Technology

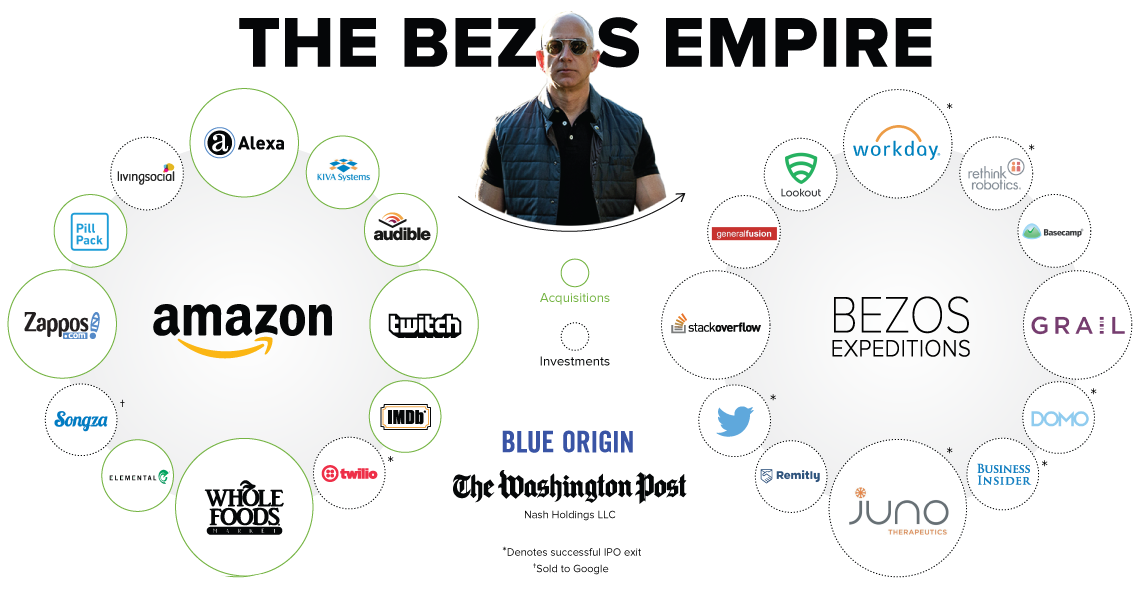

The Jeff Bezos Empire in One Giant Chart

The Jeff Bezos Empire in One Giant Chart

With a fortune largely tied to his 79 million Amazon shares, the net worth of Jeff Bezos has continued to rise.

Most recently, the Amazon founder was even able to surpass Bill Gates on the global wealth leaderboard with $137 billion to his name – however, this ascent to the very top may be extremely short-lived.

On January 9th, 2019, Jeff Bezos announced on Twitter that he was divorcing MacKenzie Bezos, his wife of 25 years. While the precise ramifications of the news are not yet clear, it’s anticipated that MacKenzie Bezos could end up with a considerable portion of shares in Amazon as a result.

There is much to be decided as the world’s wealthiest couple splits their assets – but for now, here is a list of what Jeff Bezos owns today.

The Jeff Bezos Empire in 2019

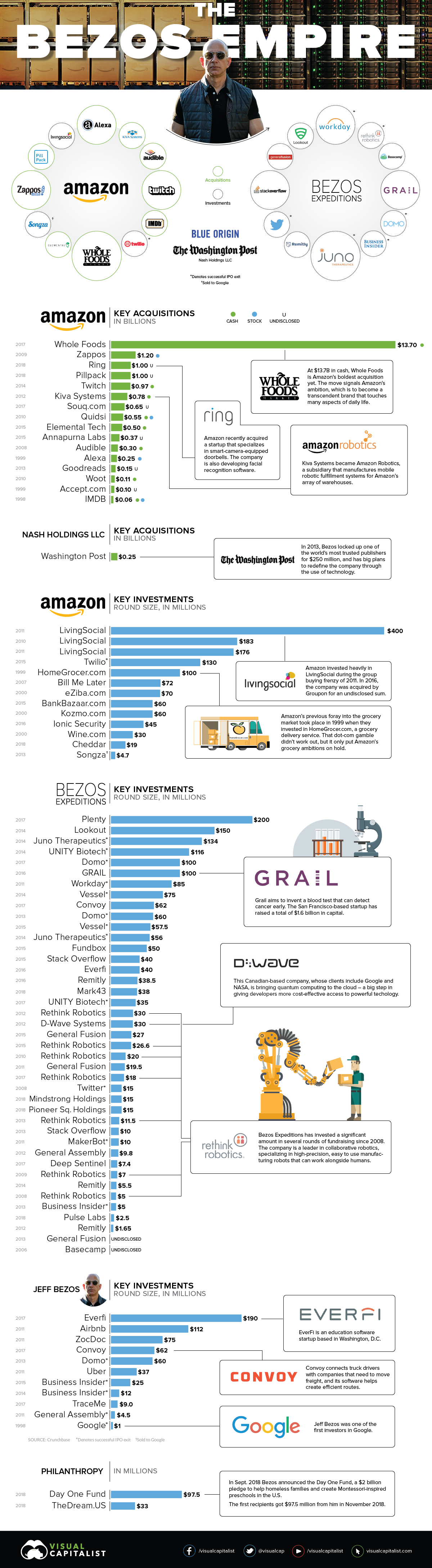

The obvious centerpiece to the Jeff Bezos Empire is the 16% ownership stake in Amazon.com.

However, beyond that, there is a wide variety of other investments and acquisitions that Jeff Bezos has made through Amazon or his other investment vehicles. These range from household names to more secretive endeavors, and are worth looking at to truly understand his assets and fortune.

Amazon.com

Amazon makes acquisitions and investments that relate to the company’s core business and future ambitions. This includes acquisitions of Whole Foods ($13.7 billion in 2017), Zappos.com ($1.2 billion in 2009), PillPack ($1 billion in 2018), Twitch.tv ($970 million in 2014), and Kiva Systems ($780 million in 2012).

This also includes investments in everything form failed dot-com company Kozmo.com (2000) to Twilio, which successfully IPO’d in 2016.

Bezos Expeditions

Bezos Expeditions manages Jeff Bezos’ venture capital investments. Over the years, this venture arm has put money into Twitter, Domo, Juno Therapeutics, Workday, General Fusion, Rethink Robotics, Business Insider, MakerBot, and Stack Overflow.

More recent investments include GRAIL, a startup that recently raised over $900 million to cure cancer before it happens, as well as EverFi, an edtech startup.

Jeff Bezos

Jeff Bezos also invests money on a personal level. He was an angel investor in Google in 1998, and has also put money in Uber and Airbnb. (Note: these last two companies are listed on the Bezos Expeditions website, but on Crunchbase they are listed as personal investments.)

Nash Holdings LLC

Nash Holdings is the private company owned by Bezos that bought The Washington Post for $250 million.

Bezos Family Foundation

The BFF is run by Jeff Bezos’ parents, and is funded through Amazon stock. It focuses on early education, and has also made an investment in LightSail Education’s $11 million Series B round.

Blue Origin

Finally, it’s also worth noting that Jeff Bezos is the founder of Blue Origin, an aerospace company that is competing with SpaceX in mankind’s final frontier.

Note: This article and infographic were originally published in June 20, 2017. Both have been updated as of January 11, 2019 to include more up-to-date acquisitions and investments.

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?