Technology

Amazon vs. Google: The Battle for Smart Speaker Market Share

View the full resolution version of this infographic.

Amazon vs. Google: The Battle for Smart Speaker Market Share

To see the full resolution version of this infographic that has higher legibility, click here.

Steve Rabuchin, the VP of Amazon Alexa, has a vision. He dreams of customers having a conversation – not just with voice-enabled devices like the Amazon Echo, but with appliances, cars, and everything in between.

Though that dream may not be realized in the short term, sales of smart speakers are increasing as people warm up to the idea of using voice-assisted devices in their homes.

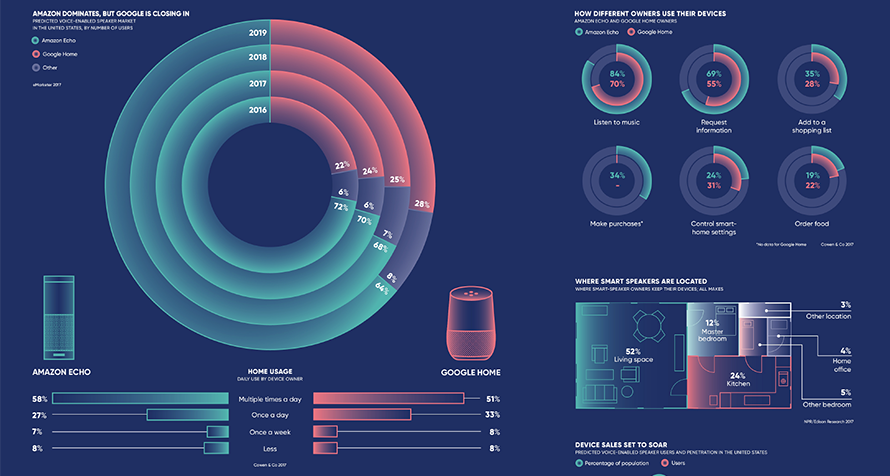

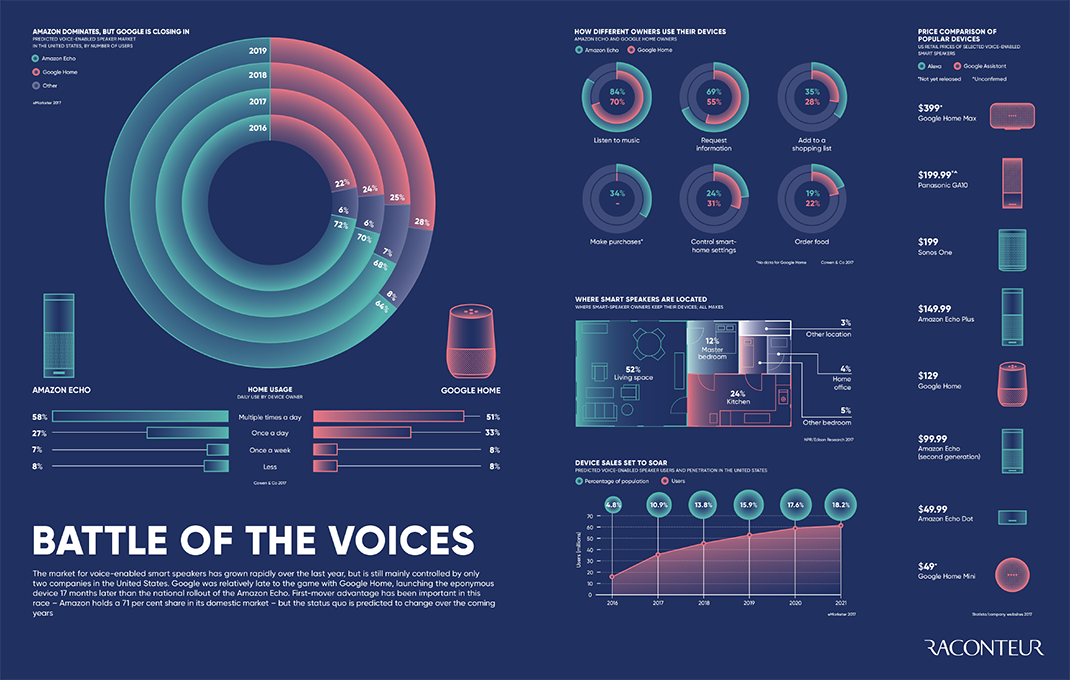

Today’s infographic, from Raconteur, sheds light on the fight for smart speaker market share, how early adopters are using the devices, and the growing array of voice-enabled devices currently on the market.

Moving into the Mainstream

When the Amazon Echo entered the market in 2015, it kicked off a new wave of demand for voice-activated smart speakers. At the time, it was unclear whether a large segment of the population would use a smart speaker, but consecutive years of rising sales are putting those worries to rest.

A recent study from Juniper Research found that smart speakers such as Amazon Echo, Google Home, and the Sonos One will be installed in over 70 million U.S. households by 2022, reaching 55% of all homes.

The recent flurry of holiday device buying seems to support this prediction. Smart speaker sales in the U.S. rose sharply to nearly 25 million in 2017, with close to 11 million purchased during the holiday season. Thanks to lower price points and wider distribution, this trend will likely continue through 2018 and beyond.

Competition is Heating Up

Amazon’s first-mover advantage resulted in an imposing 94% market share by Q3 2016 – but since then, Google Home has been eating into that lead. Experts predict that Echo will remain the top smart speaker in the future, but that Google and Chinese brands like JD and Xiaomi will continue to grow in popularity.

The two tech giants are fighting hard for the early majority because smart speakers are such a powerful gateway into their ecosystem of services and data collection.

Perhaps anticipating a binary market, Sonos is looking to win by taking a slightly different approach. Since the company is doesn’t have an existing suite of consumer services, it’s shipping devices with Alexa integration and opening up the platform to developers (think voice-activated apps). Customers who are suspicious of ulterior motives and integration limitations of the larger brands may gravitate toward a more open, agnostic approach.

You have no idea what people are going to build. When Apple opened iOS, the first thing people made was the fart app.

– Antoine Leblond, VP of Software Development at Sonos

To add even more excitement to the race for market share dominance, Apple is launching a smart speaker called HomePod in early 2018.

The Path to IoT is Voice Enabled

For now, smart speakers are primarily a fancy way to people to stream music or get tomorrow’s weather forecast, but they are a critical first step in the impending shift toward the “connected home”.

Most people don’t currently live in a place that supports full-on integration with smart speakers, but once they begin using voice-enabled devices, they are more likely to take smaller steps such as rewiring light switches.

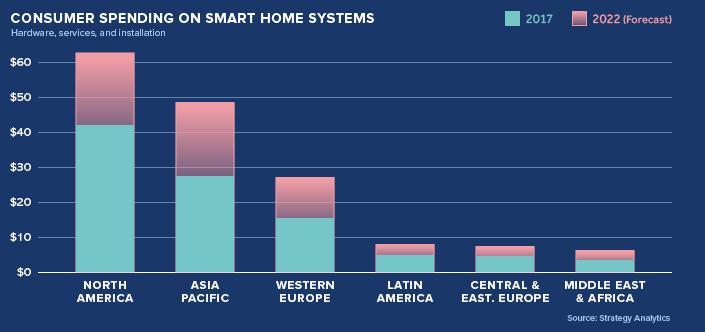

The shift towards smart homes is predicted to generate a lot of revenue in coming years – and companies like Amazon and Google see smart speakers as a foot-in-the-door. If trends continue, these tech giants stand a good chance of taking over as the nerve center for peoples’ homes as an IoT-driven future unfolds.

33 years after the debut of The Clapper, tech companies have found a better (and far more profitable) hands-free way to turn the lights out.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Markets2 weeks ago

Markets2 weeks agoAmerica’s Top Companies by Revenue (1994 vs. 2023)

-

Environment1 week ago

Environment1 week agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population

-

Automotive2 weeks ago

Automotive2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.