Energy

Chart: The Rate of Change in U.S. Energy Consumption

Chart: The Rate of Change in U.S. Energy Consumption

This chart shows the winners and losers in energy sources used

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Weeks ago, we published a flow chart that showed all U.S. energy consumption from 2015 in one giant diagram.

This is a great tool for understanding a static picture of U.S. energy consumption – it breaks down the energy sources, as well as the details about where the energy ultimately flows. It also shows that a large amount of energy potential, about 61%, is inevitably “wasted” due to the laws of physics as well as inefficient processes.

However, because it is a static view of one year, it ends up doing a poor job of encapsulating how the energy sector is shifting. This week’s chart shows the changing landscape for different energy sources in the United States.

Examining the Shift in U.S. Energy Consumption

As a starting point, based on the aforementioned diagram of energy usage, let’s look at the composition of the energy mix:

- Oil: 36%

- Natural gas: 29%

- Coal: 16%

- Renewables: 10%

- Nuclear: 9%

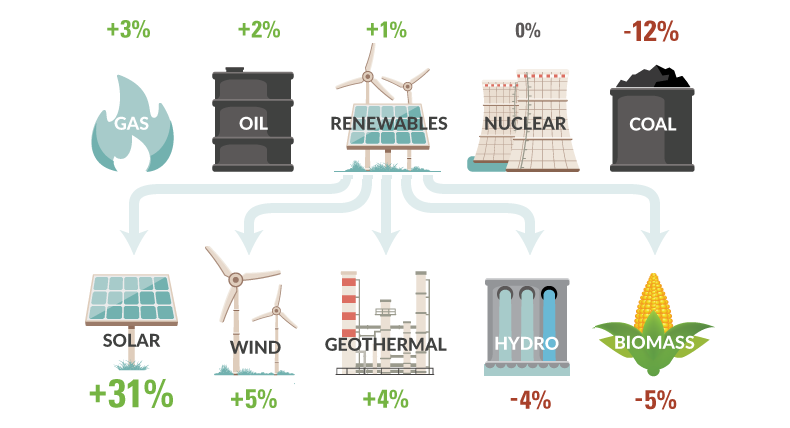

Now, let’s look at the rate of change of these broad categories between 2014 and 2015 according to the EIA:

- Oil: +2%

- Natural gas: +3%

- Coal: -12%

- Renewables: +1%

- Nuclear: 0%

On a macro level, the first obvious note is that coal consumption dropped rapidly in 2015. This, along with other factors, is why many people are declaring that coal is dead.

Another interesting observation is that renewables only increased by 1% in consumption. This seems strange, considering that there is such hype around things like the Tesla Gigafactory and the surging demand for lithium-ion batteries. Diving a bit deeper will provide an explanation for this.

Renewable Energy

There are five main components that make up U.S. renewable energy: solar, wind, hydro, geothermal, and biomass.

The biggest sub-sector is biomass, which made up about 43% of all renewable usage in the United States in 2015. Hydro is also significant, as it is 27% of the renewable total. However, as you will see, consumption in biomass and hydro dropped between 2014 and 2015:

- Biomass: -5%

- Hydro: -4%

- Wind: +5%

- Solar: +31%

- Geothermal: +4%

Even though the biomass and hydro consumption dropped, the future of renewables is in good hands. In particular, it has been the miraculous change in the price per watt of solar energy that has changed the landscape. Solar energy consumption, even though it is a relatively small number compared to other energy sources, increased by 31% in 2015.

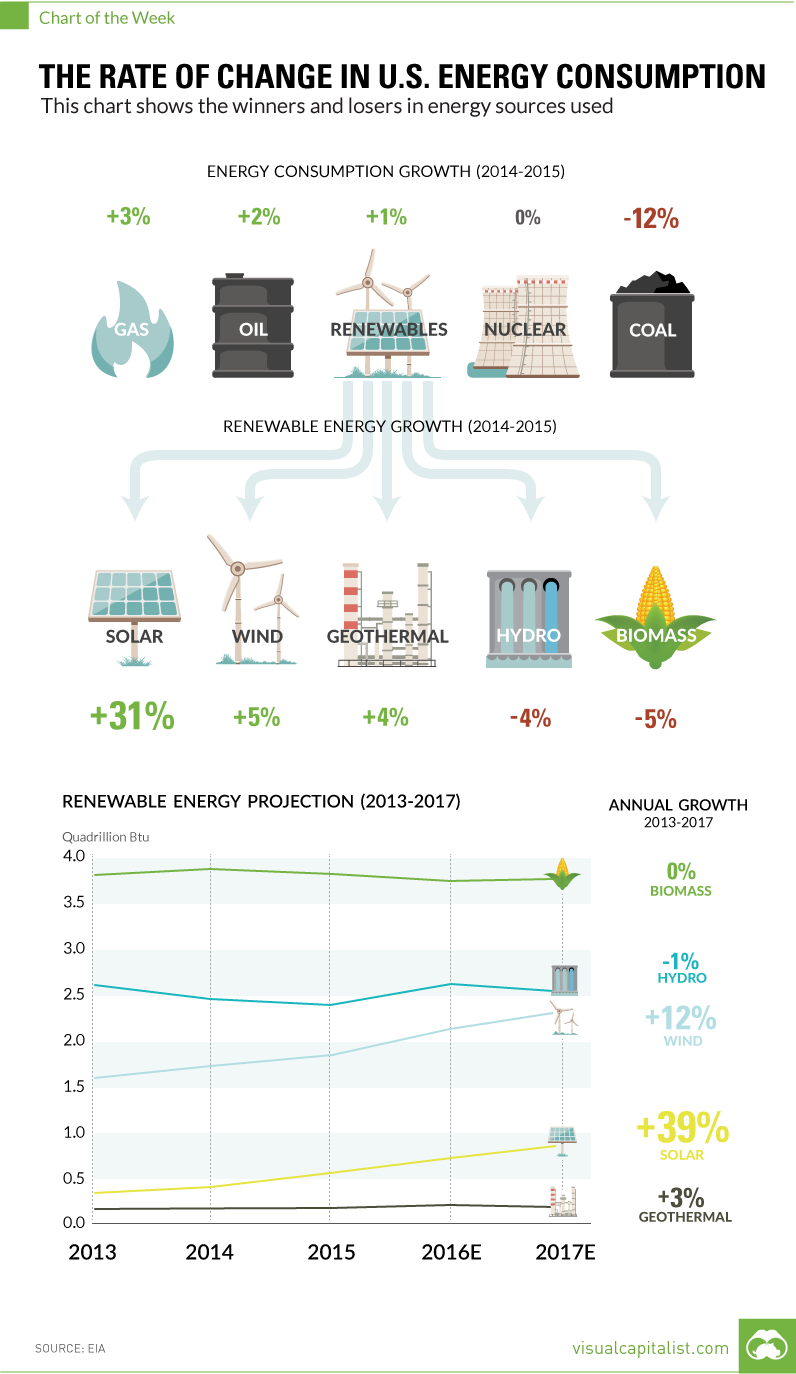

As a final point, here is the data and projections going out to 2017 for the main renewable sources, according to the EIA. Note that solar’s CAGR (compound annual growth rate) is 39% between 2013 and the projected 2017 number.

Renewable energy consumption (Quadrillion Btu, 2015)

| 2013 | 2014 | 2015 | 2016e | 2017e | CAGR (2013-2017) | |

|---|---|---|---|---|---|---|

| Solar | 0.31 | 0.42 | 0.55 | 0.66 | 0.82 | 39% |

| Geothermal | 0.21 | 0.21 | 0.22 | 0.23 | 0.23 | 3% |

| Wind | 1.60 | 1.73 | 1.81 | 2.08 | 2.26 | 12% |

| Hydro | 2.56 | 2.47 | 2.39 | 2.57 | 2.52 | -1% |

| Biomass | 3.76 | 3.93 | 3.77 | 3.74 | 3.75 | 0% |

Lithium

Ranked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

The Top 10 EV Battery Manufacturers in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Despite efforts from the U.S. and EU to secure local domestic supply, all major EV battery manufacturers remain based in Asia.

In this graphic we rank the top 10 EV battery manufacturers by total battery deployment (measured in megawatt-hours) in 2023. The data is from EV Volumes.

Chinese Dominance

Contemporary Amperex Technology Co. Limited (CATL) has swiftly risen in less than a decade to claim the title of the largest global battery group.

The Chinese company now has a 34% share of the market and supplies batteries to a range of made-in-China vehicles, including the Tesla Model Y, SAIC’s MG4/Mulan, and various Li Auto models.

| Company | Country | 2023 Production (megawatt-hour) | Share of Total Production |

|---|---|---|---|

| CATL | 🇨🇳 China | 242,700 | 34% |

| BYD | 🇨🇳 China | 115,917 | 16% |

| LG Energy Solution | 🇰🇷 Korea | 108,487 | 15% |

| Panasonic | 🇯🇵 Japan | 56,560 | 8% |

| SK On | 🇰🇷 Korea | 40,711 | 6% |

| Samsung SDI | 🇰🇷 Korea | 35,703 | 5% |

| CALB | 🇨🇳 China | 23,493 | 3% |

| Farasis Energy | 🇨🇳 China | 16,527 | 2% |

| Envision AESC | 🇨🇳 China | 8,342 | 1% |

| Sunwoda | 🇨🇳 China | 6,979 | 1% |

| Other | - | 56,040 | 8% |

In 2023, BYD surpassed LG Energy Solution to claim second place. This was driven by demand from its own models and growth in third-party deals, including providing batteries for the made-in-Germany Tesla Model Y, Toyota bZ3, Changan UNI-V, Venucia V-Online, as well as several Haval and FAW models.

The top three battery makers (CATL, BYD, LG) collectively account for two-thirds (66%) of total battery deployment.

Once a leader in the EV battery business, Panasonic now holds the fourth position with an 8% market share, down from 9% last year. With its main client, Tesla, now sourcing batteries from multiple suppliers, the Japanese battery maker seems to be losing its competitive edge in the industry.

Overall, the global EV battery market size is projected to grow from $49 billion in 2022 to $98 billion by 2029, according to Fortune Business Insights.

-

Travel1 week ago

Travel1 week agoAirline Incidents: How Do Boeing and Airbus Compare?

-

Markets3 weeks ago

Markets3 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America