Money

Swiss Bank Accounts: A Look Into Elite Banking

Swiss Bank Accounts: A Look Into Elite Banking

Swiss bank accounts have long been a place for the wealthy to store their cash in order to evade hefty taxes. As of late, however, the American government has been cracking down on tax evaders and those that aid them.

American tax authorities created an amnesty program for Swiss banks that were willing to cooperate in bringing American tax evaders to justice, in exchange for less severe fines. In total, 106 banks signed up for the program. This all stems from a criminal investigation of twelve Swiss banks, headed by US tax authorities.

In order to be in the good graces of Uncle Sam, some of these banks have even threatened to freeze the accounts of their American clientele, unless they can prove that they are fully tax-compliant. Other Swiss banks have taken a softer approach. If a client has or had an undeclared account and has avoided getting caught, the bank will aid them in paying fines if they confess to the American government. It sounds good, but the amount they are offering is only $5,000. It is likely that Uncle Sam will want a lot more than just a few thousand dollars.

Original infographic from: TimothySykes.com

Money

Charted: Who Has Savings in This Economy?

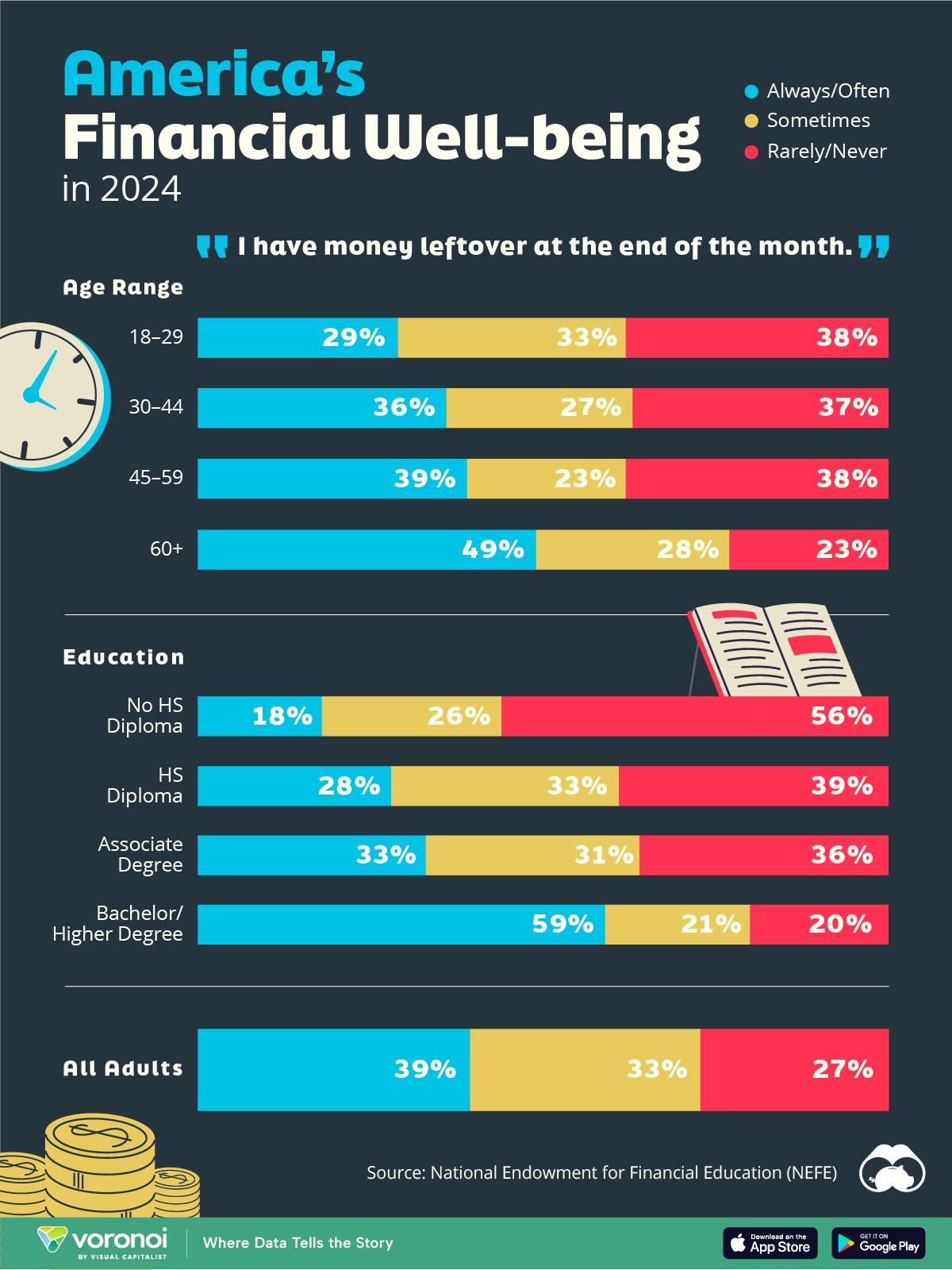

Older, better-educated adults are winning the savings game, reveals a January survey by the National Opinion Research Center at the University of Chicago.

Who Has Savings in This Economy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Two full years of inflation have taken their toll on American households. In 2023, the country’s collective credit card debt crossed $1 trillion for the first time. So who is managing to save money in the current economic environment?

We visualize the percentage of respondents to the statement “I have money leftover at the end of the month” categorized by age and education qualifications. Data is sourced from a National Endowment for Financial Education (NEFE) report, published last month.

The survey for NEFE was conducted from January 12-14, 2024, by the National Opinion Research Center at the University of Chicago. It involved 1,222 adults aged 18+ and aimed to be representative of the U.S. population.

Older Americans Save More Than Their Younger Counterparts

General trends from this dataset indicate that as respondents get older, a higher percentage of them are able to save.

| Age | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| 18–29 | 29% | 33% | 38% |

| 30–44 | 36% | 27% | 37% |

| 45–59 | 39% | 23% | 38% |

| Above 60 | 49% | 28% | 23% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

Perhaps not surprisingly, those aged 60+ are the age group with the highest percentage saying they have leftover money at the end of the month. This age group spent the most time making peak earnings in their careers, are more likely to have investments, and are more likely to have paid off major expenses like a mortgage or raising a family.

The Impact of Higher Education on Earnings and Savings

Based on this survey, higher education dramatically improves one’s ability to save. Shown in the table below, those with a bachelor’s degree or higher are three times more likely to have leftover money than those without a high school diploma.

| Education | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| No HS Diploma | 18% | 26% | 56% |

| HS Diploma | 28% | 33% | 39% |

| Associate Degree | 33% | 31% | 36% |

| Bachelor/Higher Degree | 59% | 21% | 20% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

As the Bureau of Labor Statistics notes, earnings improve with every level of education completed.

For example, those with a high school diploma made 25% more than those without in 2022. And as the qualifications increase, the effects keep stacking.

Meanwhile, a Federal Reserve study also found that those with more education tended to make financial decisions that contributed to building wealth, of which the first step is to save.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue