Markets

The Cost of Rent in 140+ North American Cities

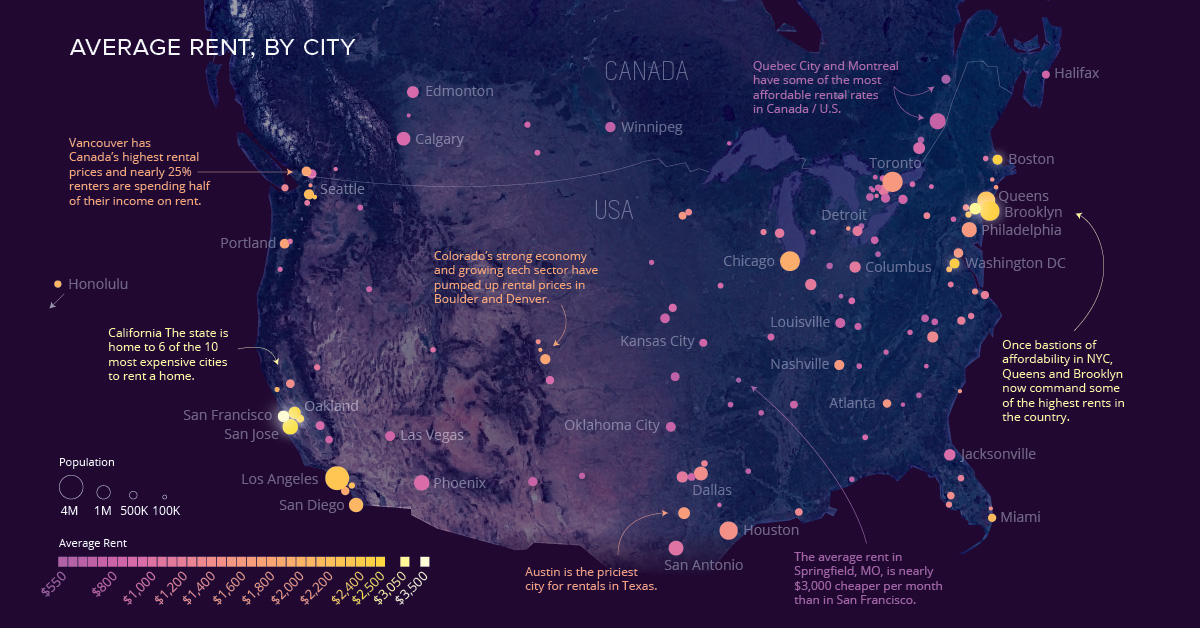

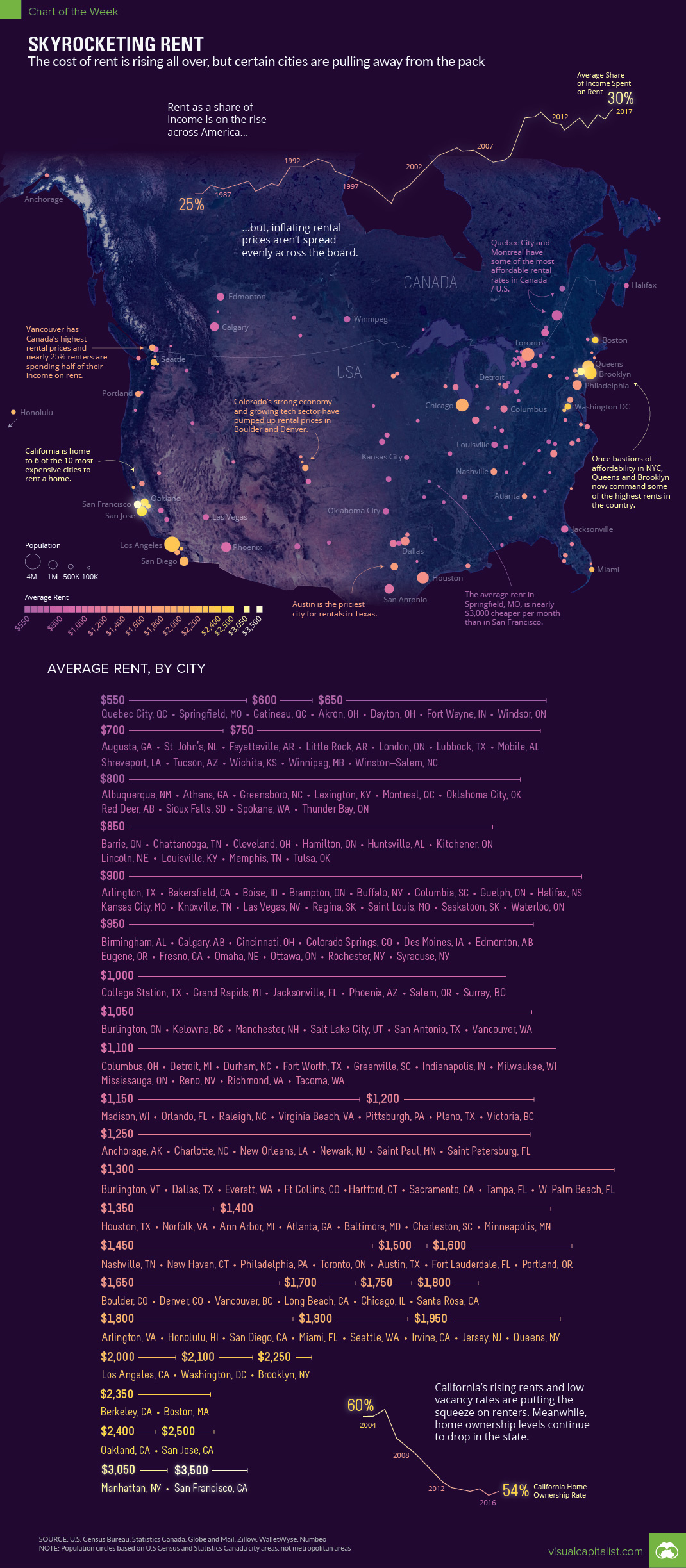

Visualizing the Cost of Rent in 140+ North American Cities

Location, location, location.

Rental markets are heating up all over the continent, but there are specific cities that are feeling the brunt of this phenomenon.

In places like San Francisco, Brooklyn, San Jose, Seattle, Vancouver, and Denver, city councils are starting to move into panic mode as regular citizens like teachers and nurses are voicing concerns about not being able to afford housing.

Simultaneously, many communities are rightfully concerned about the “brain drain” of their young people, who are moving for greener pastures (i.e. where rent or property is affordable) to start their families.

Mapping Rent Prices

The situation of skyrocketing rents is a tricky one with no silver bullets.

Given the circumstances, our contribution in today’s post is to provide some context and perspective on the situation. In the above chart, we mapped 148 cities in the U.S. and Canada and color-coded these cities based on average rent price.

The size of each circle corresponds to city size as reported by U.S. Census and Statistics Canada data, and they represent the populations of the cities themselves – not the surrounding metro population. This means that Long Beach, CA is not lumped into Los Angeles, CA, for example.

The chart was inspired by a compilation of data from WalletWyse, who used Numbeo estimates of the cost of living across these cities. Numbeo bases its rent estimates based on user-generated data for each city.

As a final note, we omitted cities from the original list with fewer than 100,000 residents, and we kept NYC split up into boroughs.

Massive Disparity

Although rents are rising everywhere, some cities are seeing clear separation from the rest of the pack.

| Rent | $1,000 or less | $1,000-$1,500 | $1,500-$2,000 | $2,000 or more |

|---|---|---|---|---|

| # of Cities | 66 | 56 | 17 | 9 |

| % of Cities | 45% | 38% | 11% | 6% |

There are 26 cities with rents higher than $1,500, and only two cities with rent over $3,000 (Manhattan and San Francisco).

Meanwhile, there is a significant chunk (46%) of the cities on the list with average rents below $1,000, including several cities that have rent for as inexpensive as $500-$650 (Springfield, MO, Quebec City, QC, or Fort Wayne, IN).

Did anything surprise you about the map and data?

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries