Mining

The Silver Series: Making The Case For Silver (Part 4 of 4)

2015 Silver Series Part 4: Making The Case For Silver

In the previous parts of The Silver Series, we’ve shown that silver has a rich and multi-faceted history with applications in money, health, and technology. We’ve covered the metal’s supply and geological origins, as well as the growing demand stemming from industry, investment, and other areas.

However, the real question for investors boils down to this: is it worth it to hold silver bullion or equities in a portfolio?

Silver and Gold

The two major precious metals are alike in many ways. They’ve both been used as money for thousands of years, and both are considered a store of wealth today. However, to understand the nuances of silver as an asset, it is important to keep in mind a couple of key differences that it holds from the yellow metal.

The most obvious difference is that silver is used much more widespread in industry than gold. Approximately 50% of all demand stems from technological applications like photovoltaics, automobiles, batteries, and other such uses. This gives silver a potentially wider range of demand triggers.

The other major difference is that in comparison to the gold market, silver trades thinly and with much higher volatility. In 2014, there was $20.4 billion of demand for physical silver and $159.7 billion demand for physical gold. Even more interesting, these physical markets are less than 1% the size of the total markets when factoring paper trades like derivatives, futures contracts, and options.

Silver typically hits higher highs and lower lows than gold. To the savvy investor, this creates great opportunity.

Why Own Silver?

The reasons an investor should consider exposure to silver can be summed up with three key points.

1. Diversification.

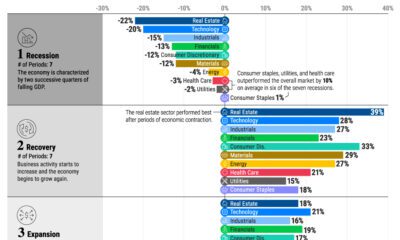

Silver has little or no correlation with most asset classes such as bonds, stocks, or real estate. This is because silver prices move based on supply and demand, but also because of other factors such as the global economic environment, futures market speculators, currency markets, the level of inflation or deflation, and central bank policy decisions. Even though silver itself is more volatile than many other asset classes, it does help reduce the overall risk of a portfolio by having less correlation to other asset classes. Over the last eight years, silver’s correlation to treasuries and bonds have been basically zero (-0.07 and 0.08 respectively). It has slightly higher correlation with US equities (0.23) and real estate (0.13).

2. Safe Haven

When the times get tough, silver is your friend. Even in the most challenging environments it holds its value or bucks the negative global trends.

How did silver do in the four years surrounding the Financial Crisis? Over a period where US equities, emerging markets, and REITs were down, silver more than doubled in value from 2007-2011.

3. Fundamentals and Value

The fundamental numbers around silver make it quite clear that silver could provide extreme value as an investment. Here are some key numbers:

- In the earth’s crust, there is 1 gram of silver for every 12.5 tonnes of rock.

- For centuries since ancient times, the gold-to-silver ratio was 15 to 1. That means 1 oz of gold could buy 15 oz of silver.

- In the earth’s crust, there is 19x more silver than gold by mass.

- The “modern” gold-to-silver ratio is closer to 50 to 1.

- Yet, in mid-2015 the ratio is 75 to 1, which means silver could be very undervalued relative to gold.

- The silver price, in terms of USD, is also at its lowest point in five years.

- Silver miners are even cheaper, trading at their lowest valuation in years.

Silver, the metal itself, continues to have the same impressive properties, supply and demand fundamentals, and a rich history as money. What has changed is what people are willing to pay for it at a given time.

Right now it seems that silver is being sold for half price.

That’s the end of our Silver Series. Thanks for reading!

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue