Money

How the Composition of Wealth Differs, from the Middle Class to the Top 1%

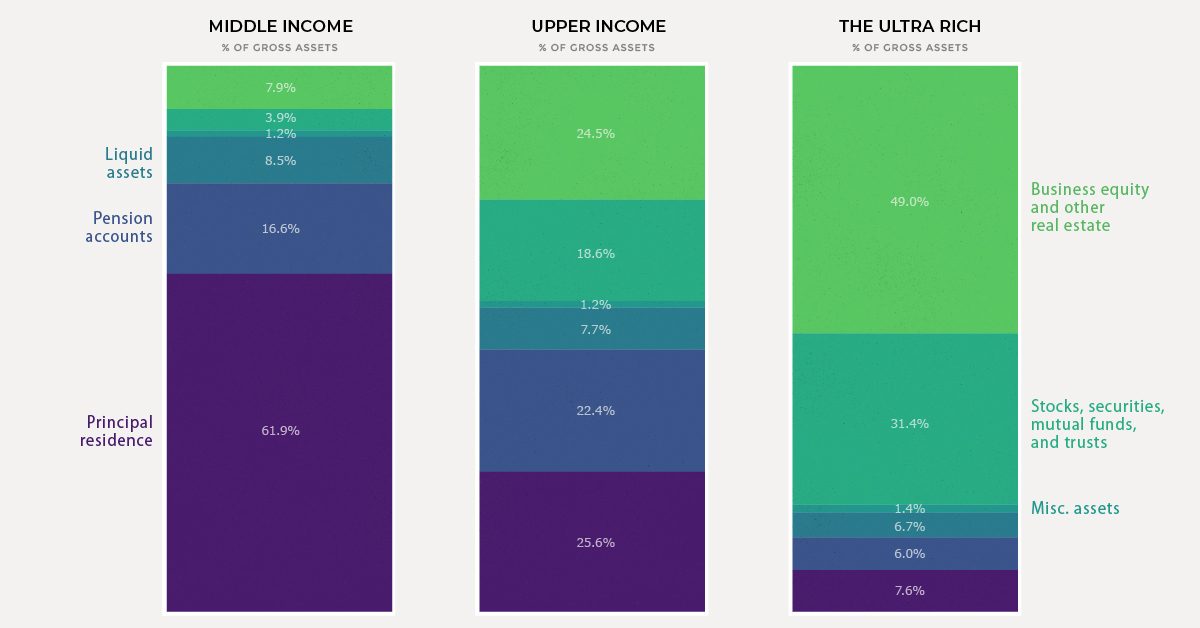

A Breakdown of Wealth, from Middle Class to the Top 1%

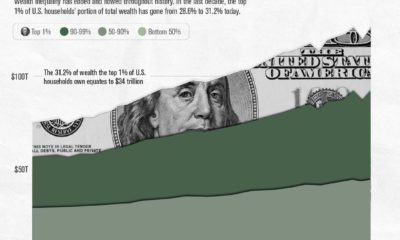

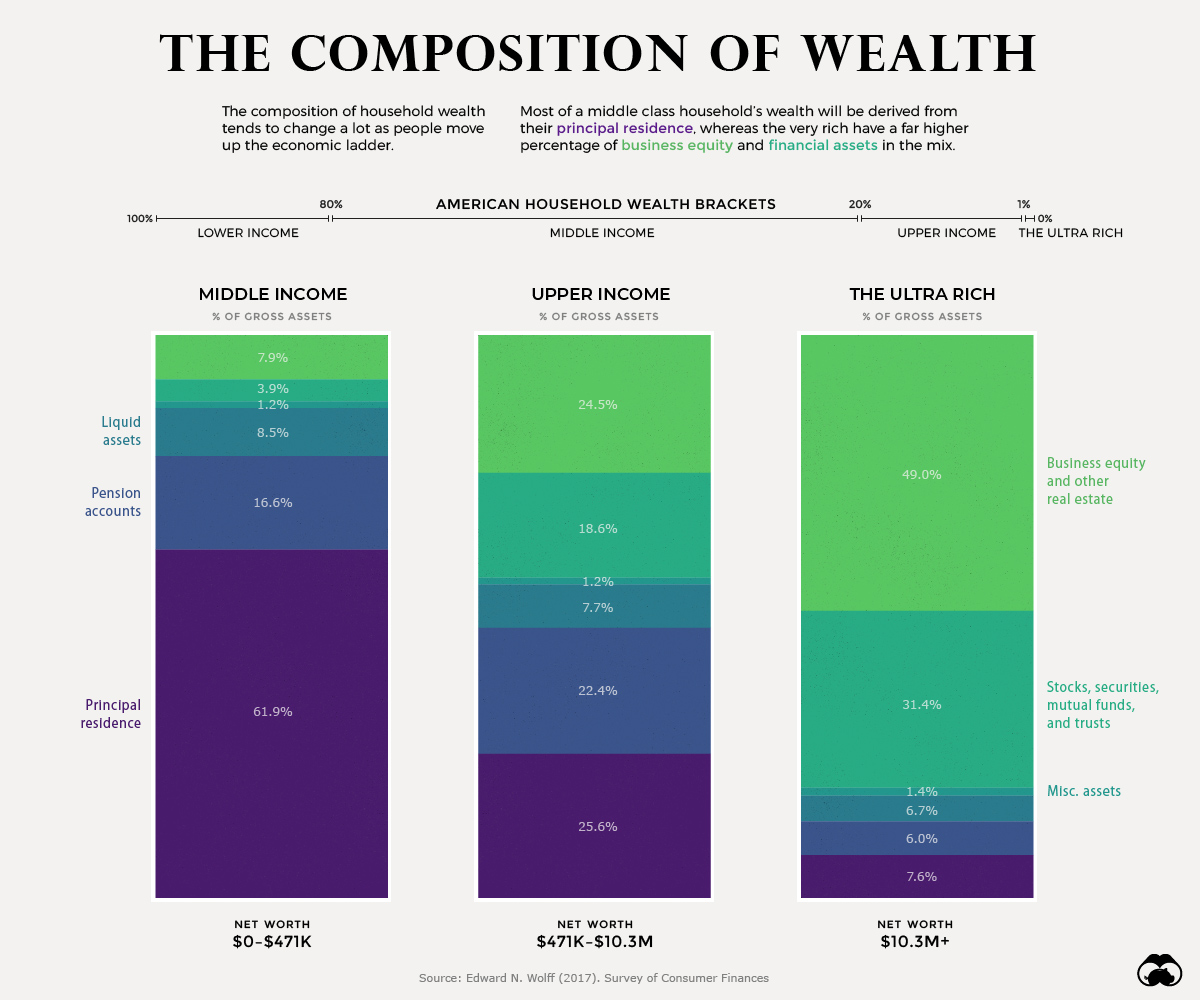

Just as household wealth varies greatly across the population, the composition of that wealth changes as well. Simply put, the person next to you at the grocery store will likely have a much different asset mix than, say, Warren Buffett.

Today’s chart breaks down the differences in the composition of wealth between middle income, upper income, and ultra wealthy (top 1%) of American households to help us better understand the building blocks that make up net worth. Let’s dive in.

Middle Income: Home is Where the Wealth is

It’s no surprise that the principal residence is the cornerstone of net worth for most Americans in the middle class. For households that fall in this wide range ($0 to $471k of net worth) the combination of housing and pension accounts make up nearly 80% of total wealth on average.

Assets like stocks and mutual funds only make up about 4% of wealth in this income bracket, partially mirroring the trend of lower stock market participation in recent years.

As we move up the income ladder, however, this situation changes quite a bit.

Upper Income: A Diversified Portfolio

If a household has a net worth that ranges between $471,000 and $10.2 million, it is considered to fall in the upper income band above. This represents the 20% richest households in the U.S., minus the top 1%, which are put in a separate bracket.

For this group, the principal residence makes up a smaller slice of the wealth pie. Instead, we see a higher mix of financial assets like stocks and mutual funds, as well as business equity and real estate. Almost half of households in this group own real estate in addition to their principal residence.

As households become wealthier, we tend to see a lower share of liquid assets as compared with the other components of net worth.

The Top 1%: The Business Equity Bulge

In the richest 1% of households, the principal residence makes up a mere 7.6% of assets. At this stage, almost half of assets fall under the category of business equity and real estate.

A prime example of this is Jeff Bezos. The lion’s share of the Amazon founder’s net worth is tied to the value of his company. Another example is President Trump, whose sprawling real estate empire comprises two-thirds of his estimated $3.1 billion net worth.

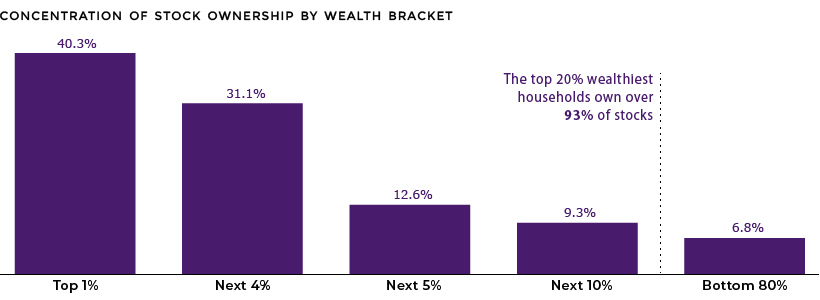

One of the more prominent features of the ultra rich wealth bracket is a much higher level of financial asset ownership. In fact, the top 1% of households own over 40% of stocks.

As well, this tiny group of ultra wealthy households earns 22% of total income, up from 8% in the 1970s.

Money

Charted: Who Has Savings in This Economy?

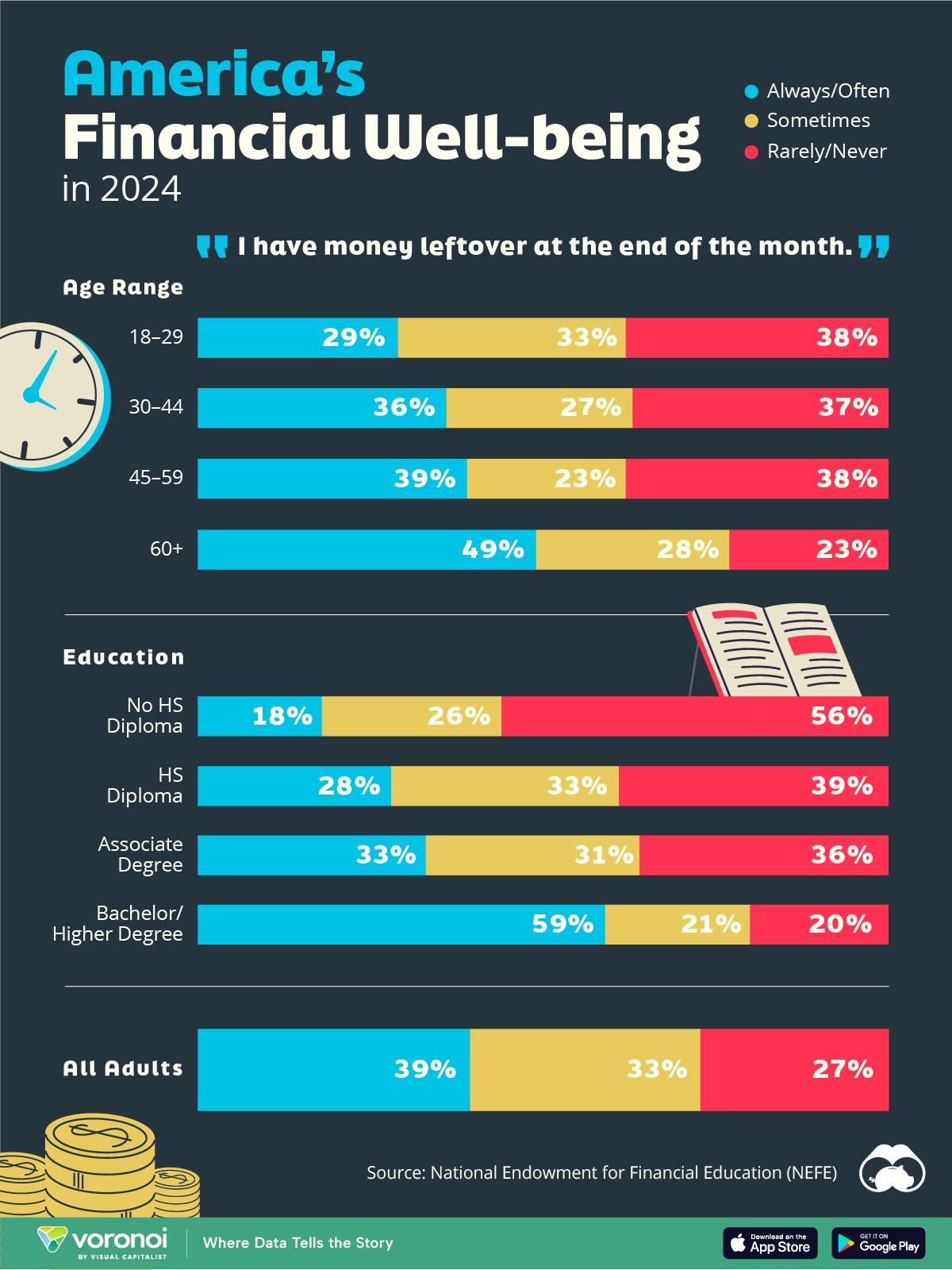

Older, better-educated adults are winning the savings game, reveals a January survey by the National Opinion Research Center at the University of Chicago.

Who Has Savings in This Economy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Two full years of inflation have taken their toll on American households. In 2023, the country’s collective credit card debt crossed $1 trillion for the first time. So who is managing to save money in the current economic environment?

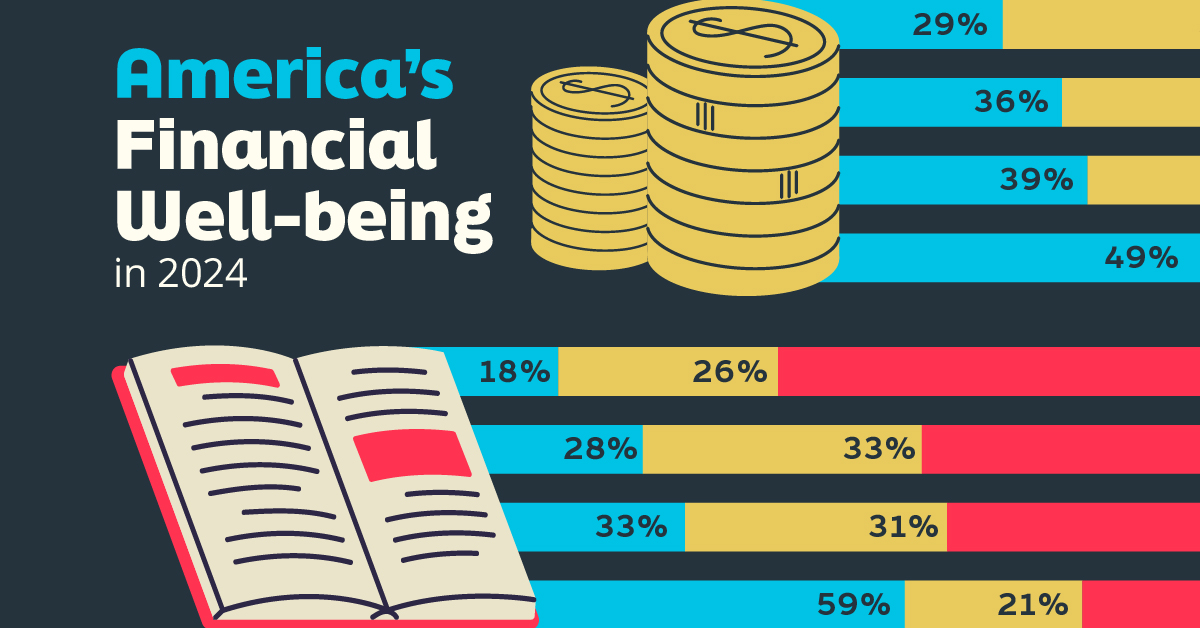

We visualize the percentage of respondents to the statement “I have money leftover at the end of the month” categorized by age and education qualifications. Data is sourced from a National Endowment for Financial Education (NEFE) report, published last month.

The survey for NEFE was conducted from January 12-14, 2024, by the National Opinion Research Center at the University of Chicago. It involved 1,222 adults aged 18+ and aimed to be representative of the U.S. population.

Older Americans Save More Than Their Younger Counterparts

General trends from this dataset indicate that as respondents get older, a higher percentage of them are able to save.

| Age | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| 18–29 | 29% | 33% | 38% |

| 30–44 | 36% | 27% | 37% |

| 45–59 | 39% | 23% | 38% |

| Above 60 | 49% | 28% | 23% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

Perhaps not surprisingly, those aged 60+ are the age group with the highest percentage saying they have leftover money at the end of the month. This age group spent the most time making peak earnings in their careers, are more likely to have investments, and are more likely to have paid off major expenses like a mortgage or raising a family.

The Impact of Higher Education on Earnings and Savings

Based on this survey, higher education dramatically improves one’s ability to save. Shown in the table below, those with a bachelor’s degree or higher are three times more likely to have leftover money than those without a high school diploma.

| Education | Always/Often | Sometimes | Rarely/Never |

|---|---|---|---|

| No HS Diploma | 18% | 26% | 56% |

| HS Diploma | 28% | 33% | 39% |

| Associate Degree | 33% | 31% | 36% |

| Bachelor/Higher Degree | 59% | 21% | 20% |

| All Adults | 39% | 33% | 27% |

Note: Percentages are rounded and may not sum to 100.

As the Bureau of Labor Statistics notes, earnings improve with every level of education completed.

For example, those with a high school diploma made 25% more than those without in 2022. And as the qualifications increase, the effects keep stacking.

Meanwhile, a Federal Reserve study also found that those with more education tended to make financial decisions that contributed to building wealth, of which the first step is to save.

-

Green1 week ago

Green1 week agoRanked: The Countries With the Most Air Pollution in 2023

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Travel2 weeks ago

Travel2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075