Markets

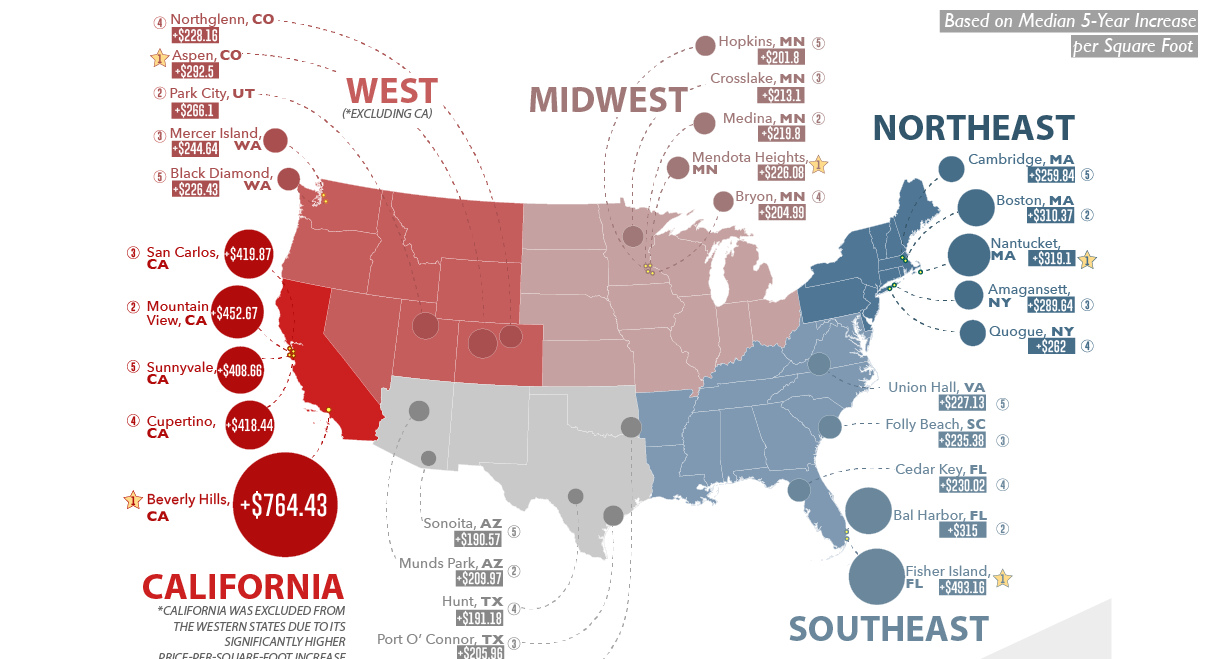

Map: Where Real Estate Prices are Rising Fastest

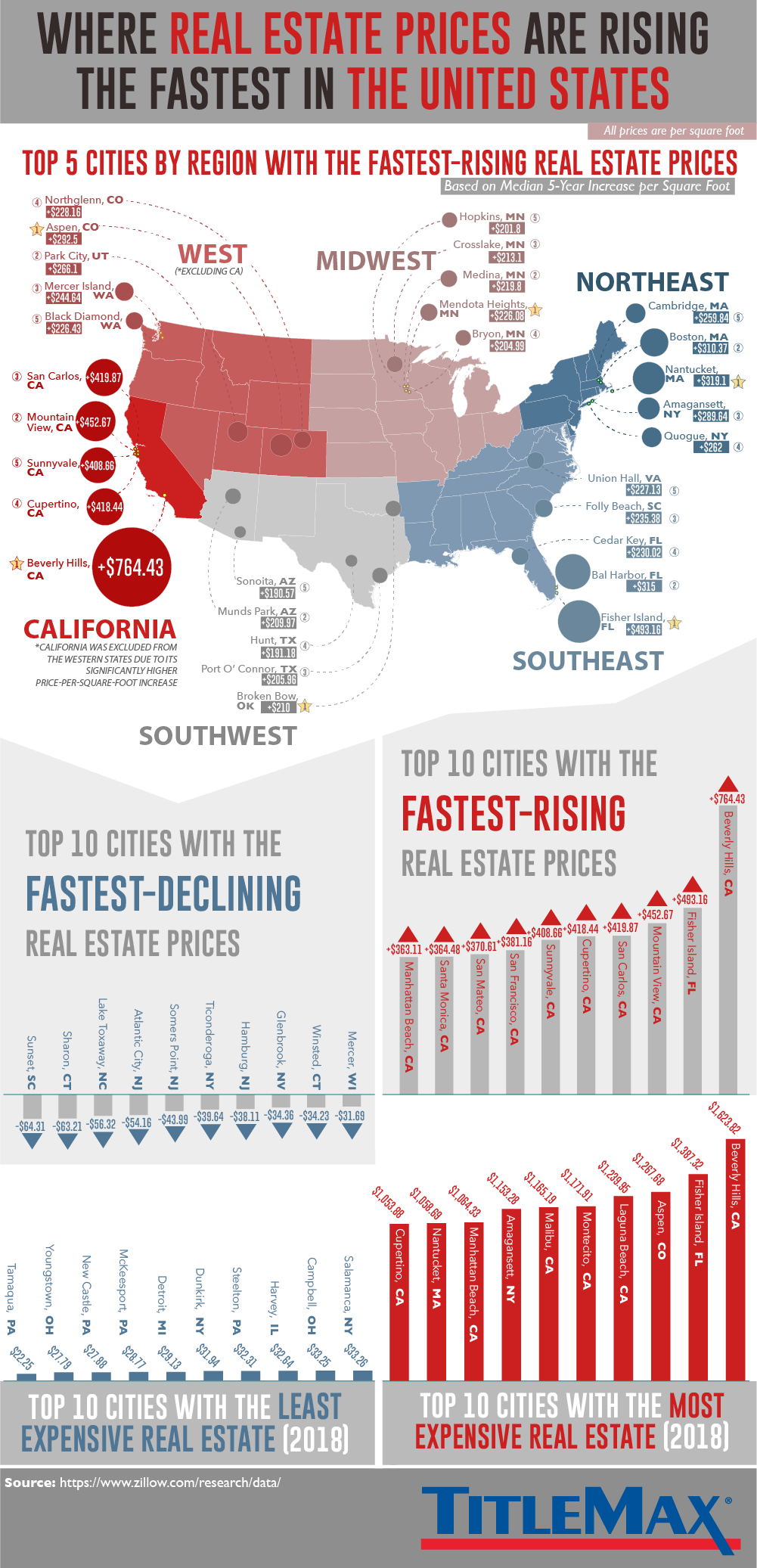

Mapped: Where Real Estate Prices are Rising the Fastest

The real estate market is a location game.

While forces like interest rates, demographics, and the economy help drive the housing market as a whole, the strength of your local market depends on other factors closer to home.

When you zoom out to look at U.S. real estate from a bird’s eye view, you’ll see this regional variance in full effect. Some markets are booming while others are tanking, and the contrast between the winners and losers is a stark one.

Real Estate Booms

Today’s infographic comes from TitleMax, and it shows where real estate prices are appreciating and depreciating the fastest.

We’ll start on the high end: here are the 10 cities that have seen the highest absolute growth in terms of price per square foot over the last five years.

| Rank | City | State | Price change (per sq. ft) |

|---|---|---|---|

| #1 | Beverly Hills | CA | +$764.43 |

| #2 | Fisher Island | FL | +$493.16 |

| #3 | Mountain View | CA | +$452.67 |

| #4 | San Carlos | CA | +$419.87 |

| #5 | Cupertino | CA | +$418.44 |

| #6 | Sunnyvale | CA | +$408.66 |

| #7 | San Francisco | CA | +$381.16 |

| #8 | San Mateo | CA | +$370.61 |

| #9 | Santa Monica | CA | +$364.48 |

| #10 | Manhattan Beach | CA | +$363.11 |

Median home price change over 5-years, measured in price per sq. ft (Source: Zillow)

The only non-California locale to make it onto the list is Fisher Island in Miami, Florida, which is home to just 467 residents including Andre Agassi, Oprah Winfrey, and Robert Herjavec.

While these are absolute increases, it’s worth noting that they are still very significant in relative terms. For example, although it’s true that Beverley Hills is the most expensive housing market in the U.S., prices have risen 47% over the last five years.

Real Estate Busts

Things may be rosy in the Golden State, but there are also places spread throughout the country where prices are dropping fast.

Many of these are smaller, lesser-known locales – and while they are located all over the map, eight of them are in states along the Eastern Seaboard.

| Rank | City | State | Price change (per sq. ft) |

|---|---|---|---|

| #1 | Sunset | SC | -$64.31 |

| #2 | Sharon | CT | -$63.21 |

| #3 | Lake Toxaway | NC | -$56.32 |

| #4 | Atlantic City | NJ | -$54.16 |

| #5 | Somers Point | NJ | -$43.99 |

| #6 | Ticonderoga | NY | -$39.64 |

| #7 | Hamburg | NJ | -$38.11 |

| #8 | Glenbrook | NV | -$34.36 |

| #9 | Winsted | CT | -$34.23 |

| #10 | Mercer | WI | -$31.69 |

Median home price change over 5-years, measured in price per sq. ft (Source: Zillow)

A Stark Contrast

If you sold a 1,000 sq. ft condo in Beverley Hills – the country’s most expensive real estate market – it would likely net you about $1.6 million.

What could you buy for that in Tamaqua, PA, the country’s cheapest?

In theory, you could pick up roughly 71,000 sq. ft of real estate – that’s about 10 mansions worth, or just short of the size of an average Walmart.

Markets

U.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

U.S. Debt Interest Payments Reach $1 Trillion

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

The cost of paying for America’s national debt crossed the $1 trillion dollar mark in 2023, driven by high interest rates and a record $34 trillion mountain of debt.

Over the last decade, U.S. debt interest payments have more than doubled amid vast government spending during the pandemic crisis. As debt payments continue to soar, the Congressional Budget Office (CBO) reported that debt servicing costs surpassed defense spending for the first time ever this year.

This graphic shows the sharp rise in U.S. debt payments, based on data from the Federal Reserve.

A $1 Trillion Interest Bill, and Growing

Below, we show how U.S. debt interest payments have risen at a faster pace than at another time in modern history:

| Date | Interest Payments | U.S. National Debt |

|---|---|---|

| 2023 | $1.0T | $34.0T |

| 2022 | $830B | $31.4T |

| 2021 | $612B | $29.6T |

| 2020 | $518B | $27.7T |

| 2019 | $564B | $23.2T |

| 2018 | $571B | $22.0T |

| 2017 | $493B | $20.5T |

| 2016 | $460B | $20.0T |

| 2015 | $435B | $18.9T |

| 2014 | $442B | $18.1T |

| 2013 | $425B | $17.2T |

| 2012 | $417B | $16.4T |

| 2011 | $433B | $15.2T |

| 2010 | $400B | $14.0T |

| 2009 | $354B | $12.3T |

| 2008 | $380B | $10.7T |

| 2007 | $414B | $9.2T |

| 2006 | $387B | $8.7T |

| 2005 | $355B | $8.2T |

| 2004 | $318B | $7.6T |

| 2003 | $294B | $7.0T |

| 2002 | $298B | $6.4T |

| 2001 | $318B | $5.9T |

| 2000 | $353B | $5.7T |

| 1999 | $353B | $5.8T |

| 1998 | $360B | $5.6T |

| 1997 | $368B | $5.5T |

| 1996 | $362B | $5.3T |

| 1995 | $357B | $5.0T |

| 1994 | $334B | $4.8T |

| 1993 | $311B | $4.5T |

| 1992 | $306B | $4.2T |

| 1991 | $308B | $3.8T |

| 1990 | $298B | $3.4T |

| 1989 | $275B | $3.0T |

| 1988 | $254B | $2.7T |

| 1987 | $240B | $2.4T |

| 1986 | $225B | $2.2T |

| 1985 | $219B | $1.9T |

| 1984 | $205B | $1.7T |

| 1983 | $176B | $1.4T |

| 1982 | $157B | $1.2T |

| 1981 | $142B | $1.0T |

| 1980 | $113B | $930.2B |

| 1979 | $96B | $845.1B |

| 1978 | $84B | $789.2B |

| 1977 | $69B | $718.9B |

| 1976 | $61B | $653.5B |

| 1975 | $55B | $576.6B |

| 1974 | $50B | $492.7B |

| 1973 | $45B | $469.1B |

| 1972 | $39B | $448.5B |

| 1971 | $36B | $424.1B |

| 1970 | $35B | $389.2B |

| 1969 | $30B | $368.2B |

| 1968 | $25B | $358.0B |

| 1967 | $23B | $344.7B |

| 1966 | $21B | $329.3B |

Interest payments represent seasonally adjusted annual rate at the end of Q4.

At current rates, the U.S. national debt is growing by a remarkable $1 trillion about every 100 days, equal to roughly $3.6 trillion per year.

As the national debt has ballooned, debt payments even exceeded Medicaid outlays in 2023—one of the government’s largest expenditures. On average, the U.S. spent more than $2 billion per day on interest costs last year. Going further, the U.S. government is projected to spend a historic $12.4 trillion on interest payments over the next decade, averaging about $37,100 per American.

Exacerbating matters is that the U.S. is running a steep deficit, which stood at $1.1 trillion for the first six months of fiscal 2024. This has accelerated due to the 43% increase in debt servicing costs along with a $31 billion dollar increase in defense spending from a year earlier. Additionally, a $30 billion increase in funding for the Federal Deposit Insurance Corporation in light of the regional banking crisis last year was a major contributor to the deficit increase.

Overall, the CBO forecasts that roughly 75% of the federal deficit’s increase will be due to interest costs by 2034.

-

Maps1 week ago

Maps1 week agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share