Markets

Japan Officially Gets Leapfrogged by the Four Asian Tigers

Japan Officially Gets Leapfrogged by the Four Asian Tigers

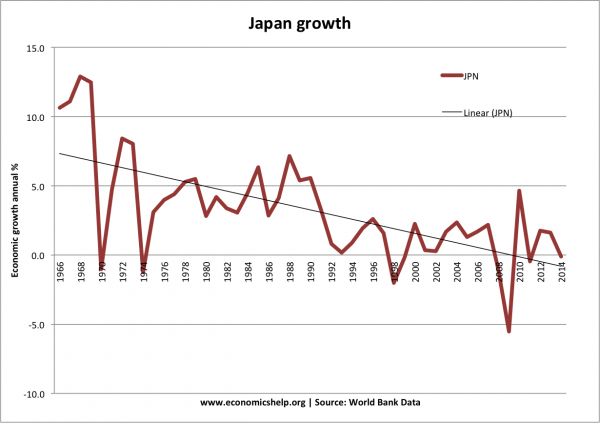

Throughout the decades in the 1950s and 1960s, the Japanese economy was envied for its unrelenting growth.

Dubbed the “Post-War Miracle”, this period of time saw Japan become a global center of manufacturing and exports. Japanese brands such as Toyota, Sony, Honda, Mitsubishi, Panasonic, and Canon would become household names worldwide. By the 1960s, Japan catapulted to become the second largest economy in the world.

Today, Japan has the third largest economy in terms of total nominal GDP, and the fourth largest by GDP adjusted for Purchasing Power Parity (PPP). This doesn’t seem so bad on paper, but Japan also has nearly 130 million people.

What do those amounts look like per capita? It turns out to be not so good.

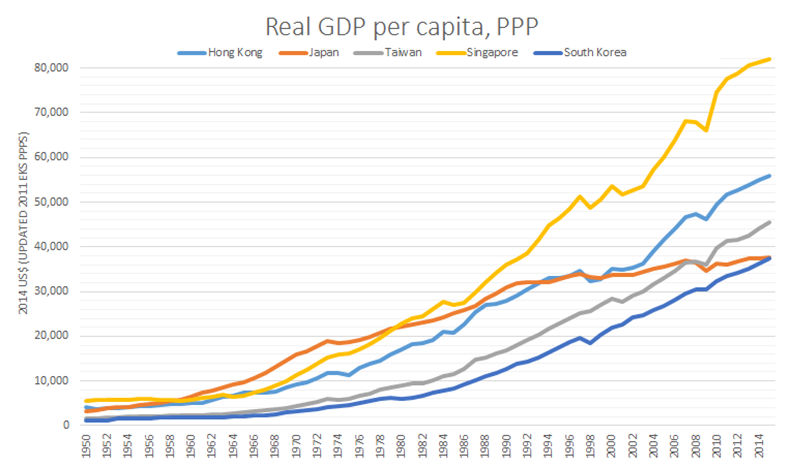

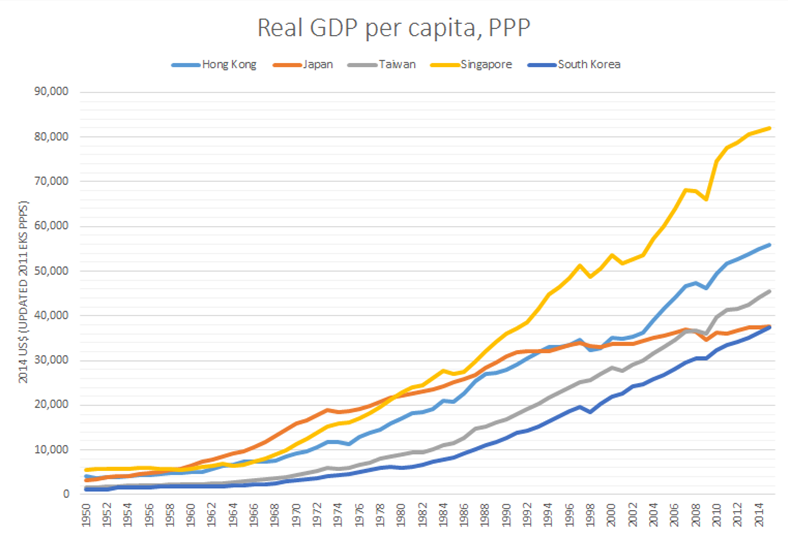

After over two decades of economic stagnation, the most recent GDP per capita (PPP) numbers for 2014 by the IMF had the Japanese economy in 29th place globally. As you saw in the opening chart, even more recent projections from another source show that all four Asian Tigers have now all officially leapfrogged Japan in terms of GDP per capita (PPP).

The “Four Asian Tigers”, a term used to reference the highly free-market and developed economies of Hong Kong, Singapore, South Korea, and Taiwan, have continued to grow despite Japan’s struggles. Singapore, a significant Asian banking center, passed Japan in GDP per capita (PPP) back in 1979. Hong Kong would be the next to do so in 1993, and Taiwan would jump ahead during the Financial Crisis. The last of the leapfrogging happened when South Korea passed Japan this year.

This shouldn’t be too surprising, as the struggles of Japan over the last 25 years have been well-documented. However, a point of interest may be the context of how these challenges began.

In the mid-80s, the yen had basically doubled in value against the dollar. For a manufacturing and exporting nation (similar to how China is today), this was less than ideal. While this was happening, the Bank of Japan intervened with five sessions of monetary easing starting in January 1986 to weaken the yen, cutting interest rates from 5.0% to 2.5% in just one year.

During this time, monetary growth was much quicker than anticipated. More-than-sufficient liquidity and ultra low interest rates fueled speculation, which helped lead to inflate a classic asset bubble. In the early 90s, the BOJ hiked rates to counter speculation and curb inflation.

The asset bubble popped, and Japan’s economy would be sent into the “Lost Decade” – a “decade” which has lasted 25 years.

You can see the drastic increase in money supply leading up to the crisis here:

Japan now has the world’s highest debt-to-GDP ratio of 243% as well as the world’s highest debt-to-revenue ratio.

Despite this, they’ve started an even more potentially dangerous experiment known as Abenomics, which is the three-headed beast of unprecedented quantitative easing, monetary stimulus, and reforms.

Original graphics by: Utopia – You’re Standing In It (blog), Trading Economics

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries