Mining

Video: Equity Financing in the Mining Exploration Sector

Video: Equity Financing in the Mining Exploration Sector

Mining exploration is a notoriously capital intensive sector. Because companies typically generate no or little revenue, they must go to the capital markets with the lure of creating the next big economic discovery.

These dynamics create the risk and reward in the sector that make it unique, but they also create a barrier to entry for average person. Many regular investors that trade stocks and mutual funds do not know how private placements, warrants, or hold periods work.

About a year ago, we worked in conjunction with VADAR and Cambridge House to create this video (and the infographic below) to educate investors on the nuts and bolts of raising capital in the mining sector.

Copper

Brass Rods: The Secure Choice

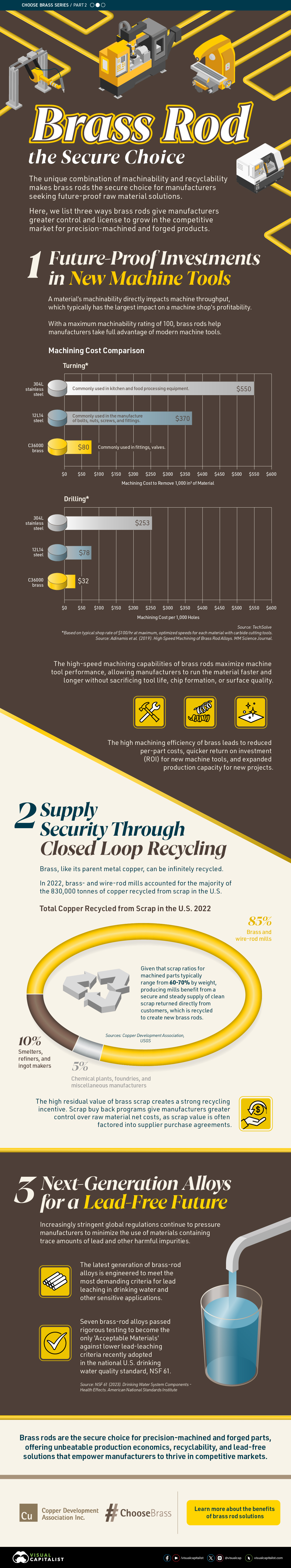

This graphic shows why brass rods are the secure choice for precision-machined and forged parts.

Brass Rods: The Secure Choice

The unique combination of machinability and recyclability makes brass rods the secure choice for manufacturers seeking future-proof raw material solutions.

This infographic, from the Copper Development Association, shows three ways brass rods give manufacturers greater control and a license to grow in the competitive market for precision-machined and forged products.

Future-Proof Investments in New Machine Tools

A material’s machinability directly impacts machine throughput, which typically has the largest impact on machine shop profitability.

The high-speed machining capabilities of brass rods maximize machine tool performance, allowing manufacturers to run the material faster and longer without sacrificing tool life, chip formation, or surface quality.

The high machining efficiency of brass leads to reduced per-part costs, quicker return on investment (ROI) for new machine tools, and expanded production capacity for new projects.

Supply Security Through Closed Loop Recycling

Brass, like its parent element copper, can be infinitely recycled.

In 2022, brass- and wire-rod mills accounted for the majority of the 830,000 tonnes of copper recycled from scrap in the United States.

Given that scrap ratios for machined parts typically range from 60-70% by weight, producing mills benefit from a secure and steady supply of clean scrap returned directly from customers, which is recycled to create new brass rods.

The high residual value of brass scrap creates a strong recycling incentive. Scrap buy back programs give manufacturers greater control over raw material net costs as scrap value is often factored into supplier purchase agreements.

Next Generation Alloys for a Lead-Free Future

Increasingly stringent global regulations continue to pressure manufacturers to minimize the use of materials containing trace amounts of lead and other harmful impurities.

The latest generation of brass-rod alloys is engineered to meet the most demanding criteria for lead leaching in drinking water and other sensitive applications.

Seven brass-rod alloys passed rigorous testing to become the only ‘Acceptable Materials’ against lower lead leaching criteria recently adopted in the national U.S. drinking water quality standard, NSF 61.

Learn more about the advantages of brass rods solutions.

-

Base Metals1 year ago

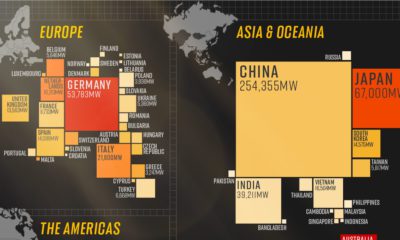

Base Metals1 year agoRanked: The World’s Largest Copper Producers

Many new technologies critical to the energy transition rely on copper. Here are the world’s largest copper producers.

-

Silver2 years ago

Silver2 years agoMapped: Solar Power by Country in 2021

In 2020, solar power saw its largest-ever annual capacity expansion at 127 gigawatts. Here’s a snapshot of solar power capacity by country.

