Markets

What Happens To Trading During a Market Crash?

It’s hard to predict when a stock market crash will occur, so the best defense is to be prepared.

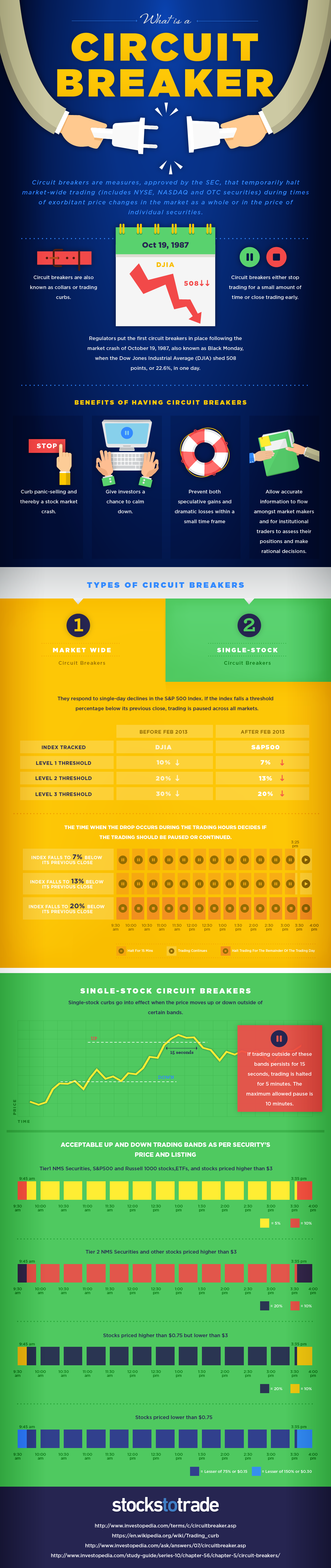

Today’s infographic comes to us from StocksToTrade.com, and it explains what happens when a large enough drop in the market triggers a “circuit breaker”, or a temporary halt in trading.

These temporary halts in trading, or “circuit breakers”, are measures approved by the SEC to calm down markets in the event of extreme volatility. The rules apply to NYSE, Nasdaq, and OTC markets, and were put in place following the events of Black Monday in 1987.

Circuit Breaker Rules

Previously, the Dow Jones Industrial Average (DJIA) was the bellwether for such market interventions.

However, the most recent rules apply to the whole market when a precipitous drop in the S&P 500 occurs:

| Before Feb 2013 | After Feb 2013 | |

|---|---|---|

| Index Tracked | DJIA | S&P 500 |

| Level 1 Threshold | -10% | -7% |

| Level 2 Threshold | -20% | -13% |

| Level 3 Threshold | -30% | -20% |

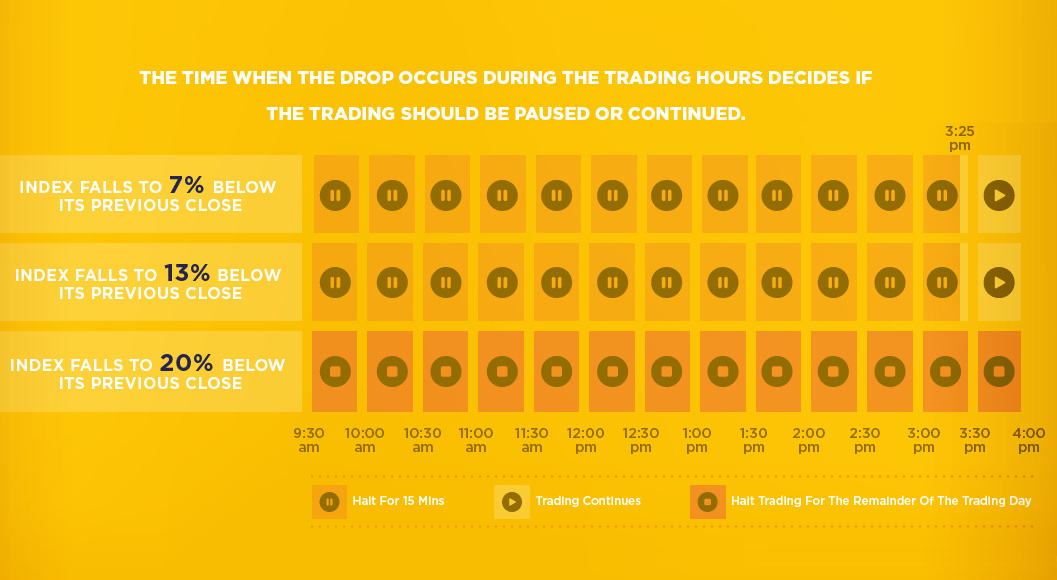

Upon reaching each of the two first thresholds, a 15-minute halt in trading is prompted. This is the case unless the drop happens in the last 35 minutes of trading.

Upon reaching the third threshold (-20% drop in S&P 500), the day’s trading is stopped altogether.

Can Circuit Breakers Stop a Market Crash?

In theory, the use of circuit breakers can help curb panic-selling, as well as limit opportunities for massive gains (or losses) within a short time frame. Further, by creating a window where trading is paused, circuit breakers help make time for market makers and institutional traders to make rational decisions.

Regulators and exchanges hope that all of this together will give investors a chance to calm down, preventing the next market crash.

But do circuit breakers actually work? While they make logical sense, recent evidence from China paints a murkier picture.

The Illusion of Safety

In Paul Kedrosky’s piece from The New Yorker, titled The Dubious Logic of Stock Market Circuit Breakers, he makes some interesting points on the series of market crashes in China from late-2015 to early-2016.

To understand why circuit breakers can make markets less ‘safe,’ imagine that you’re a Chinese trader on a day when markets are approaching a five-per-cent decline. What do you do?

– Paul Kedrosky, The New Yorker

Kedrosky continues by explaining that a market participant in that situation would try to get as many sell orders in as possible, before the circuit breaker is triggered.

Further, when the markets re-open, the same trader would again sell immediately to avoid the second breaker (which triggers an end in trading for the day). Each time the breakers get triggered, it creates a market memory of the events, and traders try to avoid future shutdowns by selling faster.

Preparation is Key

Whether they work or not, it is essential for investors to understand the rules behind circuit breakers, as well as how markets think and react after these pauses in action.

In the event of a market crash, this preparation could help to make a difference.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Money2 weeks ago

Money2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries