Technology

The Most Overhyped Sectors in Tech, According to Entrepreneurs

Most Overhyped Sectors in Tech

What founders think about emerging technologies

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Founders are at the very ground level, and their pursuits have a ripple effect on the entire startup ecosystem.

As a result, how entrepreneurs think about different subsectors within tech is of utmost importance. Not only do their perceptions influence what projects they themselves choose to build, but how founders allocate their time and energy may also be a useful gauge of where future economic potential lies.

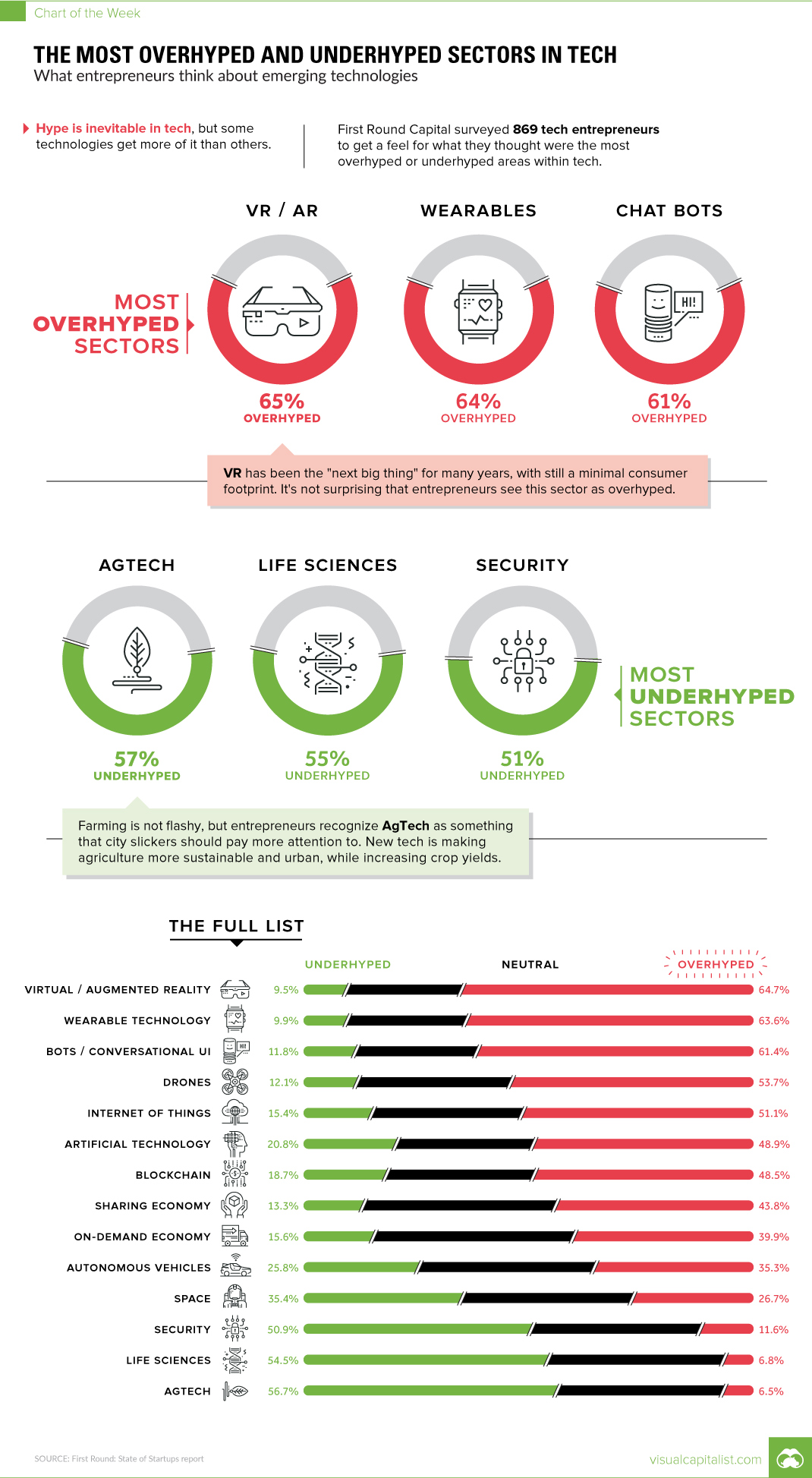

Today’s chart focuses on what entrepreneurs think of specific technologies, using data from a survey of 869 entrepreneurs that was done by First Round Capital.

Seeing Through the Hype

In the survey, entrepreneurs were asked to give their opinions on 14 different technologies, on whether they were overhyped or underhyped. Entrepreneurs could also answer “neutral” to any of the questions.

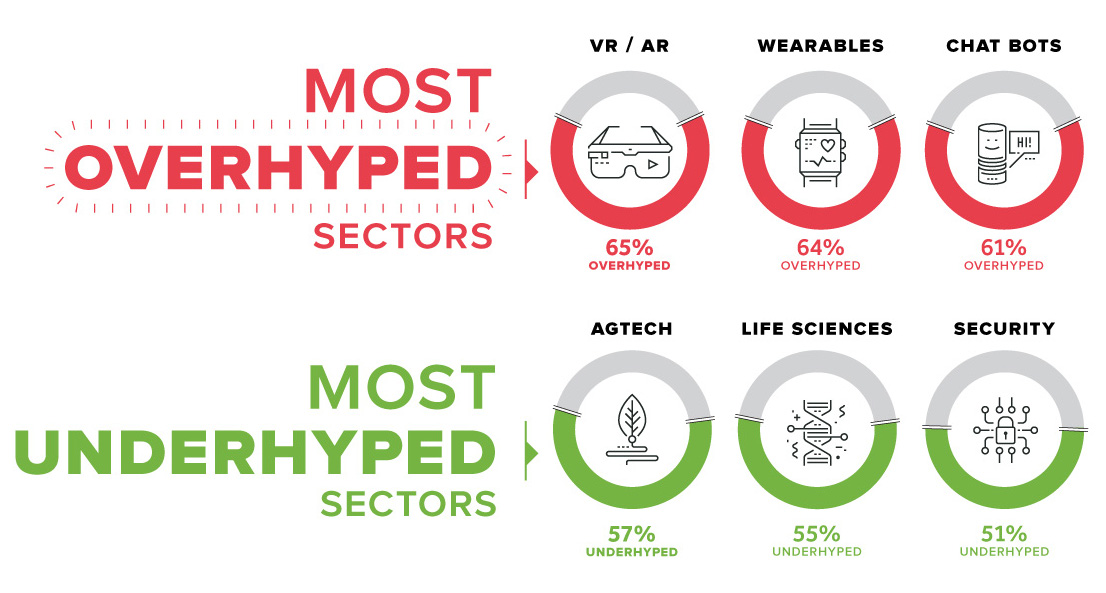

Here are the three technologies that were considered the most overhyped:

1. VR/AR: 65% Overhyped

VR has been the “next big thing” for many years, with still a minimal consumer footprint. It’s not surprising that entrepreneurs see this sector as overhyped. For companies like Facebook and Magic Leap to reverse the perception of VR/AR, they’ll need to get consumers adopting these technologies at a faster rate.

2. Wearables: 64% Overhyped

When Google Glass first came out in 2013, hype about a future filled with wearables seemed inevitable. Now it’s almost five years later, and wearables haven’t delivered on the scale that many entrepreneurs thought was possible.

3. Chatbots: 61% Overhyped

Will chatbots really change customer service, health, and other industries? Most entrepreneurs seem to be a little skeptical about their potential impact.

Diamonds in the Rough?

Entrepreneurs also thought some sectors deserve more attention – and this is where there may be some potential opportunities for investors or new founders.

1. Agtech: 57% Underhyped

Farming is not flashy, but entrepreneurs recognize agtech as something that city slickers should pay more attention to. New tech is making agriculture more sustainable and urban, while increasing crop yields.

We covered some of these interesting next generation food systems in a previous infographic post.

2. Life Sciences: 55% Underhyped

Advances in areas such as longevity, genomics, and biotechnology are unnerving to some people, but life sciences seems to be at a tipping point. Founders see this as an area that deserves more attention from the media and investors.

3. Security: 51% Underhyped

Last year, $450 billion was spent on cybersecurity – and this number is growing fast as the IoT becomes even more prevalent. Stopping hackers is not flashy, but it is vital to the global economy and many dollars will be spent on it in the coming years.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Markets2 weeks ago

Markets2 weeks agoAmerica’s Top Companies by Revenue (1994 vs. 2023)

-

Environment1 week ago

Environment1 week agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Maps2 weeks ago

Maps2 weeks agoMapped: Average Wages Across Europe

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Demographics2 weeks ago

Demographics2 weeks agoVisualizing the Size of the Global Senior Population

-

Automotive2 weeks ago

Automotive2 weeks agoTesla Is Once Again the World’s Best-Selling EV Company

-

Technology2 weeks ago

Technology2 weeks agoRanked: The Most Popular Smartphone Brands in the U.S.