-

Batteries5 years ago

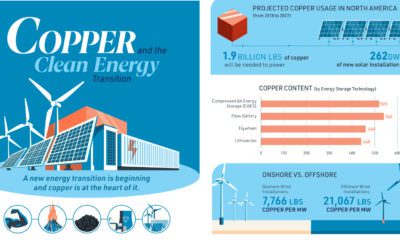

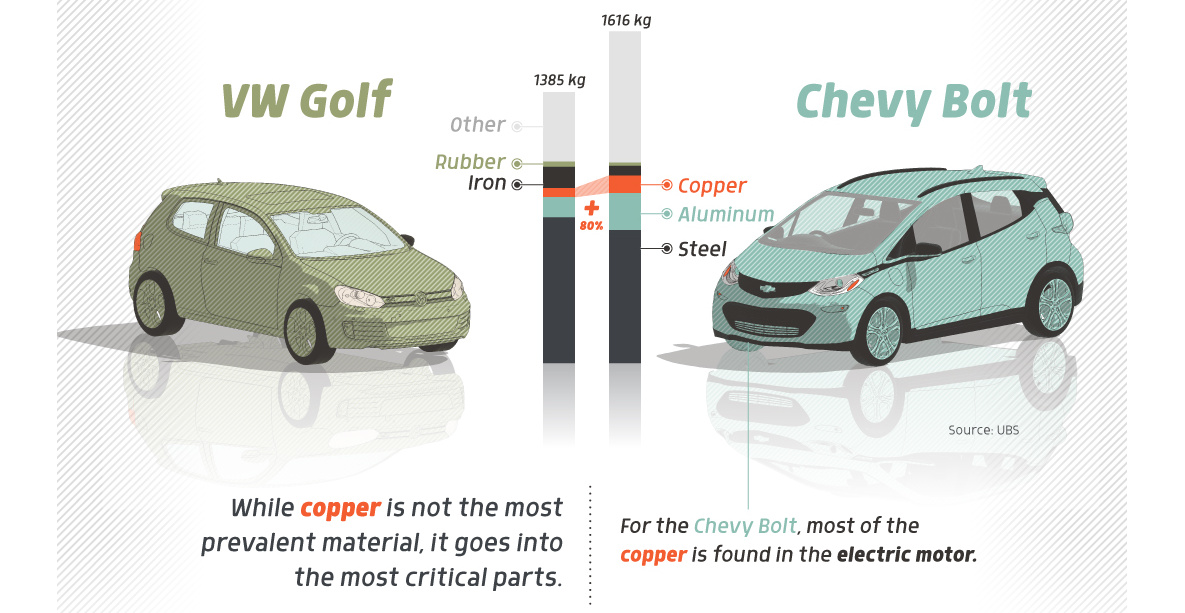

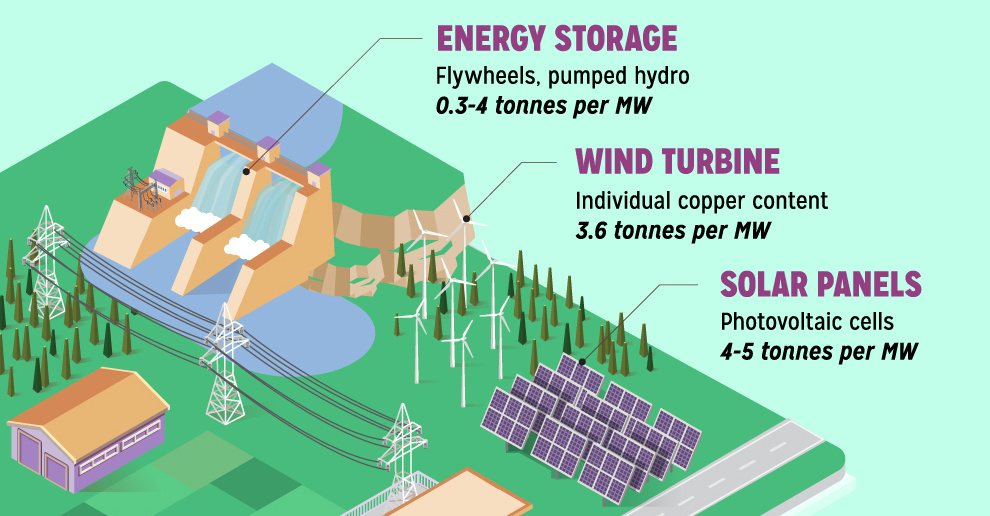

Batteries5 years agoVisualizing Copper’s Role in the Transition to Clean Energy

A clean energy transition is underway as wind, solar, and batteries take center stage. Here’s how copper plays the critical role in these technologies.

-

Science5 years ago

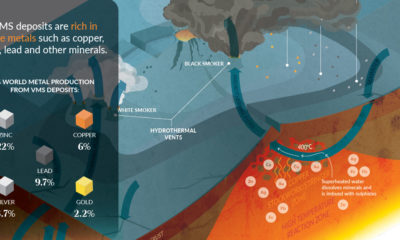

Science5 years agoEverything You Need to Know on VMS Deposits

Deep below the ocean’s waves, VMS deposits spew out massive amounts of minerals like copper, zinc, and gold, making them a key source of the metals…

-

Copper5 years ago

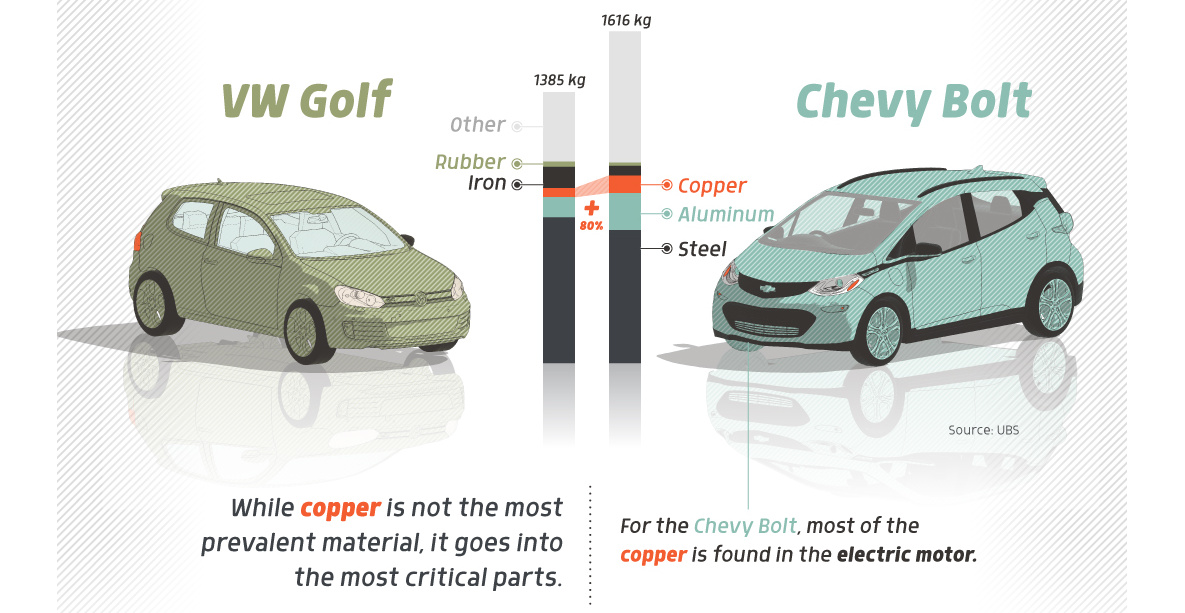

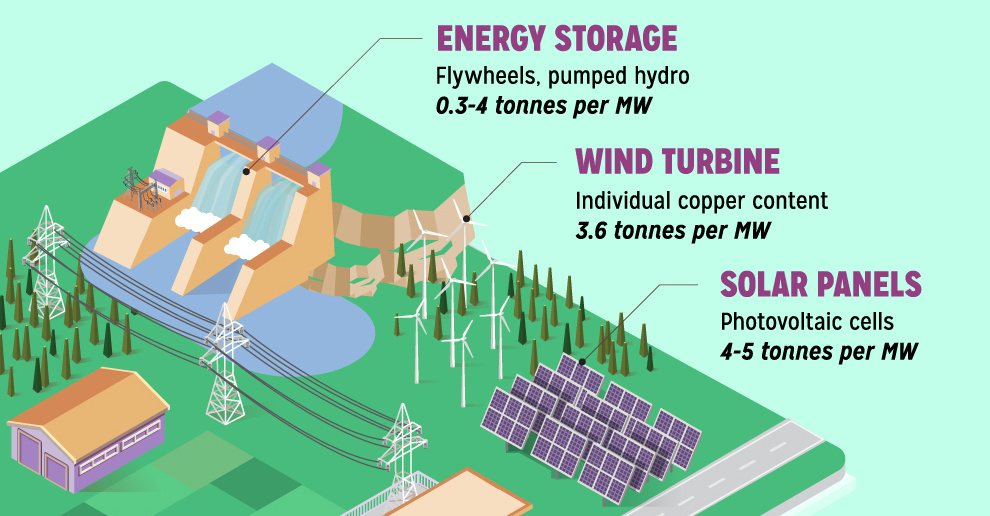

Copper5 years agoHow Much Copper is in an Electric Vehicle?

Have you ever wondered how much copper is in an electric vehicle? This infographic shows the metal’s properties as well as the quantity of copper used.

-

Copper6 years ago

Copper6 years agoCopper: Driving the Green Energy Revolution

Renewable energy is set to fuel a new era of copper demand – here’s how much copper is used in green applications from EVs to photovoltaics.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?