Technology

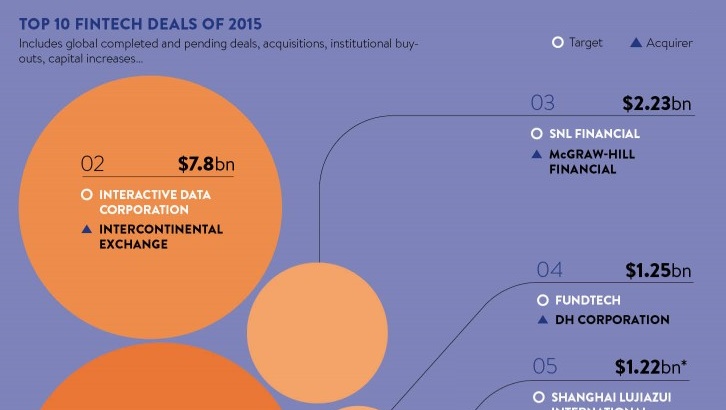

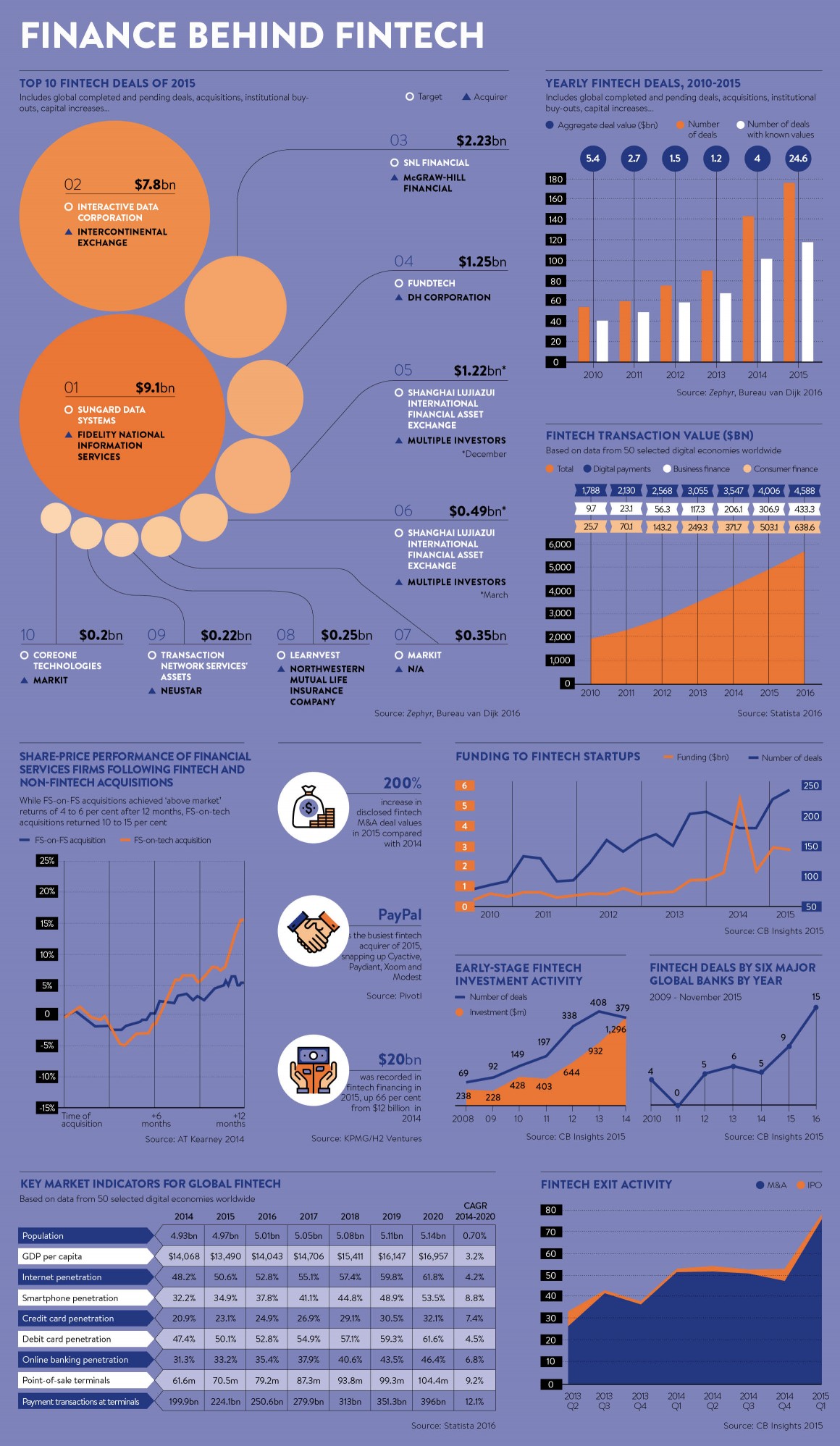

Summing Up the 10 Biggest Fintech Deals of 2015

Image courtesy of: Raconteur

Summing Up the 10 Biggest Fintech Deals of 2015

How hot is fintech right now?

This one statistic sums it up: in 2015, a record amount of fintech deals were done for a total deal value of $24.6 billion. That number is higher than the last five years put together.

With everything seemingly turning up “fintech”, here is a summary and some reflection on the 10 biggest fintech deals of last year.

Summing Up the Biggest Fintech Deals of 2015

1. FIS acquires SunGard for $9.1 billion

The acquisition, financed with a mix of 45 percent cash and 55 percent stock, yields a combined company with $9.2 billion in annual revenue, 55,000 employees, and operations in more than 130 countries. Headquartered in Jacksonville, Florida, FIS is the world’s largest global provider dedicated to banking and payments technologies. Their technology underscores $9 trillion in global transactions each year.

SunGard, which was the target of the acquisition, was previously taken over in 2005 by a consortium of private equity firms in the largest tech privatization deal ever. It was valued at $11.3 billion.

2. ICE acquires Interactive Data Corp

Intercontinental Exchange (ICE) bought Interactive Data Corporation (IDC) from private equity firms Silver Lake Group LLC and Warburg Pincus LLC. Valued at $5.2 billion, including $3.65 billion in cash and $1.55 billion in stock, the deal allows ICE to expand the markets it serves while bringing in new technology platforms and data services.

ICE owns and operates 23 exchanges and marketplaces, with the most famous of these being the New York Stock Exchange (NYSE).

3. McGraw-Hill Financial acquires SNL Financial

McGraw-Hill Financial, the parent of the Standard & Poor’s ratings agency, paid $2.23 billion in cash to buy SNL Financial from private equity firm New Mountain Capital.

McGraw-Hill is also known for some of its other subsidiaries, such as S&P Dow Jones Indices and Platts.

4. D+H Corporation buys Fundtech

D+H, a Canadian corporation which was historically a manufacturer of cheques, has recently shifted its focus on more technology-related endeavors. Part of this includes buying global payment services provider Fundtech for $1.25 billion in cash.

In a recent press release, D+H described the transaction as a key piece in their transition to technology: “The Fundtech acquisition significantly advanced D+H in our FinTech journey and was evidence of our commitment to continue providing clients the innovative solutions they need to grow and compete.”

5. Lufax is funded by multiple investors

Lufax, also known as the Shanghai Lujiazui International Financial Asset Exchange Co., is an online Internet finance marketplace in China. Focusing on peer-to-peer loans, Lufax connects individual investors with borrowers for loans of around $10,000 while collecting a 4% fee off each loan.

Domestic and overseas institutions participated in the most recent $1.2 billion financing in December, including the investment arm of COFCO Group and Guotai Junan (Hong Kong). The company is considered a mover and shaker in the Chinese lending space, and is now valued at $18.5 billion.

6. Lufax is funded by multiple investors

Lufax was also responsible for the sixth biggest deal of 2015, as it did an earlier raise in March 2015 for $488 million from a group of investors at a valuation of nearly $10 billion.

7. Markit

Markit, which recently announced a merger with IHS to create a data heavyweight, was also very active last year.

In 2015, it initiated a secondary public offering of its common shares to investors worth $350 million.

8. Learnvest acquired by Northwestern Mutual

Northwestern Mutual went all-in on personalized financial planning by buying New York-based startup LearnVest for over $250 million.

9. Neustar acquires TNS

Real-time information services provider Neustar bought caller authentication assets from Transaction Network Services (TNS), an affiliate of Siris Capital Group, for $220 million in cash.

10. Markit buys CoreOne

Earlier in 2015, market data company Markit bought CoreOne Technologies, a global leading provider of regulatory reporting for $200 million.

Original graphic by: Raconteur

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?