Technology

China’s Digital Wallets Offer a Glimpse at the Future of Payments

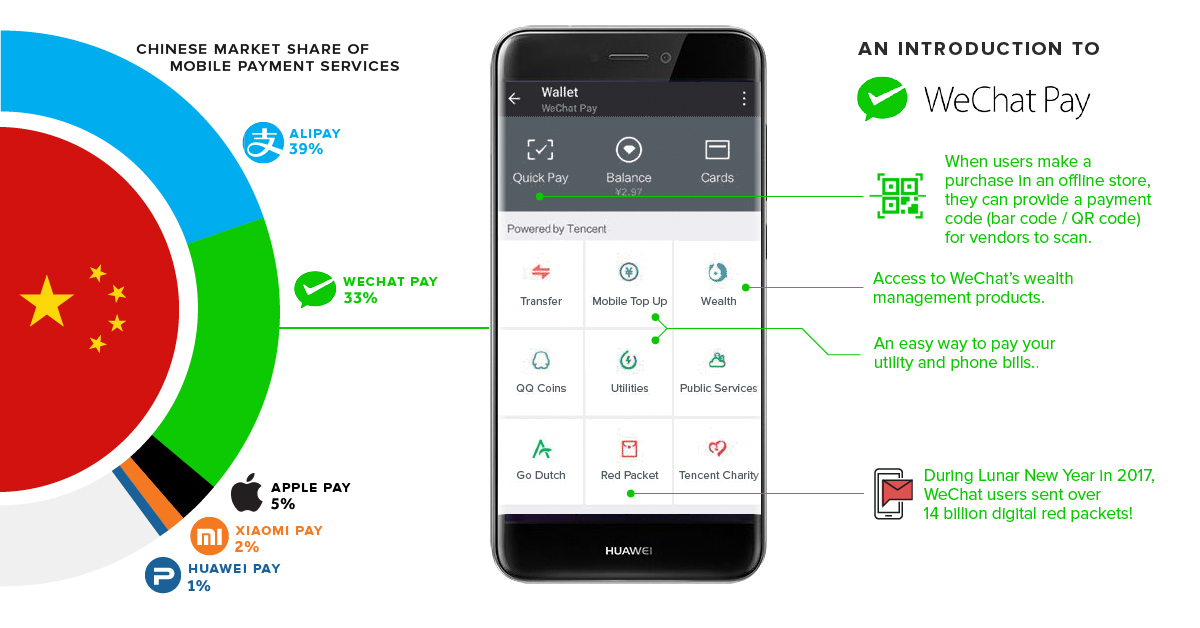

Chinese consumers conduct 11 times more mobile payments than their counterparts in the United States, so as we look to the future of digital wallets, China is a natural place to start.

Forecasts for mobile payment adoption in the United States remain flat for now; however, two major brands – WeChat and AliPay – offer a glimpse of what the future may eventually hold for mobile payments in North America.

Digging Through WeChat’s Wallet

WeChat, a platform owned by Tencent, is a force to be reckoned with. It’s fast closing in on one billion monthly active users (MAUs), and the average user spends over an hour on the app each day.

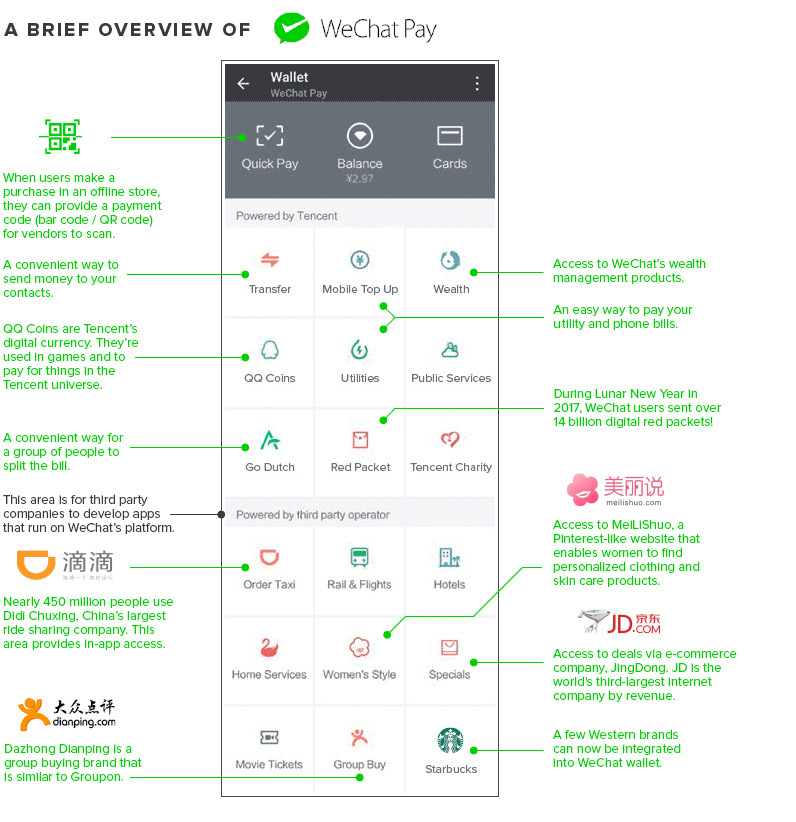

WeChat users aren’t just unusually chatty – there’s actually a high level of utility to the platform that North American apps have yet to match. WeChat’s wallet alone is packed with features ranging from mobile payments to ride hailing. Below is a look at just some of the features.

WeChat’s wallet is packed with features that are constantly evolving, but here are some current features worth noting:

Payments in the real world

“Scan-and-pay” is widely popular in China, particularly in big cities where it’s hard to find a product or a service that cannot be purchased with a mobile device. According to China Channel, over 90% of Chinese consumers have adopted WeChat as a method of payment in offline purchases. That compares with a 32% adoption rate for debit and credit cards.

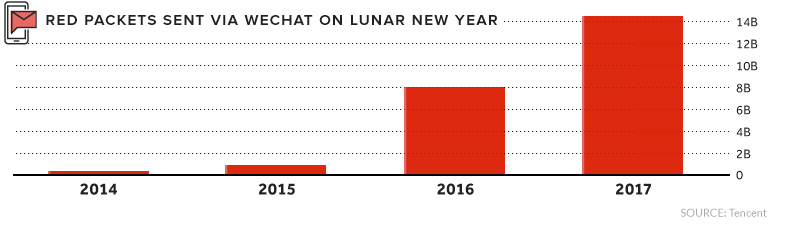

Red Packets

WeChat has seen tremendous growth of its wallet by capitalizing on China’s tradition of gifting cash-filled red envelopes (known as hongbao). In fact, the volume of digital red packets sent has skyrocketed from 16 million to 14.2 billion in only three years.

Digital Tip Jar

WeChat also offers a glimpse at a new avenue for content creators to monetize their hard work online. WeChat’s Tip Jar feature allows users to send micro-payments to writers, musicians, artists, and more.

Go Dutch

Splitting the bill in a busy restaurant or pub setting can be major hassle. “Go Dutch” is a feature that allows WeChat users to divvy up a bill and pay using the app. Features like Go Dutch make digital payments an appealing option because they solve a real world problem.

Third-Party Apps

WeChat has robust third-party integration within its wallet. Functionality is so deep that users can order anything from transportation to home cleaning services with the push of a button. China’s largest e-commerce, group buy, and ride hailing companies are already on these platforms, but Western brands like Starbucks are getting in on the action too.

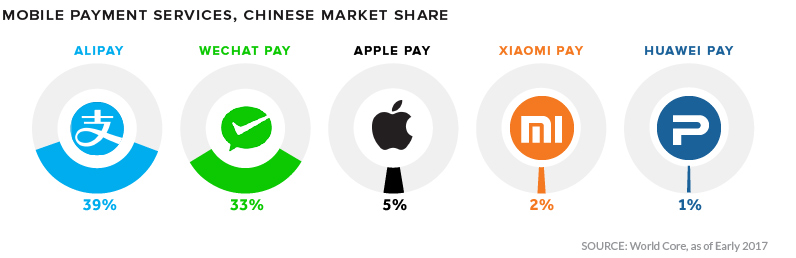

Going Head-To-Head

The mobile payments sector is becoming increasingly binary as WeChat and AliPay dogfight for market share. AliPay – Ant Financial’s payment brand – was once the undisputed leader in mobile payments, but the company has recently seen its market share eroded by an increasingly scrappy WeChat. WeChat has smartly leveraged its popularity and massive user base to get people using it as a payment tool as well.

ApplePay, which had high hopes for the Chinese market, continues to lag far behind domestic brands.

Growing Pains for Digital Wallets

China’s central bank recently imposed tougher rules regarding scan-and-go payments, a move that Ant Financial and Tencent are publicly praising, but that may dampen the meteoric growth trajectory of mobile payments. The new regulations take aim at aggressive tactics used to capture market share from competitors, and set limits on how much consumers can spend daily using barcode-based payments.

Despite growing pains, mobile payments and digital wallets will continue to be a dominant part of the Chinese economy. The only question is, when will the rest of the world follow suit?

Technology

Ranked: Semiconductor Companies by Industry Revenue Share

Nvidia is coming for Intel’s crown. Samsung is losing ground. AI is transforming the space. We break down revenue for semiconductor companies.

Semiconductor Companies by Industry Revenue Share

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that some computer chips are now retailing for the price of a new BMW?

As computers invade nearly every sphere of life, so too have the chips that power them, raising the revenues of the businesses dedicated to designing them.

But how did various chipmakers measure against each other last year?

We rank the biggest semiconductor companies by their percentage share of the industry’s revenues in 2023, using data from Omdia research.

Which Chip Company Made the Most Money in 2023?

Market leader and industry-defining veteran Intel still holds the crown for the most revenue in the sector, crossing $50 billion in 2023, or 10% of the broader industry’s topline.

All is not well at Intel, however, with the company’s stock price down over 20% year-to-date after it revealed billion-dollar losses in its foundry business.

| Rank | Company | 2023 Revenue | % of Industry Revenue |

|---|---|---|---|

| 1 | Intel | $51B | 9.4% |

| 2 | NVIDIA | $49B | 9.0% |

| 3 | Samsung Electronics | $44B | 8.1% |

| 4 | Qualcomm | $31B | 5.7% |

| 5 | Broadcom | $28B | 5.2% |

| 6 | SK Hynix | $24B | 4.4% |

| 7 | AMD | $22B | 4.1% |

| 8 | Apple | $19B | 3.4% |

| 9 | Infineon Tech | $17B | 3.2% |

| 10 | STMicroelectronics | $17B | 3.2% |

| 11 | Texas Instruments | $17B | 3.1% |

| 12 | Micron Technology | $16B | 2.9% |

| 13 | MediaTek | $14B | 2.6% |

| 14 | NXP | $13B | 2.4% |

| 15 | Analog Devices | $12B | 2.2% |

| 16 | Renesas Electronics Corporation | $11B | 1.9% |

| 17 | Sony Semiconductor Solutions Corporation | $10B | 1.9% |

| 18 | Microchip Technology | $8B | 1.5% |

| 19 | Onsemi | $8B | 1.4% |

| 20 | KIOXIA Corporation | $7B | 1.3% |

| N/A | Others | $126B | 23.2% |

| N/A | Total | $545B | 100% |

Note: Figures are rounded. Totals and percentages may not sum to 100.

Meanwhile, Nvidia is very close to overtaking Intel, after declaring $49 billion of topline revenue for 2023. This is more than double its 2022 revenue ($21 billion), increasing its share of industry revenues to 9%.

Nvidia’s meteoric rise has gotten a huge thumbs-up from investors. It became a trillion dollar stock last year, and broke the single-day gain record for market capitalization this year.

Other chipmakers haven’t been as successful. Out of the top 20 semiconductor companies by revenue, 12 did not match their 2022 revenues, including big names like Intel, Samsung, and AMD.

The Many Different Types of Chipmakers

All of these companies may belong to the same industry, but they don’t focus on the same niche.

According to Investopedia, there are four major types of chips, depending on their functionality: microprocessors, memory chips, standard chips, and complex systems on a chip.

Nvidia’s core business was once GPUs for computers (graphics processing units), but in recent years this has drastically shifted towards microprocessors for analytics and AI.

These specialized chips seem to be where the majority of growth is occurring within the sector. For example, companies that are largely in the memory segment—Samsung, SK Hynix, and Micron Technology—saw peak revenues in the mid-2010s.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Business2 weeks ago

Business2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?