Markets

The Pandemic Economy: What are Shoppers Buying Online During COVID-19?

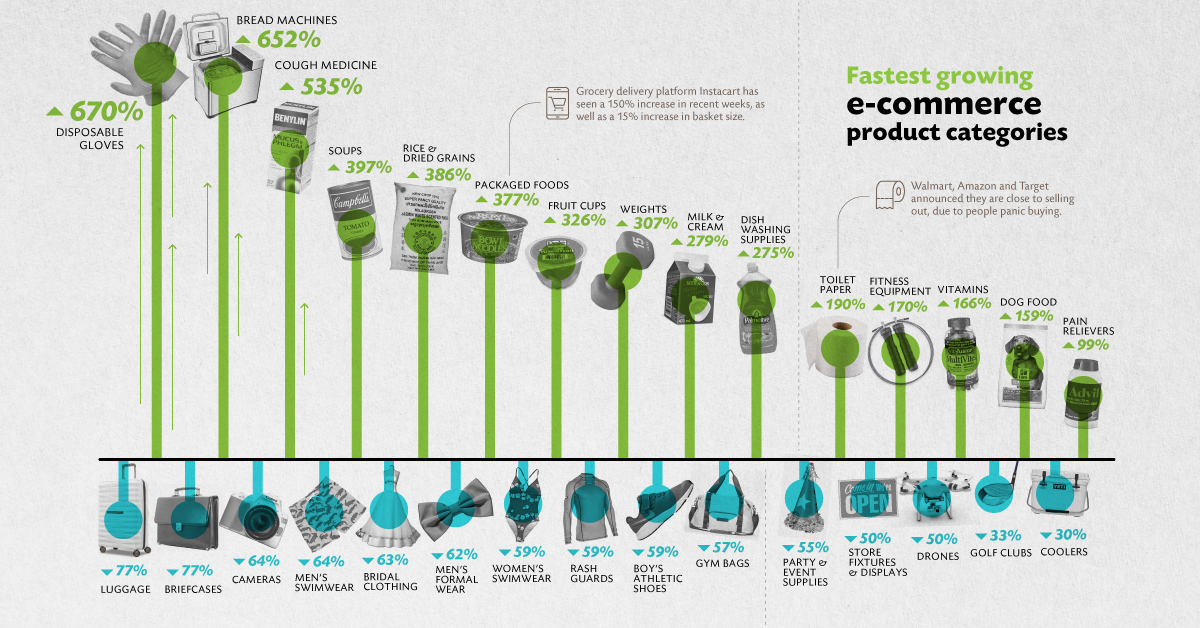

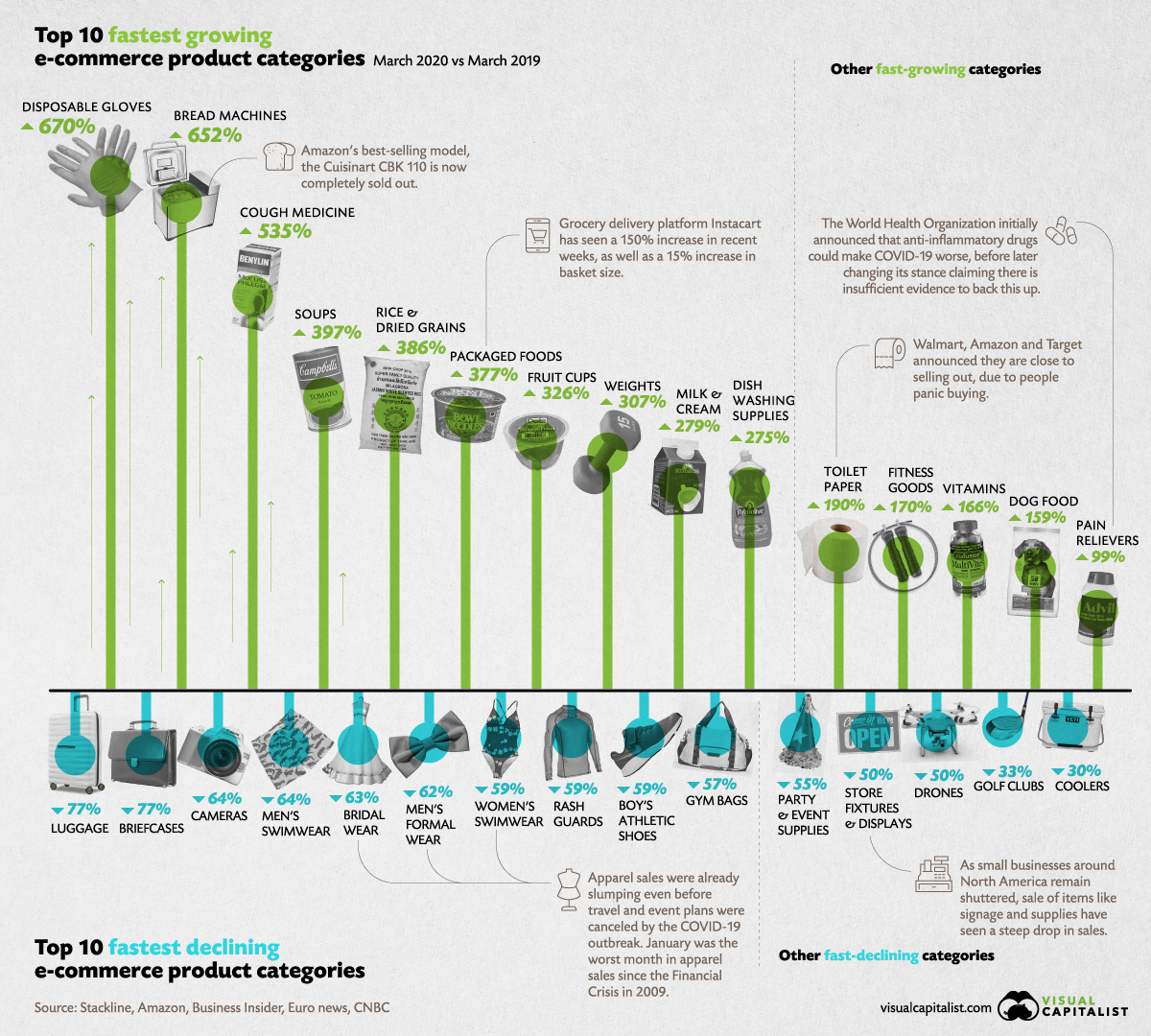

The Fastest Growing and Declining E-Commerce Categories

The COVID-19 pandemic is having a significant impact on every aspect of life, including how people shop for their necessities, and their not-so-necessities.

With online retail sales estimated to reach an eye-watering $6.5 trillion by 2023, the ecommerce sector was already booming. But since the outbreak, online shopping has been catapulted into complete overdrive. Even the largest retailers on the planet are struggling to keep up with the unprecedented consumer demand—but what exactly are people buying?

To answer this question, retail intelligence firm Stackline analyzed ecommerce sales across the U.S. and compiled a list of the fastest growing and declining ecommerce categories (March 2020 vs. March 2019) with surprising results.

The Frenzy of Buyer Behavior

As people come to terms with their new living situations, their buying behavior has adapted to suit their needs. While panic buying may have slowed in some countries, consumers continue to stock up on supplies, or “pandemic pantry products”.

Many consumers are also using their newfound time to focus on their health, with 85% of consumers taking up some kind of exercise while in social isolation, and 40% of them saying they intend to keep it up when restrictions are lifted.

These changing behaviors have resulted in a number of product categories experiencing a surge in demand — and although a lot of them are practical, others are wonderfully weird.

The Fastest Growing Categories

While the below list features several shelf-stable items, it seems as though consumers are taking matters into their own hands, with bread making machines sitting in second place and retailers selling out of their top models.

It’s clear from the list that consumers are considering positive changes to their lifestyle while in isolation, as fitness, smoking cessation, and respiratory categories are all experiencing growth.

Explore the 100 fastest growing product categories below:

| Rank | Category | % Change in March (2020 vs. 2019) |

|---|---|---|

| #1 | Disposable Gloves | 670% |

| #2 | Bread Machines | 652% |

| #3 | Cough & Cold | 535% |

| #4 | Soups | 397% |

| #5 | Dried Grains & Rice | 386% |

| #6 | Packaged Foods | 377% |

| #7 | Fruit Cups | 326% |

| #8 | Weight Training | 307% |

| #9 | Milk & Cream | 279% |

| #10 | Dishwashing Supplies | 275% |

| #11 | Paper Towels | 264% |

| #12 | Hand Soap & Sanitizer | 262% |

| #13 | Pasta | 249% |

| #14 | Vegetables | 238% |

| #15 | Flour | 238% |

| #16 | Facial Tissues | 235% |

| #17 | Allergy Medicine | 232% |

| #18 | Women’s Health | 215% |

| #19 | Cereals | 214% |

| #20 | Power Generators | 210% |

| #21 | Laundry Supplies | 200% |

| #22 | Household Cleaners | 195% |

| #23 | Soap & Body Wash | 194% |

| #24 | Toilet Paper | 190% |

| #25 | Jerky & Dried Meats | 187% |

| #26 | Chips & Pretzels | 186% |

| #27 | Crackers | 184% |

| #28 | Health Monitors | 182% |

| #29 | Popcorn | 179% |

| #30 | Computer Monitors | 172% |

| #31 | Fitness Equipment | 170% |

| #32 | Single Vitamins | 166% |

| #33 | Nut & Seed Butters | 163% |

| #34 | Cat Food | 162% |

| #35 | Fruit Snacks | 162% |

| #36 | Baby Care Products | 162% |

| #37 | Refrigerators | 160% |

| #38 | Baking Mixes | 160% |

| #39 | Toilet Accessories | 160% |

| #40 | Dog Food | 159% |

| #41 | Diapers | 154% |

| #42 | Yoga Equipment | 154% |

| #43 | Bottled Beverages | 153% |

| #44 | Baby Meals | 153% |

| #45 | Cookies | 147% |

| #46 | Digestion & Nausea | 144% |

| #47 | Snack Foods | 141% |

| #48 | Herbal Supplements | 136% |

| #49 | Cooking Oils | 135% |

| #50 | Water | 130% |

| #51 | Incontinence & Tummy | 129% |

| #52 | Mutivitamin | 126% |

| #53 | Cat Litter | 125% |

| #54 | Training Pads and Trays | 125% |

| #55 | Juices | 125% |

| #56 | Smoking Cessation | 122% |

| #57 | Dried Fruit & Raisins | 120% |

| #58 | Salt & Pepper Seasoning | 118% |

| #59 | Craft Kits & Projects | 117% |

| #60 | Batteries | 116% |

| #61 | Trash Bags | 116% |

| #62 | Nuts & Seeds | 116% |

| #63 | Hair Coloring | 115% |

| #64 | Sauce & Gravy | 115% |

| #65 | Deli Foods | 114% |

| #66 | Syrups | 114% |

| #67 | Breads & Bakery | 114% |

| #68 | Minerals | 113% |

| #69 | Condiments | 111% |

| #70 | First Aid | 108% |

| #71 | Nail Care | 108% |

| #72 | Humidifiers | 105% |

| #73 | Art Paint | 104% |

| #74 | Office Chairs | 104% |

| #75 | Deodorant | 103% |

| #76 | Jams, Jellies & Spreads | 102% |

| #77 | Coffee | 101% |

| #78 | Spices & Seasoning | 100% |

| #79 | Skin Care | 99% |

| #80 | Pain Relievers | 99% |

| #81 | Cooking Vinegars | 98% |

| #82 | Air Purifiers | 97% |

| #83 | Granola & Nutrition Bars | 97% |

| #84 | Pudding & Gelatin | 97% |

| #85 | Toy Clay & Dough | 95% |

| #86 | Single Spices | 95% |

| #87 | Bird Food & Treats | 91% |

| #88 | Lab & Science Products | 90% |

| #89 | Eczema & Psoriasis | 90% |

| #90 | Ping Pong | 89% |

| #91 | Chocolate | 86% |

| #92 | Baking Ingredients | 84% |

| #93 | Energy Supplements | 84% |

| #94 | Respiratory | 82% |

| #95 | Office Desks | 82% |

| #96 | Potty Training Supplies | 82% |

| #97 | Herbs, Spices & Seasonings | 82% |

| #98 | Keyboard & Mice | 80% |

| #99 | Body Lotion | 79% |

| #100 | Safes | 69% |

Interestingly, toilet paper has seen more growth than baby care products, and cured meats have seen more growth than water. But while some categories are experiencing a drastic increase in demand, others are slumping in the pandemic economy.

The Fastest Declining Categories

An unprecedented wave of event and vacation cancellations is having a huge impact on the products people consume. For instance, luggage and suitcases, cameras, and men’s swimwear have all seen a dip in sales.

See the full list of 100 fastest declining categories below:

| Rank | Category | % Change in March (2020 vs. 2019) |

|---|---|---|

| #1 | Luggage & Suitcases | -77% |

| #2 | Briefcases | -77% |

| #3 | Cameras | -64% |

| #4 | Men’s Swimwear | -64% |

| #5 | Bridal Clothing | -63% |

| #6 | Men's Formal Wear | -62% |

| #7 | Women’s Swimwear | -59% |

| #8 | Rash Guards | -59% |

| #9 | Boy’s Athletic Shoes | -59% |

| #10 | Gym Bags | -57% |

| #11 | Backpacks | -56% |

| #12 | Snorkelling Equipment | -56% |

| #13 | Girl’s Swimwear | -55% |

| #14 | Baseball Equipment | -55% |

| #15 | Event & Party Supplies | -55% |

| #16 | Motorcycle Protective Gear | -55% |

| #17 | Camera Bags & Cases | -54% |

| #18 | Women’s Suits & Dresses | -53% |

| #19 | Women’s Boots | -51% |

| #20 | Cargo Racks | -51% |

| #21 | Women’s Sandals | -50% |

| #22 | Drones | -50% |

| #23 | Boy's Active Clothing | -50% |

| #24 | Lunch Boxes | -50% |

| #25 | Store Fixtures & Displays | -50% |

| #26 | Automotive Mats | -50% |

| #27 | Men’s Outerwear | -49% |

| #28 | Watches & Accessories | -49% |

| #29 | Cargo Bed Covers | -48% |

| #30 | Track & Field Equipment | -48% |

| #31 | Ceiling Lighting | -47% |

| #32 | Camera Lenses | -47% |

| #33 | Girl’s Coats and Jackets | -47% |

| #34 | Women’s Hats & Caps | -47% |

| #35 | Women's Outerwear | -47% |

| #36 | Video Cameras | -46% |

| #37 | Wheels & Tires | -46% |

| #38 | Motorcycle Parts | -45% |

| #39 | Women’s Wallets | -45% |

| #40 | Shocks & Struts | -44% |

| #41 | Transmission & Parts | -44% |

| #42 | Girl’s Athletic Shoes | -44% |

| #43 | Women’s Shoes | -44% |

| #44 | Telescopes | -44% |

| #45 | Sunglasses & Eyeglasses | -43% |

| #46 | Men’s Tops | -41% |

| #47 | Video Projectors | -40% |

| #48 | Men’s Athletic Shoes | -40% |

| #49 | Marine Electronics | -40% |

| #50 | Hand Tools | -40% |

| #51 | Wine Racks | -40% |

| #52 | Men's Shoes | -40% |

| #53 | Clocks | -39% |

| #54 | Baby Girl’s Shoes | -39% |

| #55 | Bracelets | -39% |

| #56 | Men’s Boots | -39% |

| #57 | Tapestries | -39% |

| #58 | Camping Equipment | -39% |

| #59 | Men’s Bottoms | -38% |

| #60 | Cell Phones | -38% |

| #61 | Tool Storage & Organizers | -38% |

| #62 | Necklaces | -38% |

| #63 | Swimming Equipment | -37% |

| #64 | Men’s Hats & Caps | -37% |

| #65 | Girl’s Shoes | -37% |

| #66 | Industrial Tools | -36% |

| #67 | Juicers | -36% |

| #68 | Desktops | -35% |

| #69 | Classroom Furniture | -35% |

| #70 | Bar & Wine Tools | -35% |

| #71 | Glassware & Drinkware | -35% |

| #72 | Musical Instruments | -34% |

| #73 | Power Winches | -34% |

| #74 | Home Bar Furniture | -34% |

| #75 | Office Storage Supplies | -34% |

| #76 | Girl's Active Clothing | -34% |

| #77 | Women’s Tops | -34% |

| #78 | Braces, Splints & Supports | -34% |

| #79 | Car Anti-theft | -34% |

| #80 | Rings | -34% |

| #81 | Blankets & Quilts | -33% |

| #82 | Women's Athletic Shoes | -33% |

| #83 | Kitchen Sinks | -33% |

| #84 | Golf Clubs | -33% |

| #85 | Equestrian Equipment | -33% |

| #86 | GPS & Navigation | -32% |

| #87 | Recording Supplies | -32% |

| #88 | Home Audio | -32% |

| #89 | Boy's Accessories | -32% |

| #90 | Earrings | -32% |

| #91 | Dining Sets | -31% |

| #92 | Calculators | -31% |

| #93 | Boy's Shoes | -31% |

| #94 | Volleyball Equipment | -31% |

| #95 | Strollers | -31% |

| #96 | Coolers | -30% |

| #97 | Sanders & Grinders | -30% |

| #98 | Men's Activewear | -29% |

| #99 | Living Room Furniture | -29% |

| #100 | Climbing & Hiking Bags | -28% |

Regardless of which list a product falls under, it is clear that the pandemic has impacted retailers of every kind in both positive and negative ways.

The New Normal?

Officially the world’s largest retailer, Amazon has announced it can no longer keep up with consumer demand. As a result, it will be delaying the delivery of non-essential items, or in some cases not taking orders for non-essentials at all.

This presents a double-edged sword, as the new dynamic that is bringing some retailers unprecedented demand could also bring about an untimely end for others.

Meanwhile, the question remains: will this drastic change in consumer behavior stabilize once we flatten the curve, or is this our new normal?

Investor Education

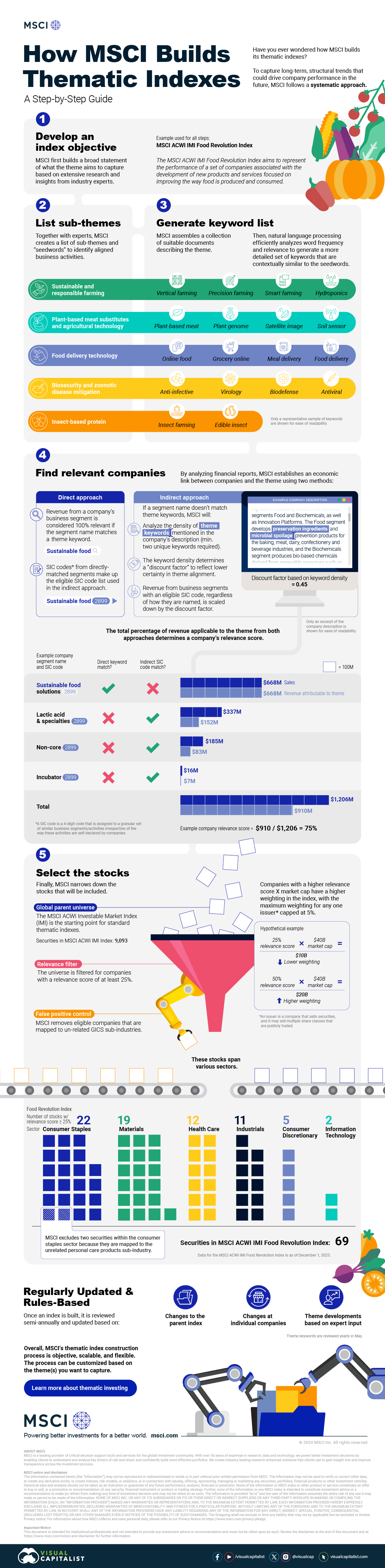

How MSCI Builds Thematic Indexes: A Step-by-Step Guide

From developing an index objective to choosing relevant stocks, this graphic breaks down how MSCI builds thematic indexes using examples.

How MSCI Builds Thematic Indexes: A Step-by-Step Guide

Have you ever wondered how MSCI builds its thematic indexes?

To capture long-term, structural trends that could drive business performance in the future, the company follows a systematic approach. This graphic from MSCI breaks down each step in the process used to create its thematic indexes.

Step 1: Develop an Index Objective

MSCI first builds a broad statement of what the theme aims to capture based on extensive research and insights from industry experts.

Steps 2 and 3: List Sub-Themes, Generate Keyword List

Together with experts, MSCI creates a list of sub-themes or “seedwords” to identify aligned business activities.

The team then assembles a collection of suitable documents describing the theme. Natural language processing efficiently analyzes word frequency and relevance to generate a more detailed set of keywords contextually similar to the seedwords.

Step 4: Find Relevant Companies

By analyzing financial reports, MSCI picks companies relevant to the theme using two methods:

- Direct approach: Revenue from a company’s business segment is considered 100% relevant if the segment name matches a theme keyword. Standard Industrial Classification (SIC) codes from these directly-matched segments make up the eligible SIC code list used in the indirect approach.

- Indirect approach: If a segment name doesn’t match theme keywords, MSCI will:

- Analyze the density of theme keywords mentioned in the company’s description. A minimum of two unique keywords is required.

- The keyword density determines a “discount factor” to reflect lower certainty in theme alignment.

- Revenue from business segments with an eligible SIC code, regardless of how they are named, is scaled down by the discount factor.

The total percentage of revenue applicable to the theme from both approaches determines a company’s relevance score.

Step 5: Select the Stocks

Finally, MSCI narrows down the stocks that will be included:

- Global parent universe: The ACWI Investable Market Index (IMI) is the starting point for standard thematic indexes.

- Relevance filter: The universe is filtered for companies with a relevance score of at least 25%.

- False positive control: Eligible companies that are mapped to un-related GICS sub-industries are removed.

Companies with higher relevance scores and market caps have a higher weighting in the index, with the maximum weighting for any one issuer capped at 5%. The final selected stocks span various sectors.

MSCI Thematic Indexes: Regularly Updated and Rules-Based

Once an index is built, it is reviewed semi-annually and updated based on:

- Changes to the parent index

- Changes at individual companies

- Theme developments based on expert input

Theme keywords are reviewed yearly in May. Overall, MSCI’s thematic index construction process is objective, scalable, and flexible. The process can be customized based on the theme(s) you want to capture.

Learn more about MSCI’s thematic indexes.

-

Investor Education5 months ago

Investor Education5 months agoThe 20 Most Common Investing Mistakes, in One Chart

Here are the most common investing mistakes to avoid, from emotionally-driven investing to paying too much in fees.

-

Stocks10 months ago

Stocks10 months agoVisualizing BlackRock’s Top Equity Holdings

BlackRock is the world’s largest asset manager, with over $9 trillion in holdings. Here are the company’s top equity holdings.

-

Investor Education10 months ago

Investor Education10 months ago10-Year Annualized Forecasts for Major Asset Classes

This infographic visualizes 10-year annualized forecasts for both equities and fixed income using data from Vanguard.

-

Investor Education1 year ago

Investor Education1 year agoVisualizing 90 Years of Stock and Bond Portfolio Performance

How have investment returns for different portfolio allocations of stocks and bonds compared over the last 90 years?

-

Debt2 years ago

Debt2 years agoCountries with the Highest Default Risk in 2022

In this infographic, we examine new data that ranks the top 25 countries by their default risk.

-

Markets2 years ago

Markets2 years agoThe Best Months for Stock Market Gains

This infographic analyzes over 30 years of stock market performance to identify the best and worst months for gains.

-

Money2 weeks ago

Money2 weeks agoVisualizing the Growth of $100, by Asset Class (1970-2023)

-

Money1 week ago

Money1 week agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population

-

Automotive2 weeks ago

Automotive2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company