Misc

How Affluent Millennials are Changing the Finance Industry

How Affluent Millennials are Changing the Finance Industry

We previously showed a set of nine charts that show the views of Millennials on debt, banking, and investing. We also recently showed what Millennials want in a first home.

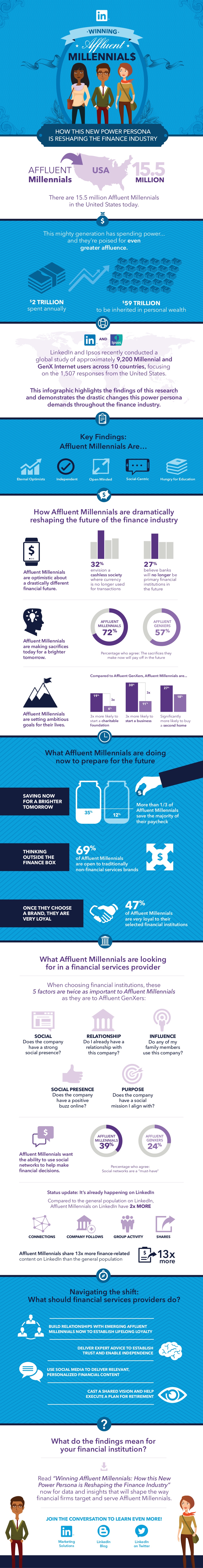

Today’s infographic follows a similar thread, looking at the values of the 15.5 million affluent Millennials in the United States, and what the finance industry will have to do to appeal to this group.

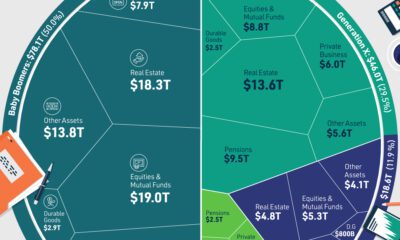

Probably the most important fact worth considering is the sheer wealth that this group will command as they inherit money from the Baby Boomer generation. To start, they already control $2 trillion of spending power each year. However, it is estimated that when it is all said and done, they will command an additional $59 trillion in net worth with inheritances.

Through a survey conducted by LinkedIn and Ipsos Reid, the biggest finding about this group was that they view finance and banking differently. Most Millennials (69%) are open to non-traditional finance brands, while 32% view the future as being a cashless society and 27% hold a view that big banks will not be the primary financial institutions in the future. (Note: we previously also looked at the tech startups that are aiming to disrupt these dinosaur institutions.)

Even more important is that Millennials made it clear they are looking for a social connection to these institutions. They want a brand that they believe does good for the world, rather than just raking in bank fees and profits. For this, finance will have to change: it’s not just about being good with money anymore.

Millennials want their brands to align with their purpose and to be a part of their self-actualization.

Original graphic by: LinkedIn

VC+

VC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

A sneak preview of the exclusive VC+ Special Dispatch—your shortcut to understanding IMF’s World Economic Outlook report.

Have you read IMF’s latest World Economic Outlook yet? At a daunting 202 pages, we don’t blame you if it’s still on your to-do list.

But don’t worry, you don’t need to read the whole April release, because we’ve already done the hard work for you.

To save you time and effort, the Visual Capitalist team has compiled a visual analysis of everything you need to know from the report—and our upcoming VC+ Special Dispatch will be available exclusively to VC+ members on Thursday, April 25th.

If you’re not already subscribed to VC+, make sure you sign up now to receive the full analysis of the IMF report, and more (we release similar deep dives every week).

For now, here’s what VC+ members can expect to receive.

Your Shortcut to Understanding IMF’s World Economic Outlook

With long and short-term growth prospects declining for many countries around the world, this Special Dispatch offers a visual analysis of the key figures and takeaways from the IMF’s report including:

- The global decline in economic growth forecasts

- Real GDP growth and inflation forecasts for major nations in 2024

- When interest rate cuts will happen and interest rate forecasts

- How debt-to-GDP ratios have changed since 2000

- And much more!

Get the Full Breakdown in the Next VC+ Special Dispatch

VC+ members will receive the full Special Dispatch on Thursday, April 25th.

Make sure you join VC+ now to receive exclusive charts and the full analysis of key takeaways from IMF’s World Economic Outlook.

Don’t miss out. Become a VC+ member today.

What You Get When You Become a VC+ Member

VC+ is Visual Capitalist’s premium subscription. As a member, you’ll get the following:

- Special Dispatches: Deep dive visual briefings on crucial reports and global trends

- Markets This Month: A snappy summary of the state of the markets and what to look out for

- The Trendline: Weekly curation of the best visualizations from across the globe

- Global Forecast Series: Our flagship annual report that covers everything you need to know related to the economy, markets, geopolitics, and the latest tech trends

- VC+ Archive: Hundreds of previously released VC+ briefings and reports that you’ve been missing out on, all in one dedicated hub

You can get all of the above, and more, by joining VC+ today.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue