energy conducted a survey of one of the most remote parts of Labrador. Voisey’s Bay is 35km from Nain, a small town of 1,000 people.

The team, in a helicopter-supported survey, tested samples in the area, but were not encouraged by the low metal content of the weathered rocks exposed at surface. They left and didn’t look back.

In early 1993, Michael McMurrough of a fledgling company called Diamond Fields Resources was looking for untapped diamond properties to add to the company’s property portfolio. He had heard that a place called “Labrador” had ancient Archean rock formations – one of the earth’s oldest rock groups – where diamonds can form in kimberlite pipes. While Labrador’s wealth in iron ore is well-documented, no diamonds have ever been discovered in the region.

Diamond Fields’ geologist, Rod Baker, was sent to Newfoundland in April 1993 but found that the best diamond prospects had just been staked by two Newfoundlanders. Al Chislett and Chris Verbiski, and their prospecting outfit named Archean Resources, eventually convinced Diamond Fields to pay $372,000 in annual instalments over four years to acquire their claims. Diamond Fields also agreed to pay $500,000 to start an exploration program.

The two prospectors sampled throughout the summer of 1993 without much luck, but they did chip some samples of chalcopyrite, a copper-bearing mineral, from an outcrop. The samples came back with 2% copper, and they pushed for Diamond Fields to put more money into the exploration program.

Diamond Fields

At this time, Diamond Fields was a fledgling company. Running under Robert Friedland’s umbrella of Ivanhoe Capital, the company had its share of issues. Legal problems were mounting, and the company had finally just raised cash in a desperation move: the company impressed investors with its idea of “vacuuming” diamonds off the seafloor near Namibia.

It was company geologist Richard Garnett that convinced the board of Diamond Fields to pursue the Labrador findings, which he had been tracking. The company eventually was able to allocate $220,000 to Labrador – or 40% of what Chislett and Verbiski recommended for follow-up spending.

The Discovery

In August 1994, the prospectors received more detailed assays from the samples they collected – assays that confirmed a multi-element deposit with cobaltite, copper, magnetite, and exceptionally high amounts of nickel. In fall, the team tried to beat winter by executing the next phase of exploration.

On drill hole number two: they hit. The drill core was yellow – not from gold, but from high-grade massive sulphides. The hole was 33 metres long, and signified that Diamond Fields was finally onto something.

At this point, Robert Friedland reigned in control of the company with one mission: to auction off the discovery for the highest price.

Copper

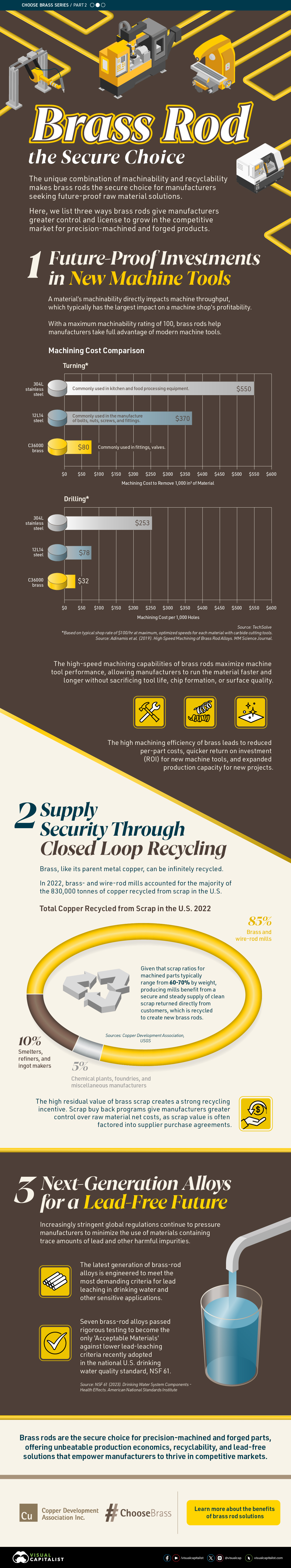

Brass Rods: The Secure Choice

This graphic shows why brass rods are the secure choice for precision-machined and forged parts.

Brass Rods: The Secure Choice

The unique combination of machinability and recyclability makes brass rods the secure choice for manufacturers seeking future-proof raw material solutions.

This infographic, from the Copper Development Association, shows three ways brass rods give manufacturers greater control and a license to grow in the competitive market for precision-machined and forged products.

Future-Proof Investments in New Machine Tools

A material’s machinability directly impacts machine throughput, which typically has the largest impact on machine shop profitability.

The high-speed machining capabilities of brass rods maximize machine tool performance, allowing manufacturers to run the material faster and longer without sacrificing tool life, chip formation, or surface quality.

The high machining efficiency of brass leads to reduced per-part costs, quicker return on investment (ROI) for new machine tools, and expanded production capacity for new projects.

Supply Security Through Closed Loop Recycling

Brass, like its parent element copper, can be infinitely recycled.

In 2022, brass- and wire-rod mills accounted for the majority of the 830,000 tonnes of copper recycled from scrap in the United States.

Given that scrap ratios for machined parts typically range from 60-70% by weight, producing mills benefit from a secure and steady supply of clean scrap returned directly from customers, which is recycled to create new brass rods.

The high residual value of brass scrap creates a strong recycling incentive. Scrap buy back programs give manufacturers greater control over raw material net costs as scrap value is often factored into supplier purchase agreements.

Next Generation Alloys for a Lead-Free Future

Increasingly stringent global regulations continue to pressure manufacturers to minimize the use of materials containing trace amounts of lead and other harmful impurities.

The latest generation of brass-rod alloys is engineered to meet the most demanding criteria for lead leaching in drinking water and other sensitive applications.

Seven brass-rod alloys passed rigorous testing to become the only ‘Acceptable Materials’ against lower lead leaching criteria recently adopted in the national U.S. drinking water quality standard, NSF 61.

Learn more about the advantages of brass rods solutions.

-

Base Metals1 year ago

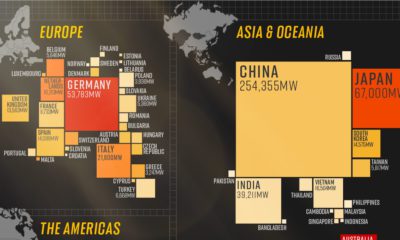

Base Metals1 year agoRanked: The World’s Largest Copper Producers

Many new technologies critical to the energy transition rely on copper. Here are the world’s largest copper producers.

-

Silver2 years ago

Silver2 years agoMapped: Solar Power by Country in 2021

In 2020, solar power saw its largest-ever annual capacity expansion at 127 gigawatts. Here’s a snapshot of solar power capacity by country.

-

Batteries5 years ago

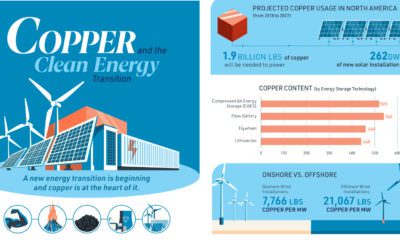

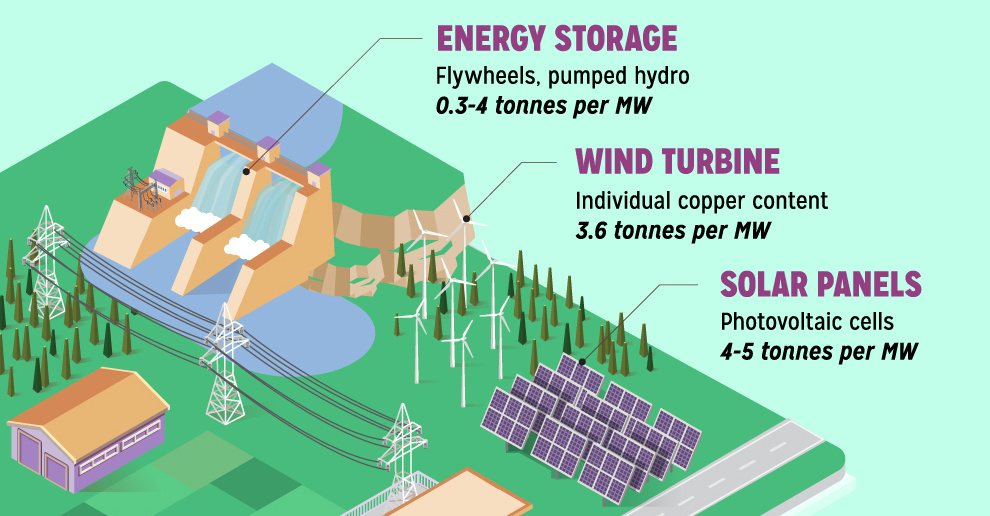

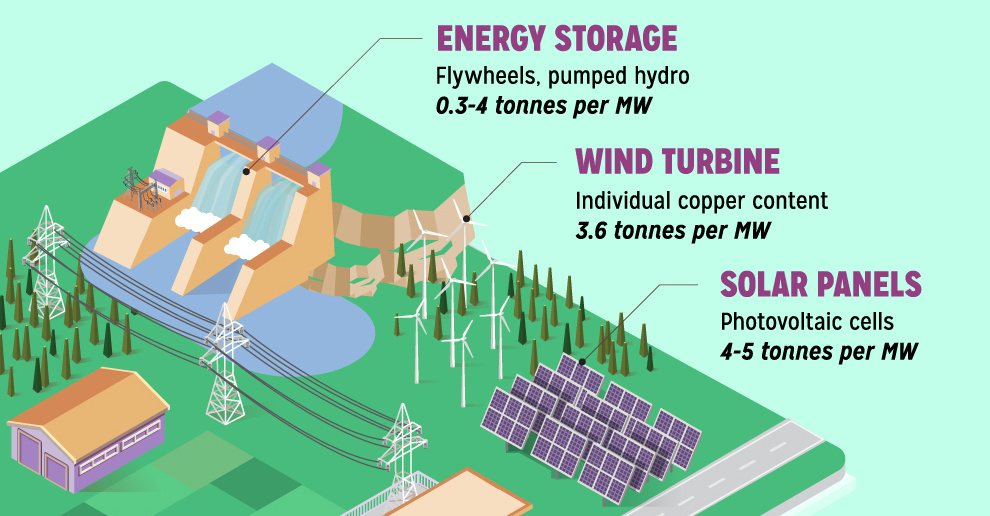

Batteries5 years agoVisualizing Copper’s Role in the Transition to Clean Energy

A clean energy transition is underway as wind, solar, and batteries take center stage. Here’s how copper plays the critical role in these technologies.

-

Science5 years ago

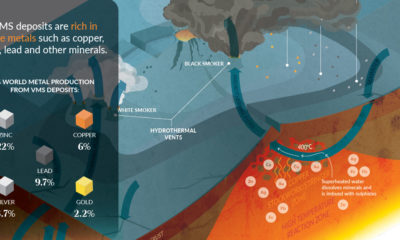

Science5 years agoEverything You Need to Know on VMS Deposits

Deep below the ocean’s waves, VMS deposits spew out massive amounts of minerals like copper, zinc, and gold, making them a key source of the metals…

-

Copper5 years ago

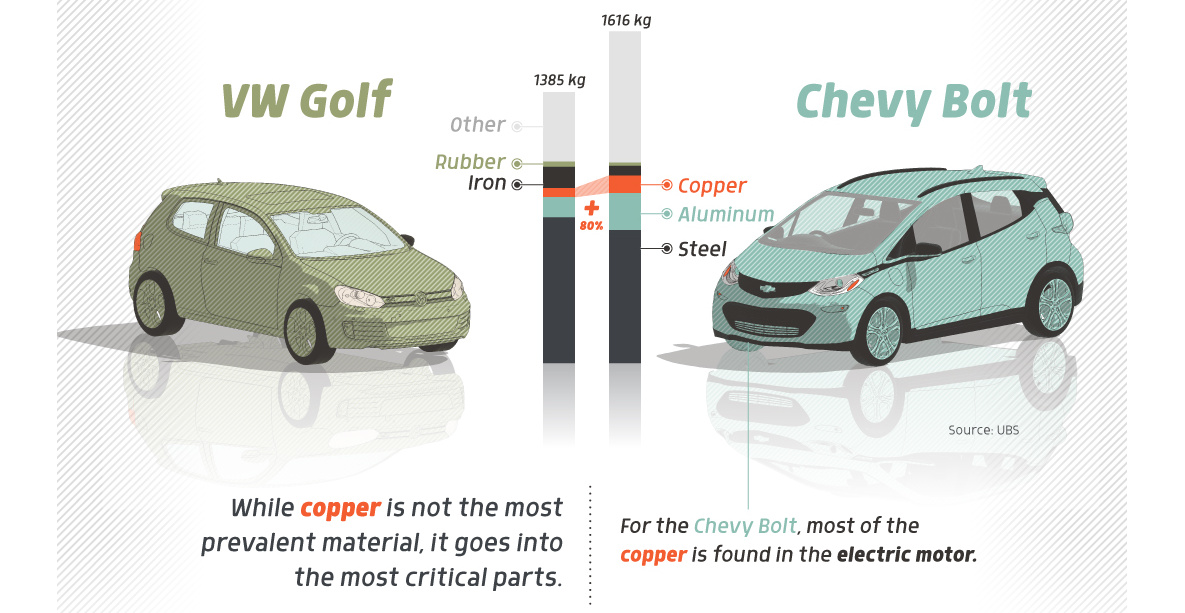

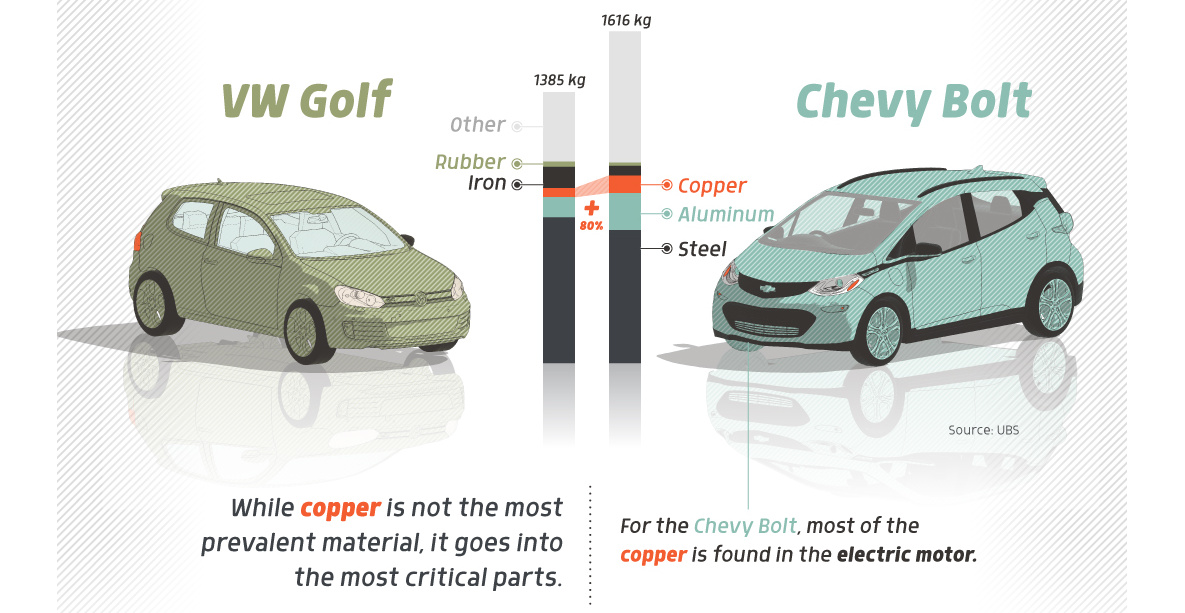

Copper5 years agoHow Much Copper is in an Electric Vehicle?

Have you ever wondered how much copper is in an electric vehicle? This infographic shows the metal’s properties as well as the quantity of copper used.

-

Copper6 years ago

Copper6 years agoCopper: Driving the Green Energy Revolution

Renewable energy is set to fuel a new era of copper demand – here’s how much copper is used in green applications from EVs to photovoltaics.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?