Misc

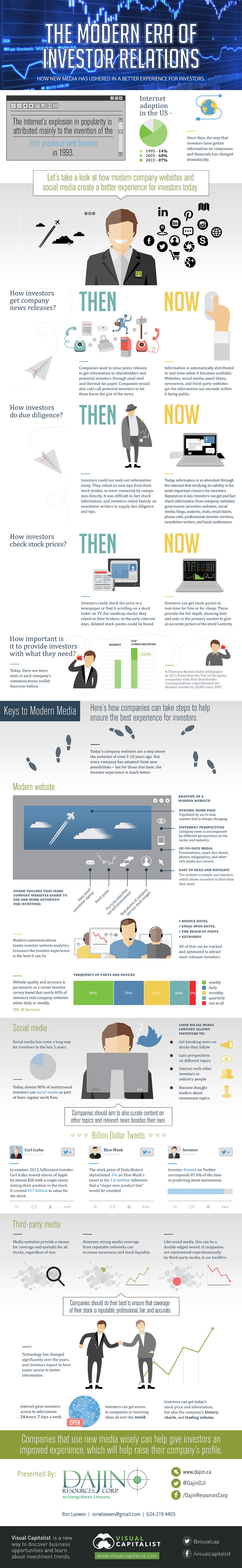

The Modern Era of Investor Relations

The Modern Era of Investor Relations

How New Media has Ushered In a Better Experience For Investors

“Modern Era of Investor Relations” infographic presented by: Dajin Resources

The internet’s explosion in popularity is attributed mainly to the invention of the first graphical web browser in 1993. Since then, the way investors have gotten information on companies and financials has changed dramatically.

Let’s take a look at how modern company websites and social media create a better experience for investors today.

How Investors Get Company News Releases

Then: Companies used to issue press releases to get information to shareholders and potential investors through snail mail and thermal fax paper. Companies would also cold call potential investors to let them know the gist of the news.

Now: Information is automatically distributed in real-time when it becomes available. Websites, social media, email blasts, newswires, and third-party websites get the information out seconds within it being public.

How Investors Do Due Diligence

Then: Investors could not seek out information easily. They relied on new tips from their stock broker, or were contacted by companies directly. It was difficult to fact check information, and investors relied heavily on newsletter writers to supply due diligence and tips.

Now: Today, information is so abundant through the internet that verifying its validity is the most important concern for investors. Reputation is key. Investors can get and fact check information from company websites, government securities websites, social media, blogs, analysts, chats, email blasts, phone calls, professional investor services, newsletter writers, and local conferences.

How Investors Check Stock Prices

Then: Investors could check the price in a newspaper or find it scrolling on a stock ticker on TV. For smallcap stocks, they relied on their brokers. In the early internet days, delayed stock quotes could be found.

Now: Investors can get stock quotes in real-time for free or for cheap. These provide the full depth, showing bids and asks in the primary market to give an accurate picture of the stock’s activity.

How Important is it to Provide Investors With What They Need?

Today there are more tools in each company’s communications toolkit than ever before. A Thomson Reuters Extel whitepaper in 2012 found that the Top 10 European companies with Best Shareholder Communications outperformed the market by 28.8% since 2007.

Keys to Modern Media

Here’s how companies can take steps to help ensure the best experience for investors.

Modern website

Today’s company websites are a step above the websites of even 5-10 years ago. Not every company has adopted these new possibilities – but for those that have, the investor experience is much better.

Anatomy of a modern website:

- Dynamic homepage: Populated by up-to-date content that is always changing

- Different perspectives: Company news is accompanied by different perspectives on the sector and industry

- Up-to-date media: Presentations, maps, fact sheets, photos, infographics, and other rich media are current

- Easy to read and navigate: The website is simple and intuitive, which allows investors to find what they need.

Other considerations to make a website top-notch include: having accessible stock quote on the company, easy email newsletter signup option, objective feel that is not too self-promotional, and real photos of company instead of stock images.

Website quality and accuracy is paramount, as a recent investor survey by SNL IR Services found that 60% of investors visit company websites either daily or weekly. This is why the teams behind modern websites monitor analytics very closely, such as bounce rates, open rates, the reach of posts, and keywords. It’s important to make the website as useful as possible, otherwise it can be detrimental to the company’s success.

Social Media

Social media has come a long way in the last five years. Today, almost 80% of institutional investors use social media as a regular part of their workflow.

Good social media content allows investors to:

- Get breaking news on stocks they follow

- Gain perspectives on different topics

- Interact with other investors or industry people

- Become thought leaders on topics

To help investors accomplish these goals, its important for companies to curate their content to cover other topics and perspectives outside of their company and sector.

Third-Party Media

Media websites provide a means for coverage and eyeballs for all stocks, regardless of size.

Strong media from reputable networks can increase awareness of a stock and liquidity. However, like social media, such coverage can be a double-edged sword. If companies are represented unprofessionally by third-party media, it can backfire.

Therefore, it is important companies do their best to ensure that coverage of their stock is reputable, professional, fair, and accurate.

VC+

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our upcoming VC+ Special Dispatch will be available exclusively to VC+ members on Thursday, April 25th.

If you’re not already subscribed to VC+, make sure you sign up now to receive the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members can expect to receive.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members will receive the full Special Dispatch on Thursday, April 25th.

Make sure you join VC+ now to receive exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries