Mining

Integra Gold Launches $1 Million Challenge to Find Next Gold Discovery

Integra Gold Launches $1 Million Challenge to Find Next Gold Discovery

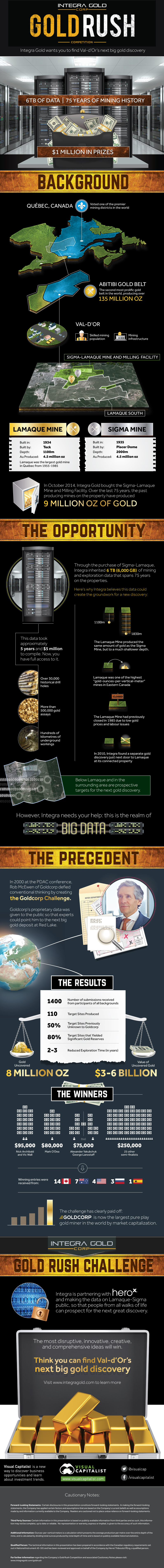

Today Integra Gold launched the world’s largest crowdsourcing challenge related to mining to find the next large gold discovery.

The company recently acquired a treasure trove of data through its acquisition of the Sigma-Lamaque Mine and Milling Facility near its Lamaque South discovery. The six terabytes (6,000 GB) of data spans 75 years and originates from the exploration and production efforts of Teck, Placer Dome, and other companies that worked these historical properties.

The data includes over 30,000 historical drill holes, 500,000 gold assays, and hundreds of kilometres of underground workings.

Overall, both the Sigma and Lamaque mines produced 4.5 million oz of gold each. However, here lies the opportunity that Integra sees: the Sigma Mine was more than 700m shallower than the Lamaque Mine, despite producing the same amount of gold. Could there be more gold underneath?

If gold was discovered in this new contest, then it wouldn’t be the first time for Integra. Just to the south, they discovered a deposit in 2010 that has over 1 million oz (3 g/t cutoff) at a high-grade of 7.1 g/t Au (Indicated). This is part of the reason that they believe in the potential of the overall complex.

Integra hopes to attract the expertise of those in academia, geology, the mining sector and many other disciplines to interpret the data. The company is partnering with HeroX, a company co-founded by the legendary XPRIZE founder Peter Diamandis, to produce the competition.

“The Gold Rush Challenge follows in the incredibly successful footsteps of the Goldcorp Challenge and the Ansari XPRIZE competition,” says XPRIZE CEO and HeroX Co-founder, Peter H. Diamandis. “We live in a world of incredible cognitive surplus and your ability to tap into brilliance is now unparalleled. By utilizing the HeroX platform, Integra Gold is paving the way for significant innovation in the mining industry by encouraging collaboration and openness.”

For more about the contest, stay tuned to Integra Gold’s website.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries