Energy

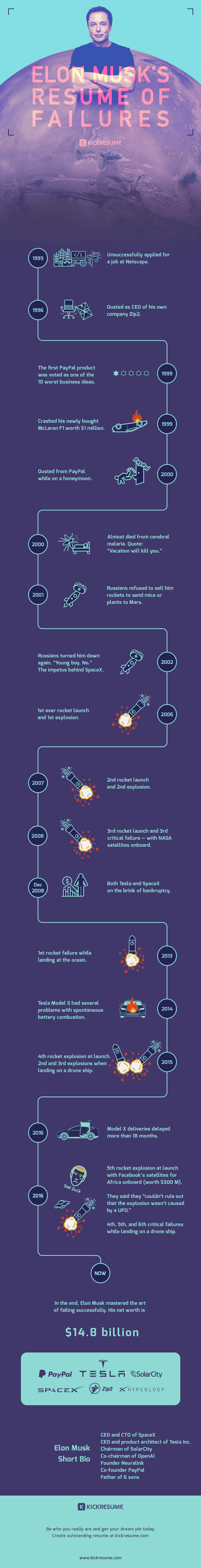

A Timeline of Elon Musk’s Long List of Failures

At first glance, it’s easy to be blown away by Elon Musk’s impressive resume.

He’s shooting for the stars with SpaceX, changing the future of transportation with Tesla, Hyperloop, and The Boring Company, and he’s already had a profound impact on the e-commerce and payments sectors through Paypal. It’s no coincidence that most of these are $1 billion+ companies.

But, focusing only on his successes provides a superficial view of the man. To get the full perspective on his career, it is much more interesting to look at the failures and lows he has experienced. These are the moments when most people would have likely given up.

Failing Often

As every entrepreneur knows, any business venture can be upended by failures at any moment – and it is how one bounces back from those failures that counts.

Today’s infographic from Kickresume shows Musk’s struggles and failures throughout his career, and how he persevered to become a modern business icon.

As the ever-quotable Winston Churchill once said:

Success is not final, failure is not fatal: it is the courage to continue that counts.

– Winston Churchill

After being ousted out of his own company, having many rockets go bust, and fighting to keep Tesla and SpaceX from going bankrupt, Musk kept pushing forward with courage.

What We Can Learn

Entrepreneurs hold people like Steve Jobs, Elon Musk, and Richard Branson in high reverence. Sometimes, we even put them on a pedestal, thinking we could only dream of making such a profound impact on the world.

However, this is obviously a one dimensional view. These figures are not superhuman, and the reality is that they’ve all experienced tragic failures throughout the course of their careers. They’ve been disheartened, but they bounced back.

We have to recognize that success in business isn’t what it appears to be on magazine covers and headlines. Failure is an everyday part of doing business, and it plagues almost every entrepreneur in some shape or form. The difference is in how you react to it.

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Misc1 week ago

Misc1 week agoAirline Incidents: How Do Boeing and Airbus Compare?

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America