Mining

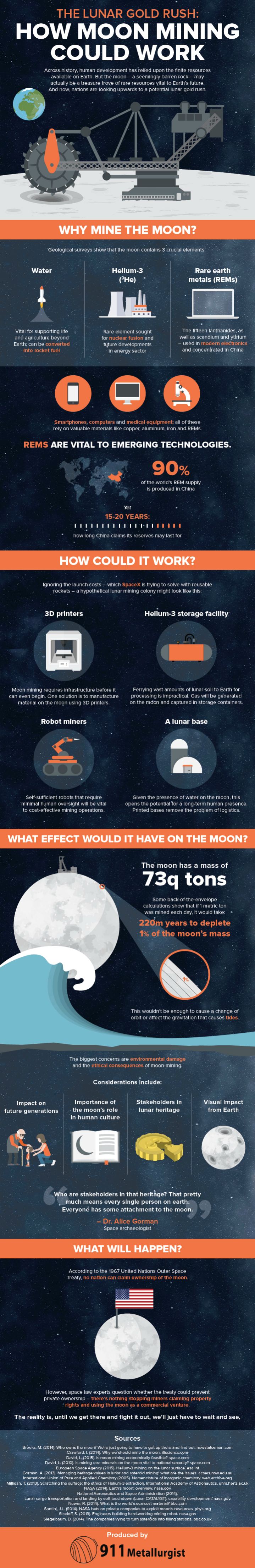

The Lunar Gold Rush: How Moon Mining Could Work

The Lunar Gold Rush: How Moon Mining Could Work

Humans are already going to extremes to get natural resources. Gold and platinum mines in South Africa go as deep as almost 4 km into the Earth’s crust, which is about twice the depth of the Grand Canyon.

Meanwhile, up high in the Andes are some of the biggest copper and gold operations in the world. In Peru, La Rinconada is the world’s highest permanent settlement at 5,100 m, and it is situated strategically between many artisanal gold deposits in the mountains.

However, there are two frontiers that humans are still exploring in their early stages: the deep sea and spacial bodies such as asteroids, planets, and the moon. Today’s infographic covers the prospect of moon mining.

While we often think of the moon as a pretty barren landscape, it turns out moon mining could take advantage of many natural resources present on the lunar surface.

Water is vital in space for a multitude of reasons, such as for use in human consumption, agriculture, or hydrogen fuel. It’s also cost prohibitive to transport water to space anytime we may need it from earth. Scientists are now confident that the moon has a variety of water sources, including water locked up in minerals, scattered through the broken-up surface, and potentially in blocks or sheets at depth.

Helium-3 is a rare isotope of helium. Currently the United States produces only 8kg of it per year for various purposes. Helium-3 is a sought-after resource for fusion energy and energy research.

Lastly, rare earth elements (REEs) are also at high concentrations on the moon. KREEP (Potassium, REEs, and Phosphorus) is a geochemical mixture of some lunar impact breccia rocks and is expected to be extremely common on the moon. This mix also has other important substances embedded, such as uranium, thorium, fluorine, and chlorine.

If a lunar colony is indeed in our future, moon mining operations may be an important component of it.

Original graphic from: 911 Metallurgist

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries